Global Market Comments

November 25, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or CATCHING OUR BREATH),

(MSFT), (GOOGL), (TLT), (VIX), (TSLA)

Global Market Comments

November 25, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or CATCHING OUR BREATH),

(MSFT), (GOOGL), (TLT), (VIX), (TSLA)

Global Market Comments

November 22, 2019

Fiat Lux

Featured Trade:

(TRADING THE KENNEDY ASSASSINATION)

Global Market Comments

November 21, 2019

Fiat Lux

SPECIAL TESLA ISSUE

Featured Trade:

(TESLA TALES), (TSLA)

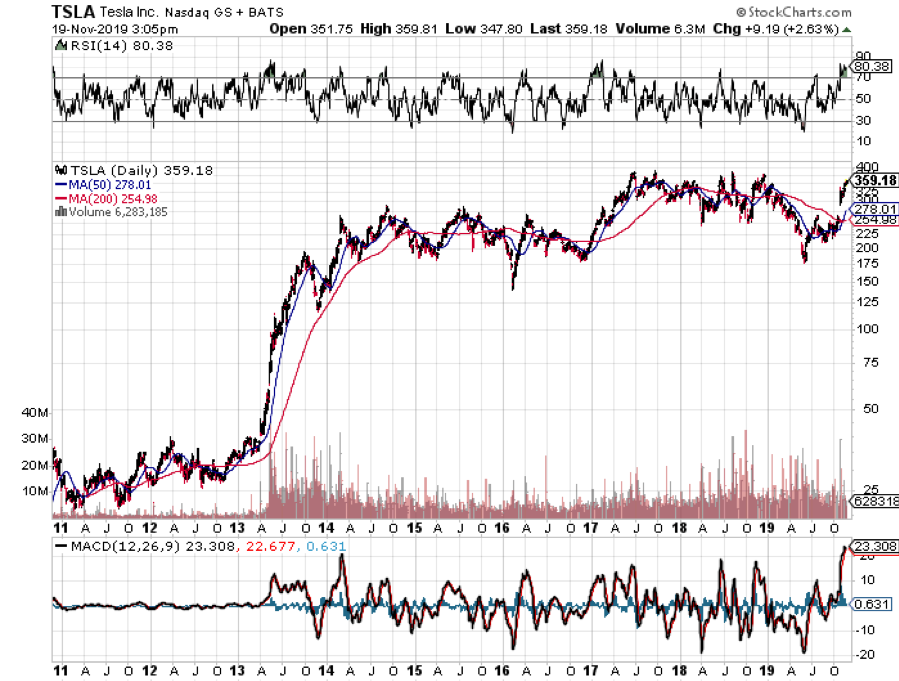

When a guest asked me to name a clear ten bagger stock for the coming decade at the Mad Hedge Technology Letter, I didn’t hesitate. It was Tesla (TSLA).

At long last, investors are perking up and taking notice of the Fremont, California based electric car manufacturer whose shares have been trapped in a highly volatile three-year trading range.

Tesla was the top-performing stock in the market over the last five months, soaring some 96% from $178 to $356.

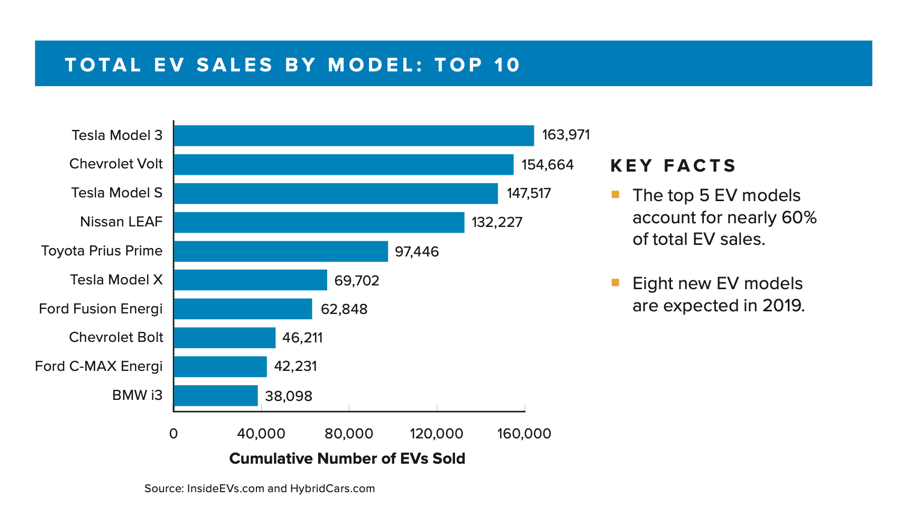

Of course, ramping up production to over 360,000 units this year has given Tesla new respectability. Elon Musk pulled this off by building a huge tent in the Tesla Fremont parking lot and constructing a third assembly line, all in three short weeks.

He also used workers to replace the German Kuka and Japanese Fanuc robots which had a bad habit of breaking down during peak production. Output instantly leaped by 50%. It was one of the most aggressive and brilliant moves in business history.

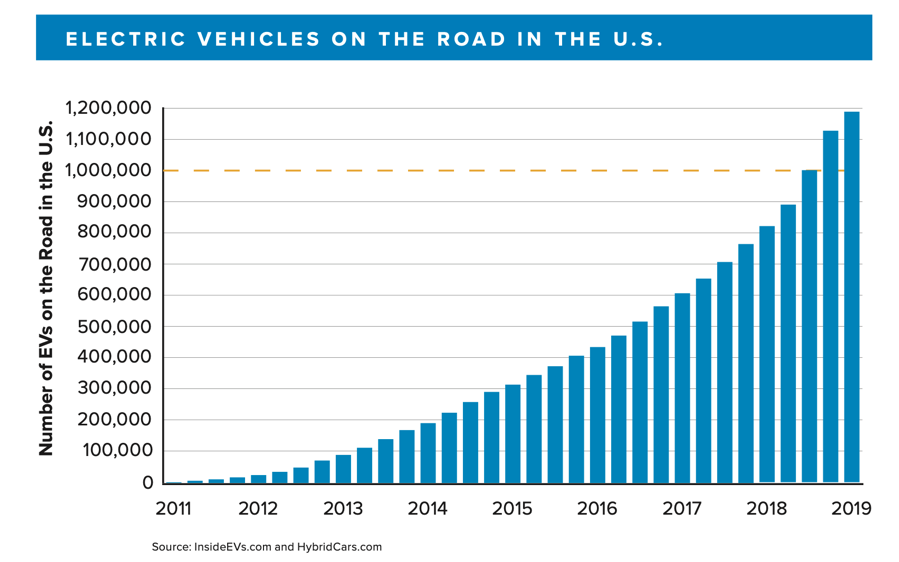

Total production of Tesla’s since the 2010 inception of Model S-1 manufacturing will reach 1 million by January 2020.

They are also encouraged by the appointment of Larry Ellison to the board of directors, a new supervising adult and Musk friend. The short answer is that they will go up a lot, certainly after they break through the old $394 high.

I was one of the first buyers of Tesla shares at $16 ½ in the aftermath of its IPO debacle during the Great Recession. I bought one of the first Tesla Model S-1’s, chassis no. 125, in 2011.

I’ve toured the Fremont factory countless times and have even taken a couple apart after I totaled them. Suffice it to say that I know which end of a Tesla to hold upwards.

So it’s time for all of us to become more familiar with this vehicle that is 20 years from the future. I have been driving the latest Model X with every possible upgrade for the past year, which included the hardware for the point-to-point autopilot that will be activated in two years.

What I learned was amazing.

While the media focus is overwhelmingly on the 1,100-pound liquid-cooled lithium-ion battery, it is fact one of the least important aspects of Elon Musk’s vision.

The car has 80% fewer parts than any other modern vehicle. That enables Tesla to cut production costs to the extent that it can afford to install a $10,000 battery in every Model 100D shipped.

And here’s the interesting part. Since I started driving electric cars 11 years ago with the Nissan Leaf, the battery cost has cratered from $1,000 to $120 per kilowatt-hour. With the completion of the second Gigafactory in Sparks, NV, that cost will drop well below $100/kWh. That’s what will make Tesla’s low-end Tesla 3 to become profitable….and go global.

I am constantly learning new things about these elegant, well thought out machines. When I picked up my last one, the configuration was all wrong. No problem. After 30 minutes in the shop, it came back to the specifications I ordered.

It was then I realized that all the options and upgrades are modular and can be snapped, fitted, or screwed on in minutes. That greatly simplified production, distribution, and versatility.

The downside is that Tesla is expanding so fast that the man who sold it to me knew virtually nothing about the car, being a former Mercedes salesman, and REGISTERED THE CAR IN THE WRONG STATE. But then it’s tough to find any good people today in this full-employment economy.

Ever the scientist, I designed a series of grueling experiments to put my “X” through during my Christmas vacation at Lake Tahoe.

I was able to make the 200 miles from the San Francisco Bay Area to Lake Tahoe on a single charge, a vertical climb of 7,200 feet. Better to stop at the Safeway in Truckee, CA which offers 16 superchargers, do your grocery shopping, and get a top-up.

Having flown small aircraft across the Atlantic, I am somewhat sensitive to range considerations. I once flew a Cessna 340 from Newfoundland to Iceland. Over Greenland, the wind shifted from a 50 miles tailwind to a 50 miles headwind, but we didn’t know it because GPS was not yet available to civilians. I ended up landing in Reykjavik with 15 minutes of fuel. An Icelandic Air Force helicopter escorted me the last 20 miles as a precaution.

And by the way, it is impossible to put on an orange survival floatation suite while you’re flying a plane. But I diverge.

I drove from the Tesla Supercharger station at the Atlantis Hotel & Casino in Reno, NV to my home in Incline Village, a distance of 30 miles. That meant crossing the Mount Rose Pass, a climb of 5,000 feet at zero degrees Fahrenheit. The “X” burned through 80 miles of range. The black ice was a killer, and I passed three accidents.

However, when I made the return trip, the vehicle used only 20 miles of range. That’s because each of the four wheels is a dynamo that recharges the battery on any decline. The car is in effect gravity-powered.

There has also been a lot of media fascination with the autopilot. Because of the three fatal crashes, its use has been cut back by Tesla to one minute at a time. You have to grip the wheel to reactivate it to prove you haven’t fallen asleep. After a while, your fingers get sore. Still, it’s useful to make phone calls or search Slacker for new music while you're driving. And the car certainly drives better than I can late at night after a bottle of fine cabernet.

Still, Bay Area police are arresting Tesla drivers found dozing at the wheel driving 70 mph. Maybe it’s those punishing Silicon Valley hours that’s doing it.

Far more useful is the radar-controlled cruise control. The car will automatically slow down when it catches up with the car in front. The problem is that at my advanced age, I can’t remember if I’m on autopilot or cruise control. I only find out when the car starts to drift over into the next lane.

A foot of fresh powder at Tahoe allowed me to test out the four-wheel-drive traction. It did fine driving up steep Sierra mountains. The all-season Pirelli Scorpion tires lived up to their billing, neatly handling an inch of clear ice on a 15-degree slope.

I learned a lot about electric cars, in general, hanging out at the ChargePoint station at the Diamond Peak Ski Resort where they offer free charging. Virtually all other competing cars only have an 80-mile range for the same price despite what their advertising says. A lot of businesses are now offering this service to lure high-end clientele, but you need a ChargePoint membership card to access the charging system.

Tahoe was a great place to test out the cold weather capability of the X where temperatures frequently can drop below zero degrees Fahrenheit at night. If you start the car cold in the morning, you’ll lose 50% of your range right off the bat.

However, if you pre-heat your car 20 minutes ahead of time by activating a handy iPhone app the loss only drops to 20% of the 295 miles range. It’s best to trickle charge the car all night at 20 watts/hour.

Playing with the 12-sensor radar is fun, whizzing past cars and trucks on the display as you pass them. It recognized my tail hitch mounted ski rack as a tailgating motorcycle. Apparently, algorithms don’t know everything….yet.

And here’s Tesla’s dirty little secret. All of the Model X’s and S’s have the same identical battery back. The ranges for the cheaper 60 and 70 kWh models are only software limited. That’s how Tesla instantly extended the range of every vehicle in Florida by 50 miles with a single command from headquarters with the onset of Hurricane Michael.

We’ll all be learning a lot more about Tesla soon. The $37,000 stripped-down Tesla 3’s are now for sale at the same price but three times the range and vastly more manufacturing experience than other electric vehicles. Sometimes they offer free charging for life.

That's when Tesla’s will truly take over the roads.

“Humans are vastly underestimated,” said Tesla founder Elon Musk.

Global Market Comments

November 20, 2019

Fiat Lux

Featured Trade:

(THE GOVERNMENT’S WAR ON MONEY)

(TESTIMONIAL)

Global Market Comments

November 19, 2019

Fiat Lux

Featured Trade:

(BLACK FRIDAY DISCOUNT OFFER FOR THE MAD HEDGE TECHNOLOGY LETTER),

(ADBE), (EBAY), (PANW)

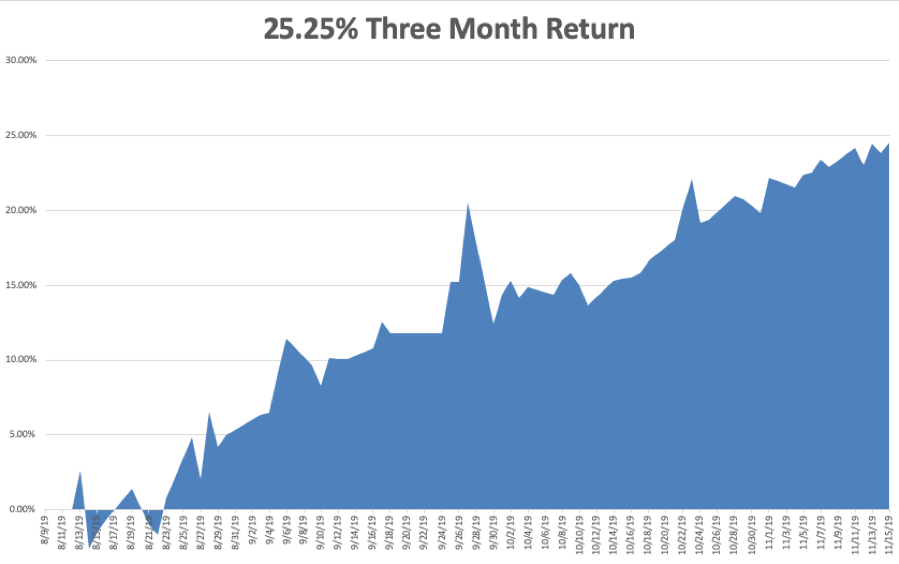

The Mad Hedge Technology Letter has been on an absolute tear lately.

It has posted an eye-popping 25.25% net profit since August. The last 14 consecutive trade alerts have been profitable, a success rate of 100%. Some 20 out of the last 22 trade alerts have been profitable, a success rate of 90.9%.

We nailed the 27.3% move in the multimedia software company, Adobe (ADBE). We killed the 23.28% pop in e-commerce leader eBay (EBAY). And we hit a total home run with a positively ballistic 30.42% gain in cybersecurity giant Palo Alto Networks (PANW).

And here’s the method to our madness. While no one was looking, the stock market has made a dramatic shift from buying in large-cap tech techs to smaller cap ones. In order words, we’ve moved from the FANGs to the mini FANG’s, and WE CAUGHT ALL OF IT!

Which brings me to the topic at hand. You absolutely HAVE to get in on this move, the most important of the year. And I’m going to make it incredibly easy for you to do so. For here at Mad Hedge Fund Trader, Black Friday comes early.

I am offering the Mad Hedge Technology Letter at an insanely bargain-basement price of $998. That is a full 61% discount to the $2,500 list price offered on our website.

I’m not doing this to make money. I am chopping prices so YOU can make money. And there is nothing I like better than happy, money-making customers. For focusing in on this one crucial sector will be the most important investment decision you make in your lifetime.

With the Mad Hedge Technology Letter, you will get:

*A three times weekly morning newsletter covering the most important technology stocks and trends of our time.

*Technology trade alerts sent out at market sweet spots telling when and where best to enter the market.

*Trade alerts sent out at market tops on where best to take profits or stop out of the rare losers.

*Invitations to biweekly Strategy Webinars with live Q&A.

*The best customer support in the industry with same day answers to all questions.

*Access to a searchable ten-year database of technology research.

*Invitations to Mad Hedge Strategy Luncheons around the world (the last one was in Zermatt, Switzerland).

In order to take advantage of this one time only offer, please click here.

Let me give you a warning. We are only accepting 25 orders at this deep discounted one-time offer so it’s a first-come, first-served basis.

I look forward to working with you.

John Thomas

CEO & Publisher

The Mad Hedge Technology Letter

Do you want to get my ultra time-sensitive money-making Trade Alerts in ten seconds, or in ten minutes? Remember, time is money.

Paid subscribers of Global Trading Dispatch are able to receive instantaneous text messages of my proprietary Trade Alerts. This eliminates frustrating delays caused by traffic surges on the Internet itself, local broadband problems, or by your provider’s server.

To activate your free service, please email customer support at support@madhedgefundtrader.com, put “TEXT ALERT SIGN UP” and include your mobile phone number. We’ll set you up instantly.

Time is of the essence in the volatile markets. Individual traders need to grab every advantage they can. This is an important one.

Good luck and good trading.

John Thomas

“First, get your facts straight. Then, distort them at your leisure,” said the humorist, Mark Twain.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.