"They say when you get old, you become wise. The truth is that when you get old, all the people who know you are stupid are dead," said the late comedian Joan Rivers.

Global Market Comments

August 23, 2019

Fiat Lux

Featured Trade:

(AUGUST 21 BIWEEKLY STRATEGY WEBINAR Q&A),

(FXB), (NVDA), (MU), (LRCX), (AMD),

(WFC), (JPM), (BIDU), (GE), (TLT), (BA)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader August 21 Global Strategy Webinar broadcast with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Hey Bill, how often have you heard the word “recession” in the last 24 hours?

A: Seems like every time I turn around. But then we’re also getting a pop in the market; we thought it bottomed a few days ago. The question was: how far were we going to get to bounce? This is going to be very telling as to what happens on this next rally.

Q: Can interest rates go lower?

A: Yes, they can go a lot lower. The general consensus in the US is that we bottom them out somewhere between zero and 1.0%. We’re already way below that in Europe, so we will see lower here in the US. It’s all happening because QE (quantitative easing) is ramping up on a global basis. Europe is about to announce a major QE program in the beginning of September, and the US ended their quantitative tightening way back in March. So, the global flooding of money from central banks, now at $17 trillion, is about to increase even more. That’s what’s causing these huge dislocations in the bond market.

Q: If we’re having trouble getting into trades, should we chase or not?

A: Never chase. Leave your limit in there at a price you’re happy with. Often times, you’ll get done at the end of the day when the high frequency traders cash out all their positions. They will artificially push up our trade alert prices during the day and take them right back down at the end of the day because they have to go 100% cash by the close of each day—they never carry overnight positions. That’s becoming a common way that people get filled on our Trade Alerts.

Q: Will Boris Johnson get kicked out before the hard Brexit occurs?

A: Probably, yes. I’m hoping for it, anyway. What may happen is Parliament forcing a vote on any hard Brexit. If that happens, it will lose, the prime minister will have to resign, and they’ll get a new prime minister. Labor is now campaigning on putting Brexit up to a vote one more time, and just demographic change alone over the last four years means that Brexit will lose in a landslide. That would pull England out of the last 4 years of indecision, torture, and economic funk. If that happens, expect British stock markets to soar and the pound (FXB) to go up, from $1.17 all the way back up to $1.65, where it was before the whole Brexit disaster took place.

Q: Is the US central bank turning into Japan?

A: Yes. If we go to zero rates and zero growth and recession happens, there’s no way to get out of it; and that is the exact situation Japan has been in. For 30 years they have had zero rates, and it’s done absolutely nothing to stimulate their economy or corporate profits. The question then—and one someone might ask Washington—is: why pursue a policy that’s already been proven unsuccessful in every country it’s been tried in?

Q: Will US household debt become a problem if there is a sharp recession?

A: Yes, that’s always a problem in recessions. It’s a major reason why financials have been in a freefall because default rates are about to rise substantially.

Q: Given the big spike in earnings in NVIDIA (NVDA), what now for the stock?

A: Wait for a 10% dip and buy it. This stock has triple in it over the next 3 years. You want to get into all the chip stocks like this, such as Micron Technology (MU), Lam Research (LRCX), and Advanced Micro Devices (AMD).

Q: Baidu (BIDU) has risen in earnings, with management saying the worst is over. Is this reality or is this a red herring?

A: I vote for A red herring. There’s no way the worst is over, unless the management of Baidu knows something we don’t about Chinese intentions.

Q: When will Wells Fargo (WFC) be out of the woods?

A: I hate the sector so I’m really not desperate to reach for marginal financials that I have to get into. If I do want to get into financials, it will be in JP Morgan (JPM), one of my favorites. The whole sector is getting slaughtered by low interest rates.

Q: Any idea when the trade war will end?

A: Yes, after the next presidential election. It’s not as if the Chinese are negotiating in bad faith here, they just have no idea how to deal with a United States that changes its position every day. It’s like negotiating with a piece of Jell-O, you can’t nail it down. At this point the Chinese have thrown their hands up and think they can get a better deal out of the next president.

Q: Would you short General Electric (GE) or wait for another bump up to short it?

A: I would wait for a bump. Obviously—with the latest accounting scandal, which compares (GE) with Enron and WorldCom—I don’t want to get involved with the stock. And we could get new lows once the facts of the case come out. There are too many better fish to fry, like in technology, so I would stay away from (GE).

Q: How do you put stop losses on your trade?

A: It’s a confluence of fundamentals and technicals. Obviously, we’re looking at key support levels on the charts; if those fail then we stop out of there. That doesn’t happen very often, maybe on 10% of our trades (and more recently even less than that). Our latest stop loss was on the (TLT) short. That was our biggest loss of the year but thank goodness we got out of that, because after we stopped out at $138 it went all the way to $146, so that’s why you do stop losses.

Q: How about putting on a (TLT) short now?

A: No, I think we’re going to new highs on (TLT) and new lows on interest rates. We’re just going through a temporary digestion period now. We’ll challenge the lows in rates and highs in prices once again, and you don’t want to be short when that happens. The liquidity is getting so bad in the bond market, you’re getting these gigantic gaps as a global buy panic in bonds continues.

Q: Do you have thoughts on what Fed Governor Powell may say in Jackson Hole, and any market reaction?

A: I have no idea what he might say, but he seems to be trying to walk a tightrope between presidential attacks and economic reality. With the stock market 3% short of an all-time high, I’m not sure how much of a hurry he will be in to lower interest rates. The Fed is usually behind the curve, lowering rates in response to a weak economy, and I’m not sure the actual data is weak enough yet for them to lower. The Fed never anticipates potential weakness (at least until the last raise) so we shall see. But we may have little volatility for the rest of the week and then a big move on Friday, depending on what he says.

Q: What is your take on the short term 6-18 months in residential real estate? Are Chinese tariffs and recession fears already priced in or will prices continue to drop?

A: Prices will continue to drop but not to the extent that we saw in ‘08 and ‘09 when prices dropped by 50, 60, 70% in the worst markets like Florida, Las Vegas, and Arizona. The reason for that is you have a chronic structural shortage in housing. All the home builders that went bankrupt in the last crash has resulted in a shortage, and you also have an immense generation of Millennials trying to buy homes now who’ve been shut out by higher interest rates and who may be coming back in. So, I’m not expecting anything remotely resembling a crash in real estate, just a slowdown. And new homes are actually not falling at all. That’s because the builders are deliberately restraining supply there.

Q: What is a good LEAP to put on now?

A: There aren’t any. We’re somewhat in the middle of a wider, longer-term range, and I want to wait until we get to the bottom of that; when people are jumping out of windows—that’s when you want to start putting on your long term LEAPS (long term equity anticipation securities), and when you get the biggest returns. We may get a shot at that sometime in the next month or two before a year in rally begins. If you held a gun to my head and told me I had to buy a leap, it would probably be in Boeing (BA), which is down 35% from its high.

Global Market Comments

August 22, 2019

Fiat Lux

Featured Trade:

(WHAT THE NEXT RECESSION WILL LOOK LIKE),

(FB), (AAPL), (NFLX), (GOOGL), (KSS), (VIX), (MS), (GS),

(TESTIMONIAL)

Global Market Comments

August 21, 2019

Fiat Lux

Featured Trade:

(WHY YOU MIISED THE TECHNOLOGY BOOM AND WHAT TO DO ABOUT IT NOW),

(AAPL), (AMZN), (MSFT), (NVDA), (TSLA), (WFC), (FB)

Global Market Comments

August 20, 2019

Fiat Lux

Featured Trade:

(JOIN US AT THE MAD HEDGE LAKE TAHOE, NEVADA CONFERENCE ON OCTOBER 25-26, 2019)

(THE BEST COLLEGE GRADUATION GIFT EVER),

(TESTIMONIAL)

Global Market Comments

August 19, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WHAT A ROLLER COASTER RIDE!),

(SPY), (TLT), (VIX), (VXX), (M),

(WMT), (FB), (AMZN), (GOOGL), (IWM)

I like roller coasters. The Giant Dipper at the Santa Cruz Boardwalk is tough to beat, the last operating wooden coaster in the United States. And I’ll always have fond memories of the Cyclone at Coney Island in New York.

I especially liked this week in the financial markets, which provided more profitable trading opportunities, both on the long and the short side, that any other week of the past decade.

Perhaps the highpoint was on Thursday when I was staring at my screens watching ten year US Treasury bond yields (TLT) bottom at a near historic 1.46%, and my own Mad Hedge Market Timing Index plunging to a lowly 19.

Impulsively, I covered the last of my short positions and started piling on longs in the FANGs. The next morning, the Dow Average opened up 300 points. But then, it’s easy to be bold and decisive when you’re up 30% on the year, compared to only 11% for the Dow Average.

And guess what? The best may be yet to come!

As long as the Volatility Index stays over $20, you will be able to print all the money you want with options spreads. I’m talking 10%-15% A MONTH!

All eyes are now on September 1 when the Chinese announce their own retaliation to our tariff increase. Will they target ag again? Or does the bond market (TLT) take the hit this time (the Chinese government owns $900 billion worth of our debt).

And now for the question that everyone is asking: How far will the stock market fall in this cycle. We have already plunged 10% from the highs on an intraday basis. Could we drop another 10% in this period of high anxiety? Certainly. However, I tend to think it will be less than that.

The initial market pop on Monday came when the new Chinese tariffs were delayed, from September 1 to December 15, on some items. Tell me who saw this one coming. The potential costs of the tariffs are hitting the US more than China. It was worth a 550-point rally in the Dow Average. In 50 years, I’ve never seen such blatant market manipulation.

Gold hit a new six-year high, with the collapse of the Argentine Peso a new factor. A poor election result drove the beleaguered currency down 15% in one day, a massive move.

Now you have to worry about what’s happening in China AND Argentina. For the first time in history, gold now has a positive yield versus the Europe and the Japanese Yen, which both offer negative interest rates.

Hong Kong is becoming a factor driving US markets down. If there is a repeat if the 1989 Tiananmen Square massacre where thousands died, global markets could collapse. The hit to growth will be more than it currently can stand in its present weakened state.

Inflation is taking off, with Core Consumer Inflation for July coming in at a red hot 0.3%, delivering the strongest two-month price burst since 2006. If it keeps up, you can kiss those future interest rate cuts goodbye.

Germany is in recession. That is the only conclusion possible when you see Q2 at -0.1% growth and the economy still in free fall. The ZEW’s figures regarding Germany yesterday were nothing short of horrific as the Economic Sentiment Index fell to -44. When you damage China’s economy, it puts the rest of the world into recession. The global economy has become so interlinked, it can’t become undone without another great recession.

Bonds rates bottomed yesterday, at least for the short term, the intraday low for the ten-year US Treasury yield hitting 1.46%. Welcome to inversion land, where long term interest rates are below short-term ones. Confidence in the economy is melting like an Alaskan glacier. But with three more 25 basis point rate cuts to come, an eventual break below 1.0% is inevitable. Watch for stocks to remake half their recent losses.

Consumer Sentiment cratered in August from 97.0 estimated to 92.1. And that was before the stock market sold off. Consumer spending remains strong. The last time it was this strong was at the market top in 2008, the market top in 1999, and the market top in 1987.

July Housing Starts plunged 4.0%, to 1.191 million units as homebuilders move into recession mode. Not even record low-interest rates can get them to stick their necks out this time. Those that did last time got wiped out.

It’s been pedal to the metal all month with the Mad Hedge Trade Alert Service, with no less than 31 Trade Alerts going out so far. Some 18 or the last 19 round trips have been profitable, generating one of the biggest performance jumps in our 12-year history.

Since July 12, we have clocked a blistering 15.15% in profits or $15,150 for the model $100,000 trading portfolio.

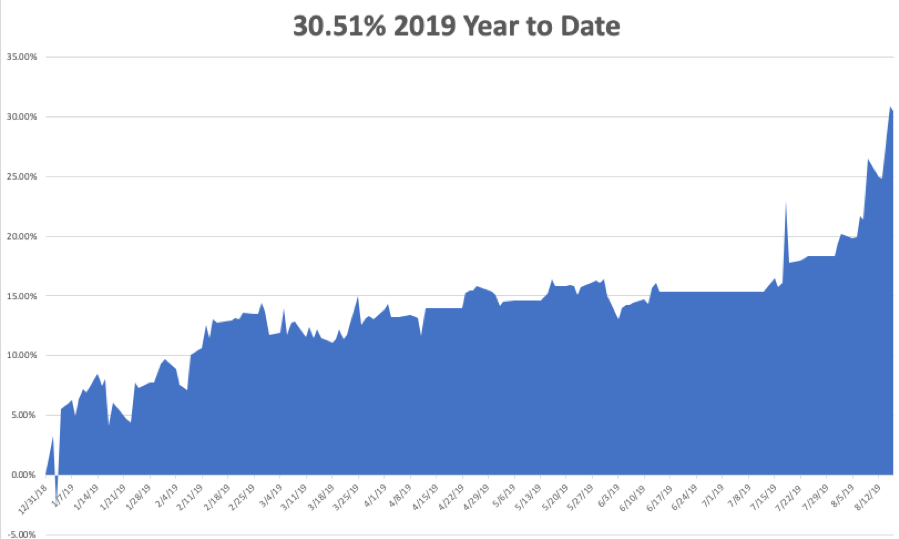

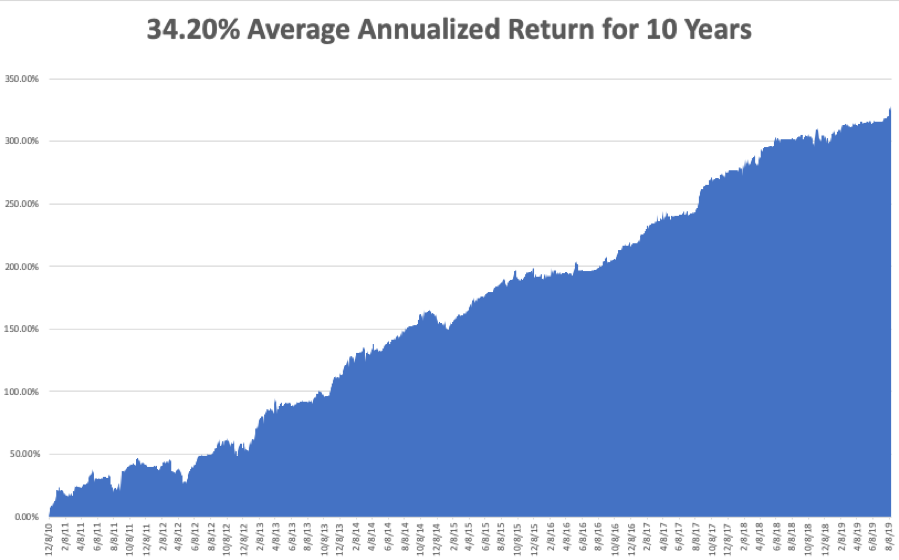

My Global Trading Dispatch has hit a new all-time high of 330.65% and my year-to-date shot up to +30.51%. My ten-year average annualized profit bobbed up to +34.20%.

I have coined a blockbuster 12.18% so far in August. All of you people who just subscribed in June and July are looking like geniuses. My staff and I have been working to the point of exhaustion, but it’s worth it if I can print these kinds of numbers.

The coming week will be a snore on the data front. Believe it or not, it could be quiet.

On Monday, August 19, nothing of note is released.

On Tuesday, August 20 at 10:30 AM, we get API Crude Oil Stocks.

On Wednesday, August 21, at 10:00 the Existing Home Sales are published for July.

On Thursday, August 22 at 8:30 AM, the Weekly Jobless Claims are printed. The Jackson Hole conference of global central bankers and economists begins.

On Friday, August 23 at 8:30 AM the July New Home Sales are announced.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I will be attending the Pebble Beach Concourse d’Elegance vintage car show where I will be exhibiting my 1925 Rolls Royce Phantom I, the best car ever made.

I don’t mind the wooden brakes, but it’s too bad they didn’t make adjustable seats in those days to fit my 6’4” frame. However, its price appreciation has been better than Apple’s (AAPL) which I bought as a fixer upper in England during the 1980s for $20,000. My average cost on Apple is a split adjusted 25 cents.

My Rolls will be shown alongside James Bond’s 1964 Aston Martin which sold for $6.3 million, a 1939 Volkswagen Type 64 priced at more than $20 million, and a $13 million 1958 Ferrari 250 GT BBT.

And what am I doing next weekend? Taking the Boy Scouts to the Six Flags roller coaster farm in Vallejo.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

My Phantom I

1939 Volkswagen

1954 Ferrari

Global Market Comments

August 16, 2019

Fiat Lux

Featured Trade:

(DON’T MISS THE AUGUST 21 GLOBAL STRATEGY WEBINAR),

(WHY CRASHING YIELDS COULD BE SIGNALING AN END TO THE STOCK SELLOFF),

(TLT), (QQQ), (DBA), (EEM), (UUP)

I believe that the entire leg down in the stock market we have seen since July has been driven by a global collapse in bonds yields, a reliable predictor of recessions.

In three weeks, ten-year US Treasury yields have collapsed from 2.15% to 1.46%, ten-year German bunds from -0.20% to -0.72, and Japanese ten-year government bonds have collapsed from -0.10% to -0.25%.

For a once in a half-century observer of the financial markets, I can assure you that these are once in a half-century moves.

Therefore, I can tell you with some news that we are coming to an end in these horrific moves, at least an interim one.

I have charted ten-year US Treasury yields for the five decades that I have been in the market below and we are rapidly approaching a crucial point. That would be the triple bottom at the all-time lows at 1.35%.

If yields bounce there, and they should, you can expect a substantial short-covering rally to ensue in the stock market. That’s why I have been using every dip this week to load up on long positions in the FANGS.

With German bunds at -0.75%, a US bottom at 1.35% may not be the final one. But it was certainly a sign for long players in the (TLT) to take their massive profits, which could take yields back up as high as 1.75%.

Investors around the world have been confused, befuddled, and surprised by the persistent, ultra-low level of long-term interest rates in the United States.

The ten-year all-time low yield of 1.33% is as rare as a dodo bird, last seen in the 19th century.

What’s more, yields across the entire fixed income spectrum have been plumbing new lows. Corporate bonds (LQD) have been fetching only 3.02%, tax-free municipal bonds (MUB) 1.60%, and the iShares IBoxx High Yield Corporate Bond ETF (HYG) a pittance at 5.27%.

Spreads over Treasuries are now inverted, with a two-year yield at 1.50% versus a ten-year yield at 1.46%. always a reliable recession indicator

Are investors being rewarded for taking on the debt of companies that are on the edge of bankruptcy, a tiny 2.0% premium? Or that State of Illinois at 3.0%? I think not.

It is a global trend.

Yikes!

These numbers indicate that there is a massive global capital glut. There is too much money chasing too few low-risk investments everywhere. Has the world suddenly become risk-averse? Is inflation gone forever?

Will deflation become a permanent aspect of our investing lives? Does the reach for yield know no bounds?

It wasn’t supposed to be like this.

Almost to a man, hedge fund managers everywhere were unloading debt instruments last year when ten-year yields peaked at 3.25%. They were looking for a year of rising interest rates (TLT), accelerating stock prices (QQQ), falling commodities (DBA), and dying emerging markets (EEM). Surging capital inflows were supposed to prompt the dollar (UUP) to take off like a rocket.

It all ended up being almost a perfect mirror image portfolio of what actually transpired since then. As a result, almost all mutual funds were down in 2018. Many hedge fund managers are tearing their hair out, suffering their worst year in recent memory.

What is wrong with this picture?

Interest rates like these are hinting that the global economy is about to endure a serious nose dive, possibly even re-entering recession territory….or it isn’t.

To understand why not, we have to delve into deep structural issues which are changing the nature of the debt markets beyond all recognition. This is not your father’s bond market.

I’ll start with what I call the “1% effect.”

Rich people are different than you and I. Once they finally make their billions, they quickly evolve from being risk-takers into wealth preservers. They don’t invest in start-ups, take fliers on stock tips, invest in the flavor of the day, or create jobs. In fact, many abandon shares completely, retreating to the safety of coupon clipping.

The problem for the rest of us is that this capital stagnates. It goes into the bond market where it stays forever. These people never sell, thus avoiding capital gains taxes and capturing a future step up in the cost basis whenever a spouse dies. Only the interest payments are taxable, and that at a lowly 1.46% rate.

This is the lesson I learned from servicing generations of Rothschild’s, Du Pont’s, Rockefellers, and Getty’s. Extremely wealthy families stay that way by becoming extremely conservative investors. Those that don’t, you’ve never heard of because they all eventually went broke.

This didn’t use to mean much before 1980, back when the wealthy only owned less than 10% of the bond market, except to financial historians and private wealth specialists of which I am one. Now they own a whopping 25%, and their behavior affects everyone.

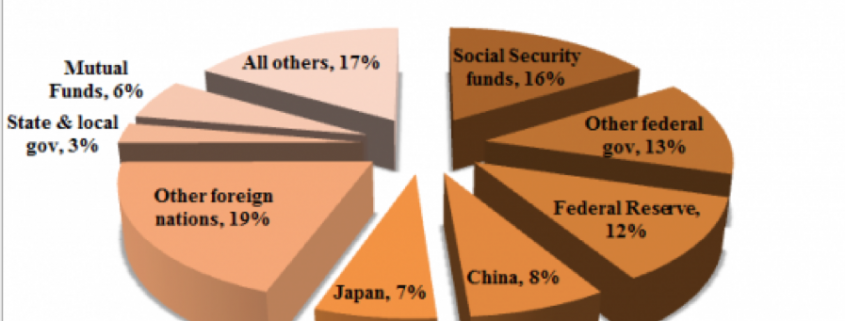

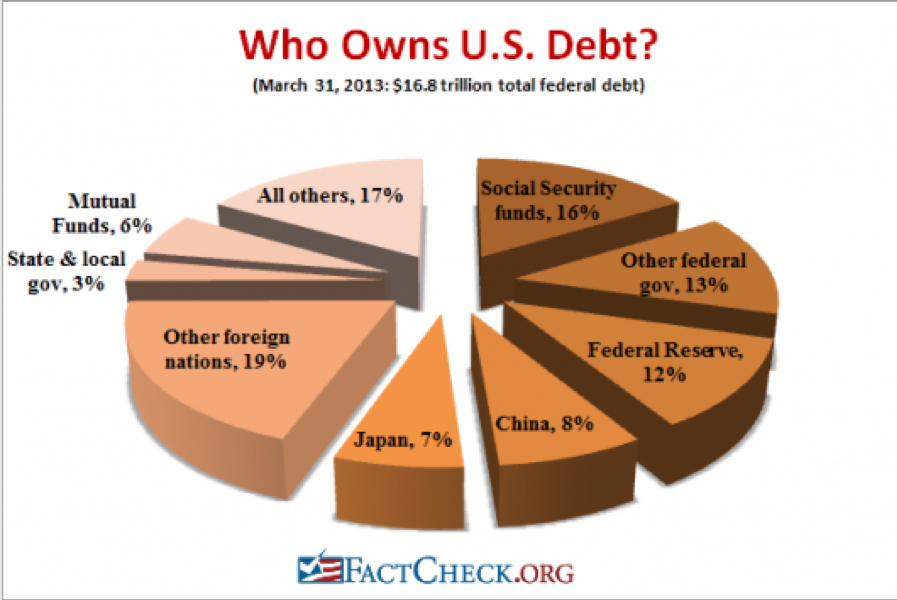

Who has been the largest buyer of Treasury bonds for the last 30 years? Foreign central banks and other governmental entities, which count them among their country’s foreign exchange reserves.

They own 36% of our national debt, with China in the lead at 8% (the Bush tax cut that was borrowed), and Japan close behind with 7% (the Reagan tax cut that was borrowed). These days they purchase about 50% of every Treasury auction.

They never sell either, unless there is some kind of foreign exchange or balance of payments crisis, which is rare. If anything, these holdings are still growing.

Who else has been soaking up bonds, deaf to repeated cries that prices are about to plunge? The Federal Reserve which, thanks to QE1, 2, 3, and 4, now owns 13.63% of our $22 trillion debt.

An assortment of other government entities possesses a further 29% of US government bonds, first and foremost the Social Security Administration, with a 16% holding. And they ain’t selling either, baby.

So what you have here is the overwhelming majority of Treasury bond owners with no intention to sell. Ever. Only hedge funds have been selling this year, and they have already done so, in spades.

Which sets up a frightening possibility for them, now that we have broken through the bottom of the past year’s trading range in yields. What happens if bond yields fall further? It will set off the mother of all short-covering squeezes and could take ten-year yield down to match 2012, 1.35% low, or lower.

Fasten your seat belts, batten the hatches, and down the Dramamine!

There are a few other reasons why rates will stay at subterranean levels for some time. If hyper-accelerating technology keeps cutting costs for the rest of the century, deflation basically never goes away (click here for “Peeking Into the Future With Ray Kurzweil.”

Hyper-accelerating corporate profits will also create a global cash glut further levitating bond prices. Companies are becoming so profitable they are throwing off more cash than they can reasonably use or pay out.

This is why these gigantic corporate cash hoards are piling up in Europe in tax-free jurisdictions, now over $2 trillion. Is the US heading for Japanese-style yields of zero for 10-year Treasuries?

The threat of a second Cold War is keeping the flight to safety bid alive and keeping the bull market for bonds percolating. You can count on that if the current president wins a second term.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.