You knew when the price of margaritas was going up that the new Mexican tariff dispute was not going to last very long, especially going into the summer. No wonder the Texas senators were so upset.

As of this writing, the tariffs have been called off two days before they were going to be implemented and a week after they were threatened. But who knows? They could be back on again at any time once the Mexicans fail to deliver on their undoubtedly impossible promises.

The Mexican standoff does, however, provide valuable lessons on how markets may perform going into the 2020 presidential election; arbitrarily create an unnecessary crisis, just as arbitrarily end it, and then collect more votes from your base.

Now let's scale this up to the trade war with China. Use fears of an impending recession to get the Fed to lower interest rates in a major way. With the economic data now falling to pieces, futures markets are currently discounting three 25 basis point rate cuts by yearend and two more in 2020. That gets the Fed funds rate down from the current 2.50% to 1.25% in a hurry.

Then what happens? A “beautiful” trade deal is signed with China, hyper-stimulating the economy in the middle of the election. What are stocks worth with a 1.25% fed funds rate? A whole lot more than they are now.

So, here is the setup for the stock market. A treacherous trading range over the next three to six months leading to lower highs and then lower lows. After that, they go ballistic next year.

I have never been a fan of conspiracy theories, and the strategy above depends on a lot of external things going incredibly right. For a start, the Chinese likely do not want to provide any assistance to the president whatsoever in getting reelected.

Still, we all need a model of how the companies, industries, the economy, and world events will transpire before we enter a single trade, and this is the best one I can come up with….today.

It’s not that interest rates are so important anymore. The biggest chunk of the stock market, large-cap tech stocks, are hugely cash flow positive, have no net debt, and actually lose money when rates fall. And rates have been so low for so long that we have all become used to free money.

The biggest impact is on the consumer who accounts for 70% of GDP. Lower credit card rates and home mortgages have an immediate and positive effect on the economy.

The May Nonfarm Payroll Report definitely cast a long shadow over the economy, coming in at only 75,000, less than half of what was expected. March and April were also revised down by an additional 75,000. The headline Unemployment Rate held steady at 3.6%.

Professional Services gained by 33,000, Construction by 4,000, and Health Care by 16,000. Retail was the biggest loser at 7,000.

If it was just one data point that was so horrible, I wouldn’t be so worried. In fact, Private jobs growth hit a nine-year low on Wednesday, with the May ADP in at only 27,000. Is this the canary in the coal mine?

The takeaway here is that the trade war is finally starting to exact its pound of flesh (I’m going to Venice after all), and that the next report could be worse. The Mexican tariffs and the antitrust assault on big tech are too recent to be reflected in the data. It makes a July Fed rate cut a slam dunk (after all, I live in Oakland).

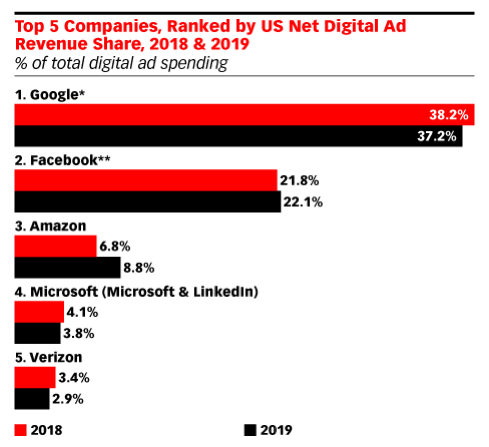

The Justice Department has started an antitrust investigation against Google, claiming that search results favor Google-owned companies. The problem is that Google invented modern online search, with a 92.81% market share. Bing has a 2.38% market share and Yahoo has 1.89%. And while they own search, they contain only 38.2% of the online advertising market.

Microsoft (MSFT) had the same problem during the 1990s, with an antitrust suit brought by the government that lasted a decade. Before that, there was the interminable IBM antitrust suit. I thought Amazon’s (AMZN) head was supposed to be on a plate? Note: I had to Google (GOOGL) the information for this article.

The Fed Beige Book says the economy is slowing, and that is pre-Mexican tariff data. The summer slowdown is here, and GDP growth may fall under 1%. Bond, commodity, and energy markets say the recession is already here, but what do they know?

International trade is in free fall. Expect stocks to hit new 2019 lows while you’re basking on the beach. Your next GM model upgrade is trapped at the border. Sounds like a good time for me to take a trip around the world. Those camels in Egypt are looking better by the minute.

The trade war will cut global airline profits by 21%, from $35.5 billion to $28 billion, says industry trade association IATA in a forecast. More war means less first-class travel. And you wonder why airline share prices have been getting creamed (DAL), (LUV).

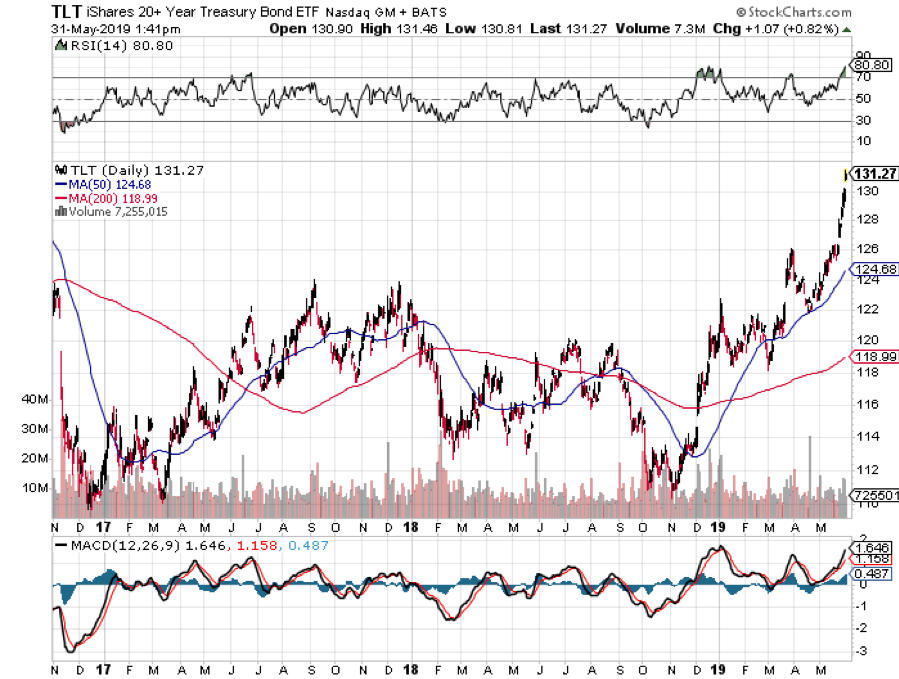

The bond market is now gunning for a 1.85% yield, and after that, the 2016 low of 1.33%, as a trade war escalating daily brings forward the next recession. The market has nearly given Trump his 1% cut in interest rates he has been clamoring for. It’s now up to the Fed to follow.

The New York Fed recession indicator is now at 30%, a 12-year high, and with the yield curve now inverted you have to pay attention. This one may be a predicted recession that actually happens. However, recessions usually happen when interest rates spike, not collapse, as they have done.

Thanks to the extreme volatility of the week I gave up my profits for the month of June and have to start all over again. Such is show business. We are now a mere 1.92% below our last all-time high from the previous week. Trading a narrow range with extreme volatility is about the worst kind of market to trade.

It was the antitrust news about the FANGs that really hit me, a core long of mine for the last decade. Thus, I was stopped out of positions in Amazon (AMZN) and Microsoft (MSFT). I was able to hang on to my long in Tesla (TSLA) because the spread was so deep in-the-money.

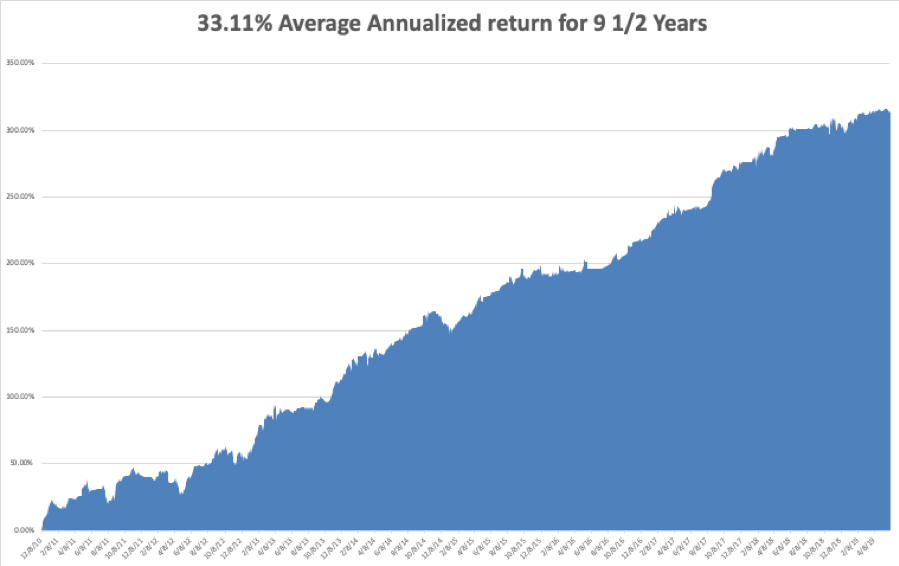

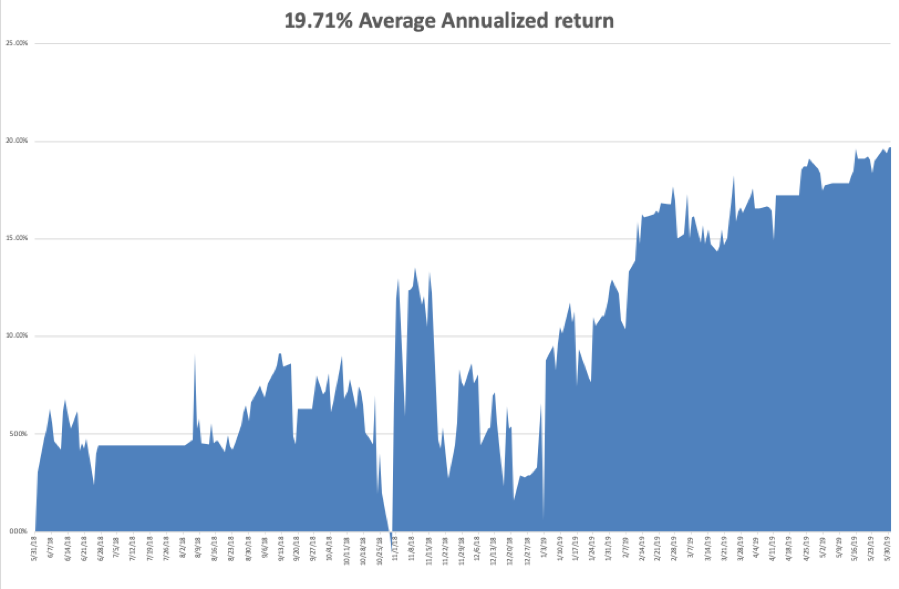

Global Trading Dispatch closed the week up 14.43% year-to-date and is down by -1.29% so far in May. My trailing one-year declined to +13.07%.

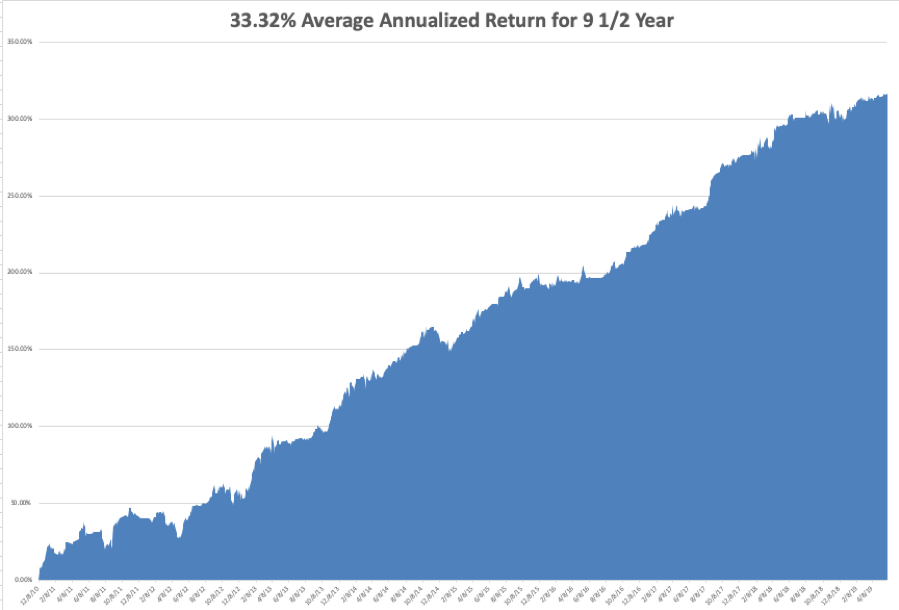

My nine and a half year profit fell back to +314.57%. The average annualized return shrank to +33.11%. With the trade war with China raging, I am now 90% in cash with Global Trading Dispatch and 100% cash in the Mad Hedge Tech Letter.

I’ll wait until the markets enjoy a brief short-covering rally before adding any short positions to hedge my longs.

The coming week will be a fairly sedentary one on the data front after last week’s jobs fireworks.

On Monday, June 10 at 12:00 PM, the May Consumer Inflation Expectations report is out.

On Tuesday, June 11, 9:00 AM EST, the May US Producer Price Index is released.

On Wednesday, June 12 at 9:30 AM, the May US Core Inflation is published.

On Thursday, June 13 at 8:30 AM, the Weekly Jobless Claims are printed.

On Friday, June 14 at 9:30 AM, May US Retail Sales are out. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I am spending the weekend packing for my 2019 Mad Hedge World Tour. I’ll be chasing down my mosquito spray for the Philippines, my ice ax and loden hat for Switzerland, my plug adapters and diarrhea treatments for India, and my hangover medicine for Australia. I know I already have all this stuff somewhere, I just have to find it.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader