Global Market Comments

March 26, 2019

Fiat Lux

Featured Trade:

(WHY I’M SELLING SHORT TESLA SHARES),

(TSLA)

Global Market Comments

March 26, 2019

Fiat Lux

Featured Trade:

(WHY I’M SELLING SHORT TESLA SHARES),

(TSLA)

The news is out that new Tesla (TSLA) new car registrations in the major states are falling off a cliff. California, New York, and even Texas are the major culprits.

The company says the ramp up in mass production of the Tesla 3 is the main reason, and that car registrations, in any case, are a deep lagging indicator. (No kidding! I bought a Model X P100D in Nevada in November and it is still not registered).

Analysts say it is because the electric car subsidy was chopped in half by the Trump administration this year from $7,500 to $3,750 per vehicle, and it is going to zero next year, thus demolishing the Tesla 3 market for entry-level low-end buyers. They also point to the company’s fragile financial condition which could be going bankrupt at any time.

For whatever reason, I believe that the shares will break two-year support on the charts and plunge to new lows. At the very least, Tesla shares are capped for the time being.

I, therefore, sold short Tesla shares yesterday.

As much as this looks like a great short-term trade, I love Tesla long term and see it as a potential ten bagger from current price levels. Tesla will become the world’s largest car company within a decade and become the first car company with a $1 trillion market valuation.

As long as I have been following Tesla since the early venture capital days, it has been going bankrupt. It was going bankrupt during the move in the share price from $16.50 to $394, and it is going bankrupt today.

When I pulled up to the Fremont factory last week, I couldn’t believe what I found. There was a version 3 supercharger that would top up my battery at the staggering rate of 1,000 miles an hour!

That meant that with 50 miles of range left on my 300-mile range Model X battery, I could get a full charge in 15 minutes! The electric power was coming down the cable so fast that it had to be liquid-cooled.

I pinched myself to make sure I hadn’t fallen into a Star Trek movie. The V3 supercharger will soon be available across the country. No other car company is close to achieving something like this.

The fact is that I have been subjected to an unrelenting torrent of bad news, rumors, and envy since I first bought the shares at $16.50 ten years ago. This is the most despised company in the universe and regularly sits among the top five companies with the greatest short interest, often above 25%.

But I guess this is what happens when you take on big oil, the Detroit big three, the advertising industry, labor unions, and the entire Republican party all at once. By my calculation, Tesla is a disruptive threat to about 50% of the US GDP all at once.

I ignore them all and just look at the numbers. Here they are.

1) Tesla has increased its total production from 125 when I bought my first Model S1 in 2009 to 245,519 in 2018. It should hit 500,000 by the end of this year when the Shanghai factory comes online. They have gone from employing 100 people to 50,000.

2) With the completion of the Sparks, NV Gigafactory, battery prices are collapsing and are now 50% cheaper per mile than any other competitor, 4.1 miles per kWh versus 2.5 miles.

3) Tesla’s costs for batteries have cratered from $1,000 per kWh ten years ago to $100 per kWh today and are expected to drop to $75 per kWh in a few years. Below $100 per kWh Teslas are cheaper to run than conventional gasoline-powered cars, even without the tax subsidy.

4) Tesla now makes half the lithium batteries in the world, and that figure is growing by 50% a year.

5) Tesla’s vast national charger network will soon become the country’s largest electric power utility and that will also become an enormous money-spinner. They just raised prices to 30 cents per kWh versus a cost of 5 cents. Assuming that 5 million cars buy a 70-kWh charge three times a week, that works out to a $13.65 billion a year profit.

6) Anyone who actually reads Tesla’s balance sheet can see that the company is now spinning off $1 billion in free cash flow. It is investing in new plant and equipment at a prodigious rate.

7) With a market capitalization of $44.5 billion, Tesla just trails General Motors (GM) at $51 billion, but surpasses Ford Motors at $34 billion, and therefore can raise new capital to finance its hyper-growth any time it wants.

More product at high prices at a prodigiously falling cost sounds like a pretty good business model to me. Oh, and climate change is about to become the top political issue for the 2020 presidential election. Who is the big winner in that case?

Tesla.

Global Market Comments

March 25, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR GAME CHANGER)

(SPY), (TLT), (BIIB), (GOOG), (BA), (AAPL), (VIX), (USO)

“When the facts change, I change. What do you do sir?” is a famous quote from the great economist John Maynard Keynes which I keep taped to the top of my monitor and constantly refer to.

The facts certainly changed on Wednesday when the Federal Reserve announced a change in the facts for the ages. Not only did governor Jay Powell announce that there would be no further rate increases in 2019.

He also indicated that the Fed would end its balance sheet unwind much earlier than expected. That has the effect of injecting $2.7 trillion into the US financial system and is the equivalent of two surprise interest rate CUTS.

The shocking move opens the way for stocks to trade up to new all-time high, with or without a China trade deal. Only the resumption of all-out hostilities, like the imposition of new across the board 25% tariffs, would pee on this parade.

As if we didn’t have enough to discount into the market in one shot. I held publication of this letter until Sunday night when we could learn more about the conclusion of the Mueller Report. There was no collusion with Russia and there will be no obstruction of justice prosecution.

However, the report did not end the president’s legal woes as it opened up a dozen new lines of investigation that will go on for years. The market could care less.

At the beginning of the year, I listed my “Five Surprises for 2019”. They were:

*The government shutdown ended and the Fed makes no move to raise interest rates

*The Chinese trade war ends

*The US makes no moves to impeach the Trump, focusing on domestic issues instead

*Britain votes to rejoin Europe

*The Mueller investigation concludes that he has an unpaid parking ticket in

NY from 1974 and that’s it

Notice that three of five predictions listed in red have already come true and the remaining two could transpire in coming weeks or months. All of the above are HUGELY risk positive and have triggered a MONSTER Global STOCK RALLY

Make hay while the sun shines because what always follows a higher high? A lower low.

The Fed eased again by cutting short their balance sheet unwind and ending quantitative tightening early. It amounts to two surprise interest rate cuts and is hugely “RISK ON”. New highs in stocks beckon. This is a game changer.

Bonds soared and rates crashed taking ten-year US Treasury bond yields down to an eye-popping 2.42%, still reacting to the Wednesday Fed comments. This is the final nail in the bond bear market as global quantitative easing comes back with a vengeance. German ten years bonds turn negative for the first time since 2016.

Interest rates inverted with short term rates higher than long term ones for the first time since 2008. That means a recession starts in a year and the stock market starts discounting that in three months.

Interest rates are now the big driver and everything else like the economy, valuations, and earnings are meaningless. Foreign interest rates falling faster than ours making US assets the most attractive in the world. BUY EVERYTHING, including stocks AND bonds.

Biogen blew up canceling their phase three trials for the Alzheimer drug Aducanumab. This is the worst-case scenario for a biotech drug and the stock is down a staggering 30%. Some $12 billion in prospective income is down the toilet. Avoid (BIIB) until the dust settles.

Europe fined Google $1.7 billion, in the third major penalty in three years. Clearly, there’s a “not invented here” mentality going on. It's sofa change to the giant search company. Buy (GOOG) on the dip.

More headaches for Boeing came down the pike. What can go wrong with a company that has grounded its largest selling product? Answer: they get criminally prosecuted. That was the unhappy news that hit Boeing (BA), knocking another $7 off the shares. It can’t get any worse than this, can it? Buy this dip in (BA).

Indonesia canceled a massive 737 order for 49 planes, slapping the stock on the face for $9. Apparently, they are unwilling to wait for the software fix. Buy the dip in (BA).

Oil prices hit a new four-month high at $58 a barrel as OPEC production caps work and Venezuela melts down. At a certain point, high energy prices are going to hurt the economy. Buy (USO) on dips.

The CBOE suspended bitcoin futures due to low volume and weak demand. It could be a fatal blow for the troubled cryptocurrency. Avoid bitcoin and all other cryptos. They’re a Ponzi scheme.

Equity weightings hit a 2 ½ year low as professional institutional money managers sell into the rally. They are overweight long defensive REITs and short European stocks. Watch out for the reversal.

December stock sellers are now March buyers. Expect this to lead to a higher high, then a lower low. Volatility is coiling. Don’t forget to sit down when the music stops playing.

Volatility hits a six-month low with the $12 handle revisited once again down from $30. (VIX) could get back to $9 before this is all over. Avoid (VIX) as the time decay will kill you.

Weak factory orders crush the market, down 450 points at the low. Terrible economic data is not new these days. But it ain’t over yet. Buy the dip.

The Mad Hedge Fund Trader was up slightly on the week. That’s fine, given the horrific 450 point meltdown the market suffered on Friday. We might have closed unchanged on the day but for rumors that the Mueller Report would be imminently released.

March is still negative, down -1.54%. My 2019 year to date return retreated to +11.74%, boosting my trailing one-year return back up to +24.86%.

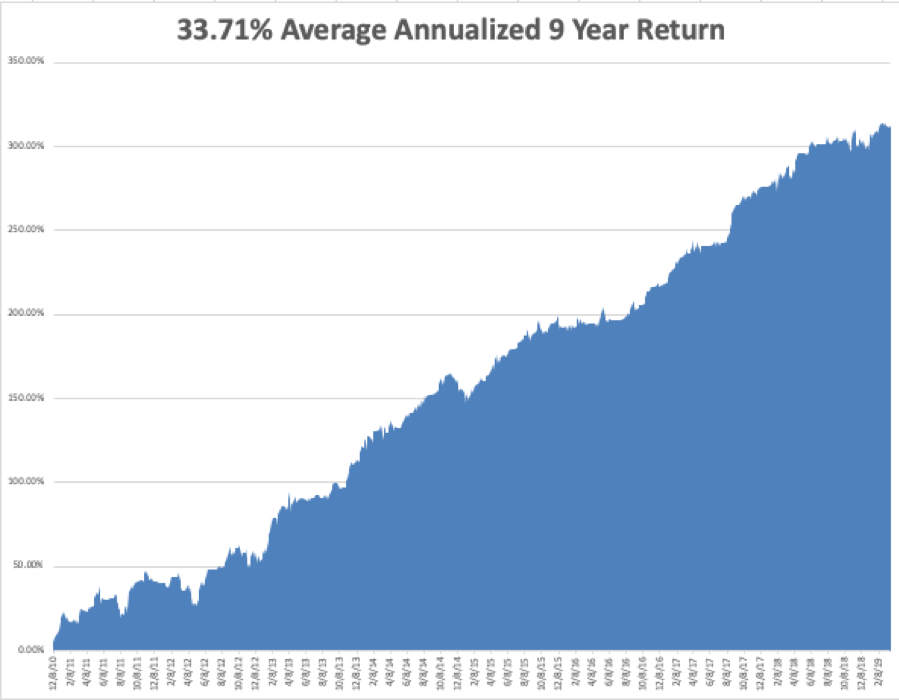

My nine-year return recovered to +311.88%. The average annualized return appreciated to +33.71%. I am now 40% in cash, 40% long and 20% short, and my entire portfolio expires at the April 18 option expiration day in 14 trading days.

The Mad Hedge Technology Letter used the weakness to scale back into positions in Microsoft (MSFT), Alphabet (GOOGL), and PayPal (PYPL), which are clearly going to new highs.

The coming week will be a big one for data from the real estate industry.

On Monday, March 25, Apple will take another great leap into services, probably announcing a new video streaming service to compete with Netflix and Walt Disney.

On Tuesday, March 26, 9:00 AM EST, we get a new Case Shiller CoreLogic National Home Price index which will almost certainly show a decline.

On Wednesday, March 27 at 8:30 AM, we get new Trade Deficit figures for January which have lately become a big deal.

Thursday, March 28 at 8:30 AM EST, the Weekly Jobless Claims are announced. We also then get another revision for Q4 GDP which will likely come down.

On Friday, March 29 at 10:00 AM, we get February New Home Sales. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’m praying that it stops snowing in the High Sierras long enough for me to get over Donner Pass and spend the spring at Lake Tahoe. We are at 50 feet for the season, the second highest on record.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 22, 2019

Fiat Lux

Featured Trade:

(I HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE),

(MARCH 20 BIWEEKLY STRATEGY WEBINAR Q&A),

(BA), (FCX), (IWM), (JNJ), (FXB), (VIX), (JPM)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader March 20 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What do you make of the Fed’s move today in interest rates?

A: By cutting short their balance sheet unwind early and ending quantitative tightening (QT) early, it amounts to two surprise interest rate cuts and is hugely “RISK ON”. In effect, they are injecting $2.7 trillion in new cash into the financial system. New highs in stocks beckon, and technology stocks will lead. This is a game changer. In a heartbeat, the world has moved from QT to QE, and we already know what that means for socks. They go up.

Q: Why buy Boeing shares (BA) ahead of a global recession?

A: It’s an 18-day bet that I’ve made in the options market. The US economic data is already indicating recession. The data will continue to worsen and that will continue until we go into a recession. But that’s not happening in 18 trading days. Also, we’re getting into Boeing down 20% from the top so our risk is minimal.

Q: Why are we in an open Russell 2000 (IWM) short position?

A: We now have three long positions— 40% on the long side with the Freeport McMoRan (FCX) double position. It’s always nice to have something on the other side to hedge sudden 145-point declines like we have today. Ideally, you want to be hedged at all times. But it’s hard to fund good companies to sell short in a bull market.

Q: Do you need some euphoria to get the Volatility Index (VIX) to the $30-$60 level?

A: No, you don’t need euphoria. You need fear and panic. The (VIX) is a good “fear index” in that it rises when markets are crashing and falling when markets are slowly rising. And for that reason, I’m not buying (VIX) right now. With a sideways to slowly rising market, we could see the $9 handle again before this move is over.

Q: What should be the exit on the Russell 2000 (IWM)?

A: One choice is taking 80% of the maximum profit when you hit it—that’s where the risk-reward tips against you if you keep the position. The other option is to be greedy and run it all the way into expiration, taking the full profit. It depends on your risk tolerance. Remember, we hit the 80% profit three times in March only to stop out of positions for a loss. The market just doesn’t seem to want to let you take the whole 100%.

Q: Why are all your expirations on April 18?

A: That’s when the monthly options expire; therefore, they have the most liquidity of any other option expiration. If you go with the weeklies before or after the monthlies, the liquidity declines dramatically, which can be very frustrating. Since I used to cover only the largest clients, we could only trade in monthlies because we needed the size.

Q: Will Johnson and Johnson (JNJ) survive all those talcum powder lawsuits?

A: They’ve been going on for 10 years—you’d think they’d know by now if they have asbestos in their talcum powder or not. I highly doubt this will get anywhere; they’ll probably win everything on appeal.

Q: What do you anticipate on Brexit?

A: I think eventually Brexit will fail; we’ll have a referendum which will get voted down, Britain will rejoin Europe, and the British pound (FXB) will go to $1.65 to the dollar where it was when Brexit hit three years ago, up from $1.29 today. It would be economic suicide for Britain to leave Europe, as they would have to compete against Europe, the US, and China alone, and they are slowly figuring that out. Demographic change alone over three years would guarantee that another referendum fails.

Q: My partner owns JP Morgan (JPM). Do you still say banks are not a good place to be?

A: Yes. Fintech is eating their lunch. If they couldn't go up with interest rates moving up in the right direction, they certainly won’t be doing better now that interest rates are going down. Legacy banks are the new buggy whip industry.

Q: Why are commodities (FCX) increasing with a coming recession?

A: They are a hard asset and do better in inflation. Also, they’re stimulating their economy in China and we aren't—commodities do better in that situation as China is the world’s largest buyer of commodities, as do all Chinese investments.

Q: Would you buy Biogen (BIIB) on the dip? Its down 30% today.

A: Canceling their advanced phase three trials for the Alzheimer drug Aducanumab is the worst-case scenario for a biotech company. Some $12 billion in prospective income is down the toilet and many years of R&D costs are a complete write-off. Avoid (BIIB) until the dust settles.

Global Market Comments

March 21, 2019

Fiat Lux

Featured Trade:

(DIVING BACK INTO THE MOUSE HOUSE),

(DIS),

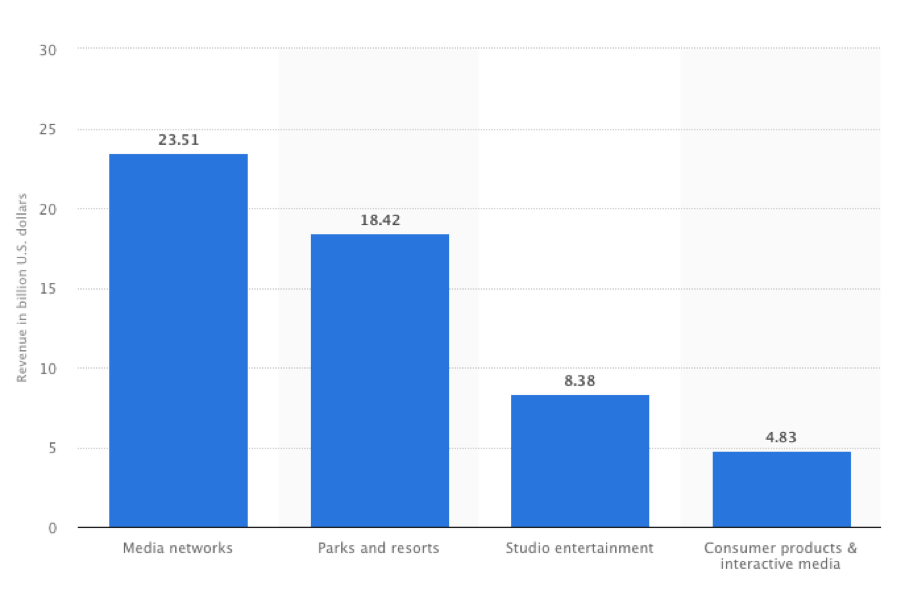

Walt Disney (DIS) shares have just suffered a 6% dive on the news they will buy the assets of 20th Century Fox in one of the largest entertainment takeovers in history. The new combined mega-company will dominate Hollywood and content production in general.

In fact, the new acquisition will enable the company to go from strength, enabling it to become the most powerful media company in well….the universe, to borrow from one of its many franchises.

This gives us a rare entry point to get into. Disney is just about to launch its own streaming service which will allow them to take a generous share of the Netflix and Amazon businesses.

Disney is spending a staggering $12 billion on new content this year. The parks are all packed to the gills. They already launch so many blockbuster movies that they have to be rationed awards at the Oscars.

It really is a company that is firing on all cylinders, as long as its erstwhile CEO Bob Iger doesn’t run for president in 2020.

I am therefore buying the Walt Disney Corp (DIS).

I’ll never forget the first time I met Walt Disney. There he was smiling at the entrance on opening day of the first Disneyland in Anaheim, Calif., in 1955 on Main Street, shaking the hand of every visitor as they came in. My dad sold the company truck trailers and managed to score free tickets for the family.

At 100 degrees on that eventful day, it was so hot that the asphalt streets melted. Most of the drinking rooms and bathrooms didn’t work. And ticket counterfeiters made sure that 100,000 jammed the relatively small park. But we loved it anyway. The bandleader handed me his baton and I was allowed to direct the musicians in the most ill-tempoed fashion possible.

After Disney took a vacation to my home away from home in Zermatt, Switzerland, he decided to build a roller-coaster based on bobsleds running down the Matterhorn on a 1:100 scale. In those days, each ride required its own ticket, and the Matterhorn needed an “E-ticket,” the most expensive. It was the first tubular steel roller coaster ever built.

Walt Disney shares have been on anything but a roller-coaster ride for the past four years. In fact, they have absolutely gone nowhere.

The main reason has been the drain on the company presented by the sports cable channel ESPN. Once the most valuable cable franchise, the company is now suffering on multiple fronts, including the acceleration of cord-cutting, the demise of traditional cable, the move to online streaming, and the demographic abandonment of traditional sports such as football.

However, ESPN’s contribution to Walt Disney earnings is now so small that it is no longer a factor.

In the meantime, a lot has gone right with Walt Disney. The parks are going gangbusters. With two teenage girls in tow, I have hit three in the past two years (Anaheim, Orlando, Paris).

The movie franchise is going from strength to strength. Pixar has Frozen 2 and Toy Story 4 in the pipeline. Look for Lucasfilm to bring out a new trilogy of Star Wars films, even though Solo: A Star Wars Story was a dud. Its online strategy is one of the best in the business. And it’s just a matter of time before they hit us with another princess. How many is it now? Nine?

It is about to expand its presence in media networks with the acquisition of 21st Century Fox (FOX) assets, already its largest source of earnings. It will join the ABC Television Group, the Disney Channel, and the aforementioned ESPN.

It has notified Netflix (NFLX) that it may no longer show Disney films, so it can offer them for sale on its own streaming service. Walt Disney is about to become one of a handful of giant media companies with a near monopoly.

What do you buy in an expensive market? Cheap stuff, especially quality laggards. Walt Disney totally fits the bill.

As for old Walt Disney himself, he died of lung cancer in 1966, just when he was in the planning stages for the Orlando Disney World. All that chain smoking finally got to him. He used to start out every TV show with a non-filter Luck Strike in his hand.

My own grandfather died the same way from the same brand, the one who fought in the trenches of WWI where Euro Disney sits today. It is a small world after all.

Despite that grandfatherly appearance on the Wonderful World of Color weekly TV show, friends tell me he was a complete bastard to work for.

Global Market Comments

March 20, 2019

Fiat Lux

Featured Trade:

(WHO THE GRAND NICARAGUA CANAL HAS WORRIED),

(SCAM OF THE MONTH)

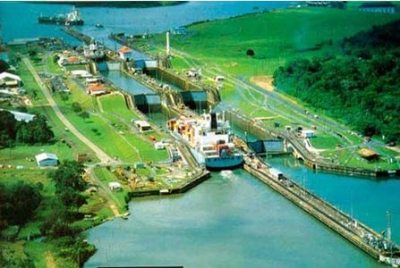

Multinationals, Global development economists, and armchair military strategists are all watching with great interest China’s plans to build a Grand Nicaragua Canal.

The government in Managua inked a deal with a Hong Kong-based consortium in 2013 led by telecommunications magnate Wang Jing and broke ground on a minor access road on December 22. But that is a very long way from the mega project getting built.

The project is nothing if not ambitious. The 172-mile canal will connect the town of Brito on the Pacific coast with Punta Gorda on the Caribbean traversing Lake Nicaragua for 65 miles and crossing a minor mountain range.

The new passage has many merits. Much wider and deeper than the Panama Canal, it will be able to accommodate the new ultra “Triple E” super container ships now under construction in China and South Korea.

These behemoths, which are as large as the Empire State Building flipped on its side, carry a staggering 18,000 containers and are nearly four times larger than the standard “Panamax” ship, which can only hold 5,000 containers.

The Nicaraguan route would knock days off the 18-day trip from Los Angeles to New York, substantially dropping shipping costs, and stimulating international trade.

More important, it would give direct access from China to the US Gulf ports, enabling them to bypass troublesome strike-prone ports on the US West Coast. A prolonged strike brought traffic there to a virtual standstill in early 2015.

The aging Panama Canal, now over 100 years old, its infrastructure is getting rather long in the tooth, dating back to the era of Teddy Roosevelt, and still won’t be able to handle the new Triple Es.

Prices to transit Panama have also been rising and is now a major income earner for the country. Further expansion is mooted, if the China traffic can justify it.

The project is certainly being welcomed in Nicaragua, the second poorest country in the western hemisphere, just above destitute Haiti, and not far behind impoverished Cuba. Some 15% of the population earns less than $1.25 a day, and many don’t even own shoes.

The infrastructure of every description is sorely lacking, with paved roads scarce and cities subject to power brownouts or outright failure. A functioning cellular network is but a distant dream in most of the country.

The project is expected to cost $50 billion, but overruns could take the final price tag much higher. This compares to Nicaragua’s miniscule $11 billion GDP. The 2020 completion deadline is therefore considered fanciful. The project will create 50,000 jobs during the five years the canal is under construction.

The final boost to economic growth could produce as many as 200,000 jobs in a country with a population of 6 million and beset with chronic unemployment. If the project goes ahead, it will spark an unprecedented economic boom.

This isn’t the first time that a canal across Nicaragua has been contemplated. German and French companies drew up plans during the 19th century but fell victim to malaria, yellow fever, dysentery, and bankruptcy.

Roosevelt considered the country for his canal but passed over worries about erupting volcanoes, which Nicaragua prominently displayed on its postage stamps. In the end, smaller and weaker Panama was easier to take over by force via an imagined coup d’ etat.

The Grand Nicaragua Canal is not without its own challenges. Actual plans are somewhat murky, and the organizing Chinese group is clouded in secrecy.

Only $200 million has actually been raised from private investors. Transparency has been completely lacking. The prime organizer, a Chinese telecommunications tycoon, has no prior experience with a project of this size.

Some 100,000 peasants will have to be displaced whose legal title to the land they occupy is tenuous at best. Demonstrations against the Sandinista government of Daniel Ortega in the capital, Managua, have become commonplace. Workers have even refused to transport machinery to the project.

More than 1 million acres of virgin jungle and wetlands will have to be destroyed to make way for the canal, appalling environmentalists. Nicaragua is much more prone to hurricanes than Panama. Indeed, in 1998, Hurricane Mitch flattened the country and killed 3,800.

Having Chinese ships, notorious for dumping sewage and waste oil in foreign ports, crossing Nicaragua’s principal source of drinking water is adding further concerns.

US railroads will also be impacted by the canal which have prospered mightily by picking up Chinese imports on the west coast and moving them inland. American transportation infrastructure will have to convert from a predominantly East-West axis to more of a North-South one.

That is a big deal.

But Union Pacific’s CEO John Koraleski isn’t worried, citing this as the source of only 1% of their revenues. They, too, would be happy to be rid of the pesky unions there. For more depth here, please click “Will the Oil Bust Kill the Railroads”.

Chinese construction of the canal has piqued the interest of military observers around the world. It would give the Middle Kingdom’s naval vessels direct and rapid access to the Atlantic Ocean for the first time in history.

China has already refurbished a used Russian aircraft carrier, and work is underway on a second carrier it purchased from France. Could the Grand Nicaragua Canal ultimately pose a military threat to the US east coast?

It doesn’t help that relations between Washington and Managua have never been cordial. In fact, Ronald Reagan financed right-wing death squads there for nearly a decade against none other than president Ortega himself (remember Iran-Contra?).

I have watched many of these gigantic projects take shape over the years. The 31-mile underwater Eurotunnel connecting England and France wiped out all of its original investors, and the initial cost doubled to $15 billion before it was done.

I covered France for Morgan Stanley in those days, and my institutional clients used to wear me out with a torrent of complaints about how much money they lost on the channel tunnel. But then, the French will complain about anything.

Still, it is a nice ride today, but it took 20 years to complete. And that was with an entire continent behind it with unlimited budgets.

Like the California bullet train, these megaprojects look great on paper and attract many avid followers, but are very difficult to pull off.

I’ll believe it when I see it.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.