Global Market Comments

December 27, 2018

Fiat Lux

Featured Trade:

(HOW TO PLAY APPLE IN 2019)

(AAPL)

(THE EIGHT WORST TRADES IN HISTORY),

(TESTIMONIAL)

Global Market Comments

December 27, 2018

Fiat Lux

Featured Trade:

(HOW TO PLAY APPLE IN 2019)

(AAPL)

(THE EIGHT WORST TRADES IN HISTORY),

(TESTIMONIAL)

Not a day goes by when someone doesn’t ask me about what to do about Apple (AAPL).

After all, it is the world largest company. It is the planet’s most widely owned stock. Almost everyone uses their products in some form or another.

So, the widespread interest is totally understandable.

Apple is a company with which I have a very long relationship. During the early 1980s, I was ordered by Morgan Stanley to take Steve Jobs around to the big New York Institutional Investors to pitch a secondary share offer for the sole reason that I was one of three people who worked for the firm who was then from California.

They thought one West Coast hippy would easily get along with another. Boy, were they wrong. It was the worst day of my life. Steve was not a guy who palled around with anyone.

Today, some 200 Apple employees subscribe to the Diary of a Mad Hedge Fund Trader looking to diversify their substantial holdings. Many own Apple stock with an adjusted cost basis of under $5. Suffice it to say, they all drive really nice Priuses.

So I get a lot of information about the firm far above and beyond the normal effluent of the media and stock analysts. That’s why Apple has become a favorite target of my Trade Alerts over the years.

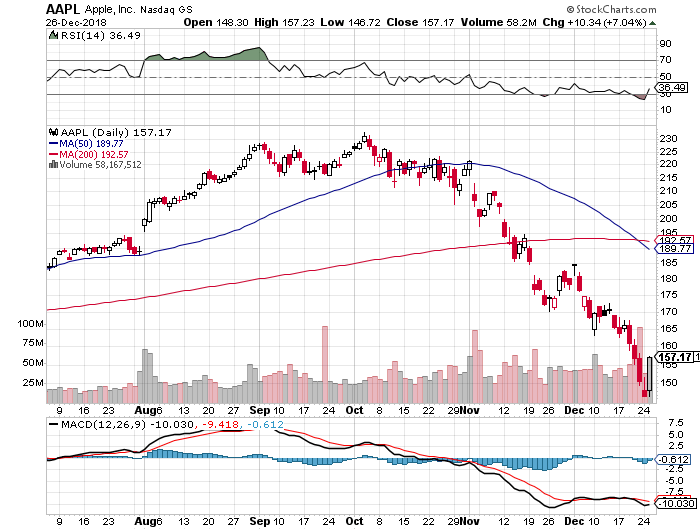

And here is the take: You didn’t want to touch the stock during the last quarter of 2018.

And here’s why. Apple is all about the iPhone which accounts for 75% of its total earnings. The TV, the watch, the car, iPods, the iMac, and Apple pay are all a waste of time and consume far more coverage than they are collectively worth.

The good news is that iPhone sales are subject to a fairly reliable cycle. Apple launches a major new iPhone every other fall. The share price peaks shortly after that. The odd years see minor upgrades, not generational changes.

Just like you see a big pullback in the tide before a tsunami hits, iPhone sales are flattening out. This is because consumers start delaying purchases in expectation of the introduction of the iPhone 7 in September 2016 with far more power, gadgets, and gizmos.

Channel checks, however dubious these may be, are already confirming the slowdown of orders for iPhone-related semiconductors from suppliers you would expect from such a downturn.

So during those in-between years, the stock performance is disappointing. 2018 certainly followed this script with Apple down a horrific 30.13% at the lows. Maybe it’s a coincidence, but that last generation in Apple shares in 2015 brought a decline of, you guessed it, exactly 29.33%.

The coming quarter could bring the opposite.

After March, things will start to get interesting especially post the Q1 earnings report in April. That’s when investors will start to discount the rollout of the next iPhone seven months later.

The last time this happened, in 2018, Apple stock rocketed by $86, or 55.33%. This time, I expect a minimum rally to the old $233 high, a gain of $71, or 43.82%.

After all, I am such a conservative guy with my predictions.

Even at that price, it will still be one of the cheapest stocks in the market on a valuation basis which currently trades at a 14X earnings multiple. The value players will have no choice to join in, if they’re not already there.

But Apple is a much bigger company this time around, and well-established cycles tend to bring in diminishing returns. It’s like watching the declining peaks of a bouncing rubber ball.

The bull case for Apple isn’t dead, it is just resting.

The China business will continue to grow nicely once we get through the current trade war. Their new lease program promises to deliver a faster upgrade cycle that will allow higher premium prices for their products. That will bring larger profits.

Just thought you’d like to know.

As you are all well aware, I have long been a history buff. I am particularly fond of studying the history of my own avocation, trading, in the hope that the past errors of others will provide insights into the future.

History doesn’t repeat itself, but it certainly rhymes.

So after decades of research on the topic, I thought I would provide you with a list of the eight worst trades in history. Some of these are subjective, some are judgment calls, but all are educational. And I do personally know many of the individuals involved.

Here they are for your edification, in no particular order. You will notice a constantly recurring theme of hubris.

1) Ron Wayne’s sales of 10% of Apple (AAPL) for $800 in 1976

Say you owned 10% of Apple (AAPL) and you sold it for $800 in 1976. What would that stake be worth today? Try $70 billion. That is the harsh reality that Ron Wayne, 76, faces every morning when he wakes up, one of the three original founders of the consumer electronics giant.

Ron first met Steve Jobs when he was a spritely 21-year-old marketing guy at Atari, the inventor of the hugely successful “Pong” video arcade game.

Ron dumped his shares when he became convinced that Steve Jobs’ reckless spending was going to drive the nascent startup into the ground and he wanted to protect his own assets in a future bankruptcy.

Co-founders Jobs and Steve Wozniak each kept their original 45% ownership. Today Jobs’ widow, Laurene Powel Jobs, has a 0.5% ownership in Apple worth $4 billion, while the value of Woz’s share remains undisclosed.

Today, Ron is living off of a meager monthly Social Security check in remote Pahrump, Nevada, about as far out in the middle of nowhere as you can get where he can occasionally be seen playing the penny slots.

2) AOL's 2001 Takeover of Time Warner

Seeking to gain dominance in the brave new online world, Gerald Levin pushed old-line cable TV and magazine conglomerate, Time Warner, to pay $164 billion to buy upstart America Online in 2001. AOL CEO, Steve Case, became chairman of the new entity. Blinded by greed, Levin was lured by the prospect of 130 million big spending new customers.

It was not to be.

The wheels fell off almost immediately. The promised synergies never materialized. The Dotcom Crash vaporized AOL’s business the second the ink was dry. Then came a big recession and the Second Gulf War. By 2002, the value of the firm’s shares cratered from $226 billion to $20 billion.

The shareholders got wiped out, including “Mouth of the South” Ted Turner. That year, the firm announced a $99 billion loss as the goodwill from the merger was written off, the largest such loss in corporate history. Time Warner finally spun off AOL in 2009, ending the agony.

Steve Case walked away with billions, and is now an active venture capitalist. Gerald Levin left a pauper, and is occasionally seen as a forlorn guest on talk shows. The deal is widely perceived to be the worst corporate merger in history.

3) Bank of America's Purchase of Countrywide Savings in 2008

Bank of America’s CEO Ken Lewis thought he was getting the deal of the century picking up aggressive subprime lender, Countrywide Savings, for a bargain $4.1 billion, a “rare opportunity.”

As a result, Countrywide CEO Angelo Mozilo pocketed several hundred million dollars. Then the financial system collapsed, and suddenly we learned about liar loans, zero money down, and robo signing of loan documents.

Bank of America’s shares plunged by 95%, wiping out $500 billion in market capitalization. The deal saddled (BAC) with liability for Countrywide’s many sins, ultimately, paying out $40 billion in endless fines and settlements to aggrieved regulators and shareholders.

Ken Lewis was quickly put out to pasture, cashing in on an $83 million golden parachute, and is now working on his golf swing. Mozilo had to pay a number of out of court settlements, but was able to retain a substantial fortune, and is still walking around free.

The nicely tanned Mozilo is also working on his golf swing.

4) The 1973 Sale of All Star Wars Licensing and Merchandising Rights by 20th Century Fox for Free

In 1973, my former neighbor George Lucas approached 20th Century Fox Studios with the idea for the blockbuster film, Star Wars. It was going to be his next film after American Graffiti which had been a big hit earlier that year.

While Lucas was set for a large raise for his directing services – from $150,000 for American Graffiti to potentially $500,000 for Star Wars – he had a different twist ending in mind. Instead of asking for the full $500,000 directing fee, he offered a discount: $350,000 off in return for the unlimited rights to merchandising and any sequels.

Fox executives agreed, figuring that the rights were worthless, and fearing that the timing might not be right for a science fiction film.

In hindsight, their decision seems ridiculously short-sighted.

Since 1977, the Star Wars franchise has generated about $27 billion in revenue, leaving George Lucas with a net worth of over $3 billion by 2012. In 2012, Disney paid Lucas an additional $4 billion to buy the rights to the franchise

The initial budget for Star Wars was a pittance at $8 million, a big sum for an unproven film. So, saving $150,000 on production costs was no small matter, and Fox thought it was hedging its bets.

George once told me that he had a problem with depressed actors on the set while filming. Harrison Ford and Carrie Fisher thought the plot was stupid and the costumes silly.

Today, it is George Lucas that is laughing all the way to the bank.

5) Lehman Brothers Entry Into the Bond Derivatives Market in the 2000s

I hated the 2000s because it was clear that men with lesser intelligence were using other people’s money to hyper leverage their own personal net worth. The money wasn’t the point. The quantities of cash involved were so humongous they could never be spent. It was all about winning points in a game with the CEOs of the other big Wall Street institutions.

CEO Richard Fuld could have come out of central casting as a stereotypical bad guy. He even once offered me a job which I wisely turned down. Fuld took his firm’s leverage ratio up to 100 times in an extended reach for obscene profits. This meant that a 1% drop in the underlying securities would entirely wipe out its capital.

That’s exactly what happened, and 10,000 employees lost their jobs, sent packing with their cardboard boxes with no notice. It was a classic case of a company piling on more risk to compensate for the lack of experience and intelligence. This only ends one way.

Morgan Stanley (MS) and Goldman Sachs (GS) drew the line at 40 times leverage and are still around today but just by the skin of their teeth, thanks to the TARP.

Fuld has spent much of the last five years ducking in and out of depositions in protracted litigation. Lehman issued public bonds only months before the final debacle, and how he has stayed out of jail has amazed me. Today he works as an independent consultant. On what I have no idea.

6) The Manhasset Indians' Sale of Manhattan to the Dutch in 1626

Only a single original period document mentions anything about the purchase of Manhattan. This letter states that the island was bought from the Indians for 60 Dutch guilders worth of trade goods which would consist of axes, iron kettles, beads, and wool clothing.

No record exists of exactly what the mix was. Indians were notoriously shrewd traders and would not have been fooled by worthless trinkets.

The original letter outlining the deal is today kept at a museum in the Netherlands. It was written by a merchant, Pieter Schagen, to the directors of the West India Company (owners of New Netherlands) and is dated 5 November 1626.

He mentions that the settlers “have bought the island of Manhattes from the savages for a value of 60 guilders.” That’s it. It doesn’t say who purchased the island or from whom they purchased it, although it was probably the local Lenape tribe.

Historians often point out that North American Indians had a concept of land ownership different from that of the Europeans. The Indians regarded land, like air and water, as something you could use but not own or sell. It has been suggested that the Indians may have thought they were sharing, not selling.

It is anyone’s guess what Manhattan is worth today. Just my old two-bedroom 34th-floor apartment at 400 East 56th Street is now worth $2 million. Better think in the trillions.

7) Napoleon's 1803 Sale of the Louisiana Purchase to the United States

Invading Europe is not cheap, as Napoleon found out, and he needed some quick cash to continue his conquests. What could be more convenient than unloading France’s American colonies to the newly founded United States for a tidy $7 million? A British naval blockade had made them all but inaccessible anyway.

What is amazing is that president Thomas Jefferson agreed to the deal without the authority to do so, lacking permission from Congress, and with no money. What lies beyond the Mississippi River then was unknown.

Many Americans hoped for a waterway across the continent while others thought dinosaurs might still roam there. Jefferson just took a flyer on it. It was up to the intrepid explorers, Lewis and Clark, to find out what we bought.

Sound familiar? Without his bold action, the middle 15 states of the country would still be speaking French, smoking Gitanes, and getting paid in Euros.

After Waterloo in 1815, the British tried to reverse the deal and claim the American Midwest for themselves. It took Andrew Jackson’s (see the $20 bill) surprise win at the Battle of New Orleans to solidify the US claim.

The value of the Louisiana Purchase today is incalculable. But half of a country that creates $17 trillion in GDP per year and is still growing would be worth quite a lot.

8) The John Thomas Family Sale of Nantucket Island in 1740

Yes, my own ancestors are to be included among the worst traders in history. My great X 12 grandfather, a pioneering venture capitalist investor of the day from England, managed to buy the island of Nantucket off the coast of Massachusetts from the Indians for three ax heads and a sheep in the mid-1600s. Barren, windswept, and distant, it was considered worthless.

Two generations later, my great X 10 grandfather decided to cut his risk and sell the land to local residents just ahead of the Revolutionary War. Some 17 of my ancestors fought in that war including the original John Thomas who served on George Washington’s staff at the harsh winter encampment at Valley Forge during 1777-78. Maybe that’s why I have an obsession about not wasting food?

By the early 19th century, a major whaling industry developed on Nantucket fueling the lamps of the world with smoke-free fuel. By then, our family name was “Coffin,” which is still abundantly found on the headstones of the island’s cemeteries.

One Coffin even saw his ship, the Essex, rammed by a whale and sunk in the Pacific in 1821 (read about it in The Heart of the Sea by Nathaniel Philbrick, to be released as a movie in 2015). He was eaten by fellow crewmembers after spending 99 days adrift in an open lifeboat. Maybe that’s why I have an obsession about not wasting food?

In the 1840s, a young itinerant writer named Herman Melville visited Nantucket and heard the Essex story. He turned it into a massive novel about a mysterious rogue white whale, Moby Dick, which has been torturing English literature students ever since. Our family name, Coffin, is mentioned seven times in the book.

Nantucket is probably worth many tens of billions of dollars today as a playground for the rich and famous. Just a decent beachfront cottage there rents for $50,000 a week in the summer.

The Ron Howard film The Heart of the Sea came out a few years ago, and it is breathtaking. Just be happy you never worked on a 19th-century sailing ship.

Yes, it’s all true and documented.

First and foremost, thank you for what you do.

The small cost of this newsletter pays for itself a thousand times over. My returns mimic those of your portfolio for the year and for that I am grateful.

The only suggestion I would offer is to keep doing what you are doing. It is people like you that will help return the once storied name to Wall Street.

Regards,

Shirin

Tampa, Florida

Global Market Comments

December 26, 2018

Featured Trades:

(A CHRISTMAS STORY),

(THE U-HAUL INDICATOR)

Global Market Comments

December 24, 2018

Fiat Lux

SPECIAL END OF YEAR ISSUE

Featured Trade:

(THANK YOU FROM THE MAD HEDGE FUND TRADER),

(MY LAST RESEARCH PIECE OF THE YEAR)

You are in safe hands now with your trading portfolios up nearly 23% on the year if you had followed every one of my Trade Alerts to the letter.

I know a lot of you made much more.

I would have delivered a much higher return in 2018 if I had taken off a week earlier and missed the worst December since 1931. Nothing like closing out the year with a swift kick in the pants.

All I can say is thank goodness for stop losses.

I will be making a beeline for my beachfront estate at Incline Village on the pristine shores of Lake Tahoe and work from there for the next two weeks. That is if I can battle my way through the nightmarish Sacramento holiday traffic.

My new Tesla Model X is packed to the gills with Christmas presents, ski equipment, snowshoes, board games (yes, “Qi” is a word in Scrabble), my expedition backpack, and food for 12 guests for two weeks. This will be the first time that I make it up to Lake Tahoe on a single charge. Thank you P100D!

For proof that after working 12 hours a day, six days a week to make you wealthier and wiser, please read my last research piece of the year below written tongue-in-cheek with a certain Hollywood classic in mind.

And what a year it has been. Over 26 trips and 40 speaking engagements in 20 countries, I managed to log 75,000 flight miles, a distance of roughly three times around the world.

Some 250,000 miles were posted to my various frequent flier accounts. Whenever I board Virgin Atlantic, the crew lines up at attention and snaps off a brisk salute. Needless to say, first class, for me, is the Land of Milk and Honey.

The research I gathered was enough for me to publish 260 daily letters totaling 350,000 words. That is about half the length of Tolstoy’s War and Peace, but them Tolstoy had to pen his time with a quill and ink, not Word for Windows.

I also managed to pump out over 200 trade alerts with a success ratio of 90%.

According to the email traffic, many of you did extremely well. If you are into triple digits, please send me an email. I would love to get a testimonial from you. I know that many of you have run out and purchased the new Tesla Model X gull wing P100D with the “ludicrous mode” on my recommendation.

You know that when they are advertising power tools and Pajamagrams on CNBC, it is time to get out of Dodge. I’ll take the hint.

There, I will consume a suitcase full of research and, after much cogitation and contemplation, write my 2019 Annual Asset Review which I will publish on Wednesday, January 8.

I will also be rethinking my business model, so if any of you have suggestions on how I can improve this service, send me an email at madhedgefundtrader@yahoo.com.

Just put “suggestions” in the subject line. My intention is to never stop improving the product to under promise and over deliver.

It’s a nostrum of Silicon Valley that whenever you think you're finished, you’re finished.

Please forgive me in advance if I take a few hours catching some “big air” off of Squaw Valley’s treacherous double X black runs.

If you have any trading questions, please seek me out on the northern section Tahoe Rim Trail around 11,000 feet where I will be snowshoeing my way around the lake in subzero temperatures.

I will probably be the only guy up there so you can just follow the first set of tracks you find. That is if hungry mountain lions don’t get you first.

I’ll have my Bowie knife and an industrial sized can of bear spray so I’ll be fine. As for you, I’m not so sure. This is what I do during my winter leisure time.

During my absence, I will be posting some of my favorite pieces from the last year which give insights on how markets will play out over the coming decades and a lot of basic educational pieces.

I have thousands of new subscribers who will be reading these for the first time, and many legacy readers may have missed them the first time around or forgotten the data because they are older than me.

I hope you find them as another useful step towards your education on the global financial markets. Charts and data have been updated to make them relevant.

Finally, I want to thank you all for an incredible year. I crossed the Atlantic in luxury in the owner's suite of Cunard’s Queen Mary 2 (my uncle took the Queen Mary 1 in 1943 in somewhat more cramped conditions).

I rode the Orient Express from London to Venice. I lived in the lap of luxury at the Hotel Cipriani in Venice and at the Raffles in Singapore.

And I managed to haggle the merchants in Tangier’s historic bazaar down in price of the most elegant handmade carpets.

I had the opportunity to meet heads of state, CEOs, top money managers, our nation’s military leaders, and even a Maori chieftain.

I had the pleasure of flying the length of the Grand Canyon at low altitude as a pilot, weaving my way along the Colorado River. And, oh yes, I made it to the top of the Matterhorn one more time.

I really did get to rub shoulders with the high and mighty who run the world and harvest their pearls of wisdom which I passed on to you.

I logged 200 hours as a pilot flying to such diverse locations as the Great Barrier Reef in Australia and Honda’s loading docks in San Francisco.

I never minded the horrendous jet lag, the well-deserved hangovers, or the traffic jams in China. Your subscriptions to my products, your support of my research, and your endless compliments made it all worth it.

I always tell people that I am not in this for the money, and it’s true.

Not a day goes by when I don’t receive an email from a grateful reader who claims that I have paid off their mortgage, a kid’s college education, a parent’s uninsured operation, or a child’s chemotherapy.

They tell me that I am teaching them to fish; thus, sparing them from the frozen tasteless kind they sell at Safeway which they must wait in line to pay inflated prices. You can’t buy that kind of appreciation, not with all the money in the world.

It certainly beats the hell out of spending my retirement scoring a 98 on the local golf course. And I’ll never beat Tiger Woods, no matter how many blonds I date.

To leave you all in the Christmas spirit, I have posted a video and pictures of the Polar Express in Portland, Oregon.

Taking my family for a ride has become an annual event, and it is a thrill for my younger kids as well. To watch a short video of one of the largest steam engines in the world, please click here.

Merry Christmas and Happy New Year to All!

Good Trading in 2019!

John Thomas

The Mad Hedge Fund Trader

“If the Fed brings a lump of coal in 2019, then they better bring some candy canes for the kids as well,” said Bill Gross, former CEO of bond giant, PIMCO.

Global Market Comments

December 21, 2018

Fiat Lux

Featured Trade:

(WHY CASH IS THE BEST HEDGE)

(INDU)

(PRINT YOUR OWN CAR),

(TESTIMONIAL)

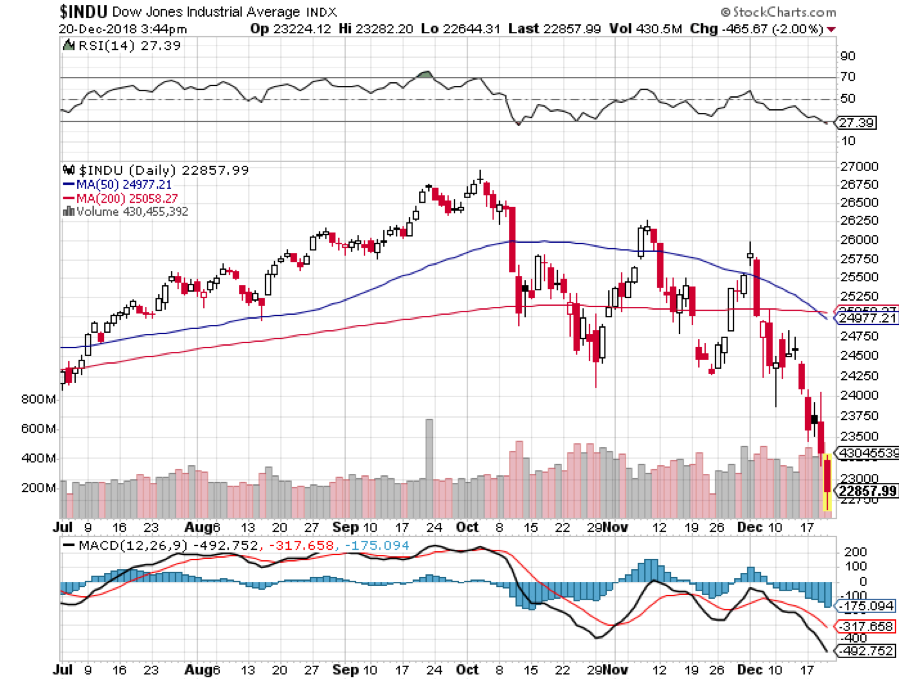

Over the decades, I have been besieged by suggestions by various market players over how to hedge their downside risk in the stock market.

I have analyzed most of these, experimented with them, and even tried out a few. These range from buying equity put options to selling call options, investing in bear ETFs, and trading the volatility index (VIX).

My conclusion is always the same: Cash is always the best hedge.

Hedge fund managers like me are always under pressure to deliver positive returns whether the stock market goes up, down, or sideways. A lot make this promise but few are actually able to deliver. You can almost count them on one hand and I know all of them personally.

And here is a hedge fund manager’s worst nightmare: both your longs go down and your shorts go down, eroding capital at a double rate. This is often the result when you come to rely on these esoteric “hedges.”

This happens when you have done all the research in the world, have countless mathematical formulas to back you up, and you backtest your data for 30 years.

First of all, assets classes don’t always perform according to financial models because there is always one big variable that managers can’t quantify: human emotion.

While algorithms and computers are completely rational, people aren’t, even the most experienced ones. After watching markets for over 50 years I can tell you that there is only one certainty. That the natural tendency of most people is to buy at market tops and sell at market bottoms.

In order words, making money in the stock market is an unnatural act and fights against the long-term tide of evolution. We, humans, are predators and hunters evolved to track game on the horizon of an African savanna. Modern humans are maybe 5 million years old but civilization has been around for only 10,000 years. Our brains have not had time to make the adjustment.

In the market, this means that if a stock has gone up, you believe it will continue to do so. This is why market tops and bottoms see volume spikes. To make money, you have to go against these innate instincts. Some people are born with this ability while others can only learn it through decades of training. I am in the latter group.

The 4,400-point decline we have all suffered over the last 2 ½ months is a classic example. Prices earnings multiples have given up half of their gains since the 2009 bear market bottom. It is one of the best buying opportunities in four years. So, what are investors doing? Selling.

Share prices are now discounting a severe recession in 2019 that probably isn’t going to happen. I don’t believe that we’ll get one until the end of 2019 and even then it will be a modest one. Essentially, we already have a recession in the price at these levels. If the recession doesn’t show, stocks will rocket.

What hedges worked during this time? Absolutely none. If you shifted from growth stocks to value ones, or from high beta ones to low beta shares, you still lost money, probably a lot. Those who hedged with volatility probably has some one-hit wonders, but add up their profit and loss for the entire year and it probably comes to negative numbers.

You know what didn’t lose money? Cash which in fact is now earning 2%-4% depending on where you have it parked.

This is why I have been running cash positions of 70%-90% for the past four months. Oh, how I love the smell of cash in the morning. Logging into my online trading account every morning and seeing a wad of cash is like getting a short rush of adrenaline.

Absolutely, cash is the best hedge.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.