Global Market Comments

November 21, 2018

Fiat Lux

Featured Trade:

(TRADING THE KENNEDY ASSASSINATION)

Global Market Comments

November 21, 2018

Fiat Lux

Featured Trade:

(TRADING THE KENNEDY ASSASSINATION)

Global Market Comments

November 20, 2018

Fiat Lux

Featured Trade:

(TRADING FOR THE NON-TRADER),

(ROM), (UXI), (UCC), (UYG),

(CATCH MY ALL ASSET CLASS REVIEW ON “INVEST LIKE A BOSS”)

My friend and long-time subscriber, San Marks, invited me to appear on a podcast with him the other day. Who am I to say no? Besides, you never know when you might get a new question you haven’t heard, a truly original analysis, or a well-justified out-of-consensus approach.

It is my most up-to-date view on all asset classes out there, so you might take a listen. In these tumultuous times, you can never be current enough. To listen to the interview in full, please click here.

Global Market Comments

November 19, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or MASS EVACUATION)

(SPY), (WMT), (NVDA), (EEM), (FCX), (AMZN), (AAPL), (FCX), (USO), (TLT), (TSLA), (CRM), (SQ)

I will be evacuating the City of San Francisco upon the completion of this newsletter.

The smoke from the wildfires has rendered the air here so thick that it has become unbreathable. It reminds me of the smog in Los Angeles I endured during the 1960s before all the environmental regulation kicked in. All Bay Area schools are now closed and anyone who gets out of town will do so.

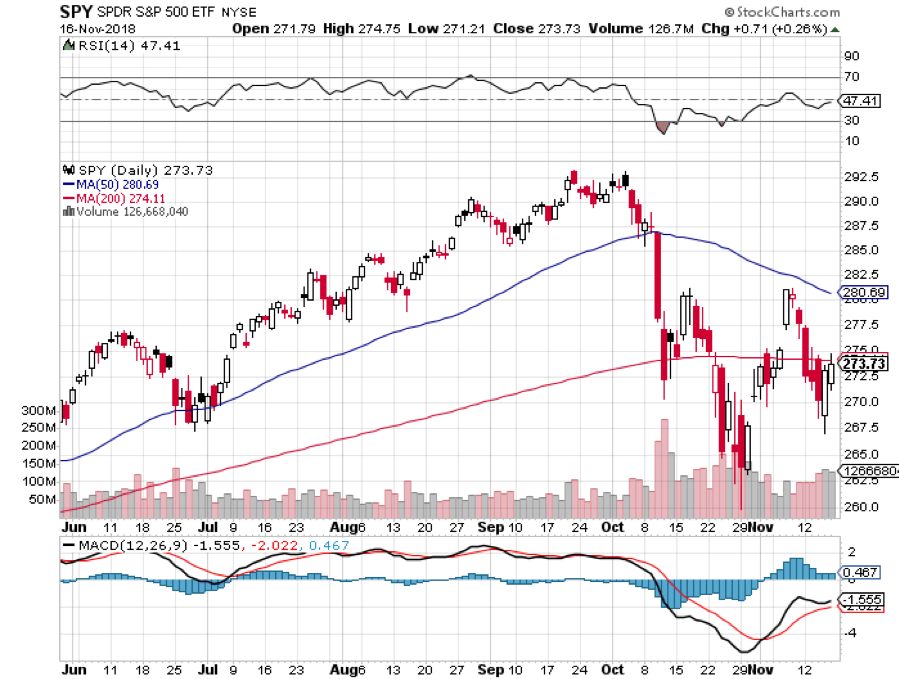

There has been a mass evacuation going on of a different sort and that has been investors fleeing the stock market. Twice last week we saw major swoons, one for 900 points and another for 600. Look at your daily bar chart for the year and the bars are tiny until October when they suddenly become huge. It’s really quite impressive.

Concerns for stocks are mounting everywhere. Big chunks of the economy are already in recession, including autos, real estate, semiconductors, agricultural, and banking. The FANGs provided the sole support in the market….until they didn’t. Most are down 30% from their tops, or more.

In fact, the charts show that we may have forged an inverse head and shoulders for the (SPY) last week, presaging greater gains in the weeks ahead.

The timeframe for the post-midterm election yearend rally is getting shorter by the day. What’s the worst case scenario? That we get a sideways range trade instead which, by the way, we are perfectly positioned to capture with our model trading portfolio.

There are a lot of hopes hanging on the November 29 G-20 Summit which could hatch a surprise China trade deal when the leaders of the two great countries meet. Daily leaks are hitting the markets that something might be in the works. In the old days, I used to attend every one of these until they got boring.

You’ll know when a deal is about to get done with China when hardline trade advisor Peter Navarro suddenly and out of the blue gets fired. That would be worth 1,000 Dow points alone.

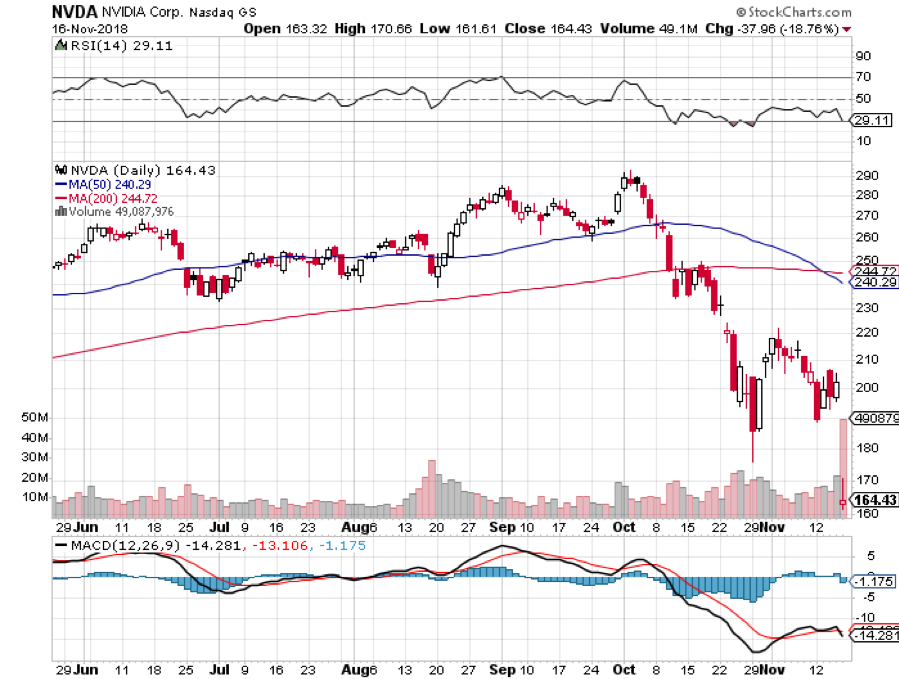

It was a week when the good were punished and the bad were taken out and shot. Wal-Mart (WMT) saw a 4% hickey after a fabulous earnings report. NVIDIA (NVDA) was drawn and quartered with a 20% plunge after they disappointed only slightly because their crypto mining business fell off, thanks to the Bitcoin crash.

Apple (AAPL) fell $39 from its October highs, on a report that demand for facial recognition chips is fading, evaporating $170 billion in market capitalization. Some technology stocks have fallen so much they already have the next recession baked in the price. That makes them a steal at present levels for long term players.

The US dollar surged to an 18-month high. Look for more gains with interest rates hikes continuing unabated. Avoid emerging markets (EEM) and commodities (FCX) like the plague.

After a two-year search, Amazon (AMZN) picked New York and Virginia for HQ 2 and 3 in a prelude to the breakup of the once trillion-dollar company. The stock held up well in the wake of another administration antitrust attack.

Oil crashed too, hitting a lowly $55 a barrel, on oversupply concerns. What else would you expect with China slowing down, the world’s largest marginal new buyer of Texas tea? Are all these crashes telling us we are already in a recession or is it just the Fed’s shrinkage of the money supply?

The British government seemed on the verge of collapse over a Brexit battle taking the stuffing out of the pound. A new election could be imminent. I never thought Brexit would happen. It would mean Britain committing economic suicide.

US Retails Sales soared in October, up a red hot 0.8% versus 0.5% expected, proving that the main economy remains strong. Don’t tell the stock market or oil which think we are already in recession.

My year-to-date performance rocketed to a new all-time high of +33.71%, and my trailing one-year return stands at 35.89%. November so far stands at +4.08%. And this is against a Dow Average that is up a miniscule 2.41% so far in 2018.

My nine-year return ballooned to 310.18%. The average annualized return stands at 34.46%. 2018 is turning into a perfect trading year for me, as I’m sure it is for you.

I used every stock market meltdown to add aggressively to my December long positions, betting that share prices go up, sideways, or down small by then.

The new names I picked up this week include Amazon (AMZN), Apple (AAPL), Salesforce (CRM), NVIDIA (NVDA), Square (SQ), and a short position in Tesla (TSLA). I also doubled up my short position in the United States US Treasury Bond Fund (TLT).

I caught the absolute bottom after the October meltdown. Will lightning strike twice in the same place? One can only hope. One hedge fund friend said I was up so much this year it would be stupid NOT to bet big now.

The Mad Hedge Technology Letter is really shooting the lights out the month, up 8.63%. It picked up Salesforce (CRM), NVIDIA (NVDA), Square (SQ), and Apple (AAPL) last week, all right at market bottoms.

The coming week will be all about October housing data which everyone is expecting to be weak.

Monday, November 19 at 10:00 EST, the Home Builders Index will be out. Will the rot continue? I’ll be condo shopping in Reno this weekend to see how much of the next recession is already priced in.

On Tuesday, November 20 at 8:30 AM, October Housing Starts and Building Permits are released.

On Wednesday, November 21 at 10:00 AM, October Existing Home Sales are published.

At 10:30 AM, the Energy Information Administration announces oil inventory figures with its Petroleum Status Report.

Thursday, November 22, all market will be closed for Thanksgiving Day.

On Friday, November 23, the stock market will be open only for a half day, closing at 1:00 PM EST. Second string trading will be desultory, and low volume.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I'd be roaming the High Sierras along the Eastern shore of Lake Tahoe looking for a couple of good Christmas trees to chop down. I have two US Forest Service permits in hand at $10 each, so everything will be legit.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

November 16, 2018

Fiat Lux

Featured Trade:

(RISK CONTROL FOR DUMMIES),

(SPY), (AMZN), (TLT), (CRM), (VXX)

Global Market Comments

November 15, 2018

Fiat Lux

Featured Trade:

(ARE YOU IN THE 1%?),

(SNE), (HMC)

(DUMPING THE OLD ASSET ALLOCATION RULES)

Global Market Comments

November 14, 2018

Fiat Lux

Featured Trade:

(DINNER WITH BEN BERNANKE)

(TESTIMONIAL)

Dear John,

You gave me a profit this year well into six digits which has me so addicted to your service that I'm considering taking out life insurance on you from Lloyd's of London.

I admit I get VERY nervous every time you adventure off to climb the Matterhorn or vagabond through the High Sierras within stalking distance of mountain lions or drive that Tesla further than the end of your driveway or travel with the swells on the Orient Express, virtually daring the enemies of capitalism to do something rash.

You must stop all such foolishness so you can maximize the probability of keeping us in Trade Alerts for the longest possible time. Toward that end, we also respectfully request that you watch your consumption of bubbly and cholesterol at all those fancy restaurants you favor, rein in the holiday celebrations over your amazing track record, and be sure to take your meds.

Also, getting to bed early the rest of the year won't hurt, unless of course you're pulling all-nighters with Mad Day Trader’s Bill Davis on the phone as you both nervously watch the overseas markets until the early dawn, followed by a hectic day of domestic trading and writing of Trade Alerts, all of which you should feel free to do as frequently as needed to keep your performance on its current blistering track. (We must, after all, keep our eye on what's most important in life.)

I, like most of your subscribers, am long -- very long -- on the Mad Hedge Fund Trader...and we need you healthy for many years--preferably decades--to come.

Gary

Garden City, NY

Global Market Comments

November 13, 2018

Fiat Lux

SPECIAL VETERANS DAY ISSUE

Featured Trade:

(NO BIWEEKLY STRATEGY WEBINAR FOR WEDNESDAY NOVEMBER 14)

(A TRIBUTE TO A TRUE VETERAN)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.