Global Market Comments

October 4, 2018

Fiat Lux

Featured Trade:

(TUESDAY OCTOBER 16 MIAMI GLOBAL STRATEGY LUNCHEON),

(BONDS FINALLY BREAK TWO-YEAR RANGE),

(TLT), (TBT), ($TNX)

Come join me for lunch for the Mad Hedge Fund Trader’s Global Strategy luncheon, which I will be conducting in Miami, Florida, on Tuesday, October 16, 2018.

A three-course lunch will be followed by an extended question-and-answer period.

I’ll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, energy, precious metals, and real estate.

And to keep you in suspense, I’ll be tossing a few surprises out there, too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $248.

I’ll be arriving at 11:30 AM and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a restaurant at a major downtown hotel.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets, click here.

I love executing one day wonders.

Since we sold short the US Treasury bond market on Monday, it has plunged a stunning 3 points. Bond yields just performed a rare 10 basis point move up to 3.18%. You usually only see that during a major “RISK OFF” geopolitical event or financial crisis.

You could see all of the key support levels failing like a hot knife for butter. The next support for the United States Treasury Bond Fund (TLT) is now at $111, or some 2.5 points down from here, pointing to a 3.25% yield for the ten-year bond.

My yearend forecast of a ten-year yield of 3.25% and a one-year target of 4.0% is alive and well.

The break marks an important departure from a stubborn two-year trading range….to the downside.

As with major breaks there is not a single a data point that broke the camel’s back. It could have been the agreement to NAFTA 2.0 on Monday or the blistering hot ISM Services print at a 21-year high on Wednesday.

Rather, it has been a steady death by a thousand cuts spread over several points that did it. It was just a matter of time before a 4.2% GDP growth rate crushed the fixed income market.

If I had to point to one single thing that triggered this debacle, it would be Amazon’s (AMZN) decision to give a 25% raise to its 250,000 US employees to $15 an hour.

If Wal-Mart (WMT), McDonald’s (MCD), or Target (TGT) have to resort to the same, you could have a serious outbreak of inflation on 2019. Imagine that, a bidding war for minimum wage workers.

ALL of those costs will be passed on to us, which is highly inflationary, and bonds absolutely HATE inflation.

Other than giving us boasting rights, the bond market move carries several important messages for us.

Money is about to start transferring from borrowers to savers in a major way. You won’t hear about seniors unable to live off of their savings anymore, a common refrain of the past decade.

Cash is now offering a serious competitor to bond and equity investments. And the next recession and bear market have just been moved closer.

The rocketing US budget deficit is starting to bear its bitter fruit as the government is starting to crowd out private sector borrowers. The budget deficit should be running at a $1 trillion annualized rate by the end of this year.

All of you celebrating your windfall tax cuts are getting a sharp reminder that the money has been entirely borrowed, some 40% from foreign bond investors we have been attacking. It will have to be paid back some time.

Of course, we all knew this was coming. It is no accident that the most capital-intensive industries in the country, also the heaviest borrowers, have seen the worst stock performance of 2018 including real estate, REITS, steel, and autos. Their profit margins have all just been seriously chopped.

So, what to do about the bond market now that we have begun the next leg in a 30-year bear market? For a start, don’t sell. Rather, wait for the next rally back up to the old support level at $116. It should revisit the old support level at least once.

When it does, SELL WITH BOTH HANDS.

I Just Love That 25% Wage Hike

“The biggest loss I ever suffered was not buying Amazon when I met Jeff Bezos in 1999,” said legendary value investor Ron Baron, when Amazon was trading at $15 a share.

Global Market Comments

October 3, 2018

Fiat Lux

Featured Trade:

(TAKING A LOOK AT GENERAL ELECTRIC LEAPS), (GE),

(TEN SURPRISES THAT WOULD DESTROY THIS MARKET),

(USO), (AMZN), (MCD), (WMT), (TGT)

Long Term Equity Anticipation Securities, or LEAPS, are a great way to play the market when you expect a substantial move up in a security over a long period of time. Get these right and the returns over 18 months can amount to several hundred percent.

At market bottoms these are a dollar a dozen. At all-time highs they are as scarce as hen’s teeth. However, scouring all asset classes there are a few sweet ones to be had.

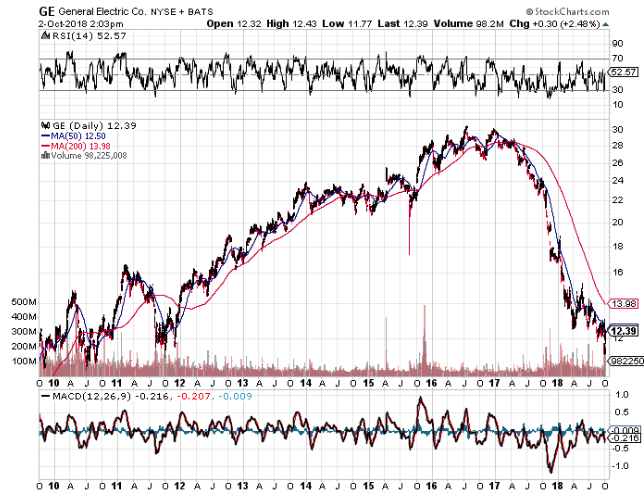

General Electric (GE) is a stock that has been taken out to the woodshed and beaten senseless. Management has made every possible mistake they could have over the past two decades.

During the 2000’s the company paid enormous premiums to get into the financial sector, thus causing the pros to dub it as the “hedge fund that made light bulbs.” They bailed out right at the market bottom after the 2008 crash for pennies on the dollar.

If it weren’t for Oracle of Omaha Warren Buffet’s generous move to buy their 10% yielding convertible bonds the company would have almost certainly gone under.

Another legacy dud dates back to former CEO Jack Welch’s entry into the insurance business. Although most of that business has been sold off, it still managed to lose $6.2 billion in the fourth quarter of 2017.

The result of this epic mismanagement has been to wipe out over $1 trillion in market capitalization. The shares have plunged some 66%, from $32 to $11.

At the urging of major shareholders a long-suffering board ousted GE’s latest CEO, John Flannery, after only a year in the job and replaced him with former Danaher (DHR) CEO Lawrence Culp. The move may have finally put a bottom in the stock.

It’s obvious what GE has to do here. It needs to liquidate the remaining money losing assets that have been such a huge drain on cash flow.

It could also sell a few other successful business lines at big premiums that are money makers, just as jet engines or its Baker Hughes oil subsidiary. These days investors are paying up for almost everything.

I don’t know how long it will take Culp to work his magic. However, I bet the stock market will start to sniff out a turnaround sometime in the next year and a half.

The GE January 17, 2020 $15-$18 vertical bull call spread (called a LEAP because it has a maturity of more than one year) is currently priced at 55 cents.

If the shares make it back up to $18, the price it traded at in January, the LEAP would be worth $3.00, delivering you a gain of 345%. It makes a very low risk, high return set up for investors tired of paying new all-time highs for everything else.

Whatever happened to Jack Welch, who originally created this disaster? Jack retired a billionaire and is now giving lectures on corporate managements. Go figure.

I’ll try to come up with another interested LEAP idea tomorrow. I know you’re all starved for them.

“Stock don’t stop on a dime when they reach the right valuation. I’m afraid this time, they’re going to overshoot,” said Karen Finerman of Metropolitan Capital Advisors.

Global Market Comments

October 2, 2018

Fiat Lux

Featured Trade:

(HOW FINTECH IS EATING THE BANKS LUNCH),

(BAC), (C), (WFC), (SQ), (PYPL),

(WCAGY), (FISV), (INTU), (BABA),

(WE’RE MAKING SOME CHANGES HERE AT MAD HEDGE FUND TRADER)

Given the ballistic growth of our business here at the Mad Hedge Fund Trader, you will soon be seeing some major improvements in the service.

You may have already noticed a substantial upgrade to our website. Further changes will be ongoing in the coming months promising better functionality and faster speeds. Some 10,000 pages of content is a lot to manage.

Mad Hedge Hot Tips started six weeks ago and have proven wildly successful. It enables us to have a more immediate and constant contact with our readers which has become crucial in this hyper accelerating fast forward world.

Our online customer support telephone number has changed. The new one is 347-480-1034. This is a high tech global online telephone number that operates 24 hours a day. If you can’t get through just leave a voicemail with the English lady with the posh accent. It will be transcribed instantly and emailed to us wherever we are.

Hey, what’s the point in publishing the Mad Hedge Technology Letter if you can’t use the new tech to spice up our own service?

Our mailing address has changed to a conveniently tax free domicile at:

John Thomas-Mad Hedge Fund Trader

Conifer Group LLC

PO Box 4470

Stateline, NV 89449

USA

If you want to mail me a bottle of The Glenlivet because you made so much money on you last Trade Alert, please feel free to do so.

Globalizing our production means there will be a slight delay in getting our daily content to you. Instead of 1:00 AM EST you should receive you letter by 9:00 AM EST, or 30 minutes before the New York Stock Exchange opens. Today is the exception.

Finally, it is with a heavy heart that I announce the retirement of Nancy at the end of the year, who has been diligently performing our customer support for the past six years. She is the one who has been instructing you on navigating the site, getting a new password, and dealing with the general ins and out of the Mad Hedge Fund Trader. I understand that a long cruise is in the offing.

Again, thanks for supporting our research and I look forward to meeting you at my next strategy luncheon or the Lake Tahoe conference in October.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Only the mediocre are always at their best,” said the late American comedian Jonathan Winters.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.