Global Market Comments

September 11, 2018

Fiat Lux

Featured Trade:

(A NOTE ON ASSIGNED OPTIONS,

OR OPTIONS CALLED AWAY), (MSFT),

(TEN MORE REASONS WHY BONDS WON’T CRASH),

(TLT), (TBT), (ELD), (MUB)

Global Market Comments

September 11, 2018

Fiat Lux

Featured Trade:

(A NOTE ON ASSIGNED OPTIONS,

OR OPTIONS CALLED AWAY), (MSFT),

(TEN MORE REASONS WHY BONDS WON’T CRASH),

(TLT), (TBT), (ELD), (MUB)

Global Market Comments

September 10, 2018

Fiat Lux

Featured Trade:

(WEDNESDAY, OCTOBER 17, 2018, HOUSTON

GLOBAL STRATEGY LUNCHEON INVITATION),

(THE MARKET OUTLOOK FOR THE WEEK AHEAD,

or “IT WASN’T ME!”),

(AMZN), (NKE), (SPY), (PCG)

First of all, I want to confirm absolutely and without any doubt that I did not write the anonymous and controversial New York Times op-ed entitled “I Am Part of the Resistance Inside the Trump Administration.” It wasn’t me.

During the 1970s I tried to write for the Grey Lady about the Chinese Cultural Revolution, the threat to the U.S. posed by the Japanese auto industry, and the coming appreciation of the Japanese yen. But they would have none of it.

That’s because they only ran copy from their own full-time journalists and didn’t accept work from freelancers. The Wall Street Journal, Barron’s, The Economist, no problem. The New York Times, no way Jose.

Anyway, anyone with any knowledge of military aviation knows who wrote it. Yes, it’s that obvious.

I was driving over the Oakland Bay Bridge on my way to San Francisco the other day and what I saw stunned me.

This time of year, you usually see 18 enormous Chinese container ships waiting to offload their cargo at the Port of Oakland in the run-up to the Christmas shopping season. This time I saw only 10.

Either the Chinese are sending their toys, electronics, and apparel to other U.S. ports, or they are not sending them at all. If it’s the latter it means that U.S. consumer demand is about to fall off a cliff, driven away by the high prices demanded by the new 25% import duties.

I called around to see if this was just a local problem. In fact, U.S. port landings are down 10% year on year, and off by a dramatic 25% in the hardest hit ports such as New Orleans, a major agricultural exporter.

If this is true, the consequences for U.S. investors are dire.

Let me give you one of my secret trading insights borne of a half century of stock market research. Real world observations front run official government data releases by three to six months. This is why I spend so much time in the field kicking tires, chatting up store managers, and flying over auto landing docks. If this is true, you could see early signs of a recession by early 2019.

The August Nonfarm Payroll Report came in at 201,000 on Friday, with the headline Unemployment Rate unchanged at 3.9%. June and July were revised down by 50,000 jobs.

The real news here is that Average Hourly Earnings popped to 2.9%, the biggest gain in nine years, proving that inflation is edging its way closer.

Health Care added 33,000 jobs, Construction 23,000, and Transportation up 20,000. Manufacturing lost 3,000 jobs, a victim of the trade wars, while Retail lost 5,000.

The U-6 broader “discouraged worker” unemployment fell to 7.4%, a new decade low. Certainly, the job market is firing on all cylinders.

The news gave us a nice little gap down in our short position in the bond market, taking the 10-year U.S. Treasury yield up to 2.95%, a one month high.

Still, you have to wonder why the stock market behaved so poorly after the release of such a healthy number. Was it “buy the rumor, sell the news,” the September effect, or the end of the 8 ½-year bull market? Obviously, I came out of my long (VXX) position too soon.

All doubts were removed when the president delivered a sucker punch to stocks by announcing new tariffs on a further $267 billion in Chinese imports. This is on top of the duties that applied to $200 billion of imports on Monday. The trade war steps up another notch. Now ALL Chinese imports are subject to punitive U.S. duties.

Amazon (AMZN) finally topped $1 trillion in market capitalization, delivering for my followers a ten-bagger on a recommendation I made several years ago.

Nike (NKE) delivered the ad campaign of the century, led by former San Francisco 49ers quarterback Colin Kaepernick. Just think of all the new demand created in the market by all those burning shoes.

The State of California passed a bill to stick the utility PG&E (PCG) with the bill for last year’s big fires. The company will pass it on to rate payers. Thank goodness I went all solar three years ago!

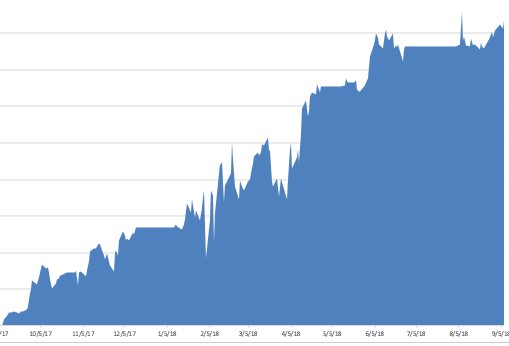

With the Mad Hedge Market Timing Index diving from 78 to 52 we definitely got some topping action in the market, and our short positions paid off handsomely. Both of my remaining positions are making money, my longs in Microsoft (MSFT) and my short in the U.S. Treasury bond market (TLT).

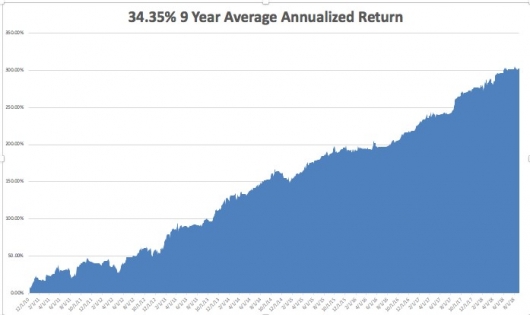

We are off to the races in September, giving us a robust return of 1.37%. My 2018 year-to-date performance has clawed its way back up to 28.39% and my nine-year return appreciated to 304.86%. The Averaged Annualized Return stands at 34.51%. The more narrowly focused Mad Hedge Technology Fund Trade Alert performance is annualizing now at an impressive 29.59%.

This coming week only has one important data release, the Fed Beige Book on Wednesday afternoon.

On Monday, September 10, at 3:00 PM, July Consumer Credit is out and should be at an all-time high as people max out their credit cards at the top of an economic cycle.

On Tuesday, September 11, at 6:00 AM, the NFIB Small Business Optimism Index is released at 6:00 AM.

On Wednesday, September 12, at 2:00 PM, the Federal Reserve discloses its Beige Book, which includes the data from the 12 Fed districts the Federal Open Market Committee at its September 19-20 meeting.

Thursday, September 13 leads with the Weekly Jobless Claims at 8:30 AM EST, which saw an amazing fall of 10,000 last week to 203,000.

On Friday, September 14, at 9:15 AM, we learn August Industrial Production. The Baker Hughes Rig Count is announced at 1:00 PM EST.

As for me,

Good luck and good trading.

Global Market Comments

September 7, 2018

Fiat Lux

Featured Trade:

(MONDAY, OCTOBER 15, 2018, ATLANTA, GA,

GLOBAL STRATEGY LUNCHEON),

(SEPTEMBER 5 BIWEEKLY STRATEGY WEBINAR Q&A),

(AMZN), (MU), (MSFT), (LRCX), (GOOGL), (TSLA),

(TBT), (EEM), (PIN), (VXX), (VIX), (JNK), (HYG), (AAPL)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader September 5 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: Do you think the collapse of commodity prices in the U.S. will affect the U.S. election?

A: Absolutely, it will if you count agricultural products as commodities, which they are. We have thousands of subscribers in the Midwest and many are farmers up to their eyeballs in corn, wheat, and soybeans. It won’t swing the entire farm vote to the Democratic party because a lot of farmers are simply lifetime Republicans, but it will chip away at the edges. So, instead of winning some of these states by 15 points, they may win by 5 or 3 or 1, or not at all. That’s what all of the by-elections have told us so far.

Q: What will be the first company to go to 2 trillion?

A: Amazon, for sure (AMZN). They have so many major business lines that are now growing gangbusters; I think they will be the first to double again from here. After having doubled twice within the last three years, it would really just be a continuation of the existing trend, except now we can see the business lines that will actually take Amazon to a much bigger company.

Q: Is this a good entry point for Micron Technology (MU)?

A: No, the good entry point was in the middle of August. We are at an absolute double bottom here. Wait for the tech washout to burn out before considering a re-entry. Also, you want to buy Micron the day before the trade war with China ends, since it is far and away its largest customer.

Q: Is Micron Technology a value trap?

A: Absolutely not, this is a high growth stock. A value trap is a term that typically applies to low price, low book to value, low earning or money losing companies in the hope of a turnaround.

Q: I didn’t get the Microsoft (MSFT) call spread when the alert went out — should I add it on here?

A: No, I am generally risk-averse this month; let’s wait for that 4% correction in the main market before we consider putting any kind of longs on, especially in technology stocks which have had great runs.

Q: How do you see Lam Research (LRCX)?

A: Long term it’s another double. The demand from China to build out their own semiconductor industry is exponential. Short term, it’s a victim of the China trade war. So, I would hold back for now, or take short-term profits.

Q: Is this a good entry point for Google (GOOGL)?

A: No, wait for a better sell-off. Again, it’s the main market influencing my risk aversion, not the activity of individual stocks. It also may not be a bad idea to wait for talk of a government investigation over censorship to die down.

Q: Would you buy Tesla (TSLA)?

A: No, buy the car, not the stock. There are just too many black swans out there circling around Tesla. It seems to be a disaster a week, but then every time you sell off it runs right back up again. Eventually, on a 10-year view I would be buying Tesla here as I believe they will eventually become the world’s largest car company. That is the view of the big long-term value players, like T. Rowe Price and Fidelity, who are sticking with it. But regarding short term, it’s almost untradable because of the constant titanic battle between the shorts and the longs. At 26% Tesla has the largest short interest in the market.

Q: I’m long Microsoft; is it time to buy more?

A: No, I would wait for a bit more of a sell-off unless you’re a very short-term trader.

Q: What would you do with the TBT (TBT) calls?

A: I would buy more, actually; preferably at the next revisit by the ProShares Ultra Short 20 Year Plus Treasury ETF (TBT) to $33. If we don’t get there, I would just wait.

Q: What’s your suggestion on our existing (TLT) 9/$123-$126 vertical bear put spread?

A: It expires in 12 days, so I would run it into expiration. That way the spread you bought at $2.60 will expire worth $3.00. We’re 80% cash now, so there is no opportunity cost of missing out with other positions.

Q: Do you like emerging markets (EEM)?

A: Only for the very long term; it’s too early to get in there now. (EEM) really needs a weak dollar and strong commodities to really get going, and right now we have the opposite. However, once they turn there will be a screaming “BUY” because historically emerging nations have double the growth rate of developed ones.

Q: Do you like the Invesco India ETF (PIN)?

A: Yes, I do; India is the leading emerging market ETF right now and I would stick with it. India is the next China. It has the next major infrastructure build-out to do, once they get politics, regulation, and corruption out of the way.

Q: Do you trade junk bonds (JNK), (HYG)?

A: Only at market tops and market bottoms, and we are at neither point. When the markets top out, a great short-selling opportunity will present itself. But I am hiding my research on this for now because I don’t want subscribers to sell short too early.

Q: With the (VXX), I bought the ETF outright instead of the options, what should I do here?

A: Sell for the short term. The iPath S&P 500 VIX Short-Term Futures ETN (VXX) has a huge contango that runs against it, which makes long-term holds a terrible idea. In this respect it is similar to oil and natural gas ETFs. Contango is when long-term futures sell at a big premium to short-term ones.

Q: How much higher for Apple (AAPL)?

A: It’s already unbelievably high, we hit $228 yesterday. Today it’s $228.73, a new all-time high. When it was at $150, my 2018 target was initially $200. Then I raised it to $220. I think it is now overbought territory, and you would be crazy to initiate a new entry here. We could be setting up for another situation where the day they bring out all their new phones in September, the stock peaks for the year and sells off shortly after.

Global Market Comments

September 6, 2018

Fiat Lux

Featured Trade:

(TUESDAY, OCTOBER 16, 2018, MIAMI, FL,

GLOBAL STRATEGY LUNCHEON),

(HOW THE RISK PARITY TRADERS ARE RUINING EVERYTHING!),

(VIX), (SPY), (TLT),

(TESTIMONIAL)

Global Market Comments

September 5, 2018

Fiat Lux

Featured Trade:

(JOIN US AT THE MAD HEDGE LAKE TAHOE, NEVADA, CONFERENCE,

OCTOBER 26-27, 2018),

(THE HIGH COST OF TRADE TARIFFS),

(TESTIMONIAL)

Global Market Comments

September 4, 2018

Fiat Lux

Featured Trade:

(WEDNESDAY, OCTOBER 17, 2018, HOUSTON GLOBAL STRATEGY LUNCHEON),

(DON’T MISS THE SEPTEMBER 5 GLOBAL STRATEGY WEBINAR),

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or

THE WAR WITH CANADA STARTS ON TUESDAY),

(MSFT), (VXX), (TLT), (AAPL), (KO), (GM), (F)

I have spent all weekend sitting by the phone, waiting for the call from Washington D.C. to re-activate my status as a Marine combat pilot.

Failure of the administration to reach a new NAFTA trade agreement by the Friday deadline makes such a conflict with Canada inevitable.

And while you may laugh at the prospect of an invasion from the North, the last time this happened Washington burned. You can still see the black scorch marks inside the White House today.

This is all a replay for me, when in 1991, I enjoyed an all-expenses paid vacation courtesy of Uncle Sam. That’s when I spent a year shuttling American fighter pilots from RAF Lakenheath to forward bases at Ramstein, Aviano, Cyprus, and Dharan, Saudi Arabia.

It may seem unlikely that our nation’s military would require the services of a decrepit 66-year-old. However, in my last conflict I ran into another draftee who was then 66. It seems that the Air Force then had a lot of F-111 fighter bombers left over from Vietnam that no one knew how to fly.

That’s the great thing about the military. It never throws anything away. Not even me. The life of our remaining B-52 Stratofortress bombers at their final retirement in 2050 will be 100 years.

Perhaps Canada will decide that discretion is the better part of valor, and simply wait for the World Trade Organization to declare the Trump tariffs illegal, which they obviously all are.

That would then force the administration to withdraw from the organization the U.S. created at the end of WWII to regulate fair trade and go rogue. But then what else is new?

And while there was immense media time devoted to the NAFTA talks, which only oversees trade with partners with around $2 trillion each, China, the 800-pound gorilla, is still lurking out there. It has a $12.2 trillion GDP and Trump is imposing tariffs on another $200 billion of their imports there today.

The corner that Trump has painted himself into is that he has made himself SO unpopular abroad, insulting virtually everyone but Russia, that no leader is willing to risk doing a deal with him lest they get kicked out of office.

I certainly felt this in Europe this summer where the discussion was all about Trump all of the time. When you insult a nation’s leader you insult everyone in that country. I haven’t received that kind of treatment since the Vietnam War was running hot and heavy in 1968.

I’ll tell you, I’d much rather be flying combat missions over enemy territory without a parachute than trading a market like we had last week. For months now, it has been utterly devoid of low risk/high return entry points for all asset classes.

It’s been a slow-motion melt-up virtually every day against the most horrific news backdrop imaginable. Such is the wonder of massive global excess liquidity. It Trumps everything.

NASDAQ topped 8,000, proving that if you aren’t loaded to the gills with technology stocks, as I have been pleading all year, you are out of your freaking mind. If you don’t own Apple, you are doubly screwed.

I doubt that such data is available, but I bet the illiterate and the uneducated have been beating more literate types in performance by a huge margin.

The unresponsiveness to news isn’t the only thing afflicting this market. As the summer coughs and sputters its way to a close, we enter September, notorious as the most horrific trading month of the year. And we are launching into it with the Mad Hedge Market Timing Index stuck in the 70s, overbought territory, for weeks now.

Blockbuster earnings, the principal impetus for rising share prices in 2018, are now firmly in the rearview mirror, and won’t make a reappearance for another month. Then they die completely in 2019.

Perhaps this is why my long volatility position in the (VXX) is doing moderately well, even though the indexes have been hitting new all-time highs, with the S&P 500 briefing kissing $292. I rather practice my golf swing rather than try to outtrade this market, even though I don’t play golf.

Other than NAFTA, there was little to trade off of last week. Apple (AAPL) shares continue to break new records, hitting an incredible $228, in front of their big iPhone launch this month. Trump announced he was freezing wages on 1 million-plus federal employees next year. That will solve their tax problems for sure.

Coca-Cola (KO) bought British owned Costa for $5 billion, where I regularly breakfast while traveling abroad, in the hopes that perhaps its 501st new drink launch this year will be successful.

Amazon (AMZN) is within sofa change of becoming the next $1 trillion market cap company, making the parents of founder Jeff Bezos the most successful angel investors in history, worth $30 billion.

U.S. auto sales are in free fall. Car company shares (GM), (F) continued their slide as they are pummeled on every side by administration economic policies. One has to ask the question of how long the American economy can survive after losing a major leg like this one. Home sales, another vital component, are also suddenly awful.

Trump attacked big tech. The market yawned.

With the Mad Hedge Market Timing Index at 71 and bounces around in the 70s all week, I am not inclined to reach for trades here. All three of my current positions are making money, my longs in Microsoft (MSFT) and volatility (VXX) and my short in the U.S. Treasury bond market (TLT).

August finally brought in a performance burst in the final days, leaving us with a respectable return of 2.13%. My 2018 year-to-date performance has clawed its way back up to 25.30% and my nine-year return appreciated to 303.48%. The Averaged Annualized Return stands at 34.35%. The more narrowly focused Mad Hedge Technology Fund Trade Alert performance is annualizing now at an impressive 28.59%.

This coming week housing statistics will give the most important insights on the state of the economy.

On Monday, September 3, there was a national holiday, Labor Day.

On Tuesday, September 4, at 9:45 AM the PMI Manufacturers Index is out. August Construction Spending is out at 10:00 AM.

On Wednesday, September 5 at 7:00 AM, we learn MBA Mortgage Applications for the previous week.

Thursday, September 6 leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a rise of 3,000 last week to 213,000. Also announced at 9:45 AM are the August PMI Services Index.

On Friday, September 7 the Baker Hughes Rig Count is announced at 1:00 PM EST.

As for me, the high point of my weekend was the funeral services for Senator John McCain. Boy, the Squids really know how to put on a ceremony. I suspect it may market a turning point for our broken American politics.

In the meantime, King Canute sits in his throne at the seashore ordering the tide not to rise.

Good luck and good trading.

Global Market Comments

August 31, 2018

Fiat Lux

Featured Trade:

(MONDAY, OCTOBER 15, 2018, ATLANTA, GA, GLOBAL STRATEGY LUNCHEON),

(WATCH OUT FOR BEARS!), ($INDU),

(MORE BIOTECH AND PHARMA STOCKS TO SOAK UP)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.