Global Market Comments

March 14, 2018

Fiat Lux

Featured Trade:

(TEN REASONS WHY APPLE IS GOING TO $200),

(AAPL), (AVGO), (QCOM), (GOOGL), (AMZN),

(TEN REASONS WHY STOCKS CAN'T SELL OFF BIG TIME),

(SPY)

Global Market Comments

March 14, 2018

Fiat Lux

Featured Trade:

(TEN REASONS WHY APPLE IS GOING TO $200),

(AAPL), (AVGO), (QCOM), (GOOGL), (AMZN),

(TEN REASONS WHY STOCKS CAN'T SELL OFF BIG TIME),

(SPY)

Here it is mid-March, and Apple is already closing in on my 2018 target of $200. Indeed, with a market capitalization today of $930 billion, Apple is on the verge of becoming the world's first $1 trillion publicly traded company.

And here's the really great thing about this year for Apple bulls. If you had the right cajones you had a chance to load the boat just above $150 only five weeks ago.

If you did, as I begged, pleaded, and beseeched you to do, your Apple trade earned a handy 22.33% at today's $183.50 high.

Now for the good news. The best is yet to come. In fact, there are ten reasons why Apple shares should hit my lofty target sometime this year.

1) Share buy backs are first and foremost. With $280 worth of cash in the bank abroad, and two thirds of that committed to buy back Apple stock, shareholders essentially have a free put option.

Indeed, you could see the company's invisible hand in the marketplace during the recent correction, soaking up shares at every opportunity. We won't learn the true numbers until the next quarterly earnings report on May 1.

2) Valuation is still the overwhelming factor driving institutions into Apple stock. With a price earnings multiple of 18X and a dividend yield of 1.40%, Apple is trading not only at a discount to the main market, but a discount to most of tech as well. No one ever got fired for buying Apple, at least not recently.

3) Apple's sales are as good as ever. The expected draw down in between new phone launches is proving less than expected. All of the channel checks suggesting a bigger drop have proven unfounded.

4) The rest of technology is on fire. Even if Apple were stumbling now, which it isn't, it would get dragged up by the meteoric moves seen in the rest of the FANG's.

5) The administration's nixing of the Broadcom (AVGO) takeover of QUALCOMM (QCOM), protects the principal supply of propriety chips for Apple phone safe from foreign interference. Broadcom could have chopped the research budget or transferred crucial technology to foreign competitors.

6) Apple is broadening its product lines, shifting to a new business model that delivers multiple new phones at the same time. This will include low priced models that will compete in new markets like India, as well as go head to head with the market share leaders, Samsung. This will increase market share and profitability.

7) While Apple possesses only 8% of the global cell phone market, it accounts for a staggering 92% of cell phone profits. Apple effectively has a monopoly on cell phone profits.

8) Their new lease program promises to deliver a faster upgrade cycle that will allow higher premium prices for their products and demand more phones. That will bring larger profits.

9) Apple continues to inexorably move into new products and services. While the company was late with the HomePod to compete against Amazon's (AMZN) Alexa and Alphabet's (GOOGL) Google Home, integration with the rest of the Apple ecosystem will enable the company to have the last laugh. Watch out for Apple Pay. Health care is another big target area.

10) Standards of living are rising worldwide. And guess what the first thing a newly enriched middle class does around the planet? They dump their Samsung Galaxies and Google Androids and join the IPhone club for the enhanced status alone.

Global Market Comments

March 13, 2018

Fiat Lux

Featured Trade:

(WHY LITHIUM IS ABOUT TO REPLACE OIL),

(SQM), (ALM), (FMC), (MLNLF),

(THERE ARE NO GURUS),

(A COW BASED ECONOMICS LESSON)

Global Market Comments

March 12, 2018

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE TEFLON MARKET THAT WON'T QUIT),

(AAPL), (FB), (FXE), (TLT), (FXY),

(HOW TO HANDLE THE FRIDAY, MARCH 16 OPTIONS EXPIRATION), (FXE), (FB)

Note to Paid Subscribers: We migrated to a new dedicated server last weekend to accommodate a much larger volume of business and greater paid content. This will require you to login in to the site. If you lost your login ID or password please send an email to Nancy at customer support at support@madhedgefundtrader.com and put ?Login? in the subject line.

I hate using worn out, hackneyed cliches like "Teflon market" or "Goldilocks," but it was one heck of a Teflon Goldilocks market last week.

The FANG's truly went bananas.

Stocks had every excuse for the wheels to fall off.

The president's chief economic advisor resigned. The US declared the most ferocious trade war since the 1930's, which should cut US GDP growth by 0.5%. The administration appeared to be lurching from one disaster to the next.

And it all turned out to be yet another fabulous buying opportunity, and a chance to go solidly "RISK ON".

As I expected.

It is another demonstration of an old trading nostrum that has served me faithfully for half a century. If you throw bad news on a market and it fails to fall, you buy it.

With the buckets of bad news poured on the market it should go ballistic.

And so it has.

If you were long technology stocks like (INTC), (AAPL), (FB), short US Treasury bonds (TLT), and short the Euro (FXE), as I have been begging, pleading, and beseeching you to do, you just saw one of your best trading weeks of the year.

And guess what? It's going to get a lot better. We still have two months of seasonal buying before stocks depart for the normal summer correction. And you can make a lot of money in two months.

What really poured gasoline on the fire was a blockbuster February Nonfarm Payroll Report, up some 313,000. That is 120,000 over expectations. The Headline Unemployment Rate remained steady at 4.1% a ten year low.

The real crusher was that this frenetic rate of job creation caused Hourly Wages to go up only 0.1%, or essential zero, meaning that inflation is nowhere to be seen anywhere. It was a number that left economists everywhere scratching their heads.

The December and January reports were revised upward by 54,000 jobs.

Construction was up by 61,000, Retail was up 50,000, and Professional and Business Services up by 50,000. No doubt a big chunk of this was prompted by deficit financed tax cuts.

The only sector showing job losses was in Information Technology, down some 12,000.

The U-6 broader "discouraged worker" jobless rate stayed at 8.2%.

Overall, the total size of the workforce jumped by 806,000, the largest gain since 1983.

It was essentially a perfect report.

I would be remiss in not remembering the nine-year anniversary of the end of the stock market crash on March 9, 2009.

In those days, the S&P 500 futures were wildly swinging at 100 points a pop. The Nonfarm Payroll Reports were then printing horrifying losses of 700,000 a month.

As the bad news always seemed to come out on Sundays, you could buy a put option at the Friday afternoon close and it would be up 400% at the Monday morning opening. We raked the profits in. Those were the days!

I turned bullish a week later and have remained so ever since. How times have changed.

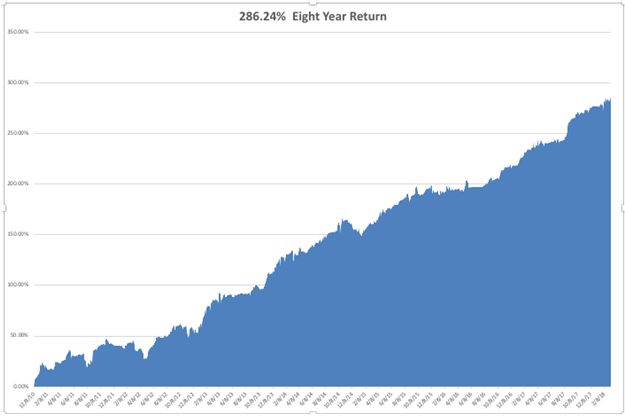

It was another great week for the Mad Hedge Fund Trader Alert Service, almost clawing our way all the way back to another new all-time high. We only need to make another 1.95% and we'll be there, hopefully sometime next week.

A double position in Apple (AAPL) really gave us a turbocharger, with that stock just short of a new all-time high, and up $10 from our last "BUY". The Iron Condor in Facebook (FB) will expire at its maximum profit point on Friday.

We already took profits in our short in the US Treasury bond market (TLT) on a quick 48-hour turnaround. The short position in the Euro is firing on all cylinders.

Mercifully, we got out of your short in the Japanese yen (FXY) at cost as a risk control measure. It looks like those who kept the positon will get the maximum profit there anyway.

Having survived the February nightmare, I now feel invincible.

This coming week is fairly subdued on the data front.

On Monday, March 12 nothing of note is released.

On Tuesday, March 13 at 8:30 AM we learn the all-important February Consumer Price Index to see if inflation really is asleep. This has recently become one of the most important numbers of the month.

On Wednesday, March 14, at 8:30 AM EST, we get February Retail Sales.

Thursday, March 15 leads with the Empire State Manufacturing Survey at 8:30 AM EST. Weekly Jobless Claims are announced at the same time.

On Friday, March 16 at 8:30 AM EST we get the February Housing Starts.

At the close we undergo a Quadruple Witching in the options market with several monthly series expiring today.

At 1:00 PM we receive the Baker-Hughes Rig Count, which saw a small rise of only one last week.

As for me, I am going to be shopping for a new Steinway Grand Piano. I have made so much money this year that it's time to upgrade and go for the max with a Model D concert grand piano!

Good luck and good trading!

We have the good fortune to have several options positions left that expire on Friday, March 16 in five trading days and I just want to explain to the newbies how to best maximize their profits.

This involves the:

Currency Shares Euro Trust ETF (FXE) March 16 $120-$123 vertical bear put debit spread

The Facebook (FB) March 16 $155-$165 vertical bull call debit spread

The Facebook (FB) March 16 $190-$195 vertical bear put debit spread

Provided that some we don't have a monster "RISK OFF" move in the market over the next few days (war with North Korea?), which could cause bonds to rally big time, these position should all expire at their maximum profit point below.

Your profit on each position should amount to the following:

(FXE) put spread - $2,000 or 20.00% in 18 trading days

(FB) call spread - $1,800 or 17.64% in 33 trading days

(FB) put spread - $1,266 or 12.35% in 22 trading days

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck and pat yourself on the back for a job well done.

You don't have to do anything.

Your broker (are they still called that?) will automatically use your long positions to cover your short positions, cancelling out the total holdings.

The profit will be credited to your account on Monday morning March 19, and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

If you don't see the cash show up in your account on Monday, get on the blower immediately.

Although the expiration process is now supposed to be fully automated, occasionally mistakes do occur. Better to sort out any confusion before losses ensue.

I don't usually run positions into expiration like this, preferring to take profits two weeks ahead of time, as the risk reward is no longer that favorable.

But we have an excess of cash right now, and I don't see any other great entry points for the moment.

Better to keep the cash working and duck the double commissions. This time being a pig paid off handsomely.

If you want to wimp out and close the position before the expiration, it may be expensive to do so.

Keep in mind that the liquidity in the options market disappears, and the spreads substantially widen, when a security has only hours, or minutes until expiration on Friday. So if you plan to exit, do so well into the final expiration.

This is known in the trade as the "expiration risk."

One way or the other, I'm sure you'll do OK, as long as I am looking over your shoulder, as I will be.

I am going to hang back and wait for good entry points before jumping back in. It's all about getting that "Buy low, sell high" thing going.

I'm looking to cherry pick my new positions going into yearend.

Take your winnings and go out and buy yourself a well-earned dinner. Or use it to pay your upcoming 2017 income tax bill.

It's probably going to be a big one, given how much money you made trading this year.

Well done, and on to the next trade.

Global Market Comments

March 9, 2018

Fiat Lux

Featured Trade:

(HERE'S ANOTHER CHANCE TO MAKE YOUR EMERGING MARKET PLAY),

(EEM), (SPY), (PIN),

(TRADING DEVOID OF THE THOUGHT PROCESS),

(SPY), (QQQ), (IWM)

I have been pounding the table for years about a global synchronized recovery, and there is no better way to play it than emerging markets (EEM).

That play it not over.

After suffering volatility that was a multiple of what we saw here in the US during the February meltdown, Emerging markets ae getting ready for an upside move.

The fundamental case is there.

During a period of global growth, emerging nations see growth rates that are double or more those seen here in the US and Europe.

Emerging companies tend to be more highly leveraged than western competitors, giving an upside hockey stick effect on profit growth.

And much of the emerging world is tied to commodities, a legacy of the investments made in their countries by former colonial masters during the last century.

Commodity prices usually outperform those of stocks as we approach the tag ends of a prolonged economic cycle because additional supply can't be created with a printing press.

Emerging countries are also getting a strong tailwind from a weak US dollar, as it increasing the purchasing power of their earnings on the world stage.

Companies that financed their debt in US dollars, a common occurrence abroad, effectively see their loans paying themselves off.

With exploding US budget deficits and a ballooning national debt, a continuation of a weak dollar is a sure thing for the foreseeable future.

This has heralded a dramatic improvement in the credit quality of emerging companies.

Even the technical set up is looking attractive on the charts. You see a narrowing triangle formation to the right which should break out to the upside once the growth data comes in.

The is just a continuation of a trend that has been in place for years.

Since they bottomed at the beginning of 2016, the (EEM) has tacked on an impressive 100%. This is in sharp contrast to the S&P 500 (SPY), which has gained by only 63.42% during the same period. Owning technology was the only way you could beat emerging market returns.

China is the mainstay of emerging markets, with far and away the largest weighting in the (EEM). Last week, the government confirmed that it was targeting a 6.5% growth rate for 2018, the same that was achieved last year.

China only accounts for 3% of US steel imports, so the imposition of a punitive 25% tariff will have a minimal impact on the countries growth prospects.

However, don't look and emerging markets as a one-way bet. After a two-year bull run, it happens to be one of the most over owned sectors in the markets.

There are also major elections coming up in several emerging nations, like Brazil and Mexico. A backlash against Trumps nationalist, protectionist, "America First" policies are a sure thing. That would be market negative.

One way to sidestep this is to take a rifle shot at a single country that has no imminent election. India is the hedge fund community's favorite right now, which has the additional attraction that its steel and trade exposure to the US is minimal.

Take a look at the PowerShares India Portfolio ETF (PIN) if you are so inclined.

??

??

??

??

With every major index rolling around like a BB in a boxcar (SPY), (QQQ), (IWM), the day to day call has become almost impossible.

The Mad Hedge Market Timing Index is now showing “Extreme Fear” with a reading of 20, never a good time to initiate a new short.

What’s a trader to do here?

Invest purely on the basis of momentum?

That risks buying the top tick in the entire move and looking like a complete mug to your clients, your boss, your coworkers, and your wife.

Maybe it’s time to take a long cruise at let your performance flat line at an all-time high?

But then, mid-March is a little early to call it a year, even though you may be up double digits.

The exit of institutional money to trading in in-house dark pools, the concentration of trading into single sector exchange traded funds (ETF’s), and the departure of the traditional individual investor, are all exaggerating these moves.

It doesn’t help that stock markets are sitting just short of all-time highs.

You could run off and trade something else besides stocks. That’s easier said than done, as virtually all other asset classes have become untradeable.

Bonds (TLT) have just entered a new 30-year bear market.

Some commodities (COPX) are now trading at double their fall lows.

Precious metals (GLD), (SLV) seem to be hesitating here.

What’s a poor trader to do?

Take up the action in collectable Beanie Babies? Rare French postage stamps? Crypto-currencies? Rare vintage Madeira’s?

There are only two ways to deal with a market like this. Turn off the TV, cancel your newswire feeds, quit reading research, and just look at your screens.

Buy the low numbers and sell the high ones.

It is no more complicated than that.

Don’t confuse matters with the thought process. The markets are now so illogical you will only muddy the waters. A brilliant move in one hour may look like a disaster in the next.

The other method is to become boring. Just find the cheapest, low fee index fund you can find, like one of Vanguard’s, buy it, and stuff it under your mattress.

I’m pretty confident that it will be up 10% by the end of the year.

That means you will probably beat most hedge managers out there, as you would have done for the past nine consecutive years.

Try to earn more than 10% trading in these choppy markets, and you could end up losing 10%, or 100%.

As for me, I am going to stick with trading. At least I’ll be there when it turns easy again, which has to be soon, and I’ll make a hell of a lot more than 10%.

And was never very good at the “boring” thing.

Global Market Comments

March 8, 2018

Fiat Lux

Featured Trade:

(SO, WHERE'S THE CRASH?),

(GS), (INTC), (CSCO), (VXX), (TLT),

(DON'T GET SCAMMED BY THE MUTUAL FUNDS)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.