By now, you are all long up the wazoo with the shares of Apple (AAPL).

How would you respond if I told you that Steve Jobs' creation is about to take a gigantic $33 billion earnings hit?

My guess is that you'd jump off the nearest bridge, slit your wrists, or at the very least, come down with a severe case of Montezuma's Revenge.

I can pretty much guarantee you that such a blockbuster announcement is headed your way in the coming weeks, if not days.

What the heck happened? Wasn't the dream scenario playing out for big tech, as predicted by the Mad Hedge Fund Trader for the past decade?

It is. But these days, things are complicated. Very complicated.

Buried in the tax bill passed with great haste at the end of 2004 is a provision that allows US companies to repatriate profits they have held overseas for the past 14 years. We're not talking small beer here.

The latest estimate for this figure is some $2.8 trillion, which is stashed away in the bank accounts of subsidiaries in Switzerland, the Cayman Islands, and Lichtenstein.

Five companies account for about one third of this total, including Apple (AAPL), Microsoft (MSFT), Pfizer (PFE), Cisco (CSCO), and Oracle (ORCL).

Oil companies, and other companies with major international business, like Johnson & Johnson (JNJ), Morgan Stanley (MS), and Procter & Gamble (PG), account for much of the rest.

Until now, if management wanted to bring this money back to the US they would have to count it as regular income and pay a stiff 35% tax rate. As of January 1, they can repatriate the funds and pay as little as 8%.

And here's the problem. These one-time-only tax payments have to be counted as a current expense. The amounts are so huge that they be enough to wipe out all present operating earnings.

For example, in Apple's case one estimate has the tax bill as high as $33 billion as the company brings home money from dozens of different foreign domiciles.

The writing is already on the way. Goldman Sachs (GS) has already said that it expects a tax hit of $5 billion, while Royal Dutch Shell (RDS/A) has come in at $2.3 billion.

The logic behind the tax cut is that repatriated money would be used to build more factories and hire more people in the good old USA.

Past repatriations prove that nothing of the sort will take place. In 2004 the Bush administration engineered just such a break. Some $312 billion was brought back and almost entirely invested in share buy backs and dividend payments.

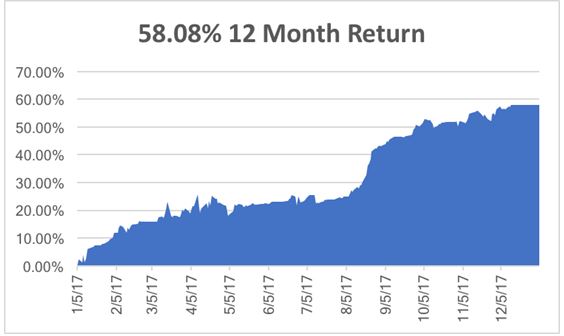

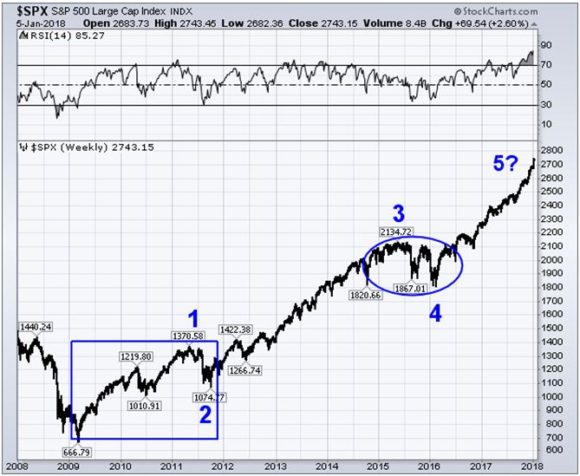

This all goes back to my argument at the end of 2017 that one way or the other the entire $1.5 trillion tax package will end up in the stock market one way or the other. The market action since then totally vindicated that view.

So what to do about Apple? Here's where it really gets complicated.

Going forward, multinational companies now have to pay only a 10.5% on their foreign earnings and 21% for domestic earnings. It is a big incentive to close down US production facilities and ship them, and their jobs, overseas. You really have to wonder who thought this stuff up.

After all, does Apple want to pay the $14 an hour it gives low end workers in the US now, or $1 an hour to workers in India where its next big growth market is located?

Apple has been expected a reoccurrence of exactly this sort of tax windfall for at least a decade and has been reserving for it annually. But it thought the tax rate would be much higher, around 13%.

The net result is that by underestimating the generosity of future administrations it has over reserved for the prospect, meaning that instead of generating a monster $33 billion loss repatriation could create a surprise $3 billion profit!

So the bottom line here for Apple is that you hang on to the stock, where I have a price target of $200, and is now looking exceedingly conservative.

If for some reason the tax announcement DOES generate a big drop in the shares, jump in with both hands and buy it.

There are other weird quirks to the new tax law. Foreign companies operating in the US are also entitled to use the break. This means that if your US operations have been running at a loss, which is the case with Daimler Benz (DDAIF) and BMW (BMWYY), it generates a surprise $1 billion profit!

Tax breaks for Germans. Who ever thought of that? Talk about unintended consequences with a turbocharger.

In the meantime, attorneys and accounts are pouring over the new code harvesting hundreds of new tax loopholes no one ever thought possible. We will stay turned and keep you informed of the important ones, as taxes are a regular part of the coverage of this letter.

My bet is that unintended consequences are creating entire new industries that no one imagined possible. That is how an innocent tax break to help new technology startups with carried interest turned into the gargantuan trillion dollar private equity industry of today.

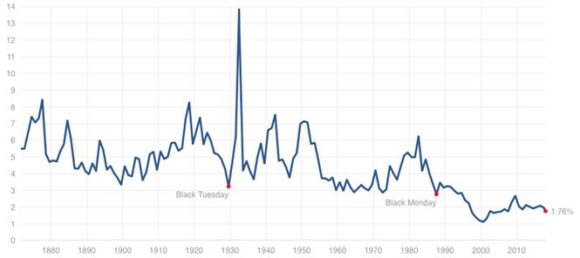

Here's another unintended consequence for you. The combined tax paid this year by repatriating companies should total around $235 billion. That will slow the current meteoric growth in the US budget deficit and means you short position in the bond market may take a little longer to play out.

Don't we live in a bizarre, upside down Alice in Wonderland world these days?

In the meantime, I'll be checking out commercial real estate in Switzerland, the Cayman Islands, and Lichtenstein.