Global Market Comments

November 17, 2016

Fiat Lux

Featured Trade:

(NEW TAX STRATEGIES FOR A TRUMP WIN),

(TESTIMONIAL)

If you don't want to save yourself a few million dollars in taxes next year, please ignore this article.?

If you do, please read on.

Thanks to Donald Trump's surprise win, the US tax code is about to undergo the biggest change since John F. Kennedy chopped the maximum tax rate of 90% in 1962.

The good new is that there is a lot you can do to minimize your tax bill for 2016, the last year to take place under current law. But you have to take action immediately or at least by December 31.

On rare occasions, changes in tax law are retroactive to the previous year. It is more likely that the new tax rates won?t take effect until 2017, as the changes will be so momentous.

So I got together with my accountant who is extremely prescient on these matters, and has saved me a bundle of money in the past.

The great irony is that most accountants in the country will be attending tax seminars in coming weeks to bone up on tax preparation for the 2016 tax year. Much of what they will be told will be reversed in coming months.

This is going to be one confusing tax year.

I?ll list off the crucial action items:

1) Defer All Income

Taxes are going to fall in 2017, a little for small income earners, and a lot for the wealthy. Any income you can defer into the New Year will get taxed at the new, lower rate, not this year?s higher rate.

The other benefit is that the taxes on 2017 income won?t be due for 16 months, compared to only four months for 2016.

Be sure to dot your i?s and cross your t?s here.

The IRS absolutely hates year-to-year income shifting like this, and they will catch you up at every opportunity. If you have already cashed a check in 2016, the income absolutely CAN?T be moved into 2017.

For those receiving 1099 income, be careful here.

If a check is mailed at the end of December and you don?t receive it until the beginning of January and cash it in January, it will still be counted as 2016 income. That?s because the payer?s 1099 dictates in which tax year the income is reported.

It may be time to have a friendly chat with your payer.

Mismatching Form 1099s and reported income are a major trigger for tax audits (I learned that the hard way).

2) Accelerate All Expenses

Anything that minimizes your 2016 profit to the benefit of your 2017 profit will have the effect of reducing your taxes.

Many overhead expenses, such as utilities' bills and online services, can be paid several months or a year in advance. Renew all those newspaper and magazine subscriptions NOW.

Have a chat with your employees and see if they are willing to accept year end bonuses early. Make sure all of the payment dates are well documented and preserved in case of a future audit.

3) Capital Gains

During the presidential campaign, nothing definitive was said about long term capital gains taxes which now range from 15%-25%.

However, if you were planning to sell stock, your home, or any other investment assets, it might be wise to defer the closing date until January.

That way, if capital gains taxes ARE cut, you will receive an immediate benefit.

4) Carried Interest

Managers and investors in hedge funds have been enormous beneficiaries of the carried interest tax treatment for the past 45 years.

This allows investors in the appropriate tax efficient structures to be taxed at a 15% rate, instead of the 39% or 43% the rest of us pay. Carried interest is considered a principal cause for the rise of the 1%.

From very early in his campaign, Trump promised to get rid of carried interest which he characterized as an unfair advantage enjoyed by hedge fund managers who largely opposed him.

As with everything else Trump has said, no one really knows if he will carry through with this plan.

I doubt even The Donald knows at this point.

5) Obamacare Penalties

We are now in the middle of the enrollment period for Obamacare for 2017 and most other health care plans. Shunning coverage will generate a fine equal to 2.5% of your adjusted gross income.

The repeal of Obamacare is one of the safest bets out there, as it was such a big campaign issue. So if you feel healthy and want to forgo health coverage, you can now do so free of any penalty or guilt.

The cheapest, lowest end health care policies cost $8,000 a year, and have high $8,000 deductibles. That means your medical expenses have to exceed $16,000 a year for you to receive one penny of net benefits.

That buys a hell of a lot of Band-Aids.

As for me, I?m home free, as Medicare kicks in for me on January 1st. That is assuming, of course, that Medicare still exists.

6) Self Employment Tax

Trump has made much of helping small businesses.

The biggest hit these businesses take is the 15.3% self-employment tax. Minimizing net income in 2016 will also have the advantage of moving income into 2017 when it will be exposed to a lower tax rate, or no tax at all.

However, no information on the details of this tax by the new powers that be has been given whatsoever.

One can only hope.

7) Solar Subsidies

With the denial of global warming now official government policy, subsidies to install solar panels or buy electric cars will almost certainly be the first on the chopping block.

These gave buyers a 30% investment tax credit which they could use to offset taxes on earned income or carry over into future years.

Especially hard hit will be taxpayers in the American Southwest who were major buyers of these panels.

The Bottom Line

Keep in mind that all of this is a work in progress, and that this is a fast moving target. Trump knows very little about the workings of the federal government, and I?m sure a crash course is underway.

How much campaign rhetoric gets translated into law remains one of the great unknowns of 2017.

It?s Been Nice! So Long!

![John Thomas Solar Panal]()

John,

Thanks for the "Heads up" on Nvidia (NVDA).?

It took a little patience to bear with all that happened last week,?but you were spot on and my $70 call option paid off 100% for a sweet 10k profit in less than a few weeks.

Keep them coming John.? After seven years with your service, I rely on you to keep my retired wife in the style she has become accustomed to living.?

Life is good and so are you.

Kurt

Lincoln, California

Global Market Comments

November 16, 2016

Fiat Lux

Featured Trade:

(THE FAT LADY IS SINGING FOR THE BOND MARKET),

(TLT), (TBT), (LQD), (ELD), (MUB),

(IS USA, INC. A ?SELL?)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

iShares iBoxx $ Invst Grade Crp Bond (LQD)

WisdomTree Emerging Markets Lcl Dbt ETF (ELD)

iShares National Muni Bond (MUB)

You have just been adopted by a new rich uncle.

I doubled my short position in the US Treasury bond (TLT) market today.

Furthermore, I?ll be using any subsequent price rise to sell more bonds, roll forward put options and put spread option positions, sell short bond futures, and buy the ProShares Ultra Short 20+ Treasury Bond Fund (TBT).

It is undoubtedly the cleanest trade out there in the world today.

Of all the momentous changes in the prospects for asset classes as a result of the presidential election, bonds absolutely top the list.

And not just US bonds, but German, Japanese, British, and every other kind of bond out there in the world as well are exiting a 30-year bull market and entering a 20-year bear market.

Fixed income instruments are totally toast for the next four and possibly eight years. Indeed, the list of reasons is so long that I?ll have to list them one by one.

1) The hallmark of Trump?s economic policy revealed so far is to lift the economy out of the mire by launching a massive round of deficit spending.

Independent analysis predicts that the US national debt could rise by as much as $10 trillion over the next decade.

That?s what a massive tax cutting, spending rises gets you.

Call it Reagan 2.0.

Even if the Federal Reserve does nothing, this unprecedented issuance of new government paper will crowd out private borrowers and drag interest rates upward, to the detriment of bond prices and borrowers everywhere.

2) The bond market was already in trouble well before the election. Prices peaked in July, and have been steadily eroding since. Every bond position I have strapped on since then has been from the short side.

This was because the world was assigning a growing probability of a Fed interest rate hike at their December 14th meeting. You could see this in the way bank shares traded which started moving off of multiyear bottoms during the same time period.

All the election did was pour gasoline on a small fire that was just starting to build.

3) After hiding in a deep cave for the past nine years, inflation is about to make a dramatic comeback. It was already starting to edge up with recent economic reports.

The October Nonfarm Payroll Report showed us that hourly earnings leapt by 2.9% YOY, while the headline U-6 structural unemployment plunged to only 9.5%.

And here is the problem. If you initiate a huge new jobs program with weekly jobless claims already at a 43-year low, wages will take off like a scalded chimp.

Oh, and by the way, wages are the largest component in any inflation calculation.

4) Years of zero, or subzero, interest rate policies from central banks around the world have created a substantial malinvestment bubble in all fixed income assets. As a result, the relative valuations have reached ludicrous levels.

The S&P 500 (SPY) is now trading at 18.5 times earnings, and possibly 17 times 2017 earnings. US Treasury bonds (TLT) at a 2.20% yield are trading at an amazing 45 times earnings.

Yes, the liquidity and risks are better for bonds, but they are not THAT much better.

This sets up the mother of all asset reallocations, out of the worst yielding financial instruments in the world into the best.

5) After spending 50 years in the financial markets, I can describe to you a problem that I have noticed from the very start. Institutional investors keep their foot firmly on the gas pedal while only looking in the rear view mirror.

Call it the herd instinct, safety in numbers, or lack of imagination, but portfolio managers, by definition, ALWAYS overweight the wrong asset classes at market tops, and underweight the right ones at market bottoms.

Making matters worse is the fact that these institutions move with the speed of molasses in the dead of a High Sierra winter. Some entertain changes in sector and asset weightings only once a quarter, while others do it annually.?

Yes, this means they can minimize tax bills. But it also assures that they are perpetually behind the curve. When the memo gets out and real changes DO occur, they unfold over years if not decades.

Every institution in the world is now overweight bonds and underweight stocks.

Guess what happens next?

Not a Time to Launch a Jobless Plan

The Fat Lady Is Singing

The Fat Lady Is Singing

Global Market Comments

November 15, 2016

Fiat Lux

Featured Trade:

(LAST CHANCE TO JOIN THE NOVEMBER 18TH LAS VEGAS GLOBAL STRATEGY LUNCHEON),

(NVIDIA REPORTS . . . STOCK ROCKS),

(NVDA),

(TESTIMONIAL),

(WHY TECHNICAL ANALYSIS DOESN?T WORK)

(SPY), (QQQ), (IWM), (VIX)

NVIDIA Corporation (NVDA)

SPDR S&P 500 ETF (SPY)

PowerShares QQQ ETF (QQQ)

iShares Russell 2000 (IWM)

VOLATILITY S&P 500 (^VIX)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update which I will be conducting in Las Vegas, Nevada on Friday, November 18, 2016.

A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate.

And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $212.

I?ll be arriving early and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a top restaurant at a major Strip casino. The exact location will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets, please click here.

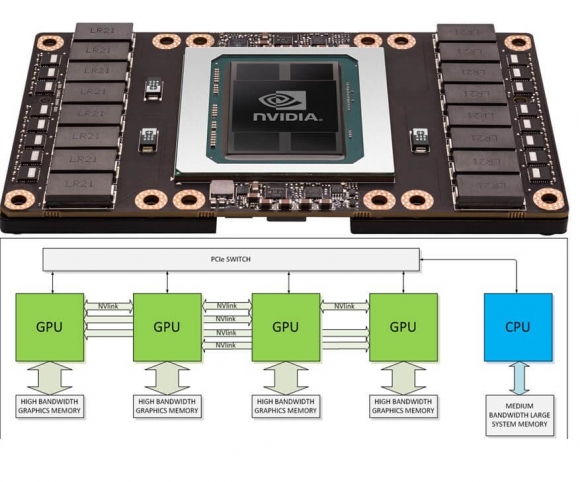

I really, really hope all of you read my report on Artificial Intelligence published on November 2nd, committed it to memory, and acted on its recommendations (click here for ?The Great Artificial Intelligence Stock Play You?ve Never Heard Of?).

For at the very end, it strongly recommended the shares of processor manufacturer Nvidia (NVDA), which occupies the nexus of the entire movement towards machine learning.

On Friday, Nvidia reported some of the most amazing earnings of the year, with the stock delivering a massive one day gain.

And Nvidia shares did this on a day when the entire rest of technology was taken out to the woodshed and beaten senseless.

?

Revenue leapt 54% to just over $2 billion, the first time Nvidia has posted a $2 billion quarter.

Its gross margin set a record at 59%, with a record 63% increase in gaming-derived revenue.

Nvidia?s dominance of the high-end GPU market is allowing it to soak up all of the spending that would normally have been at least somewhat split between itself and AMD.

Gaming was the big revenue booster for Nvidia.

Data center revenue grew by 59% as well, though this was much smaller in absolute terms ($230 million in data center sales versus over $1 billion in gaming revenue).

Jen-Hsun Huang, the CEO of Nvidia, noted that he saw strong growth in AI, though he opted not to break those figures out at this time.

Nvidia?s automotive program is also going well, with $127 million in revenue (a 61% increase year-on-year) and a 7% increase sequentially.

What Jen-Hsun talked about in the conference call is how Nvidia wants to build a computing platform that stretches from desktop GPUs, to cloud solutions like GRID, to automotive computing and self-driving cars.

It?s not that the rhetoric is different, but rather the fact that Nvidia is well on its way to accomplishing it.

These blew away even my own, wildly optimistic predictions.

Sales of Nvidia?s flagship product, the passively cooled 16GB Tesla P100 GPU, is being ravenously consumed by data centers around the country, and should grow by 95% during 2016, and another 50% in 2017.

Hold one of these dense, wicked fast processors in your hand and you possess nothing less than the future of western civilization.

Over the long term, the picture looks even better. It should continue with annual earnings growth of 20%-30% a year for the foreseeable future.

At a minimum, the shares have at least another double in them, and perhaps another double after that as well.

To learn more about Nvidia, please visit their website at http://www.nvidia.com/content/global/global.php .

Having said all that, I recommended to my concierge clients that they take profits on (NVDA) for the short term.

As much as I like the stock long term, in view of the presidential election result, it is clearly in the wrong sector at the wrong time.

Portfolio managers have been raiding their technology holdings since Wednesday, using them as an ATM, to pay for the newly discovered opportunities in financials, health care, construction, and industrials.

So better to get out of the way, and get back in when the sector has a tailwind, and not a gale force headwind, as it does now.

For those of you who did the trade, well done!

?You want to rotate your money into the sectors where Donald Trump?s policies are potentially going to work: those are financials, health care, and industrials?. said Erin Browne, head of macro investing at UBS O?Connor.

Global Market Comments

November 14, 2016

Fiat Lux

Special New World Order Issue

Featured Trade:

(TRUMP?S GIFT TO TRADERS),

(SPY), (TLT), (TBT), (GLD), (USO), (CAT),

?(X), (FCX), (BAC), (GS), (LEN), (ITB)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

SPDR Gold Shares (GLD)

United States Oil (USO)

Caterpillar Inc. (CAT)

United States Steel Corp. (X)

Freeport-McMoRan Inc. (FCX)

Bank of America Corporation (BAC)

The Goldman Sachs Group, Inc. (GS)

Lennar Corporation (LEN)

iShares US Home Construction (ITB)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

The Fat Lady Is Singing

The Fat Lady Is Singing