It?s a good thing I went to an Oktoberfest last week.

That gave me a chance to get my German up to snuff just in time for Deutsche Bank to run into financial troubles.

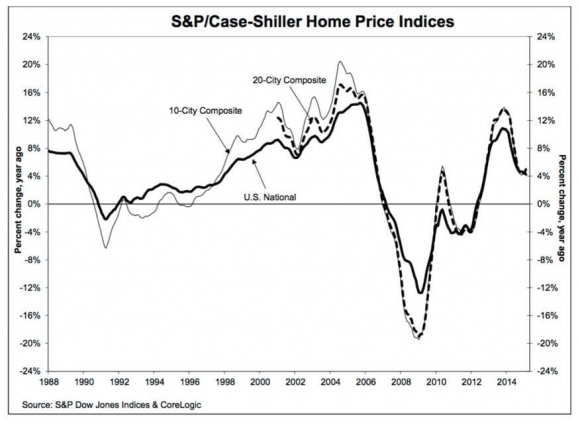

Since 2008, the knee jerk reaction to bad news about any major bank is that the Lehman Brothers nightmare is about to repeat itself.

It only took a few calls to Frankfurt and some reminiscing about the good old days in West Berlin for me to figure out that Deutsche Bank is no Lehman. They have tons of liquid cash and a rock solid balance sheet.

A systemic threat it is not.

Do you really think the Germans are going to bail out Greece, but let its largest bank go? I don?t think so.

It is only fear of a 50% dilution from a new capital raise that is driving investors out of the stock.

Not helping is the $14 billion in fines the mega bank still owes the US Justice Department related to abuses committed in the run up to the 2008 crash.

Does that sound remarkably similar to the $14 billion Apple (AAPL) owes the Irish government? I?m sure it?s just a coincidence. And I am equally shocked they allow gambling in the casino.

However, automatic fears like this will probably continue for another generation, much like they did after the great 1929 crash, leaving investors on the sidelines.

That all adds up to a giant SELL for all asset classes. There really is no place to hide.

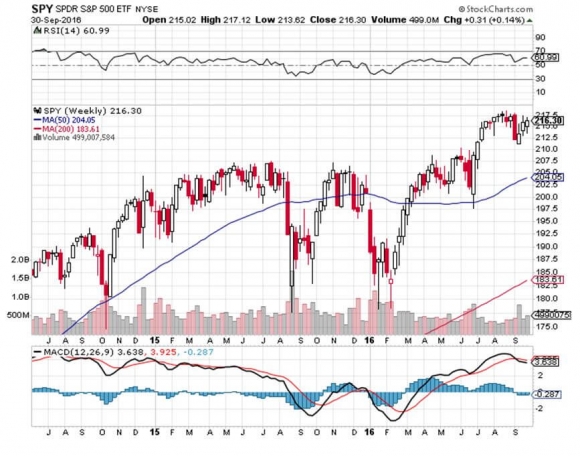

So far, every puke-out has been met by a wall of buying from underweight, underperforming, performance-chasing investors targeting 2,013 in the S&P 500 (SPX).

If this behavior continues, we could be in for what I call ?The dreaded flat line of death?.

This occurs when markets trade in incredibly tight ranges creating opportunities for virtually no one. That is exactly what we saw during the five-month period during the spring and summer of this year.

This could last all the way until the presidential election on November 8th.

So I have been hiding out with a nice little short position in the bond market (TLT), which delivered a convenient two point dump on the last trading day of the month, just pushing my performance mercifully into the green.

Hey, in these miserable trading conditions, I?ll take a push any time.

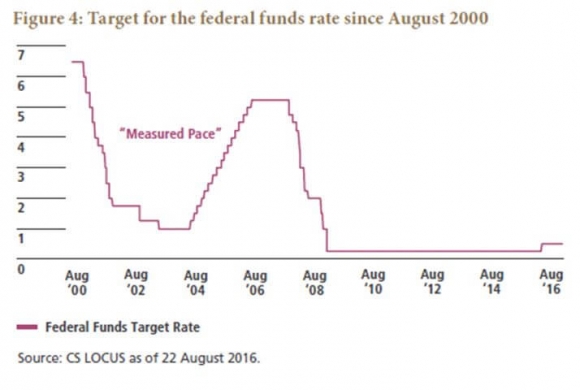

Isn?t that what?s supposed to happen when the Fed promises to raise interest rates in December?

You could have made a lot of money last week trading the Volatility Index (VIX) which made two round trips between $12-$15, a 25% range.

When will the next market panic ensue?

When a confident, assured, even tempered, and well prepared Donald Trump, brimming with facts, wins the Sunday, October 9th presidential debate at Washington University in St. Louis, Missouri.

CNN?s Anderson Cooper will be the moderator, and the questions will be randomly posed by individual citizens in a town hall format and via social media.

It will be a real ?think on your feet? challenge for both candidates.

I can?t wait.

Finally, since I am basically a positive person, I like to end on a high note.

San Jose, CA based Nutanix (NTNX) launched the best performing IPO of the year on Friday, up 131% on the first day.

The performance had the airwaves in Silicon Valley burning up.

Yes, I know these deals are engineered to create a structural short squeeze at the beginning.

But is this the deal that gets unicorn giants like Uber and Airbnb off the bench? Are another 100 unicorns behind them ready to go public? Are extravagant IPO parties making a return after a 16-year hiatus?

Most importantly, IS THE DOTCOM BUBBLE BACK?

The possibilities boggle the mind.

On Monday, October 3 at 8:30 AM, we get August Gallup Consumer Spending which should show that Americans are using their credit cards as much as ever.

On Tuesday, October 4 at 8:55 AM EST, we learn the Redbook for the week, tracking the behavior of consumers at chain stores, discounters, and department stores.

On Wednesday, October 5 at 10:00 AM EST, we get September Factory Orders and the ISM non-Manufacturing Index.

On Thursday, October 6 at 8:30 AM EST, we get the Weekly Jobless Claims which should confirm that employment remains at four decade highs.

Friday, October 7 delivers us the September Nonfarm Payroll report at 8:30 AM EST, the big release of the week. Expect a big bounce back from the disappointing 151,000 print last month, as well as substantial upside revisions.

We wind up with the Baker Hughes Rig Count on Friday at 1:00 PM EST. Worryingly, the trend has been up for the past 13 out of the past 14 weeks. Given OPEC?s surprise, and not believed, production cap last week, this report should garner more interest than usual.

All in all, I expect us to continue trading in narrow ranges, with profits accruing only to the quick and the nimble.

?If my analysis about Deutsche Bank proves correct,? all of the volatility could be confined to Friday morning.

Good luck and good trading. Keep your hard hat on.

John Thomas

The Mad Hedge Fund Trader