Global Market Comments

August 4, 2016

Fiat Lux

Featured Trade:

(CATCHING UP WITH THE NEW YORK TIMES' TOM FRIEDMAN),

(TESTIMONIAL),

(SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS)

Whenever the world undergoes an unusual amount of turmoil, as has taken place in recent months, I know there is one source that I can go to to make sense of it all.

That would be New York Times columnist Tom Friedman.

The peripatetic writer is completing the final touches on his latest book due out in November, ?Thank You for Being Late: An Optimist's Guide to Thriving in the Age of Accelerations?.

Described as a field guide to the 21st century, the book will seek to get a handle on the implications of simultaneous hyper accelerating technologies, and what they mean for us.

Tom chose this title because he dreamed it up while awaiting ever late meetings with Washington DC politicians.

Tom says we live in a hockey stick world. Technology, climate change, and Moore?s Law are all wreaking havoc on our understanding of everything. As a result, the world is changing beyond all recognition faster than we can comprehend.

During the Cold War, cash flows from the US and the old Soviet Union artificially propped up weak states.

Now that we are in a new unipolar world, that money is gone. The outcome is the failed state, Al Qaida, and ISIS, and the transition of the international scene from order to disorder.

Domestically, our politics were driven for nearly a century by Roosevelt?s New Deal and the Cold War. Today, the three hockey sticks are the main factors.

Political parties that fail to recognize this will blow up. Only resilient parties will adapt and survive.

The ?cloud? is misnamed. What is happening is an immense release of energy that is instantly turning over beliefs that stood fast for eons.

Look at how fast gay rights in Ireland went national, and the speed with which the confederate flag was removed from Southern US statehouses.

Conflicts that simmered for centuries are rapidly turning violent. In the Middle East a battle over a shrinking pie in the form of falling oil revenues has heightened the Iran-Saudi, Shiite-Sunni conflict.

A world moving from order to disorder is spawning mass migration. Kids in Syria have not been to school for five years, due to a never ending Civil War.

The US economy is spinning off new jobs at an incredible pace, but they all require constant learning and relearning.

If you can?t do this, they are the wrong jobs, and you don?t fit into the new economy. Being average no longer cuts it anymore. Enter the angry white men and polarization.

A parallel explosion of economic interdependency is creating vast new riches, but back breaking debts as well.

The biggest threat to humanity is the growing power of one.

Tom and I date back to the old days in Beirut during their vicious civil war in the early eighties, when working as a journalist meant not knowing if you would wake up the next morning.

He worked for the old United Press International, and I for the still prospering Economist.

Our mutual friend, the Associated Press?s Terry Anderson, the best man at my wedding, was kidnapped out of his apartment and held hostage by Shiite Hezbollah militants for five years, an ordeal he described in chilling detail in his book, Den of Lions.

Tom popularized the concepts of globalization and a flat world in a series of groundbreaking, best selling books, including The Lexus and the Olive Tree, Hot, Flat, and Crowded, and That Used To Be Us.

To read my previous interview with Tom Friedman, please click here.?

Two Old Warhorses

"In a connected world, the worst thing you can do is disconnect,? said Tom Friedman, a columnist for the New York Times.

Global Market Comments

August 3, 2016

Fiat Lux

Featured Trade:

(WHY GLOBALIZATION WORKS)

Global Market Comments

August 2, 2016

Fiat Lux

Featured Trade:

(AUGUST 3rd GLOBAL STRATEGY WEBINAR),

(ARE STOCKS NOW THE NEW BONDS?),

(SPY), (T), (SPG), (DUK), (TLT), (FXY), (GLD),

(HANGING OUT WITH THE WOZ),

(AAPL)

SPY SPDR S&P 500 ETF

T AT&T, Inc.

SPG Simon Property Group Inc.

DUK Duke Energy Corporation

TLT iShares 20+ Year Treasury Bond

FXY CurrencyShares Japanese Yen ETF

GLD SPDR Gold Shares

The Q2 GDP figure of 1.2% released by the Department of Commerce on Friday couldn?t have been more dismal.

What?s worse, Q1 GDP was revised down from 1.1% to a mere 0.8%.

In fact, these are only the latest in a series of subpar numbers stretching back a year that suggest the American economy is on the edge of falling into a recession.

That is, if the numbers are to be believed.

All asset classes behaved in a classic ?RISK OFF? fashion, as expected.

US Treasury bonds (TLT) brought in a banner day, gaining $1.17. Gold (GLD) tacked on $12. The Japanese yen (FXY) rocketed to ?102.18.

All asset classes, that is, except for one: Stocks.

The S&P 500 printed another new all time high of $217.54 intraday.

So are stocks now the new ?RISK OFF? asset class? Are equities really the new bonds?

Looking at stock sector performance, one would be forgiven for reaching such an iconoclastic and out of consensus conclusion.

High dividend yielders overwhelmingly dominated the scene.

Duke Energy (DUK) (4.0% yield) popped. AT&T (T) (4.40% yield) soared. Simon Property Group (SPG) (2.93% yield) continued on a tear.

What do all of these companies have in common? They are all decent quality credits that sport dividend yields a MULTIPLE of the current ten-year Treasury bond yield of 1.45%.

I hate to state the obvious, but if it looks like a duck, and quacks like a duck, it?s a bond.

Traveling around the world listening to guests at my Mad Hedge Fund Trader Global Strategy Luncheons, one concern rises above all others.

They want yield, income, and cash flow. The question is even more urgent in Europe and Japan, which suffer negative interest rates.

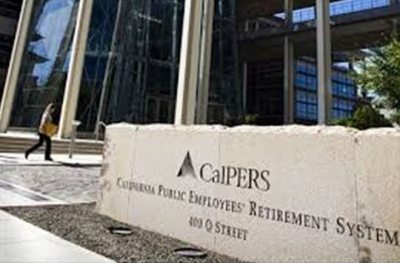

Even CaLPERS, the state of California?s public employee retirement system, is focused on the issue with a laser like intensity.

In 2015 the giant institution earned a scant 0.50% return on its sizeable $300 billion in assets, dragging its 20-year return down to 7%. The bad news is that CaLPERS has to earn at least 7.5% to meet all of its commitments.

Unless the agency can boost its investment performance, cuts in pension fund payouts are looming. Good luck pulling that off in this environment. Dozens of other states, like New York and Illinois, are in a similar fix.

There is another matter to consider here. The GDP data could be wrong, and wildly so.

I have argued for years that government data collection is unable to keep up with the hyper evolving American economy. The problem is getting worse.

There is no way that the economy of the San Francisco Bay Area is growing at a 1.2% annual rate. Some 5%-6% is more likely. And there are many other parts of the country that are doing well.

The Feds are missing large parts of US business activity because they aren?t aware that it exists. The methods of the green eyeshades are deeply lagging new technology.

And they certainly can?t measure the growing number of online services that are being given away FOR FREE.

So what if stocks really are now bonds?

That puts them on the deflationary bandwagon that has taken bond prices to new 60-year highs and yields to paltry lows. In other words, you can expect them to continue with bond like results.

What will stocks yielding an average 2.50% have to do to match the 1.45% ten-year Treasury yield?

THEY WILL HAVE TO RISE ANOTHER 72%!

Just thought you?d like to know.

CALPERS is Looking for Yield

I first spoke to Steve Wozniak via HAM radio when I was 12 and he was the 14-year-old president of the Homestead High School Radio Club in Cupertino, California.

With seven children, my dad was pretty stingy with allowance money. But when it came to electronic parts, I had an unlimited budget, as that is where he saw the future.

So while other kids collected baseball cards, I stocked up on tubes, resistors, capacitors, and rheostats. This was back when you could buy WWII surplus parts from Radio Shack for pennies a pound.

Then the transistor came out, and building projects, like simple computers programmed with basic '1's' and '0's' suddenly became possible.

By junior high school, I had gained my radio license, learning Morse code at the required five words per minute, and a path opened that eventually led me to Woz.

Whenever I had a design problem, Woz always had a solution. He seemed to know everything about electronics.

I planned to attend De Anza College in the San Francisco Bay Area to collaborate with Woz, but then the State of California dropped a big fat scholarship to the University of Southern California in my lap, and we parted ways.

That?s government for you. The state thought I was smarter than Woz. Ha!

The last thing he taught me was this really cool way to make long distance phone calls for free with something called a 'blue box.'

I later heard that Woz went to work for some kind of fruit company designing computers, which sounded stupid to me at the time, but Woz was always a guy who marched to a different drummer.

A decade later, I was an ambitious young vice president at Morgan Stanley, and ran into Woz again while escorting Steve Jobs around to big institutional investors hawking an Apple (AAPL) secondary share offering.

By then he had gained a lot of weight. He fascinated me with stories about how he had gone from scrounging around for a bootleg $12 chip, to making $100 million on the Apple IPO in just three years.

The phrase ?only in America? has to come to mind.

We bought our planes at the same time, me a Cessna 340 twin, and he a Beechcraft Bonanza. When I heard he totaled his in a crash in Santa Cruz a few years later, I sent flowers to his hospital room, even though he was in a coma and wasn't expected to live.

In later years we moved into the same philanthropic circles at the San Francisco Ballet, the Computer Museum, and local art museums. To me, Woz always stood out at the social events as the only one who was not an inveterate social climber.

That was vintage Woz. He just didn't care.

When I finally stumbled across his autobiography, iWoz, I grabbed it and devoured the pages in a couple of days.

The tome filled in the holes about what I knew about the man: the wives, the rock concerts, his universal remote control idea, and the early days at Apple.

You also learn a lot about electronics and basic computer hardware and software design.

While there are a lot of 5th grade science teachers who wish they were billionaires, there is only one billionaire who aspired to teach 5th grade science. That is what Woz did for ten years.

Despite the billions, Steve is still an all right guy. To buy the book of his engaging and entertaining story from Amazon, please click here.

Global Market Comments

August 1, 2016

Fiat Lux

Featured Trade:

(AUGUST 3 GLOBAL STRATEGY WEBINAR),

(JOIN THE MAD OPTIONS TRADER FREE PRODUCT LAUNCH),

(TESTIMONIAL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.