"In a connected world, the worst thing you can do is disconnect,? said Tom Friedman, a columnist for the New York Times.

"In a connected world, the worst thing you can do is disconnect,? said Tom Friedman, a columnist for the New York Times.

Global Market Comments

August 3, 2016

Fiat Lux

Featured Trade:

(WHY GLOBALIZATION WORKS)

Global Market Comments

August 2, 2016

Fiat Lux

Featured Trade:

(AUGUST 3rd GLOBAL STRATEGY WEBINAR),

(ARE STOCKS NOW THE NEW BONDS?),

(SPY), (T), (SPG), (DUK), (TLT), (FXY), (GLD),

(HANGING OUT WITH THE WOZ),

(AAPL)

SPY SPDR S&P 500 ETF

T AT&T, Inc.

SPG Simon Property Group Inc.

DUK Duke Energy Corporation

TLT iShares 20+ Year Treasury Bond

FXY CurrencyShares Japanese Yen ETF

GLD SPDR Gold Shares

The Q2 GDP figure of 1.2% released by the Department of Commerce on Friday couldn?t have been more dismal.

What?s worse, Q1 GDP was revised down from 1.1% to a mere 0.8%.

In fact, these are only the latest in a series of subpar numbers stretching back a year that suggest the American economy is on the edge of falling into a recession.

That is, if the numbers are to be believed.

All asset classes behaved in a classic ?RISK OFF? fashion, as expected.

US Treasury bonds (TLT) brought in a banner day, gaining $1.17. Gold (GLD) tacked on $12. The Japanese yen (FXY) rocketed to ?102.18.

All asset classes, that is, except for one: Stocks.

The S&P 500 printed another new all time high of $217.54 intraday.

So are stocks now the new ?RISK OFF? asset class? Are equities really the new bonds?

Looking at stock sector performance, one would be forgiven for reaching such an iconoclastic and out of consensus conclusion.

High dividend yielders overwhelmingly dominated the scene.

Duke Energy (DUK) (4.0% yield) popped. AT&T (T) (4.40% yield) soared. Simon Property Group (SPG) (2.93% yield) continued on a tear.

What do all of these companies have in common? They are all decent quality credits that sport dividend yields a MULTIPLE of the current ten-year Treasury bond yield of 1.45%.

I hate to state the obvious, but if it looks like a duck, and quacks like a duck, it?s a bond.

Traveling around the world listening to guests at my Mad Hedge Fund Trader Global Strategy Luncheons, one concern rises above all others.

They want yield, income, and cash flow. The question is even more urgent in Europe and Japan, which suffer negative interest rates.

Even CaLPERS, the state of California?s public employee retirement system, is focused on the issue with a laser like intensity.

In 2015 the giant institution earned a scant 0.50% return on its sizeable $300 billion in assets, dragging its 20-year return down to 7%. The bad news is that CaLPERS has to earn at least 7.5% to meet all of its commitments.

Unless the agency can boost its investment performance, cuts in pension fund payouts are looming. Good luck pulling that off in this environment. Dozens of other states, like New York and Illinois, are in a similar fix.

There is another matter to consider here. The GDP data could be wrong, and wildly so.

I have argued for years that government data collection is unable to keep up with the hyper evolving American economy. The problem is getting worse.

There is no way that the economy of the San Francisco Bay Area is growing at a 1.2% annual rate. Some 5%-6% is more likely. And there are many other parts of the country that are doing well.

The Feds are missing large parts of US business activity because they aren?t aware that it exists. The methods of the green eyeshades are deeply lagging new technology.

And they certainly can?t measure the growing number of online services that are being given away FOR FREE.

So what if stocks really are now bonds?

That puts them on the deflationary bandwagon that has taken bond prices to new 60-year highs and yields to paltry lows. In other words, you can expect them to continue with bond like results.

What will stocks yielding an average 2.50% have to do to match the 1.45% ten-year Treasury yield?

THEY WILL HAVE TO RISE ANOTHER 72%!

Just thought you?d like to know.

I first spoke to Steve Wozniak via HAM radio when I was 12 and he was the 14-year-old president of the Homestead High School Radio Club in Cupertino, California.

With seven children, my dad was pretty stingy with allowance money. But when it came to electronic parts, I had an unlimited budget, as that is where he saw the future.

So while other kids collected baseball cards, I stocked up on tubes, resistors, capacitors, and rheostats. This was back when you could buy WWII surplus parts from Radio Shack for pennies a pound.

Then the transistor came out, and building projects, like simple computers programmed with basic '1's' and '0's' suddenly became possible.

By junior high school, I had gained my radio license, learning Morse code at the required five words per minute, and a path opened that eventually led me to Woz.

Whenever I had a design problem, Woz always had a solution. He seemed to know everything about electronics.

I planned to attend De Anza College in the San Francisco Bay Area to collaborate with Woz, but then the State of California dropped a big fat scholarship to the University of Southern California in my lap, and we parted ways.

That?s government for you. The state thought I was smarter than Woz. Ha!

The last thing he taught me was this really cool way to make long distance phone calls for free with something called a 'blue box.'

I later heard that Woz went to work for some kind of fruit company designing computers, which sounded stupid to me at the time, but Woz was always a guy who marched to a different drummer.

A decade later, I was an ambitious young vice president at Morgan Stanley, and ran into Woz again while escorting Steve Jobs around to big institutional investors hawking an Apple (AAPL) secondary share offering.

By then he had gained a lot of weight. He fascinated me with stories about how he had gone from scrounging around for a bootleg $12 chip, to making $100 million on the Apple IPO in just three years.

The phrase ?only in America? has to come to mind.

We bought our planes at the same time, me a Cessna 340 twin, and he a Beechcraft Bonanza. When I heard he totaled his in a crash in Santa Cruz a few years later, I sent flowers to his hospital room, even though he was in a coma and wasn't expected to live.

In later years we moved into the same philanthropic circles at the San Francisco Ballet, the Computer Museum, and local art museums. To me, Woz always stood out at the social events as the only one who was not an inveterate social climber.

That was vintage Woz. He just didn't care.

When I finally stumbled across his autobiography, iWoz, I grabbed it and devoured the pages in a couple of days.

The tome filled in the holes about what I knew about the man: the wives, the rock concerts, his universal remote control idea, and the early days at Apple.

You also learn a lot about electronics and basic computer hardware and software design.

While there are a lot of 5th grade science teachers who wish they were billionaires, there is only one billionaire who aspired to teach 5th grade science. That is what Woz did for ten years.

Despite the billions, Steve is still an all right guy. To buy the book of his engaging and entertaining story from Amazon, please click here.

Global Market Comments

August 1, 2016

Fiat Lux

Featured Trade:

(AUGUST 3 GLOBAL STRATEGY WEBINAR),

(JOIN THE MAD OPTIONS TRADER FREE PRODUCT LAUNCH),

(TESTIMONIAL)

I am pleased to announce the launch of a major new service from the Mad Hedge Fund Trader, THE MAD OPTIONS TRADER.

The service will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times.

The trading will take place in the S&P 500 (SPX), major industry ETF?s like the Financials Select Sector (XLF), and large capitalized single names, such as Facebook (FB), JP Morgan Chase & Co. (JPM), and Apple (AAPL).

The service will be provided by my old friend and fellow comrade in arms, Matt Buckley, of Top Gun Options, one of the best performing trade mentoring outfits in the industry.

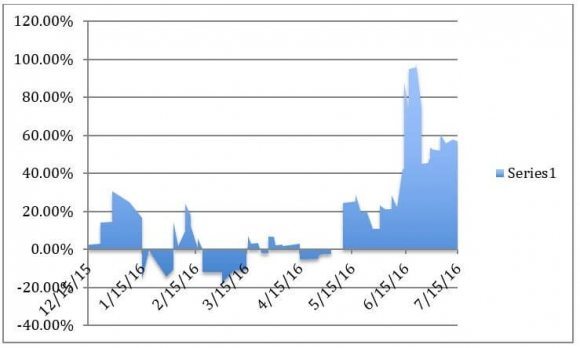

Matt knows what he is talking about. An independent audit shows that he has racked up an incredible 48.45% performance, net of commissions and fees, so far in 2016 which has been one of the most difficult years in trading history.

That works out to an average 6.92% a month, or an incredible 83.05% a year.

Matt, a native of New Jersey, joined the Navy straight out of college, and rose to become an F-18/A fighter pilot. He attended the famed Top Gun school in Coronado, California. During the second Iraq War, Matt flew 44 combat missions.

Matt left the service in 2006, and immediately entered the hedge fund industry. A rapid series of promotions eventually took him to Peak6 Investments, L.P., a prominent Chicago hedge fund.

There, he soaked up the most successful elements of technical market timing, fundamental name selection, risk control, and options trade execution.

These are the multiple skills that have enabled Matt to post such a blockbuster performance.

Matt, known to his friends by his old pilot handle of ?Whiz?, is an incredibly valuable addition to the Mad Hedge Fund Trader team. I have appointed him Head of Options Trading.

I have known for some time that fortunes were being made in the weekly options expirations, where stories of tenfold returns are not unheard of. It is a strategy that is perfectly suited to these highly volatile, uncertain times, with most options positions expiring within four days.

Matt allows us to fill that gap in our product offerings.

The Mad Options Trader provides essential support for the active trader, and will include:

1) Instant Trade Alerts sent out at key technical levels, an average of one a day. Alerts will be sent out on the opening and closing of every position.

2) Weekly Market Strategy Webinars held every Monday at 1:00 PM EST to give you a head?s up on the week ahead.

3) A weekly Live Trading Room held every Tuesday from 9:00 to 11:00 AM EST to give followers active real time trading experience.

What I love about Matt is that he eats his own cooking. Many of the Trade Alerts he recommends are executed in his own personal retirement account with real dollars.

To see how he has performed so far in 2016, please check out the daily chart below.

You will have an ample opportunity to measure The Mad Options Trader?s abilities starting August 1.

That?s when all current paid subscribers for any product of the Mad Hedge Fund Trader start receiving the service for FREE for 30 days.

From September 1, The Mad Options Trader will be available as a $1,500 per year upgrade to The Diary of the Mad Hedge Fund Trader or Global Trading Dispatch, the core research and trade mentoring service of the Mad Hedge Fund Trader.

The price for both services together will be $4,500 a year.

So, use this opportunity wisely, and watch how the Mad Options Trader performs over the coming month, FOR FREE.

Good Luck and Good Trading

John Thomas

Publisher and CEO of The Mad Hedge Fund Trader

Global Market Comments

July 29, 2016

Fiat Lux

Featured Trade:

(REPORT FROM THE MATTERHORN SUMMIT),

(TESTIMONIAL)

?

From where I stand, the rolling foothills of Northern Italy spread out below me to the south.

On my left lie the distinctive peaks of the Dolomite Alps. On my right I can see the massive expanse of Mont Blanc, at 15,781 feet the highest mountain in Europe.

I am standing at the summit of the Matterhorn. Knock another item off the bucket list.

I have been trying to climb this mountain for 45 years. During my early attempts I possessed the physical conditioning, but not the money to acquire the necessary equipment needed to get to the top.

An ice axe, crampons, helmet, and ropes don?t come cheap to a 16 year old.

In later years, vile weather frustrated my every attempt. Now the forecast was perfect, and the sun, the moon, and the stars aligned.

The Matterhorn has long been the premier climbing challenge on the continent. My doctor in Zermatt heads up many rescues and tells me that a dozen people a year die trying. The year 1999 was especially bad, claiming 39 lives.

Still, if death isn?t on the table, it?s not worth doing.

I spent a restless night sleeping under a heavy wool blanket in a shared bunk with a dozen other climbers at the 10,695 foot Hornli Hut. Get a group of guys like this together, and there is always one who snores.

At 3:00 AM we bolted out of bed to eat a hardy breakfast of eggs, cold cuts, and lots of strong coffee before launching an assault on the Mountain.

We then quietly filled canteens and donned climbing harnesses and backpacks. The night sky was crystal clear, an ocean of stars shimmering upon us, with the occasional shooting star giving it's blessing.

I had spent the past week acclimatizing myself to the high altitude, completing practice climbs to the top of increasingly difficult surrounding peaks. I was joined by my Swiss guide, Christian, of the Zermatt Alpine Center.

In his mid forties, chocolate tanned, with thighs like tree stumps, he had already climbed the Matterhorn an impressive 77 times.

We took off at a rapid pace, passing most of the early starters. Zermatt guides are notorious for speed climbing, the theory being that the quicker they wore out their clients, the sooner they could go home.

I realized there was something far more responsible going on. Christian had to gain the confidence that I had enough energy reserves left for the descent, when 90% of all fatalities occur. At 11,800 feet he said ?Good,? and we roped up.

It was about this time that I started to wonder if I should really be here. Most of the climbers we were passing were in their twenties and a few in their thirties, old enough to be my grandchildren.

After all, I?m the silver haired gentleman people give their seat up to when riding the San Francisco BART. At 12,200 feet Christian ordered, ?Now we put on our crampons.?

From there on we silently pushed our way upward in the darkness, headlamps illuminating the way, methodically positioning our feet to make the leap to the next boulder above.

The mountain has been climbed for 151 years and many of the surfaces have been polished smooth by boots to the point of becoming dangerously slippery, especially when wet.

Much of the slope is frustratingly unstable. Half the rocks you reach for are loose. Stones sent flying by climbers above are a major risk, which is why we wear helmets.

By 5:00 AM we were at 12,700 feet and the sun started to rise. I took out my camera to take a picture, but fumbling with my climbing gloves, I dropped it. It smashed into a dozen pieces on a huge boulder and then skittered down into the great Matterhorn crevasse below.

I still had my iPhone to take pictures. But it's touch screen required me to take my glove off. With the temperature at 10 degrees below freezing, photos were not worth risking fingers to frostbite. So you?ll just have to read about it.

During the first half of the 19th century, the Matterhorn was the Holy Grail among climbers, and was considered impossible to conquer. Englishman, Edward Whymper, finally led a seven-man team to the top in 1865. He pioneered the same Hornli Ridge route that I was ascending today.

But on the way down a rope broke and four perished. One body was never found. Today, you can see the rope in a Zermatt museum, a crude manila affair, along with the clothes from another dead climber found months later.

Some 5,000 now attempt the climb every year, and about 500 make it to the summit. Ulrich Inderbinen made the top over 370 times and last climbed it when he was 90. I was able to shake his hand at a picture signing in Zermatt a couple of years before he died from old age at 103 (click here for his obituary).

At 13,000 feet we approached the Mosley slab, so named for an American who fell to his death here in 1879. Beyond beckoned the Solvay Hut, a tiny, precariously sited rescue from weather that suddenly turns bad.

Taking a break, I found, amazingly, that I still had cell phone reception. Should I send out a Trade Alert from 13,133 feet?

That was where I encountered my first zombie, a climber who grievously underestimated the mountain and had used up every ounce of energy to get this far. His guide was coaxing, shouting and cajoling him to climb down one rock at a time.

Looking at his dead eyes, you know it was going to be a tough and dangerous descent. I later heard that the poor fellow, Japanese, fell and broke his leg and had to be helicoptered off.

There were many more zombies to come.

Above Solvay, we encountered the ?fixed ropes,? which are actually steel cables bolted to the face to help traverse the steepest and most dangerous passages. Lose your grip here, and its 3,000 feet straight down.

This is where we ran into the traffic jam, with simultaneous ascending and descending climbers competing for the same handholds. One dummy actually abseiled down on top of me, nearly knocking me off of my grip. Here, falling climbers are a major danger.

At 300 feet below the summit I passed Sophie?s Ridge, so named for a young Italian woman who was turned back in the 1880?s because high winds were embarrassingly blowing her Victorian ankle length dress above he waist. Now, altitude sickness was taking its toll, with many puking climbers turning back, the disappointment showing on their faces. Luckily, I felt fine.

Not far from there was the location of the original 1865 accident. We approached the small bronze statue of Saint Bernard, the patron saint of mountain climbers.

Bolted to the side of the peak, it was covered with ropes, as many teams tie on to it to rappel down.

Then we were on top. The weather was glorious. The summit was graced with a wrought iron cross that one finds atop many Alpine peaks. There was an impatient line of climbers waiting their turn to tag the summit, take some quick pictures, pick up a rock, and then start their way down.

The feeling of accomplishment was immense.

We carefully picked our way down, rappelling down the steepest faces. By now the sun was well up, the ice was melting, freeing up infinitely more loose rubble. One boulder the size of a small car crashed down 50 feet away, making a thunderous roar.

?Yikes,? I thought. ?We better get out of here.?

At 13,000 feet, we encountered a team with one climber absolutely paralyzed with fear and refusing to budge. After some discussion, I agreed to let her rope up with us and escort her down to the Hornli hut. The other guide was Christian?s friend and that would enable him to continue upward with his other clients. Our expedition turned into a mountain rescue.

Once Christian tied her in, I had second thoughts about being so charitable. If she fell, she could take me with her. Christian then convinced me he could hold both of us with a belay. We then encouraged her down the mountain one step at a time. I went through my entire repertoire of German jokes, which is rather short.

I learned

that she sold toilets on behalf of a Swiss plumbing company for a living, and that until today had never done anything more serious than a day hike out of Lausanne.

All of her equipment was brand new. Part of the problem was that she had failed to don her crampons, which we found in her backpack, untouched in it's original packaging.

Back at the Hornli Hut I was dog tired. Our impromptu guest suddenly fell to the ground and burst into tears. She then bought us both a celebratory liter of beer each. I was dying of thirst, as I had done the entire climb on just two quarts of water to save weight.

It had been the hardest day of my life and after 15 minutes at the table I couldn?t move. The $1,200 investment in Christian had been well spent. He departed for Zermatt to pick up his next client.

I elected to spend a second night at Hornli and complete the 3,000 foot hike down to Schwarzee the next day. From there I was taking the gondola down. Nothing left to prove here. The second time, I slept like a rock.

It is traditional for successful climbers to pick up a stone at the summit and deposit it on a giant cairn at the beginning of the trail at 7,000 feet. Some of these weigh over 50 pounds, a macho display of strength and endurance. When I made my contribution, a small pebble the size of a quarter, I made sure no one was looking.

I now have an empty place on my bucket list. What will replace it? I hear that Africa?s 19,341 foot Mount Kilamanjaro is pretty easy.

Life is good.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.