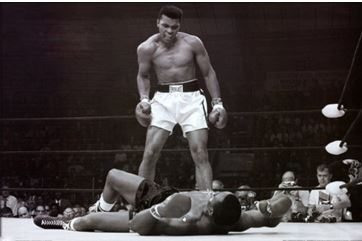

?A part of me slipped away?, said former heavyweight boxing champion, George Foreman, when he heard of the death of Muhammad Ali.

Global Market Comments

June 6, 2016

Fiat Lux

Featured Trade:

(JULY 27 BASEL, SWITZERLAND GLOBAL STRATEGY LUNCHEON),

(WHAT?S ON YOUR PLATE FOR THIS WEEK),

(WHY THE ?UNDERGROUND? ECONOMY IS GROWING),

Economic analysts were sent reeling in the wake of the May nonfarm payroll report released Friday, which showed only a feeble 38,000 in job gains.

It appears that the Great American Job Creating Engine has suddenly ground to a halt.

You know that big Fed rate rise that was coming in 9 days because the economy was so strong? You can kiss that baby goodbye, write it off, and confine it to the dustbin of history.

Personally, I never believed that rates were going to rise. I have been in the December camp all along, if ever.

What really sent researchers scurrying for their pocket calculators was the fact that the headline unemployment rate fell to a decade low of 4.7%. This occurred because 458,000 dropped out of the labor force.

Is this the beginning of a revival of productivity, or the start of the next Great Recession?

Assets classes behaved as you would expect. Stocks cratered 150 points, with interest rate plays, like the banks, taking the biggest hit. So did oil. Gold and bonds soared. The US dollar collapsed.

The payroll numbers got uglier the closer you looked at them.

Temporary help fell by -21,000, manufacturing by -18,000, construction by -10,000, and mining by -10,000. The gains were in health care, +40,000, food services, +22,000, and professional services, +10,000.

The long term U-6 unemployment rate stabilized at 9.7%.

I have been saying for weeks now that buying stocks at the top of a two-year range would only bring tears. The tears have arrived by the bucket full.

As for the coming week, you really have the ask the question, ?Other than that Mrs. Lincoln, how was the play??

The impact of the disastrous Department of Labor report far overshadows anything that will come out over the next five days.

Janet Yellen will be speaking again on Monday afternoon in Philadelphia, and no doubt will say absolutely nothing.

The JOLTS report on job openings this Wednesday at 10:00 AM EST will get more scrutiny than usual, as it will shed more light on the jobs situation. However, this is a one-month lagging indicator, so it will probably still show strength.

The US Energy Information Administration oil inventory number at 10:30 will continue to be a subject of great interest, giving a hint as to the health of the global economy.

We will get weekly Jobless Claims at 8:30 EST on Thursday, as usual. The Baker Hughes Rig Count then comes on Friday at 1:00 PM EST. With oil now at $48, look for hints of stabilization at the current 312 level (down from 1,600 in two years!).

Followers of the Mad Hedge Fund Trader trade alert service did alright this week. We took profits on our long Treasury position (TLT) and our short stock position (SPY).

I went into the May nonfarm payroll report with 90% cash because of the increasing randomness of the government report.

Unfortunately, the profit in the 10% weighting in the Japanese yen (FXY) vaporized overnight on the gap move down in the dollar.

However, I am going to hang on to my short position, as the beleaguered Japanese currency has risen 5% in four days. Moves like that in the currency market are as rare as hen?s teeth.

I assure you, the world hasn?t suddenly fallen in love with investment in Japan. If anything, economic conditions are worsening by the day, so the yen ?will fail again.

That said, if the (FXY) maintains a sustained close over the old high of $91.30, I am out of there. Iron discipline regarding stops is the only thing that will keep you alive in this kind of trading market.

This brought our final May return to an enviable 4.38%, and our average annualized return to 35.33%. The cream is still rising to the top.

What ever happens this week, don?t waste your time bothering. It?s still all about the June 14 Fed meeting.

You might as well hang out at the beach this week, save your powder for a better trading environment, and work on your tan.

In this environment, cash is king.

Better to Work on Your Tan in This Market

There is no doubt that the ?underground? economy is growing.

No, I?m not talking about violent crime, drug dealing, or prostitution. Those are largely driven by demographics, which right now, are at a low ebb.

I?m referring to the portion of the economy that the government can?t see, and therefore is not counted in its daily data releases.

This is a big problem.

Most investors rely on economic data to dictate their trading strategies. When the data is strong, they aggressively buy stocks, assuming that a healthy economy will boost corporate profits.

When data is weak, we get the flip side, and investors bail on equities. They also sell commodities, precious metals, oil, and plow their spare cash into the bond market.

We are now more than half way through a decade that has delivered unrelentingly low annual GDP growth, around the 2%-2.5% level.

We all know the reasons. Retiring baby boomers, some 85 million of them, are a huge drag on the system, as they save, and don?t spend.

Generation X-ers do spend, but there are only 65 million of them. And many Millennials are still living in their parents? basements - broke and unable to land paying jobs in this ultra cost conscious world.

But what if these numbers were wrong? What if the Feds were missing a big part of the picture?

I believe this is in fact what is happening.

I think the economy is now evolving so fast, thanks to the simultaneous hyper acceleration of multiple new technologies, that the government is unable to keep up.

Further complicating matters is the fact that many new internet services are FREE, and therefore are invisible to government statisticians.

They are, in effect, reading from a playbook that is a decade or more old.

What if the economy was really growing at a 3-4% pace, but we just didn?t know it.

I?ll give you a good example.

The government?s Consumer Price Index is a basket of hundreds of different prices for the things we buy. But the Index rarely changes, while we do.

The figure the Index uses for Internet connections hasn?t changed in ten years.

Gee, do you think that the price of broadband has risen in a decade, with the 1,000-fold increase in speeds?

In the early 2,000?s you could barely watch a snippet of video on YouTube without your computer freezing up. Now, I can download a two-hour movie in High Definition in just two minutes on my Comcast 250 megabyte per second business line.

And many people now watch movies on their iPhones. I see them in the rush hour traffic.

I?ll give you another example of the burgeoning black economy: Me.

My business shows up nowhere in the government economic data because it is entirely online. No bricks and mortar here!

Yet, I employ a dozen people, provide services to thousands of individuals, institutions, and governments in 140 countries, and take in millions of dollars in revenues in the process.

I pay a lot of American taxes too.

How many more me's are out there? I would bet millions.

If the government were understating the strength of the economy, what would the stock market look like?

It would keep going up every year like clockwork, as ever-rising profits feed into stronger share prices.

But multiples would never get very high (now at 19 times earnings) because no one believed in the rally, since the economic data was so weak.

That would leave them constantly underweight equities in a bull market.

Stocks would miraculously and eternally climb a wall of worry. Did I mention that the S$P 500 is 2% short of an all time high?

?

On the other hand, bonds would remain strong as well, and interest rates low, because so many individuals and corporations were plowing excess, unexpected profits into fixed income securities. Structural deflation would also give them a big tailwind.

If any of this sounds familiar, please raise your hand.

I have been analyzing economic data for a half century, so I am used to government statistics being incorrect.

It was a particular problem in emerging economies, like Japan and China, which were just getting a handle on what comprised their economies for the first time.

But to make this claim about the United States government, that has been counting things for 225 years, is a bit like saying the emperor has no clothes.

Sure, there has always been a lag between the government numbers and reality. In the old days they used horses to collect data, and during the Great Depression numbers were kept on 3? X 5? index cards filled out with fountain pens.

But today, the disconnect is greater than it ever has been, by a large margin, thanks to technology.

Is this unbelievable? Yes, but you better get used to it.

As for that bull market in stocks, it just might keep on going.

There May Be More Here Than Meets the Eye

There May Be More Here Than Meets the Eye

Global Market Comments

June 3, 2016

Fiat Lux

Featured Trade:

(JUNE 29 DUBLIN, IRELAND GLOBAL STRATEGY LUNCHEON),

(WHY WE DO PUT SPREADS),

(ALL I WANT TO DO IS RETIRE),

(THE TWELVE DAY YEAR)

Yesterday morning, I used the opening dip to come out of the SPY June, 2016 $212-$217 in-the-money vertical bear put spread at cost. This is being prompted by OPEC?s failure to reach a production ceiling once again.

The timing was fortuitous. An hour later, favorable inventory numbers delivered a 3% spike in Texas tea, dragging the stock market up along with it.

This allowed me to de-risk ahead of major market moving events:? the release of the May nonfarm payroll at 8:30 EST on Friday June 3, and the June 14 Fed interest rate decision.

This year, it?s all about risk control. Ignore it at you peril.

We had a nice profit in this position a week ago, before the dramatic short covering rally ensued.

Again, the hard earned lesson is to take the small profits as long as we are living in a 5% trading range. Pigs are getting slaughtered by the pen full.

This year, it seems like every market move is intended to cause maximum damage to hedge funds, regardless of the logic. From here, that means stocks could go up just enough to trigger another wave of stop loss buying, and then fail again.

A summer swoon is still in the cards, especially if the Fed raises rates in June.

Humans would be mad to buy stocks up here at the top of a two-year trading range, but machines don?t care. That is giving us our added upside volatility.

Either way, I?d rather watch from the sidelines for free. The algorithms will take advantage of the poor summer liquidity to whipsaw prices as much as they can, capturing as many pennies as possible.

If we do get an extreme move worth fading, I?ll re enter the trade. If not, then I?ll stay in cash awaiting another soft pitch.

A good rule of thumb in 2016 is to wait an extra day before strapping on a new position. Prices move more than you expect, even though it is not reflected in the Volatility Index (VIX).

The small profit we eked out of the SPY June, 2016 $212-$217 in-the-money vertical bear put spread offers a perfect illustration of why we execute put spreads.

We got the market and the timing wrong; yet,we still got out whole and lived to fight another day. When we executed this short position, the (SPY) was at $206.58.

Some 13 trading days later, the (SPY) rose 1.56% to $209.80, yet our put spread rose in value from $2.51 to $$2.55, making us $96. Some emails I received from followers indicated that they got executed as high as $2.61! All the money was made in time decay.

I love strategies that make money when you?re wrong!

The SPY June, 2016 $212-$217 in-the-money vertical bear put spread was a bet that the (SPY) would fall, move sideways, or rise modestly into the June 17 expiration. That?s exactly what we got.

Because this is a hedged option position, the minute-to minute price movement is small enough to enable readers to get in and out even accounting for transmission delays posed by the internet. You don?t need to live your life in front of a screen grasping for pennies.

You also have clearly defined risk. You can?t lose any more money than you put in. And if Armageddon hits, time value assures that you can always recover much of your investment.

I?m starting to wonder if the June 14 Fed meeting will be the last bout of volatility in the market that we see for a while. The doldrums are here for the summer, and the attractive trades in any asset class are few and far between.

I have always believed that if you don?t have a sense of humor, then you better get the hell out of this business. Below is a link to a YouTube video entitled ?All I Want to do is Retire? which covers the decline of the brokerage industry over the last 20 years.

The video is currently going viral, with 94,000 views so far, and was sent to me by a subscriber. Watch this during your next coffee break. The run time is five minutes. Sometimes the truth can be hard to swallow. Click here to view.

I have reported in the past on the value of the Friday-Monday effect, whereby the bulk of the year's performance can be had through buying the Friday close in the stock market and then selling the Monday close (click here for ?The Friday-Monday Effect Exposed?).

Well, I have discovered a further distillation of this phenomenon. During 2010, the S&P 500 rose by 143 points. Some 134 points of this was racked up on the first trading day of each month, some 12 days in total. That is 94% of the entire return for the year.

I can see where this is coming from. Many pension and mutual funds are completely devoid of any real trading expertise. So they rely on a 'dumb' dollar cost averaging models to commit funds. In a rising market, like we had for most of last year, this produces an ever rising average cost.

More than a few hedge funds have figured this out, front run these executions at the expense of the investors of the other institutions. And you wonder why the public has become so disenchanted with their financial advisors.

The possibilities boggle the mind. Imagine strolling into the office on the last trading day of each month and committing your entire capital line. You then spend the night hoping that a giant asteroid doesn't destroy the earth.

You return to your desk at the next day's close, unload everything, and take off on a 30-day vacation. Every month, you come back for a reprise. At the end of the year you top the performance leagues, and retire richer than Croesus.

It sounds like a nice 12 day work year to me!

Is It Time to Trade Yet?

Is It Time to Trade Yet?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.