Global Market Comments

January 17, 2025

Fiat Lux

Featured Trades:

(JANUARY 15 BIWEEKLY STRATEGY WEBINAR Q&A),

(GS), (MS), (JPM), (C), (BAC), (TSLA), (HOOD), (COIN), (NVDA), (MUB), (TLT), (JPM), (HD), (LOW), FXI)

Global Market Comments

January 17, 2025

Fiat Lux

Featured Trades:

(JANUARY 15 BIWEEKLY STRATEGY WEBINAR Q&A),

(GS), (MS), (JPM), (C), (BAC), (TSLA), (HOOD), (COIN), (NVDA), (MUB), (TLT), (JPM), (HD), (LOW), FXI)

Below please find subscribers’ Q&A for the January 15 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Sarasota, Florida.

Q: What would I recommend right now for my top five stocks?

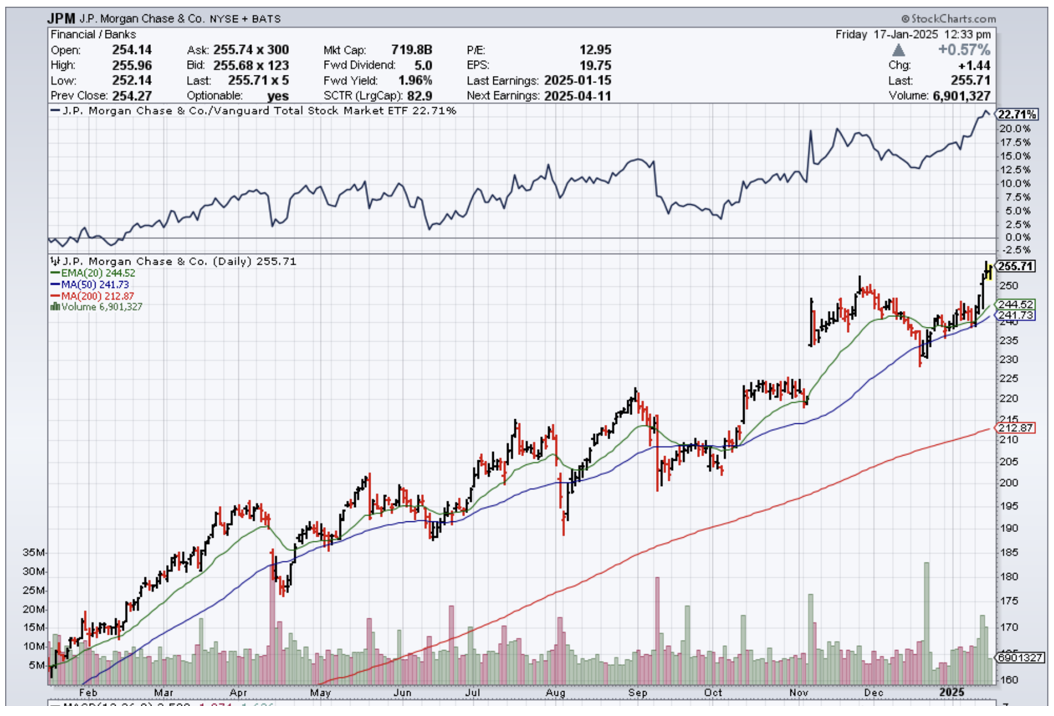

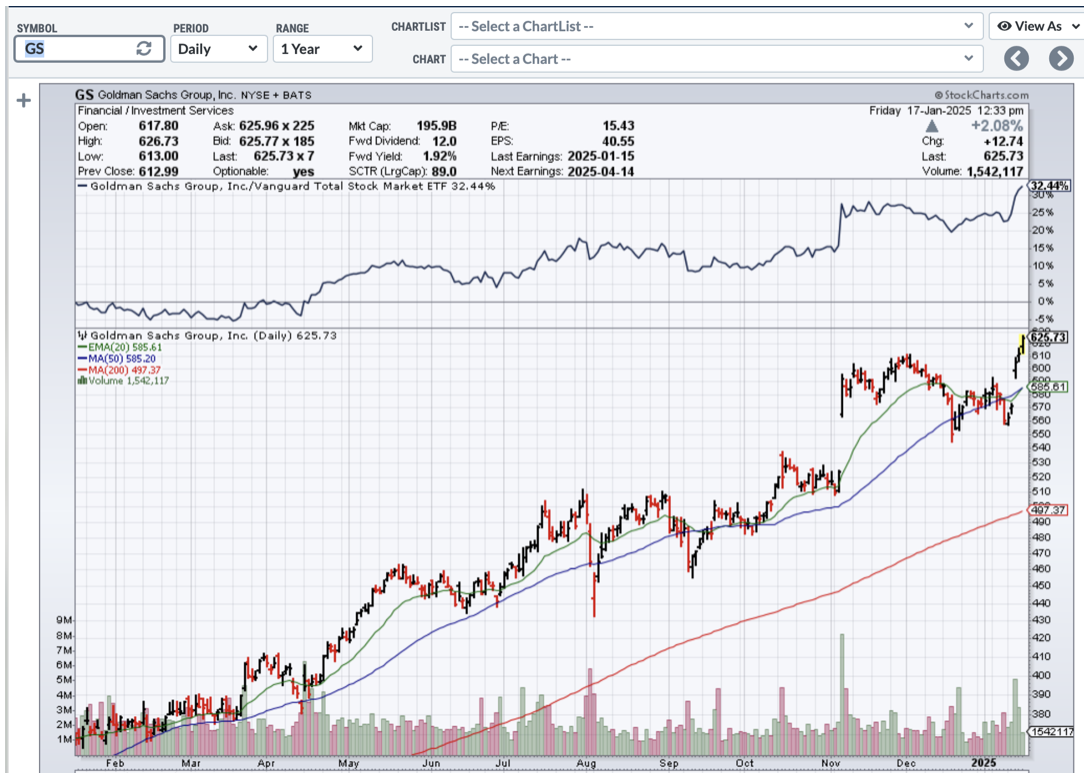

A: That’s easy. Goldman Sachs (GS), Morgan Stanley (MS), JP Morgan (JPM), Citibank (C), and Bank of America (BAC). There's five right there—the top five financials that are coming out of a decade-long undervaluation. A lot of the regional banks, which are also viable, are still trading to discount the book value, which all the financials used to trade out only a couple of years ago. Of course, JP Morgan's reaching a two-year return of around double, but the news just keeps getting better and better, so buy the dips. Buy every sell-off in financials and you will be a happy camper for the year.

Q: What do you think about Robin Hood (HOOD)?

A: Well, the trouble with Robinhood is it’s very highly dependent on crypto volumes. If you think crypto is going to go higher and volumes will increase, this is a great play. However, you get another 95%, out-of-the-blue selloff in crypto like we had three years ago and Coinbase (COIN) will follow it right back down again. On the last downturn, there were concerns that Coinbase would go under, so if you can hack the volatility, take a shot, but not with my money. I have the largest banks in the country that are about to double again; I would much rather be buying LEAPS in that area and getting anywhere from 100% to 1000% percent returns on a 2-year view—much more attractive risk-reward for me. And they pay a dividend.

Q: How do you define a 5% correction?

A: Well, if you have a $100 stock and it drops $5, that is a 5% correction.

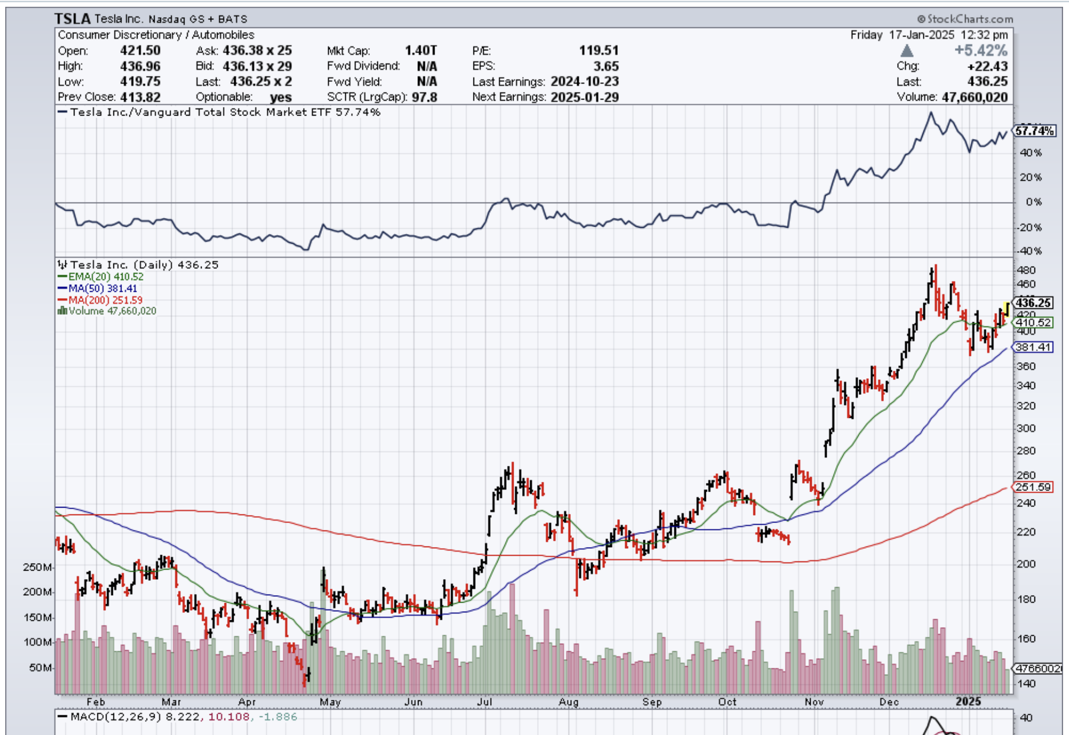

Q: Can you please explain what Tesla 2X leverage actually means and is it a way to trade Tesla as an alternative?

A: I steer people away from the 2Xs because the tracking error is really quite poor. You only get 1.5% of the upside, but 2.5 times the downside over time. These are more day trading vehicles. They take out huge fees, and huge dealing spreads—it's a very expensive way to trade. Far cheaper is just to buy Tesla (TSLA) stock on margin at 2 to 1, and there your tracking error is perfect, your fees are much lower, and you just have the margin interest rate to pay on the position, which is 6% a year or 50 basis points a month. No reason to make the ETF people richer than they already are. They keep coining these products—1x, 2x, 3x long shorts on every one of the high volume stocks, and it sucks a lot of people in, but it's higher risk, lower returns for the amount of money you're risking as far as I'm concerned. So that's the way to do it.

Q: What are your projections for Nvidia (NVDA)?

A: I think not just Nvidia, but all of the big tech is going to be kind of trading in a sideways range for a while, maybe 6 months, and then we get an upside breakout if you get the earnings breakout, which we are all expecting. AI is still in business, and still growing gangbusters. There are always a lot of Cassandra's out there saying that we're going to crash anytime, and I just don't see it. I know a lot of these people, I'm in touch with a lot of the companies, I see Beta releases of all products, the consumer products, and…the slowdown just ain't happening, I'm sorry. And I've been through a lot of these tech booms over the last 40 years, and this is only showing signs of just getting started.

Q: How come Tesla (TSLA) is up and down $30 every couple of days?

A: Number one, it is the most actively traded stock in the market right now. It has implied volatility on the options of 70%, which is really the highest in the market of any individual stock. That just creates immense amounts of trading by options traders, volatility traders, by call writing, and 2x and 3x ETF long and short players. All of the financial engineering and new products that we see all gravitate toward the high volume stocks like Nvidia, Tesla, and Apple because that's where the money is being made. Some days Tesla accounts for 25% of all the market trading. Financial engineers go where the action is, where the volume is, where the customer demand is.

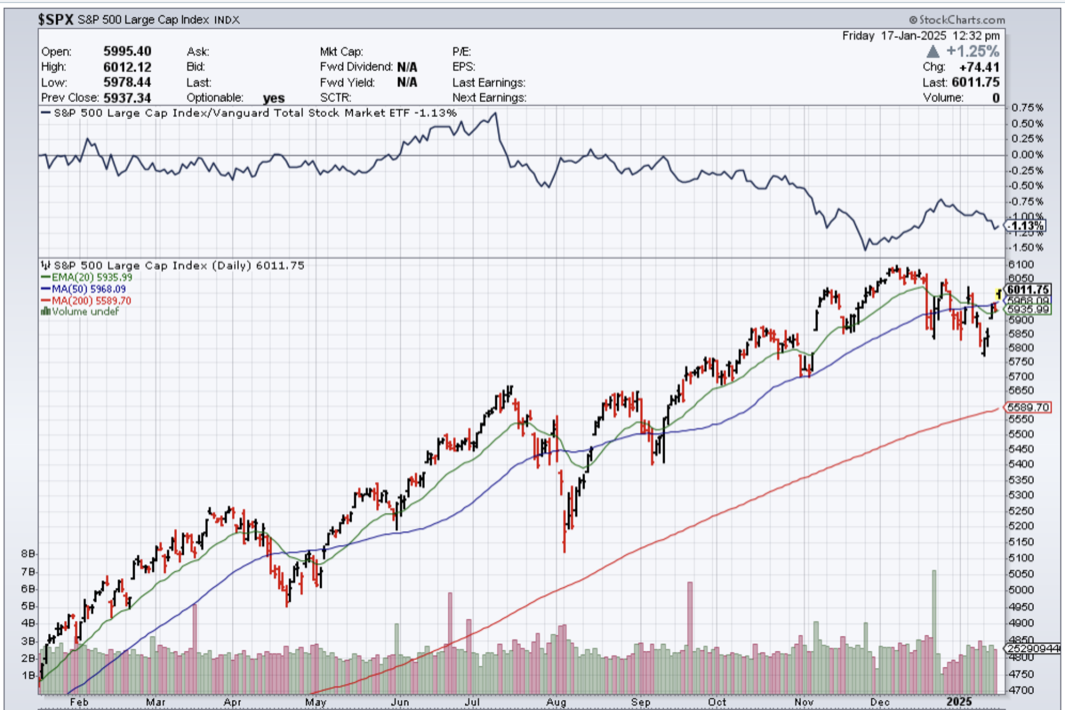

Q: Why do you expect only 5% to 10% corrections if the Fed rate cuts get completely priced out?

A: I don't expect the Fed to keep cutting interest rates. We should get another rate cut this year, and that may be it for the year. If inflation comes back (and of course, all of the new administration’s policies are highly inflationary) it’s just a question of how long it takes for it to hit the system.

Q: Do you believe I should hold all of my municipal bonds (MUB) with 10-year call protection at 4.75%?

A: On a tax-adjusted basis, I would say yes. You know, stock markets may peak and deliver a zero return, and in that situation, muni bonds are very attractive. The nice thing about bonds is that you hold on to maturity—you get 100% of your money back. With stocks, that is not always the case. Stocks you have to trade because the volatility can be tremendous. And in fact, what I do is I keep all of my money in one year Treasury bills. Last time I did this, which was in September, I locked in a one-year return for 5%.

Q: Would you prefer to buy deep in the money and put spreads on top of any rally?

A: Absolutely yes. If this is a real trading year, you not only buy the dips, you sell the rallies. We did almost no real selling last year. We really only did it in June and July because the market essentially went straight up, except for two hickeys. This could be the year of not only call sprints but put spreads as well. You just have to remember to sit down when the music stops playing.

Q: You say buy the dips; what would your dip be in JP Morgan (JPM)?

A: Well lower volatility stocks by definition have smaller drawdowns. JP Morgan (JPM) is one of those, so I'd be very happy to buy a 5% dip in JP Morgan. If it drops more, you double the position on a 10% pullback. Higher volatility stocks like Tesla—I'm really waiting for 10% or 20% corrections. You saw I just bought a 22% correction twice in Tesla with it down 110 points. One of those trades is at max profit right now and the other one has probably made half its money since yesterday. That is the game. The amount of dip you buy is directly related to the volatility of the stock.

Q: Should you let your cash go uninvested?

A: Yes, never let your cash go uninvested just sitting as cash. Your broker will take that money and put it in 90-day T-bills and keep the money for himself. So buy 90-day T-bills as a cash management tool—they're paying about 4.21% right now— and you can always use those as collateral under my positions on margin.

Q: Is Home Depot (HD) a buy on the LA reconstruction story?

A: I would say no, Los Angeles is probably no more than 5% of Home Depot's business—the same with Lowe's (LOW). A single city disaster is not enough to move the stock for more than a few days, and the fact is: Home Depot is mostly dependent on home renovation, which tends not to happen during dead real estate markets because, you know, it takes the flippers out of the market. It really needs lower interest rates to get Home Depot back up to new highs.

Q: Do you expect a big market move at the end of the day when the Fed makes its announcement?

A: The market has basically fully discounted the move on January 28, and if anything happens, there'll probably be a “sell on the news.” So, I expect we could give up a piece of the recent performance on the announcement of the Fed news.

Q: Should we expect trade alerts for LEAPS coming from you?

A: Absolutely, yes. However, LEAPS are something you really only want to do on down moves. If we don't get any, we'll just do the front-month call spreads. You can still make 10%, 20% a month just concentrating on financial call spreads.

Q: What would have happened to our accounts if we kept the (TLT) $82-$85 iShares 20+ Year Treasury Bond ETF (TLT) call spread and it went all the way down to $82?

A: The value of your investment goes to zero. Of course, it was declining at a very slow rate, and the $80: you might have gotten a bounce off the $85 level. But if the inflation number had come in hot, as had all other economic data of the last month, then you could have easily gotten a gap down to $82 and lost your entire investment, because two days is not enough time to expiration to recover that 3-point loss. And that's why I stopped out yesterday.

Q: Didn't David Tepper buy China (FXI)?

A: With both hands last September, yes he did. And my bet is he got out before he got killed. I mean, that's what hedge funds do. He probably got out close to cost, and you likely won't see him promoting China again anytime in the near future.

Q: I have June 530 puts on the S&P 500, should I get rid of them?

A: Yes, I don't see a big crash coming. You probably paid a lot going all the way out to June, and it's probably not worth hanging on to. Put spreads are the better way to go—that cuts your cost by two-thirds and those you only want to put on at market tops.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or JACQUIE'S POST, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

"Investing now is like taking a shower while Norman Bates is somewhere in your house," said Jim McTague, a journalist at Barron's.

Global Market Comments

January 16, 2025

Fiat Lux

Featured Trades:

(WHY TECHNICAL ANALYSIS IS A DISASTER)

(SPY), (QQQ), (IWM), (VIX)

(TESTIMONIAL)

At my Mad Hedge Miami Beach Luncheon, I heard an amazing piece of information from a guest.

Fidelity recently conducted a study to identify their best-performing clients.

They neatly fell into two groups: people who forgot they had an account at Fidelity and dead people.

It all underlines the futility of trading the markets without true professional guidance, something many aspire to but few actually accomplish.

Of the many thousands of online newsletters and trade mentoring services, I only know of three that actually make money for clients.

Those would be mine and two others, and I’m not talking about who the other two are.

It is an industry filled with professional marketers, charlatans, and conmen.

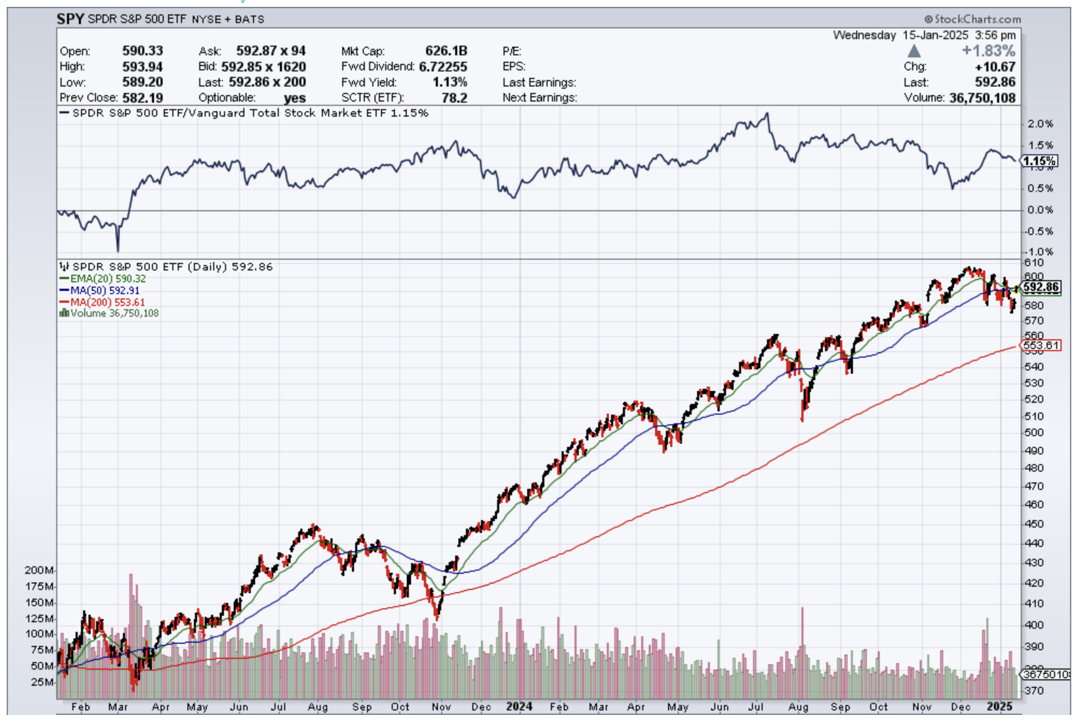

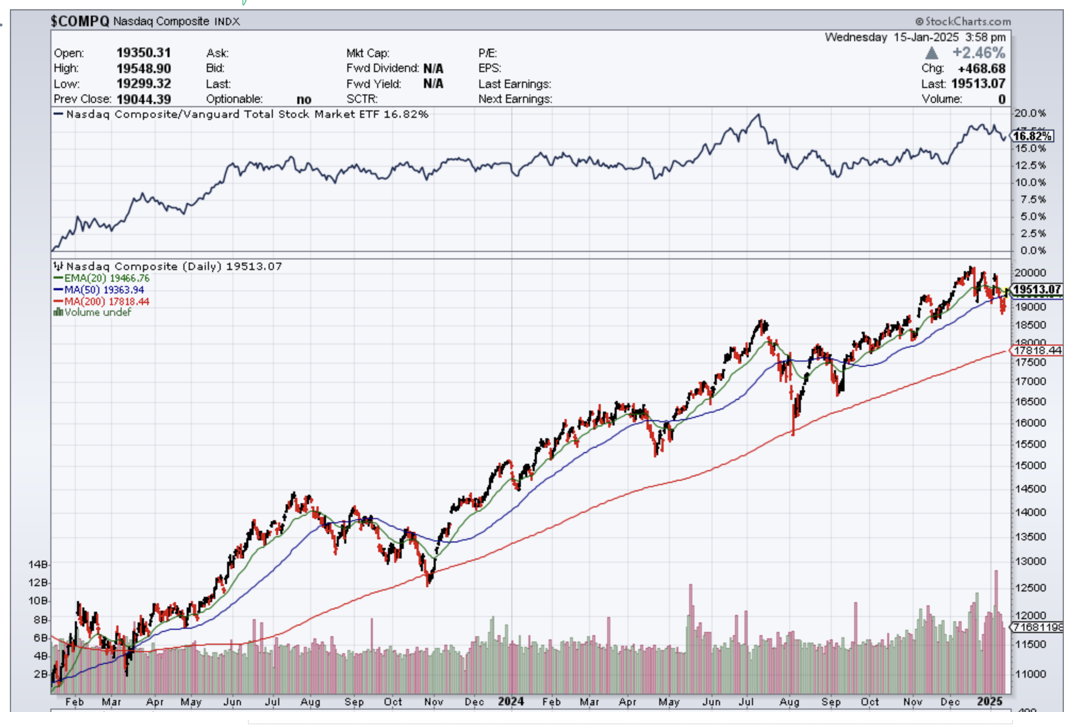

Let me point out a few harsh lessons learned from this most recent meltdown and the rip-your-face-off rally that followed.

The next five months are ones of historical seasonal market strength.

The big lesson learned this summer was the utter uselessness of technical analyses. Usually, these guys are right only 50% of the time. This year, they missed the boat entirely.

The biggest losers?

Algorithms, which used the decisive breakdown of the (SPY) in August to go heavily short.

If you did, you lost your shirt. The market just shed a couple more points, reversed, and then kept going, and going, and going.

This is why technical analysis is utterly useless as an investment strategy. How many hedge funds use a pure technical strategy and a stand-alone basis?

Absolutely none, as it doesn’t make any money.

At best, it is just one of 100 tools you need to trade the market effectively. The shorter the time frame, the more accurate it becomes.

On an intraday basis, technical analysis is actually quite useful.

Leave it for the kids.

This is why I advise portfolio managers and financial advisors to use technical analysis as a means of timing order executions, and nothing more.

Most professionals agree with me.

Technical analysis derives from humans’ preference for looking at pictures instead of engaging in abstract mental processes. A picture is worth 1,000 words, and probably a lot more.

This is why technical analysis appeals to so many young people entering the market for the first time.

Buy a book available for $5 on Amazon, and you can become a Master of the Universe.

Who can resist that?

The problem is that high-frequency traders also bought that same book from Amazon a long time ago and have designed algorithms to frustrate every move of the technical analyst.

Sorry to be the buzz kill, but that is my take on technical analysis.

I have a much better solution than forgetting you have a trading account, or dying.

Take Cunard’s round-the-world cruise.

I have been sailing with Cunard since the 1970s when the original Queen Elizabeth was still afloat.

I’ve lost count of how many Transatlantic voyages I have taken across the pond.

For a mere $16,669 you can spend 117 days circumnavigating the globe with Cunard from Southampton, England in their cheapest inside cabin (click here for the link.)

That includes all the food you can eat for four months.

On the way, you can visit such exotic destinations as Bora Bora, The Seychelles, Reunion, and Moorea.

Not a bad deal.

By the time you get home, you will probably earn enough in your investment account to pay for the entire trip.

Hope you enjoyed your cruise.

Correction? What Correction?

Global Market Comments

January 15, 2025

Fiat Lux

Featured Trades:

(FRIDAY, JANUARY 31, 2025, SALT LAKE CITY, UTAH STRATEGY LUNCHEON)

(IT’S TIME TO PULL OUT THOSE OLD INFLATION PLAYS OUT OF THE DRAWER),

(GLD), (SLV), (TIPS)

Come join me for the Mad Hedge Fund Trader’s Global Strategy Luncheon, which I will be conducting high in the western desert in Salt Lake City, Utah at the foot of the Rocky Mountains. The event begins at 12:00 noon on Friday, January 31, 2025.

A three-course meal will be provided and an open discussion on the crucial issues facing investors today will take place. The dress is business casual.

I’ll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, precious metals, energy, China, and real estate. And to keep you in suspense, I’ll be throwing a few surprises out there too. Tickets are available for $276.

I’ll be arriving early and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The event will be held in a private room at a downtown Salt Lake City restaurant, the details of which will be emailed directly to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for this luncheon, please click here.

Being an old do-it-yourself carpenter, I never throw anything away.

My garage is filled with ancient tools I bought 50 years ago and used only once.

Scraps of wood, odd lengths of wiring, and old coffee cans filled with loose nuts, screws, and nails are everywhere.

You KNOW that if you throw a tool out, you’ll desperately need it the next day.

The same is true of my investment approach. Nothing new ever happens in the financial market, plays that worked in past years just get endlessly recycled.

My inventory of ancient trading strategies includes instruments that were once incredibly profitable (Japanese equity warrant arbitrage?), but haven’t made money in decades.

So I was rooting around my trading toolbox the other day when I found just the ones I needed: inflation plays.

Some of the greatest trades of my half-century-long career in the trenches have been with inflation plays.

Of course, gold during the 1970s was the no-brainer after President Nixon took the US off the gold standard. I started buying in the barbarous relic in the mid-$30s and chased it all the way up to $900.

I made similar fortunes in that other great inflation hedge, residential real estate. Some of the properties I owned then in California have risen 100 times in value, thanks to inflation.

It was with those fond memories in mind that found myself looking for similar inflation plays to execute.

Let me stop right here.

The oldies are still the goodies.

In the next surge of inflation that the new administration is about to unleash, I expect gold to rise from today’s $2,703 an ounce to at least $5,000. After that, look out above!

Silver (SLV) should do double, eventually touching $100 an ounce from today’s $30.83.

Your home will also be a fantastic inflation hedge. Anything you own today should rise in value at least tenfold over the next 20 years.

However, in updating my research, I came across a few new wrinkles that are definitely worthy of your attention.

The big one is TIPS.

TIPS are US Treasury bonds that are indexed to inflation. If inflation rises, the value of your TIPS rises.

Specifically, TIPS are tied to the Consumer Price Index as calculated by the US Department of Labor Bureau of Labor Statistics.

Let me show you how they work.

Let’s say you bought $1,000 worth of TIPS with a 1% coupon. If the CPI comes in at zero, you will receive $10 that year in interest payments.

If the CPI rises 2%, your $1,000 in principal increases to $1,020. Your 1% coupon is then calculated off of this new, higher amount and jumps to $10.20, giving you a total return of $32.10.

Now here is the really fun part.

If the CPI rises to 15%, as it did in 1979, the value of your investment rises by 16.15% to $1,161.50.

Yes, I still have my bell bottoms from those days, although the waist is rather tight.

This explains why many high-net-worth individuals always have a few TIPS parked away in their portfolios, usually stuck in a folder behind the radiator.

TIPS are issued by the U.S. Treasury at recurring auctions as part of the government’s overall funding program.

Currently, the Treasury conducts monthly TIPS auctions: three per year for five-year TIPS, six for 10-year TIPS, and three for 30-year TIPS.

You can buy TIPS directly from the US government and bypass hefty third-party management and brokerage fees.

However, the semi-annual inflation adjustments of a TIPS bond are treated as taxable income by the IRS, even though investors won’t see that money until they sell the bond or it matures.

So it may be wise to buy your TIPS via a mutual fund or ETF or to only hold them in a tax-exempt IRA, 401k, or deferred benefit plan.

TIPS also have the additional benefit in that, like municipal bonds, they are exempt from state and local taxes.

Well-heeled residents of highly taxed California, New York, and Illinois absolutely love them.

Like many government programs, TIPS was first created in 1997 for a problem that didn’t exist: inflation. That year the CPI was only 1.7%.

The highest CPI since then was 3.4% in 2000, the year of the dotcom bubble top. For most of 2016, it hung around 1.6%.

Since the first issuance of tips, the US economy has been steadily battered by something no one predicted: deflation.

Thanks to the onslaughts of hyper-accelerating technology, flat wage growth, and global competition, prices worldwide have been heading ever lower.

For more than two decades, investors in TIPS were shortchanged. They accepted lower yields in return for protection against something that never happened. It was the fire insurance without the fire.

That is, no fire until January this year, when we saw an actual spark.

The CPI for that month came in at 0.6%, which works out to 2.5% annualized, the fastest pace of price appreciation in four years.

The TIPS explanation I have given you so far is the simple one. It gets much more complicated.

Seasoned bond pros have figured out ways to game this market six ways from Sunday using an array of sophisticated algorithms.

This enables them to add “alpha” by outperforming generic TIPS returns with aggressive high-turnover trading strategies.

Bond giant PIMCO and DoubleLine Capital are some of the more ardent practitioners of this approach.

These firms employ both top-down and bottom-up strategies, which can be broken down into the following:

Top-down strategies include:

Bottom-up strategies include:

If all of this gives you a headache and you just want to keep your life simple, you can just buy one of the many TIPS ETFs out there.

PIMCO has the Broad US TIPS Index ETF (TIPZ).

BlackRock has the iShares TIPS Bond ETF (TIP). Barclays has the SPDR 1-10 Year TIPS ETF (TIPX).

The only way these won’t work is if deflation, instead of ending, accelerates.

Artificial intelligence is only just starting to pervade our lives, and the productivity increases and cost savings it promises are enormous.

So is the potential job and wage destruction, the largest component of the CPI calculation.

If that is the case, then the CPI could turn negative, and sharply so. In that scenario, inflation-indexed TIPS will deliver losses instead of the promised gains.

Global Market Comments

January 14, 2025

Fiat Lux

Featured Trades:

(THE KINDLE EDITION OF THE JOHN THOMAS BIO IS OUT)

Global Market Comments

January 13, 2025

Fiat Lux

Featured Trades:

(MARKET OUTLOOK FOR THE WEEK AHEAD or WHAT’S NEXT),

(SPY), (TSLA), (TLT), (GS)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.