Global Market Comments

March 2, 2016

Fiat Lux

Featured Trade:

(APRIL 15 HOUSTON STRATEGY LUNCHEON INVITATION),

(THE MAD HEDGE FUND TRADER?S 8TH ANNIVERSARY ISSUE)

Global Market Comments

March 2, 2016

Fiat Lux

Featured Trade:

(APRIL 15 HOUSTON STRATEGY LUNCHEON INVITATION),

(THE MAD HEDGE FUND TRADER?S 8TH ANNIVERSARY ISSUE)

Yes, it seems like it was only yesterday. But as of February 1 the Diary of a Mad Hedge Fund Trader has been going out to idea hungry investors now for eight long years.

And what an eight years it has been!

So I will take the opportunity to explain the murky history of this august publication, which is now visited by thousands of readers every day from 137 countries around the world.

I am weak in Mali and North Korea, but am working on that, as soon as they get electricity.

Way back in mid 2007, I was toying with the idea of launching another hedge fund, and started emailing global macro ideas to a list of potential investors. This grew into a daily commentary.

However, I was soon to discover that the regulatory and legal costs of launching a new fund had risen astronomically since the last time I did this in 1989.

The competitive environment had also changed dramatically. When I first started, there were only 20 hedge funds. Now there were 10,000, many with marketing teams in the dozens targeting large institutional clients and pension funds.

The bottom line was that it would cost a minimum of $10 million to get started, and I needed to raise at least $500 million in assets just to break even.

In other words, it was a young man?s game.

So I decided to post my comments on the Internet and see what happened.

Something happened.

First, I had to come up with a name. A quick search at the US Copyright Office records revealed that every possible combination of ?trading?, ?hedge fund?, ?macro?, and ?research? was already taken.

So, I modified the name of an obscure and long forgotten 1970 Alice Cooper movie, ?Diary of a Mad Housewife.? My friends laughed, so I ran with that.

Then, I had to build a website. After obtaining offers from professional website developers to do this for hundreds of thousands of dollars, I decided to try it myself.

With mere teenagers accomplishing this, how hard could it be?

So I spent $5 and bought a used copy of Website for Dummies from Amazon. My goal was to see if I could launch a profitable Internet business for free.

Months of laborious programming followed, where I literally constructed the site on a trial and error basis. Another $5 investment brought a copy of Online Commerce for Dummies. That got me into the arcane world of merchant accounts, search engine optimization, and SSL certificates.

I almost pulled it off. My total up front costs for the launch of the Diary of a Mad Hedge Fund Trader came to $500.

Finally, I put the letter up for sale on February 1, 2008 for $29 a month. I sold one subscription. I thought ?This was the height of hubris for me to think that someone would pay me money for my ideas on the Internet.?

Then a funny thing happened.

Other financial newsletters started stealing my stories. So I developed a business model that encouraged and profited from stealing.

I started posting pieces on sites that then linked back to my own website, like Seeking Alpha, Business Times, Huffington Post, and Zero Hedge.

It also helped that I got a hold of Google?s 50 page long patent for their search engine, and figured out how to make my site unusually sticky and discoverable by searches.

Traffic started to build.

Then in 2010, I decided to enhance the product. Readers were raving about my trading recommendations, so I decided to create a premium Trade Alert service for $2,000 a year. This was quite a leap of faith, as the price then was $499 a year.

This would give followers the exact details they needed to execute on my ideas, including price, number of contracts, ticker symbols, and potential P&L?s.

The idea was to make subscribers feel like they were sitting at the desk of a top hedge fund trader. We launched the product on November 1, 2010.

I was thinking that I might sell a dozen subscriptions by the end of the year. So I didn?t bother to build an online store, expecting to create one when the traffic grew.

I asked buyers to send checks instead.

Oops!

A week later, I happened to be driving by the post office, so I thought I would stop and pick up the mail. The postal clerk asked me to bring my truck around the back. I said I didn?t have a truck.

Some five minutes later, three out of shape postal workers were dragging a 50-pound mail sack across the floor. It was all for me.

I couldn?t believe it.

To make a long story short, we took in 6,000 checks for $2,000 each over the following three months. It was one of the greatest Internet marketing miracles in history. My $500 investment had suddenly turned into $12 million. Overnight, I become a part of Internet lore.

My entire family spent their Christmas vacation opening up letters and manually entering names and email addresses into an excel spreadsheet.

Then something even more amazing happened. Many checks came with effusive letters of thanks. Much to my amazement, readers had been making hundreds of millions of dollars in profits trading off of my advice.

I had no idea.

I learned of college educations I had funded, mortgages paid off, parents retired early, and uninsured chemotherapy treatments for kids paid off.

Some letters brought tears to your eyes, others laughs. I particularly remember the guy who thanked me for his new Toyota Tundra pickup truck, the luxury trailer that slept eight, the camos, and the AR-15. He was going to visit me on his first cross-country trip.

He did, and I still live to tell about it.

The problem then arose of what to do with the checks. My main bank was then in Las Vegas. I didn?t trust FedEx or UPS, so I stuffed $12 million in checks into a backpack and headed for the airport.

Standing in line, I wondered if the metallic strips on the checks would set off the metal detectors. What was my explanation to Homeland Security going to be as to why I was carrying $12 million in a backpack? Was this all some kind of elaborate money laundering operation? Was I a mafia courier headed for Vegas?

In then end, nothing happened. False alarm. Wild imagination.

Once in Sin City, I took a taxi straight for the bank. No, I was not tempted to head for a casino.

I dropped the backpack at the teller?s window and said ?Please deposit these, I?ll be back.? They said ?Oh no, you can?t go anywhere. You have to stand here and watch us individually deposit each and every single check.?

They put two clerks on it, and it took eight hours. Minutes before closing, they handed me back a fist full of checks, that were unsigned, undated, or made out to me personally. I closed my account there shortly thereafter.

We have since used every opportunity to add services and functionality for subscribers. It?s all about getting you, the customer, to make more money.

I added staff around the world. The text alert service, although expensive, accelerated the Trade Alerts to the speed of light, globally. Hedge Fund Radio made its debut. Then came the travel videos, which I promise to add to when I have time.

We are still growing, and looking for new ways to grow. I am always looking for ways to improve the product. Here next to Silicon Valley they like to say that ?As soon as you think you?re finished, you're finished.?

So true, so true.

Looking at my early letters can be quite amusing.

I strongly recommended that everyone protect their assets by piling into gold (GLD) at $900 an ounce (it went to $1,927). I also suggested traders sell short the dollar against the Euro at $1.40 (it went to $1.03).

There is also mention of Microsoft?s bid for Yahoo at $31/share. Jerry Yang later turned down the offer, and the stock plunged to $8, vaporizing $22 billion of market capitalization. It was one of the worst business decisions in history.

Does the quality of any of these tips sound familiar?

Finally, I want to thank the thousands of subscribers who have supported my research over the years and supported a lifestyle that would make Jay Gatsby envious.

Regards,

John Thomas

The Mad Hedge Fund Trader

Global Market Comments

March 1, 2016

Fiat Lux

Featured Trade:

(MARCH 2 GLOBAL STRATEGY WEBINAR),

(THE CODER BOOM),

(THERE ARE NO GURUS)

Global Market Comments

February 29, 2016

Fiat Lux

(SPECIAL PROGNOSTICATION ISSUE)

Featured Trade:

(WHAT IS THE CNN FEAR & GREED INDEX?),

(ORDER EXECUTION 101),

(AND MY PREDICTION IS?.),

(TESTIMONIAL)

Global Market Comments

February 26, 2016

Fiat Lux

Featured Trade:

(MARCH 2 GLOBAL STRATEGY WEBINAR),

(IT?S SAFE TO SELL SHORT THE YEN AGAIN),

(FXY), (YCS),

(RIGHT SIZING YOUR TRADING)

CurrencyShares Japanese Yen ETF (FXY)

ProShares UltraShort Yen (YCS)

I think we are at the tag end of the recent unbelievable bout of yen strength.

Triggered by the Bank of Japan?s shocking move to negative interest rates (NIRP), it has been driven by a massive unwind of hedge fund positions in everything around the world that were all financed by short yen positions.

The memo is out now, and the bulk of the ?hot money? positions are gone. After some fits and starts, I expect the yen to resume its long-term structural downtrend shortly.

If for any reasons you can?t do options, just buy the ProShares Ultra Short Yen ETF (YCS) outright. This is the best entry point in a year.

?Oh, how I despise the yen, let me count the ways.?

I?m sure Shakespeare would have come up with a line of iambic pentameter similar to this if he were a foreign exchange trader. I firmly believe that a short position in the yen should be at the core of any hedged portfolio for the next decade.

To remind you why you hate the currency of the land of the rising sun, I?ll refresh your memory with this short list:

1) With the world?s structurally weakest major economy, Japan is certain to be the last country to raise interest rates. Interest rate differentials between countries are the single greatest driver of foreign exchange rates. That means the yen is taking the downtown express.

2) This is inciting big hedge funds to borrow yen and sell it to finance longs in every other corner of the financial markets. So ?RISK ON? means more yen selling, a lot.

3) Japan has the world?s worst demographic outlook that assures its problems will only get worse. They?re just not making enough Japanese any more. Countries that are not minting new consumers in large numbers tend to have poor economies and weak currencies.

4) The sovereign debt crisis in Europe is prompting investors to scan the horizon for the next troubled country. With gross debt well over a nosebleed 270% of GDP, or 160% when you net out inter agency cross holdings, Japan is at the top of the list.

5) The Japanese ten-year bond market, with a yield AT AN ABSOLUTELY EYE-POPPING -0.08%, is a disaster waiting to happen. It makes US Treasury bonds look generous by comparison at 1.70%. No yield support here whatsoever.

6) You have two willing co-conspirators in this trade, the Ministry of Finance and the Bank of Japan, who will move Mount Fuji if they must to get the yen down and bail out the country?s beleaguered exporters and revive the economy.

When the big turn inevitably comes, we?re going from the current ?112.75 to ?125, then ?130, then ?150. That works out to a price of $150 for the (YCS), which last traded at $76.88. But it might take a few years to get there.

If you think this is extreme, let me remind you that when I first went to Japan in the early seventies, the yen was trading at ?305, and had just been revalued from the Peace Treaty Dodge line rate of ?360.

To me the ?112.75 I see on my screen today is unbelievably expensive.

Global Market Comments

February 25, 2016

Fiat Lux

Featured Trade:

(WHAT HAPPENS WHEN QE FAILS),

(INDIA IS CATCHING UP WITH CHINA),

(FXI), (PIN), (TTM)

iShares China Large-Cap (FXI)

PowerShares India ETF (PIN)

Tata Motors Limited (TTM)

QE, QE QE!

Quantitative easing, or the vast expansion of the money supply by central banks, has been the hallmark of this decade as troubled governments sought to heal sickly economies.

And so far, it has worked. There is no doubt that the implementation of QE, first by the US, and then by Europe, Japan, and China, staved off another Great Depression.

Assets everywhere loved it!

QE was able to bridge the demographic gap created by the retirement of 80 million baby boomers, which started in 2006 and won?t end until 2022.

The last two times a bulge generation retired, the 1930?s and the 1970s, QE hadn?t been invented yet and the economy and the stock market fell to pieces.

QE is now in its seventh year in some form or another.

The hot button topic discussed among government planners, economists, and investors these days has rapidly become, ?What will happen when QE fails.?

What tools will central banks have when we go into the next recession with interest rates already at zero, or negative? Will the Fed run out of bullets and be powerless to help us out of our misery?

Will stock markets crash?

It turns out that there are quite a few things the government can still do.

Here is how the government can return us to prosperity in the next economic downturn:

1) More QE

Yes you heard me right. If at first you don?t succeed, try, try again. Since the Fed can?t lower interest rates from zero, it will resort to some new tricks.

Most US QE has so far been focused on buying US Treasury notes, bills, and bonds, thus expanding the Fed balance sheet to an unprecedented $3.5 trillion.

During the height of the financial crisis, the Fed expanded its buying to include bank commercial paper and mortgage backed securities, then trading at enormous discounts.

Future QE cycles could include government buying of stocks, corporate bonds, junk bonds, and even commercial real estate in depressed city centers (Detroit).

This is already being done in Japan, where almost the entire outstanding float of government bonds has already been purchased by the Bank of Japan.

Hong Kong did this during the Asian financial crisis, soaking up stock after a precipitous 50% dive, and then reselling it through convertible bonds at a 5% premium. It made a fortune in the process.

Asset prices would soar?. again.

2) Raise the Minimum Wage

The present federal minimum wage is $7.25 an hour, or about $14,500 a year. It is the wage for 4.3% of US workers, and is paid primarily to fast food and other low end service workers. It has not been raised since 2009.

Increasing it from $8 to $13 would have an immediate inflationary effect, something the Fed has been attempting to achieve for years. It would also put money in the pockets of a class of workers who spend 100% of their income, another plus for the economy.

This has already been implemented on the West Coast, in San Francisco, Seattle, and Los Angeles. Sure you may have to pay an extra quarter for a hamburger. But if you?re like me, you probably need one of those like a hole in the head.

3) Increase Government Spending

One of the unique aspects of this recovery is that it has taken place almost devoid of any increases in government spending. Analyze the monthly jobs statistics, as I do, and you find seven years of falling government employment in the face of rising private hiring.

After the initial 2009 $787 billion stimulus package (which got me a fourth bore to the Caldecott Tunnel, thank you very much), there has been virtually nothing. You can lay this at the feet of a gridlocked congress.

However, there is widespread bipartisan support for an infrastructure bank which would rebuild the nation's aging roads and bridges. The need is undisputed.

The American Society of Civil Engineers has found that one of nine bridges is structurally unsound. Water mains burst daily here in drought stricken California.

Another study I saw said that potholes cost $700 in damage per car per year. I am over budget here, as San Francisco Bay Area freeways have eaten two front wheels from my Tesla Model S-1.

The great thing about this approach is that it focuses spending on hiring where structural unemployment is the highest. Conditions might include funding only American made steel used in the projects.

An iteration of this idea is to fund it by permitting the $2 trillion in US corporate profits held overseas to be brought home tax exempt if it were invested in ?infrastructure bonds.?

4) Retire Government Debt

You know that $3.5 trillion in government bonds held by the Fed? What if, instead of holding them to maturity as it plans to do, it gave them back to the government?

This would have the effect of reducing the national debt from $18 trillion to $15.5 trillion, thus freeing up trillions for the above-mentioned spending. Sure, it?s never been done, but so what? Just doing some ?out of the box? thinking here.

The bottom line here is that governments never run out of bullets and always have one more thing they can do to bail out the economy.

And all of the above would be positive for asset prices of every stripe.

Just thought you?d like to know.

What? No More Bullets?

What? No More Bullets?Global Market Comments

February 24, 2016

Fiat Lux

Featured Trade:

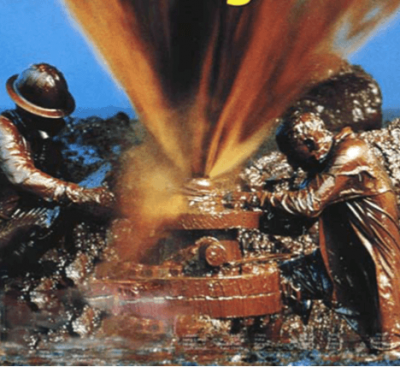

(WAS THAT A BOTTOM IN COMMODITIES?),

(USO), (BHP), (RIO), (GLD), (SLV), (CU),

(AN EVENING WITH DAVID TEPPER)

United States Oil (USO)

BHP Billiton Limited (BHP)

Rio Tinto plc (RIO)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

First Trust ISE Global Copper ETF (CU)

There is not a trader alive who wouldn?t fall down on his knees and thank the Heavens he didn?t get involved in commodities last year.

I AM ONE OF THOSE TRADERS!

It?s not that we were without opportunities. With every downside swoon, we were barraged with claims from brokers, producers, and the Internet that THIS WAS THE BOTTOM AND IT IS TIME TO BUY!

It wasn?t.

So many fingers were chopped off by falling knives that there were enough to man several symphony orchestras, if not armies.

If you want to know who last year?s commodity bulls were they?re easy to find. Their resumes are all over Craig?s List, Linked In, and other head hunting services.

However, the price action last week is making me wonder whether we finally HAVE seen the bottom in commodities.

THIS TIME IT MAY BE DIFFERENT!

Look no further than my February 9 Trade Alert Buy the United States Oil Fund (USO) May, 2016 $8 calls at $1.12 or best. Today, they traded at $1.60, up a blistering 42.86% in just 9 trading days.

I put out this Trade Alert because I believed that oil would bounce hard off of a $26 double bottom. It did. Texas Tea is now trading just short of $32, a nice 23% pop.

Now I am a pretty good trader. But I am not THAT good. The only way to get this kind of instant result is to suddenly pickup a tailwind from a new market or economic force.

That may have been just what happened.

BUT WAIT! THERE?S MORE!

Guess what the top performing sectors in the market are this year?

Energy and commodities, as I predicted in my ?2016 Annual Asset Class Review? (click here).

Single stocks have gone ballistic since the mid-January lows, like Freeport McMoran (FCX) (+129%) and Occidental Petroleum (OXY) (+22%).

Indeed, oil stocks have made it back to their September levels, when oil was trading at $46. Which is underpriced now, oil or energy stocks?

You can see identical action across the commodities space. Railroads (CSX), (UNP), whose primary business is the moving of bulk commodities like oil and coal, are up 19% so far this year.

The foreign exchange market has been confirming these trends. The commodity heavy Loonie (FXC) has picked up 7.35% in 2016, while the Aussie (FXA) has roared up by 6.15%.

Those are humongous one-month moves for currencies.

Even the dreaded PowerShares DB Multi Sector Commodity Trust ETF (DBC) has eked out a 2.6% increase, which has been trading like death for years.

The amazing thing about the entire commodities space is that they are now showing identical fundamentals and price action, possibly for the first time in history.

This is because they all have several things in common.

ALL are now selling for less than the cost of production. That is a guarantee that new production won?t come on line. Bankers for these giant projects won?t finance a negative cash flow deal.

I can almost hear the clock ticking for the next supply shortage. Some long-term thinkers believe we could even see 2011 style upside price spikes by 2021.

There was also a lot of ?reversion to the mean? buying kicking in at the beginning of 2016. Think of this as ?dogs of the Dow? with a turbocharger.

To add Alpha, or outperformance, big institutions are forced to unload last year?s best performing asset classes (technology and biotech stocks) and load up on the worst performing asset ones (oil, commodities).

This year especially, the influence was exacerbated by structurally poor liquidity and high frequency traders. This is where your new volatility is coming from.

Virtually at the hour that all of these things bottomed, a reader called me and asked if this was the final capitulation.

I responded ?I don?t know if this is the final bottom, but this is certainly what final bottom?s look like.?

Adjust you portfolio accordingly.

What? I?m Supposed to BUY it?

What? I?m Supposed to BUY it?Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.