Global Market Comments

January 11, 2016

Fiat Lux

Featured Trade:

(WHY WE ARE ALL NOW OIL TRADERS),

(USO), (WTIC), (DIG),

(THE RECEPTION THAT THE STARS FELL UPON),

(NLR), (CCJ), (CORN), (WEAT), (SOYB), (DBA)

United States Oil (USO)

Light Crude Oil - Spot Price ($WTIC)

ProShares Ultra Oil & Gas (DIG)

Vectors Uranium+Nuclear Engy ETF (NLR)

Cameco Corporation (CCJ)

Teucrium Corn ETF (CORN)

Teucrium Wheat ETF (WEAT)

Teucrium Soybean ETF (SOYB)

PowerShares DB Agriculture ETF (DBA)

After the market closes every night, I usually don a 60 pound backpack and climb the 2,000 foot mountain in my back yard.

To pass the time, I listen to audio books on financial and historical topics, about 200 a year (I?ve really got President Grover Cleveland nailed!). That?s if the howling packs of coyotes don?t bother me too much.

I also engage in mental calisthenics, engaging in complex mathematical calculations. How many grains of sand would you have to pile up to reach from the earth to the moon? How many matchsticks to circle the earth?

For last night?s exercise, I decided to quantify the impact of last year?s oil price crash on the global economy.

The world is currently consuming about 92 million barrels a day of Texas tea, or 33.6 billion barrels a year. In May, 2014 at the $107.50 high, that much oil cost $3.6 trillion. At today?s $32 intraday low you could buy that quantity of oil for a bargain $1 trillion.

Buy a barrel of crude, and you get three for free!

This means that $2.6 trillion has suddenly been taken out of the pockets of oil producers, and put into the pockets of oil consumers, i.e. you and me. Over the medium term, this is fantastic news for oil consumers. But for the short term, things could get very scary.

$2.6 trillion is a lot of money. If you had that amount of hundred dollar bills, it would rise to 250 million inches, 21 million feet, or 3,976 miles, or 1.2% of the way to the moon (another mental exercise). Tip this pile on its side, and you?d have a distance nearly equal to a round trip from San Francisco to New York.

The global financial system cannot move this amount of money around on short notice without causing some pretty severe disruptions. Expect a lot of bodies to float to the surface in 2016.

For a start, there is suddenly a lot less demand for dollars with which to buy oil. This has triggered short covering rallies in the long beleaguered Japanese Yen (FXY) and the Euro (FXE), which are just now backing off of long downtrends.

The fundamentals for these currencies are still dire. But the short-term trend now appears to be an upward one. The yen is tickling a one-year high against the buck as we speak.

The US Federal Reserve certainly sees the oil crash as an enormously deflationary event. The use of energy is so widespread that it feeds into the cost of everything. That firmly takes the chance of any interest rate rise off the table for the rest of 2016. The Treasury bond market (TLT) has figured this out and launched on a monster rally, as have muni bonds (MUB).

Traders are also afraid that the disinflationary disease will spread, so they have been taking down the price of virtually all other hard commodities as well, like coal (KOL), iron ore (BHP), and copper (CU). For more depth on this, see my piece on ?The End of the Commodity Super Cycle? by clicking here.

The precipitous fall in energy investments everywhere will be felt principally in the 15 US states involved in energy production (Texas, Oklahoma, Louisiana, North Dakota. Etc.). So, the consumers in the other 35 states should be thrilled.

However, the plunge in energy stocks is getting so severe, that it is dragging down everything else with it. ALL shares are effectively oil shares right now. In fact, all asset classes are now moving tic for tic with the price of oil. That effectively makes all of you oil traders.

Throw on top of that the systemic risk presented by the ongoing collapse of the Russian economy. The Ruble has now fallen a staggering 70% in 18 months, and there is panic buying of everything going on in Moscow stores.

The means that the dollar denominated debt owed by local firms has just risen by 300%. Any foreign banks holding this debt are now probably regretting ever watching the film, Dr. Zhivago.

Russian interest rates there were just skyrocketed. The Russian stock market (RSX) is the world?s worst performing bourse. How do you spell ?depression? in the Cyrillic alphabet?

And guess what the new Russian currency is?

IPhone 6.0?s, of which Apple is now totally sold out in Alexander Putin?s domain!

Thankfully, this is more of a European, than an American problem. But nobody likes systemic risks, especially going into New Year trading. It?s a classic case of being careful what you wish for.

Of the $2.6 trillion today, about $650 billion is shifting between American pockets. That amounts to a hefty 3.3% of GDP. Tell me this won?t become a big political issue in the 2016 presidential election.

Money spent on oil is burned. However, money spent by newly enriched consumers has a multiplier effect. Spend a dollar at Walmart, and the company has to hire more workers, who then have more money to spend, and so on.

So a shifting of funds of this magnitude will probably add 1.5% to U.S. economic growth this year.

Ultimately, cheap energy as far as the eye can see is a key element of my ?Golden Age? scenario for the 2020?s (click here for ?Get Ready for the Coming Golden Age?).

But you may have to get there by riding a roller coaster first.

![RSK 1-8-16]()

![XOM 1-8-16]()

![roller_coaster2]() Oil at $32?

Oil at $32?

Global Market Comments

January 8, 2016

Fiat Lux

Featured Trade:

(WHY THIS IS NOT A BEAR MARKET),

(SPY), (QQQ), (IWM), (VIX), (XIV),

(A DAY WITH TOM FRIEDMAN OF THE NEW YORK TIMES)

(THE BEST FINANCIAL BOOK EVER)

SPDR S&P 500 ETF (SPY)

PowerShares QQQ ETF (QQQ)

iShares Russell 2000 (IWM)

VOLATILITY S&P 500 (^VIX)

VelocityShares Daily Inverse VIX ST ETN (XIV)

Thank goodness for small mercies.

Going into the New Year with 100% cash was the best decision I made in 2015. It is allowing me to use the current melt down to cherry pick the best trades out there.

Shorting the Volatility Index (VIX) at $25 through the (XIV)? Thank you very much.

Nothing marks the bottom in a move better than bringing my old buddy, Marc Faber, on TV, when the Dow Average is down $400. Marc hasn?t had a bullish day in his life. His newsletter is entitled ?Gloom, Boom, and Doom? for a reason.

Who is next? Mr. Dow $3,000, Harry S. Dent, Jr?

These gurus are predicting that we are in a new bear market, that the average stock will be down 20%-40%, and that the worst is yet to come. Don your hardhat, man the lifeboats, and run up the white flag!

Let me tell you why my friends are wrong.

To get a bear market, you need a recession. There ain?t no recession anywhere on the horizon. US GDP is set to grow at a modest 2% plus this year, not the negative numbers you need to signal the end of this bull market.

In fact, things are about to get a whole lot better.

You know that $1 trillion de factor global tax cut in the form of cheaper energy? It just became a $2 trillion tax cut, thanks the collapse in prices that we saw in December.

That other great subsidy, free money delivered by the Federal reserve in the form of ultra low interest rates, looks to continue far longer than any imagined, except for me and Janet Yellen.

This means that the causes of every recession since 1945, energy and interest rate spikes, are absolutely nowhere to be seen.

And while the dollar was a big drag on US multinational earnings in 2015, this year I expect little movement. That's because currencies need interest rate changes to move. No, change, no movement.

If we are, in fact, in a ?one and done? world, there will be very little action in the foreign exchange market this year.

All of these positives will conspire to drive American corporate profits to new all time highs this year, probably to $130 a share for the S&P 500, or up about 10%.

Granted, we are certainly in no rose garden, and the global economy is facing some challenges.

In my book, the biggest concern is the $4 trillion in new debt piled up by companies in emerging nations over the past decade. The strong dollar has effectively doubled their interest and principal payments. But save for a few banks, that is their problem, not ours.

While the market is not cheap at a 17 times price earnings multiple, it is not expensive either. This historic range for this measure of share value is 9-22. I warned you that rising interest rates, however modest, could only translate into falling multiples, a point by my calculation.

Who knew this discount would entirely kick in during the first three days of January?

So what?s the big deal here? Why are traders and investors using the New Year?s tiding to throw up on their shoes? Did they drink the wrong Champagne?

Don?t tell me it?s all about China. The bourses there never really were stock markets in the conventional sense. They are really places where the government attempts to exercise its control of their economy. As a 45 year China veteran, I have always known this. They rest of you have known it since the summer.

And these are tiny markets, accounting for no more than a couple of percent of global market capitalization. What is the foreign ownership there ? A scant 2%, held by a handful of exchange traded funds and errant hedge funds.

Remember, the Chinese didn?t want to let us join their club while prices were rising. Now that they are falling, we don?t want to join.

So was it North Korea that caused the big dump? Fat chance. It is likely that what was actually detonated was a primitive nuclear weapon, more the product of a high school chemistry class, and not the H-bomb that was advertised. It really had more to do with the Great Leader?s birthday.

The Hermit Kingdom is so poor that it will take them another five years to build another one. Take this from someone who used to build nuclear weapons for a living.

I worked at the Nuclear test Site in Nevada before my math skills took me to Wall Street, where ?yield? had an entirely different meaning.

So is ISIS and the turmoil in the Middle East causing the sell off? Nope. The threat to the US posed by this criminal organization has been wildly exaggerated because this is a presidential election year.

I tend not to worry too much about military problems that can disappear with the push of a button, or the jiggle of a joystick in Nevada.

In any case, US bear markets are prompted only by domestic developments, not foreign ones, and there is definitely none of this currently at play at home.

So why are people selling? It is really all about psychology.

After nearly seven years, the fourth longest bull market in history is getting tired. Aged bull markets act differently than new ones. As conviction fades, they become choppier, with lower returns and higher volatility.

But they still go up.

I spoke with nearly a dozen managers of $1 billion plus hedge funds today, and nearly everyone has the same attitude. Go in light on risk during the first half of the year, and then pile it on in the second half.

That gives time for foreign quantitative easing to work, the global economy to recover, even for China, energy and commodities to bounce, and for the outcome of the US presidential election to become a forgone conclusion (as it already is for me).

That means this is no more than the 15% correction I predicted last week, of which we are already two thirds of the way through. That puts the final bottom for the S&P 500 at 1,800, but it may take months to get there.

In other words, don?t get too short here, lest a ferocious short covering rally rip your face off.

So as much as traders are distressed, I am very relaxed.

I think I?ll go watch the new film The Big Short, based my friend, Michael Lewis?s book.

Global Market Comments

January 7, 2016

Fiat Lux

Featured Trade:

(THE NEW COLD WAR)

(AN EVENING WITH CONGRESS BARNEY FRANK),

(TESTIMONIAL)

One of the highlights of last year?s SkyBridge Alternatives Conference was the blowout party on Wednesday night (click the following for the blow by blow description at http://madhedgefundradio.com/report-on-the-skybridge-alternatives-conference/).

Seeking refuge from a band that was blasting my ears out, and fleeing the nubile young bodies that kept bumping up against me and spilling my margaritas, I sought out a safe haven.

There, cloistered in the quietest, darkest refuge from the event, far beyond the most distant swimming pool and palm tree, I found former congressman, Barney Frank, sitting in a lounge chair.

If this name piques your memory, it is because Barney was a co-sponsor of the 2011 Dodd-Frank bill, the most sweeping regulation of the financial industry since the Securities Act of 1933.

As chairman of the House Financial Services Committee, he became a familiar figure during the endless hearings for the controversial legislation.

To say that Barney is a man with strong opinions is probably the understatement of the century. If you voice an opinion he believes is factually incorrect, he will shout you down until he has the last word.

I watched him do exactly that when he sat on a discussion panel with republican strategist, Carl Rove. The two went at it like cats and dogs for ten minutes, the rest of the participants sitting there aghast, with their mouths hanging open.

Barney is upset that the US is still spending massively to defend Europe 22 years after the collapse of the Soviet Union, their only real enemy. The continentals can easily afford to pick up the tab themselves. The US has vastly overextended itself with military commitments. We can no longer afford to be the world?s policeman.

Sunni and Shia Muslims have been hating each other for a thousand years. We are not going to change that in a few years of spending a few trillion dollars and thousands of lives.

You can?t use the US military for social engineering. Attempting to do so just pisses everyone off and only creates more American enemies.

Banks are now bigger than they were before the financial crisis, largely because the government required them to post more capital. But ?too big to fail? has been solved.

The new Resolution Authority has the power to wipe out shareholders in the wake of future poor business decisions. That did not exist in 2008. No more bonuses will be paid for large losses.

Corporate tax reform is a big priority, but is far more difficult than people realize. The people you take money away from get much angrier than the beneficiaries of change are made happy. That is a problem in the current big money election environment.

Son of a New Jersey truck stop operator, Barney went on to obtain a degree from the Harvard Law School. He entered politics in 1972 when he joined the Massachusetts House of Representatives. Frank was elected to congress in 1980, representing the western Boston suburbs. He went on to win reelection 12 consecutive times.

Frank first went to Washington about the same time as I joined the White House Press Corps as a correspondent for The Economist magazine. I didn?t know him personally, but shared with him his frustration in trying to explain economic issues to then President Ronald Reagan.

When I asked the president from my home state of California why his tax cuts gave himself the largest percentage reduction, he answered that ?It?s because I pay the most taxes.? Go figure.

What I found most fascinating about Barney was his recollections of the Boston political scene during the 1960?s. In the past year, I have read biographies on John Kennedy, Robert Kennedy, Ted Kennedy, and the most interesting, their father, Joe Kennedy.

If you ever want to gain insight into one of history?s best natural traders, finest businessmen, and the first chairman of the SEC, read The Founding Father by Richard Whalen. Barney knew all of these men, and listening to his first hand stories about them was a real education.

All of this great information came at the price of sitting downwind from his cigar smoke for two hours. As a journalist, I long ago learned that if you want to get the real dope, you sometimes have to pay the price.

?

Global Market Comments

January 6, 2016

Fiat Lux

Featured Trade:

(IT?S TIME TO PICK UP SOME GOLD),

(GLD), (GDX), (ABX), (NEM),

(TESTIMONIAL)

SPDR Gold Shares (GLD)

Market Vectors Gold Miners ETF (GDX)

Barrick Gold Corporation (ABX)

Newmont Mining Corporation (NEM)

I have not done a gold trade in yonks. That?s because it has been the asset class from hell for the past five years, dropping some 46% from its 2011 $1,927 high.

However, we are now in a brave new, and scarier world.

Given the extreme volatility of financial markets in recent months, all of a sudden keeping hedges on board looks like a good idea. I?m sure the next time stocks take a big dive, the barbarous relic will post a double digit gain.

So, this makes it an excellent hedge for my outstanding long S&P 500 (SPY) and short Treasury (TLT) ?RISK ON? positions.

Also supporting the yellow metal is what I call the ?Big Figure Syndrome?. And there is no bigger number than $1,000, the upper strike on this trade.

While rising interest rates is always bad for gold, the realization is sinking in that it is definitely NOT off to the raises now that the Federal Reserve has at last begun a tightening cycle.

Personally, I expect ?one and done? to gain credence by midyear, once implications of six months of Fed inaction starts to sink in. As long as rates rise slowly, or not at all, we have a gold positive environment.

The Treasury bond market has already figured this out, with yields now lower than when the Fed carried out its 25 basis point snugging.

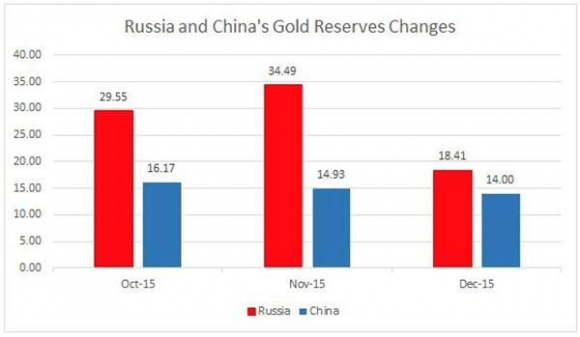

In addition, gold has recently found some new friends. Russia has come out of nowhere in recent months and emerged as one of the world?s largest buyers. This is because economic sanctions brought down upon them by the invasion of Crimea and the Ukraine is steering them away from dollar assets.

Keep in mind that this is only a trade worth about $200 to the upside. Then, I?ll probably sell it again.

I am avoiding the Market Vectors Gold Miners ETF (GDX) for now, as the next stock market swoon will take it down as well, no matter what the yellow metal does.

But get me a good price and a rising stock market, and I?ll be in there with another Trade Alert.

My interest might even expand to include the world?s largest gold miners, Barrick Gold (ABX) and Newmont Mining (NEM).

The new bull market in gold is still at least five years off. That?s when it picks up a huge tailwind from a massive demographic expansion by the Millennials, which eventually leads to much higher inflation.

Also by then, China and other emerging nations will begin to raise their gold reserve holdings to western levels. This will require the purchase of several thousand metric tonnes! That?s when my long-term forecast of $5,000/ounce will finally come true.

With conditions as grim as they were in 2015, you would have thought the price of gold was going to zero.

It didn?t.

While no one was looking, the average price of gold production has soared from $5 in 1920 to $1,300 today. Over the last 100 years, the price of producing gold has risen four times faster than the underlying metal.

It?s almost as if the gold mining industry is the only one in the world which sees real inflation, which has seen costs soar at a 15% annual rate for the past five years.

This is a function of what I call ?peak gold.? They?re not making it anymore. Miners are increasingly being driven to higher risk, more expensive parts of the world to find the stuff.

You know those tires on heavy dump trucks? They now cost $200,000 each. Barrick Gold (ABX) didn?t try to mine gold at 15,000 feet in the Andes, where freezing water is a major problem, because they like the fresh air.

What this means is that when the spot price of gold falls below the cost of production, miners will simply shout down their most marginal facilities, drying up supply. That has recently been happening on a large scale.

This inevitably leads to a shortage of supply, and a new bull market, i.e., the cure for low prices is low prices.

They can still operate and older mines carry costs that go all the way down to $600. No one is going to want to supply the sparkly stuff at a loss.

That should prevent gold from falling dramatically from here.

I am constantly barraged with emails from gold bugs who passionately argue that their beloved metal is trading at a tiny fraction of its true value, and that it is really worth $5,000, $10,000 or even $50,000 an ounce.

They claim the move in the yellow metal we are seeing is only the beginning of a 30-fold rise in prices similar to what we saw from 1972 to 1979, when it leapt from $32 to $950.

To match the 1936 monetary value peak, when the monetary base was collapsing and the double top in 1979 when gold futures first tickled $950, this precious metal has to increase in value by eight times, or to $9,600 an ounce.

I am long term bullish on gold, other precious metals, and virtually all commodities for that matter.

The seven year spike up in prices we saw in the seventies, which found me in a very long line in Johannesburg, South Africa to unload my own Krugerrand's in 1979, was triggered by a number of one off events that will never be repeated.

Some 40 years of demand was unleashed when Richard Nixon took the US off the gold standard and decriminalized private ownership in 1972. Inflation then peaked around 20%. Newly enriched sellers of oil had a strong historical affinity with gold.

South Africa, the world?s largest gold producer, was then a boycotted international pariah and teetering on the edge of disaster. We are nowhere near the same geopolitical neighborhood today, and hence my more subdued forecast.

But then again, I could be wrong.

The previous bear market in gold lasted 18 years, from 1980 to 1998, so don?t hold your breath.

What should we look for? When your friends start getting surprise, out of the blue pay increases, the largest component of the inflation calculation. That is happing now in the technology and the new US oil fields, but nowhere else.

It could be a long wait, possibly into the 2020?s, until shocking wage hikes spread elsewhere.

Ready For a Bounce

Ready For a Bounce

Global Market Comments

January 5, 2015

Fiat Lux

2016 Annual Asset Class Review

FOR PAID SUBSCRIBERS ONLY

Featured Trade:

(JANUARY 6 GLOBAL STRATEGY WEBINAR),

(SPX), (QQQQ), (XLF), (XLE), (XLI), (XLY), (EEM), (SCTY), (TAN),

(TLT), (TBT), (JNK), (PHB), (HYG), (PCY), (MUB), (HCP)

(FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB)

(FCX), (VALE), (MOO), (DBA), (MOS), (MON), (AGU), (POT), (PHO), (FIW), (CORN), (WEAT), (SOYB), (JJG)

(DIG), (RIG), (USO), (DUG), (DIG), (UNG), (USO), (OXY), (X)

(GLD), (DGP), (SLV), (PPTL), (PALL)

(ITB)

S&P 500 Index (SPX)

PowerShares QQQ (QQQ)

Financial Select Sector SPDR (XLF)

Energy Select Sector SPDR (XLE)

Industrial Select Sector SPDR (XLI)

Consumer Discret Select Sector SPDR (XLY)

iShares MSCI Emerging Markets (EEM)

SolarCity Corporation (SCTY)

Guggenheim Solar ETF (TAN)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

SPDR Barclays High Yield Bond (JNK)

PowerShares Fundamental High Yld Corp Bd (PHB)

iShares iBoxx $ High Yield Corporate Bd (HYG)

PowerShares Emerging Mkts Sovereign Debt (PCY)

iShares National AMT-Free Muni Bond (MUB)

HCP, Inc. (HCP)

CurrencyShares Euro Trust (FXE)

ProShares UltraShort Euro (EUO)

CurrencyShares Canadian Dollar Trust (FXC)

CurrencyShares Australian Dollar Trust (FXA)

ProShares UltraShort Yen (YCS)

CurrencyShares Japanese Yen Trust (FXY)

WisdomTree Chinese Yuan (CYB)

Freeport-McMoRan Copper & Gold Inc. (FCX)

Vale S.A. (VALE)

Market Vectors Agribusiness ETF (MOO)

PowerShares DB Agriculture (DBA)

The Mosaic Company (MOS)

Monsanto Company (MON)

Agrium Inc. (AGU)

Potash Corp. of Saskatchewan, Inc. (POT)

PowerShares Water Resources (PHO)

First Trust ISE Water Idx (FIW)

Teucrium Corn (CORN)

Teucrium Wheat (WEAT)

Teucrium Soybean (SOYB)

iPath DJ-UBS Grains TR Sub-Idx ETN (JJG)

ProShares Ultra Oil & Gas (DIG)

Transocean Ltd. (RIG)

United States Oil (USO)

ProShares UltraShort Oil & Gas (DUG)

United States Natural Gas (UNG)

Occidental Petroleum Corporation (OXY)

United States Steel Corp. (X)

SPDR Gold Shares (GLD)

PowerShares DB Gold Double Long ETN (DGP)

iShares Silver Trust (SLV)

Premium Energy Corp. (PPTL)

ETFS Physical Palladium Shares (PALL)

iShares US Home Construction (ITB)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.