Global Market Comments

September 24, 2015

Fiat Lux

Featured Trade:

(FRIDAY, OCTOBER 23 INCLINE VILLAGE, NEVADA STRATEGY LUNCHEON),

(A VERY BRIGHT SPOT IN REAL ESTATE),

(A SHORT HISTORY OF HEDGE FUNDS)

Global Market Comments

September 23, 2015

Fiat Lux

Featured Trade:

(OCTOBER 12 PORTLAND, OREGON GLOBAL STRATEGY LUNCHEON),

(MAD HEDGE FUND TRADER HITS NEW ALL TIME HIGH),

(A DIFFERENT VIEW OF THE US)

Global Market Comments

September 22, 2015

Fiat Lux

Featured Trade:

(SEPTEMBER 23 GLOBAL STRATEGY WEBINAR)

(WILL THE MARKET CRASH IN OCTOBER?),

(SPY), (HD),

(SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS)

SPDR S&P 500 ETF (SPY)

The Home Depot, Inc. (HD)

I think the bull market has at least three more years to run, but I?ll tell you why later.

In the meantime, we have to survive October first.

That is easier said than done.

October has long earned a notorious reputation as a wealth confiscation month for both professional traders and long-term investors.

If you go broke during this always challenging month, you won?t have any money left to play the coming price rises.

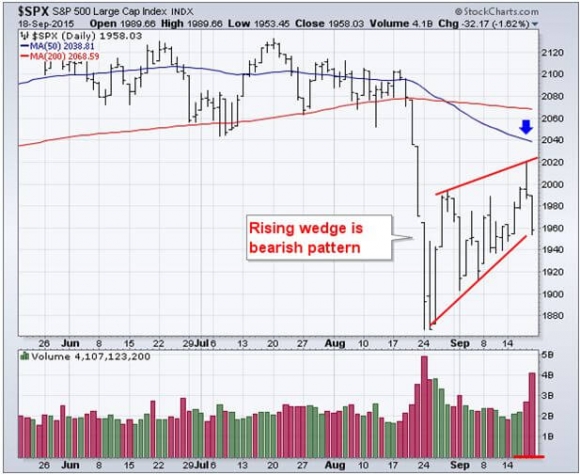

Over the weekend, I did my usual scan of the 200 most important charts for the global financial markets. The technical picture that leapt out at me was nothing less than atrocious.

Failure to break the old support/new resistance level in the (SPY) at $203 means we now have to retest the August 24 lows at $186, or $182 in the intraday futures.

If $182 doesn?t hold, then we?re breaking to new lows, and entering a new bear market.

Every technical service I subscribe to was repeating the identical pattern. This is rare enough that when it does occur, I stand to attention.

Look out below!

This year, October will be particularly vexing.

The newly elevated level of volatility has scared the daylights out of a lot of stockholders.

Look no further than last Friday, September 18. Just when everyone thought it was safe to nibble on some new longs, the Dow Averaged came out of the blue and whacked them with a 300-point loss.

I don?t even recall the reason. But it is irrelevant. Traders were gun-shy. No one wanted to hold a position over the weekend, and risk that China would have a bad Monday (it did).

It get?s worse.

Congress is now threatening another shutdown. Be it over Planned Parenthood funding or the Iran Treaty, it makes no difference. Closed is closed.

This is exactly what the market doesn?t want to hear.

Then we have three more months of Fed torture to endure. Failure to move on September 17 means that uncertainty surrounding the first interest rate reversal in nine years has been given another fresh three months of life.

As if we didn?t have enough to worry about!

It all adds up to a nightmare for neophyte traders. No one has the slightest idea of what the market will do next. If they pretend to, they?re lying.

That is, unless you happen to have a half-century of trading experience, as I do. Then it?s a piece of cake.

Just hit the mute button on the TV and close your eyes. Then buy every big dip and sell every substantial rally. Don?t try to rationalize this in any way. This is trading and investment totally devoid of the thought process.

Overthinking your trades right now can be hazardous to your wealth. Just let your primordial brain stem take over for now.

And it works like a charm.

Just look at my trades of the last few days. When the market opened high, I bought the October (SPY) $204-$207 vertical bear put spread.

When it then dove 300 points I bought the Home Depot (HD) October $105-$110 vertical bull call spread as a hedge.

When the market popped 200 points on the following Monday morning opening (and 300 points if you count the overnight Asia low), I kicked out Home Depot for a nice little 6.2% one day profit.

I then rolled down and purchased the (SPY) October $203-$206 vertical bear put spread to double up my short exposure.

I ended up +0.91% on the day on my total portfolio, just 1.23% short of a new all time high, and ahead 37.14% so far in 2015.

I don?t normally trade this fast. But they?re running the movie on triple fast forward now. A month?s worth of price movement is occurring in a day.

Bob and weave, bob and weave. We have to trade the market we have, not the one we want.

While a technical breakdown is looming, and the fundamentals seem to be backing it up, I don?t think a real bear market will appear.

Historically, stock markets continue rising an average of 30 months after the first Federal Reserve interest rate hike. That hourglass won?t even get turned over until December, or maybe even not until 2016.

The longest data point on this chart is 73 months. That means the Fed inaction means THE BULL MARKET COULD HAVE ANOTHER SIX YEARS TO RUN!

Yikes!

Beyond the hysterical, oops, I mean the historical analogies, the economy is just too darn strong to grease the skids for a true bear market.

I had to call three restaurants to get a dinner reservation in San Francisco this weekend, and finally got one only because it was a dive. I can?t get a plumber to unblock my toilet because he is too busy. And these were the guys who were collecting unemployment checks only four years ago.

For more glorious detail on the current state of the economy, please click here for ?The Bear Market That Isn?t?.

The dreaded October effect traces back to the 19th century, when agriculture accounted for 50% of the US GDP. Right before crops were harvested in the fall, farmer outlays to pay for the inputs of seed, fertilizer, and labor were the greatest.

Yet, the crops hadn?t been sold yet, so farmer borrowing also hit a peak. The aggregate of all this hit the financial markets with an enormous cash call, which led to the inevitable crashes.

Once the trend was established, it became a self-fulfilling prophecy, even though agriculture presently accounts only for 2% of the American economy now.

It is traders that sweat October now, not farmers.

Back for a Replay?

Back for a Replay?

?The Fed cannot permanently raise stock prices,? said James Bullard, president of the Federal Bank of St. Louis.

Global Market Comments

September 21, 2015

Fiat Lux

Featured Trade:

(THE DEATH OF GOLD),

(GLD), (ABX), (GDX),

(DON?T BUY ALIBABA, YET)

SPDR Gold Shares (GLD)

Barrick Gold Corporation (ABX)

Market Vectors Gold Miners ETF (GDX)

One of the most impressive moves in the wake of the Fed?s Thursday move to maintain ultra low interest rates was to be found in gold.

In the run up to the flash headline on the Fed non-announcement, the yellow metal rocketed $40. The action was even more impressive in silver (SLV), which tacked on 90 cents, or 6.6%.

Now, here is the really bad new.

The fundamentals for the barbarous relic are about to turn from bad to worse. The prospect is sending perma bulls rushing to update their life insurance policies.

This is the dilemma. To sell, or not to sell?

Gold does well when interest rates are low or falling. That reduces the opportunity cost of owning the barbarous relic, which doesn?t pay any interest or dividends. It just sits there, shines, and collects dust.

It also runs up storage and insurance fees, effectively hampering it with a real negative yield.

So what happens when the fundamentals flip from good to bad?

WARNING: if you have been carefully salting away one ounce American gold eagle coins in your safe deposit box for the past several years, you are not going to want to read this.

If I am right, and we have put in a generational high in bond prices and a low in yields, interest rates are going to rise. Initially, for the first couple of years, they may not do it a lot. But eventually they will.

That is terrible news for gold owners.

The market clearly thinks this is happening. Take a look at the charts below. Gold is making its third run at support at $1,100 over the past 18 months. Break this and cascading, stop loss selling will ensue, taking gold down to $1,000.

That, by the way, is my jeweler?s downside.

Caution: My jeweler is always right. There he plans to load the boat with bullion, which his business consumes in creating baubles for clients, like me.

It wasn?t supposed to be like this, as the arguments in favor of buying the yellow metal were so clear five years ago.

The exploding national debt was about to force the US government to default on its debt. It almost did, thanks to congressional gamesmanship.

Massive trade deficits with China and the Middle East were supposed to collapse the value of the US dollar.

The election of Barack Obama was predicted to lead to the creation of a socialist paradise. We were all going to need gold coins to bribe the border guards in order to get out of the country with only what we could carry.

The problem is that none of this happened.

The US budget deficit is falling at the fastest rate in history, from a $1.5 trillion peak to as low as $400 billion this year. Foreign capital pouring into the US has pushed the greenback to multiyear highs, and loftier altitudes beckon.

Since the 2009 inauguration, the S&P 500 has tripled off its intraday low. This has enriched the 1% more than any other group, who have seen their wealth increase at the fastest pace on record.

The trade deficit with China is now balancing out with America?s own burgeoning surpluses in services and education. As for the Middle East, we make our own oil now, thanks to fracking, so why bother.

To see such dismal price action in the barbarous relic now is particularly disturbing. Traditionally, the Indian ?Diwali? gift giving season heralded the beginning of a multi month bull run in gold. It ain?t happening.

In fact the dumping of speculative long positions by long-term traders used to this is accelerating the melt down. That?s because gold, silver, or any other inflation hedges have no place in a deflationary, reach for yield world.

Mind you, I don?t think gold is going down forever.

Eventually, emerging central banks will bid it back up, as they have to buy an enormous amount just to bring their reserve ownership up to western levels. Inflation is likely to return in the 2020?s, as my ?Golden Age? scenario picks up speed.

In the meantime, you might want to give those gold eagles to your grand kids. By the time they go to college, they might be worth something.

?

Better to Look than to Buy

Better to Look than to Buy

Long time readers of this letter have known for years that the Alibaba IPO was coming, that it had massive implications for the market, and could well signal an interim market top.

I?m sticking to my guns.

You have to hand it to the underwriters of the company?s initial public offering, the largest in history.

Some $25 billion in capital was raised.? At the all time high of $118, Alibaba had a market capitalization of $300 billion, making it the 8th largest in the US, right after Wal-Mart (WMT).

At that price, the lucky few insiders who received allocations had a paper profit of 74% from the $68 IPO price.

To get this deal off successfully, the managers had to orchestrate one of the greatest onslaughts of hype, hyperbole, and euphoria of all time.

Of course, you want to buy a company that represents Amazon (AMZN), PayPal, and Ebay (EBAY) combined, in the fastest growing major country in the world!

As my old boss at Morgan Stanley used to hammer into me, ?stocks are not bought, they?re sold.?

What artificially boosted the price of the shares in the aftermarket was the unusual allocation of the shares.

CEO Jack Ma personally hand picked the top 25 institutions that received 50% of the shares. His goal was to place them with the largest, longest-term holders, basically, people who never sell.

Hedge funds were banned from participation, as were most individuals.

That shut out thousands of investors who were forced to chase stock in the after market. This is how you get such a dramatic initial gains. They?re always engineered.

The final insult was the ?green shoe?, which increased the deal size by 15% at the last minute at the underwriters? discretion. When these guys finally get in, look out below.

Look carefully at what you get as an Alibaba shareholder, and you might have second thoughts.

This is not your father?s joint stock company. It is a share in a profit stream into a Cayman Islands holding company, the amount of which is at the discretion of Jack Ma. It is more like a hedge fund limited partnership than a publicly listed company.

In some court cases in China, the structure has already been ruled illegal. One could only imagine what would happen in a liquidation. There are no assets, just a post office box on a remote Caribbean island.

Not exactly widows and orphans stuff.

If you had any doubt about (BABA)?s next move, better take a look at the shares of its two largest shareholder?s, Softbank (SFTBY) (-46%) and Yahoo (YHOO) (-47%). They have both done an outstanding rendition of a swan dive.

Some of this is no doubt the result of new Alibaba holders hedging their position by selling short (SFTBY) and (YHOO). But it could also mean that (BABA) is grotesquely over valued and has to fall to come in line with reality.

Keep in mind, also, that non-dividend yielding stocks tend to have greater volatility than those that do pay out.

I am inclined to hold back until (BABA) hits the low $40 handles. That is still a big discount to the IPO price. Some brokers have already issued reports suggesting that the shares will get there shortly.

By the way, my old friend, Softbank?s Masayoshi Son?s $20 million initial investment in Alibaba, made in 2004, is now worth $100 billion at the peak. That has to be one of the greatest trades of all time.

Good for you, Mas, and the next dinner is one you!

?

The $25 Billion Dollar Man

The $25 Billion Dollar Man

I?m Sticking to My Guns on Alibaba

I?m Sticking to My Guns on Alibaba

Global Market Comments

September 18, 2015

Fiat Lux

Featured Trade:

(SEPTEMBER 23 GLOBAL STRATEGY WEBINAR)

(THANK YOU JANET YELLEN!),

(SPY), (TLT),

(WHY I?M CHASING THE EURO),

(FXE), (EUO)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.