“Wars are easier to get into than to get out of,” said former Secretary of Defense, Robert M. Gates.

Global Market Comments

November 22, 2024

Fiat Lux

Featured Trade:

(WEDNESDAY, JANUARY 22, 2025 ST AUGUSTINE FLORIDA STRATEGY LUNCHEON)

(NOVEMBER 20 BIWEEKLY STRATEGY WEBINAR Q&A),

(NVDA), (TSLA), (TLT), (OXY), (SLB), (MSTR), (USO), (PLTR), (SMCI), (KRE), (SMR), (UUP)

Below, please find subscribers’ Q&A for the November 20 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Lake Tahoe, Nevada.

Q: What are your stock recommendations for the end of the first quarter of 2025?

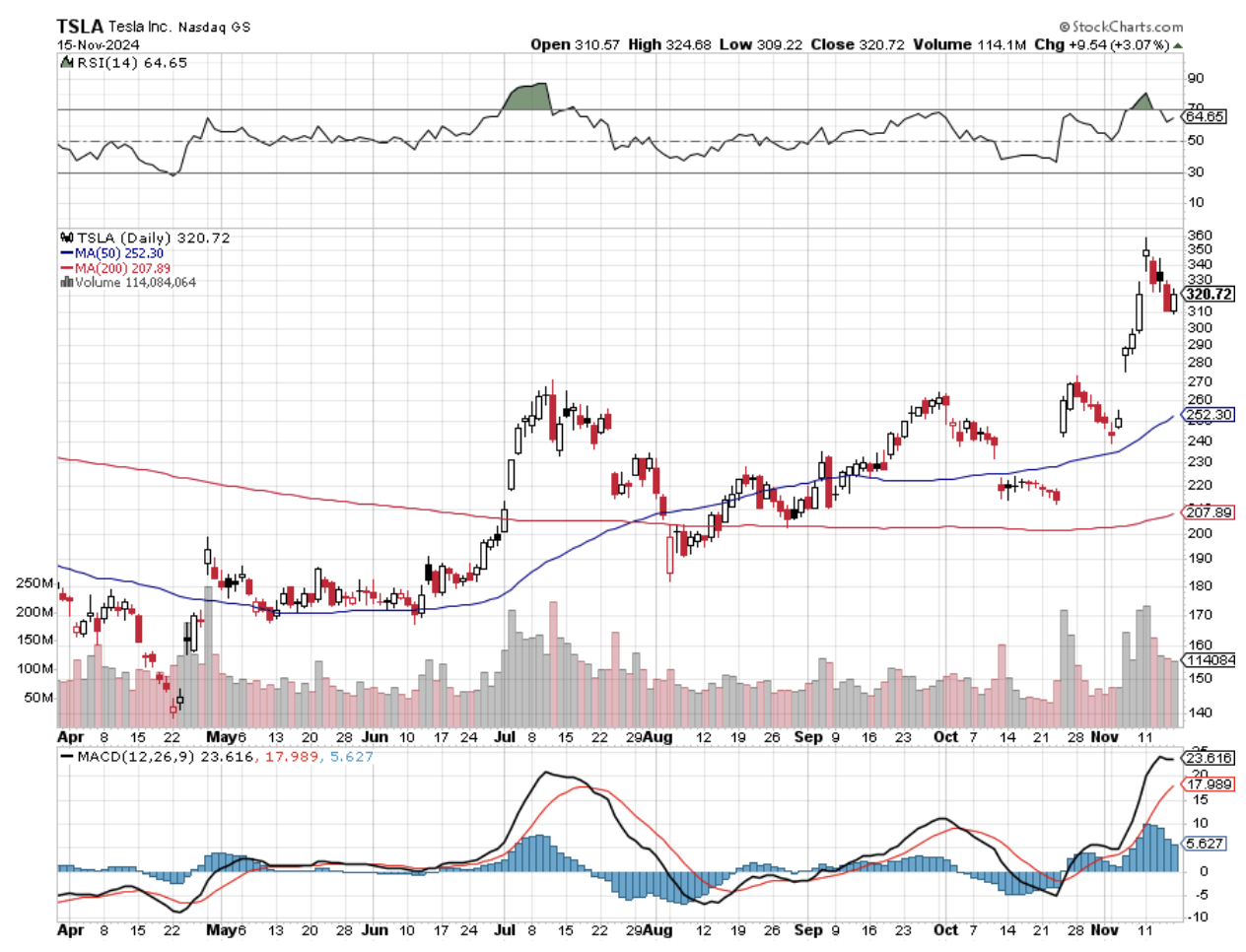

A: I say run with the winners. Dance with the girl who brought you to the dance. I think portfolio managers are going to be under tremendous pressure to buy winners and sell losers. And, of course, you all know the winners—they’re the stocks I have been recommending all year, like Nvidia (NVDA), Tesla (TSLA), and so on. And they're going to sell losers like energy to create the tax losses to offset their gains in the technology area. That could continue well into next year. Although, we’ve probably never entered a new administration with more uncertainty at any time in history, except maybe during the Civil War. I don’t think it will get as bad as that, but it could be bad.

Q: Is Putin bluffing about nuclear war?

A: Yes. First of all, Russia has 7,000 nuclear weapons, but only maybe 200 of those work. If he does use nuclear weapons, Ukraine will use its nuclear weapons in retaliation. During the Soviet Union, where did the Soviet Union make all their nuclear weapons? In Ukraine. That's where they had the scientists. They certainly have the Uranium—that's the hard part. You could literally put one together in days if you had the right expertise around. This will never go nuclear, and Putin has always been all about bluffing. There's a reason why the world's greatest chess masters are all Russian; it's all about the art of bluffing. So that doesn't worry me at all.

Q: Will Russia sacrifice a higher and higher percentage of its population in the war?

A: Yes, that is the military strategy: keep throwing bodies at your enemy until they run out of bullets.

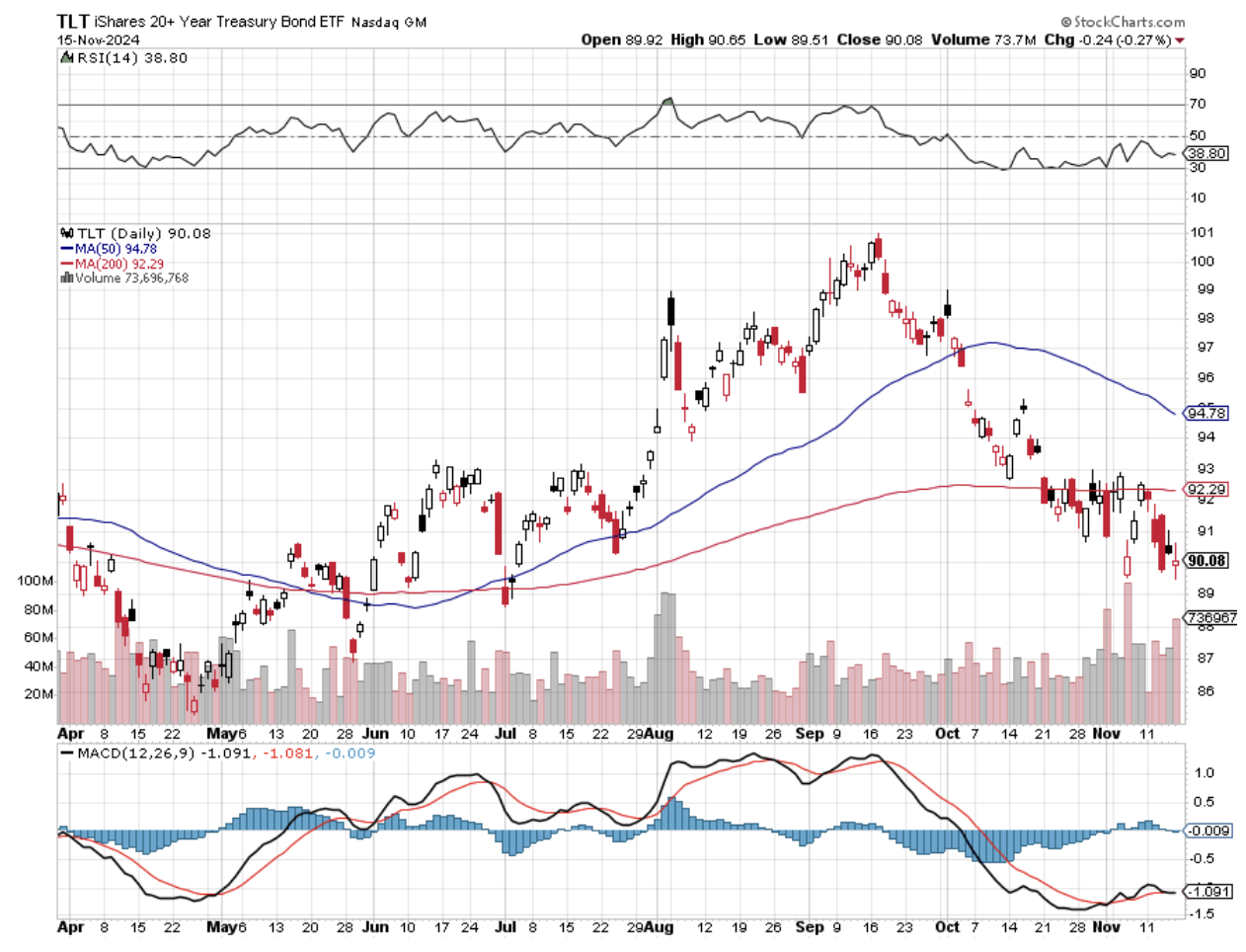

Q: What is your prediction for 30-year US Treasury yields (TLT)?

A: They go higher. Higher for longer certainly includes the 30-year. The 30-year will be the most sensitive to long-term views of interest rates. If you get a return of inflation, which many people are predicting, the 30-year gets absolutely slaughtered. Adding a potential $10 trillion to the national debt, taking it to $45 trillion, is terrible for debt instruments everywhere.

Q: Should we be exiting the LEAPS that you put out on Occidental Petroleum (OXY) and Schlumberger (SLB)?

A: For Occidental, I would say maybe; it’s already at a low. The outlook for oil prices is poor, with massive new production coming on stream. Regarding Schlumberger, they make their money on the volume of oil production—that probably is going to be a big winner.

Q: What do you think interest rates will do as we go into the end of Powell's term in 18 months?

I have no idea. It just depends on how fast inflation returns. My guess is that we'll get an out-of-the-blue sharp uptick in inflation in the next couple of months, and when that happens, stocks will get slaughtered. People assume that inflation just keeps going up forever after that.

Q: Crude oil (USO) has been choppy at around $70 a barrel. Where do you see it going next year?

A: My immediate target is $60, and possibly lower than that. It just depends on how fast deregulation brings on new oil supplies, especially from the federal lands that have been promised to be opened up. As it turns out, the federal government owns most of the western United States—all the national forests and so on. If you open that up to drilling, it could bring huge supplies onto the market. That would be deflationary. It would be death for oil companies, but it would be a death for OPEC as well. Every cloud has a silver lining. OPEC has been a thorn in my side for the last 60 years.

Q: I'm tempted to buy stocks that are flying up, like Palantir (PLTR) and MicroStrategy (MSTR). What would be an experienced investor trade in these situations?

A: Don't touch them with a 10-foot pole. You buy stocks before they fly up, not afterwards. By the way, if anyone knows of an attorney who is an expert at recovering stolen Crypto, please contact me. I have several clients who've had their crypto accounts cleaned out. Oh, and by the way, the heads of every major crypto exchange have been put in jail in the last three years. Imagine if the heads of Goldman Sachs, Morgan Stanley Fidelity, and Vanguard were all put in jail for fraud and theft? How many stocks would you want to buy after that? Not a lot.

Q: Your recommendations for AI and chips?

A: I think you get a slowdown. In order to buy the new plays in banks, brokers, and money managers, you need to sell the old plays. Those are going to be technology stocks and AI stocks—AI itself will keep winning. They will keep advancing, but the stocks have become extremely expensive. And everyone is waiting to see how anti-technology the new administration will be. Some of the early appointments have been extremely anti-technology, promising to rein in big tech companies. If you rein in big tech companies, you rein in their stock prices, too. I am being very cautious here. The next spike up in Nvidia (NVDA) might be the one you want to sell.

Q: Do you think the uranium play will continue under the new administration?

A: Absolutely, yes. Restrain the Nuclear Regulatory Commission, and costs for the new nuclear starts up like (SMR) go way down.

Q: What do you think of NuScale Power Corp (SMR)?

A: I love it. Again, deregulation is the name of the game—and if you lose a city by accident, tough luck. Let's just hope it happens somewhere else. It's only happened three times before… Three Mile Island, Chernobyl, and Fukushima.

Q: Super Micro Computer (SMCI), what do you think?

A: Don't touch it. There's never just one cockroach. Hiring a new auditor to find out how much money they misrepresented is not a great buy argument to buy the stock. I'm sorry. Very high risk if you get involved.

Q: If Nvidia (NVDA) announces great earnings but sells off anyway, what should I do?

A: Get rid of it and get rid of all your other technology stocks because this is the bellwether for all technology. Tech always comes back over the long term, but short term, they may continue going nowhere as they have done for the last six months, which correctly anticipated a Trump win. Trump is not a technology guy— he hates California. Any California-based company can't expect any favors except for Tesla.

Q: Is there any reason why you prefer in-the-money bull call spreads?

A: Well, there are lots of reasons. Number 1, it's a short volatility play. Number 2 it's a time decay play, which is why I only do front months because that's when the time decay is accelerated. Thirdly, it allows you to increase your exposure to the stock by tenfold, which brings in a much bigger profit when you're right. If you look at our trade alerts, we make 15% to 20% on every trade, and 200 trades a year adds up to a lot of money. You can see that with our 75% return for this year. And it's a great risk management tool; the day-to-day volatility of call spreads is low because you're long one call option short the other. So, the usual day-to-day implied volatility on the combination is only about 8% or 9%. The biggest problem with retail investors is the volatility scares them out of the market at market lows and scares them back in at market highs. So, call spread reduces the volatility and keeps people from doing that. The risk-reward is overwhelmingly in your favor if you have somebody like me with an 80% or 90% success rate making the calls on the stocks. And, of course, having done this for almost 60 years, nothing new ever happens in the stock market—you're just getting repetitions of old stuff. All I have to do is figure out is this the 1970s story, the 1980s story, the 1990s, the 2000s, 2010s story? I have to figure out which pattern is being repeated. People who have been in the market for one year, or even 10 years, don't have that luxury.

Q: I’m having trouble getting filled on your orders.

A: You put out a spread of orders. So if I put in an order to buy at $9.00, split your order up into five pieces: at $9.00, $9.10, $9.20, $9.30, $9.40; and one or all of those orders will get filled. Another hint is that algorithms often take my trade alerts to the maximum price. Don't pay more than that price immediately, but they have to be out by the end of the day, so if you just enter good-till-cancel orders, you have an excellent chance of getting filled by the end of the day or at the opening tomorrow.

Q: Should I purchase SPDR S&P Regional Banking ETF (KRE)?

A: I'd say yes. That probably is a good buy with deregulation, making all of these small banks takeover targets.

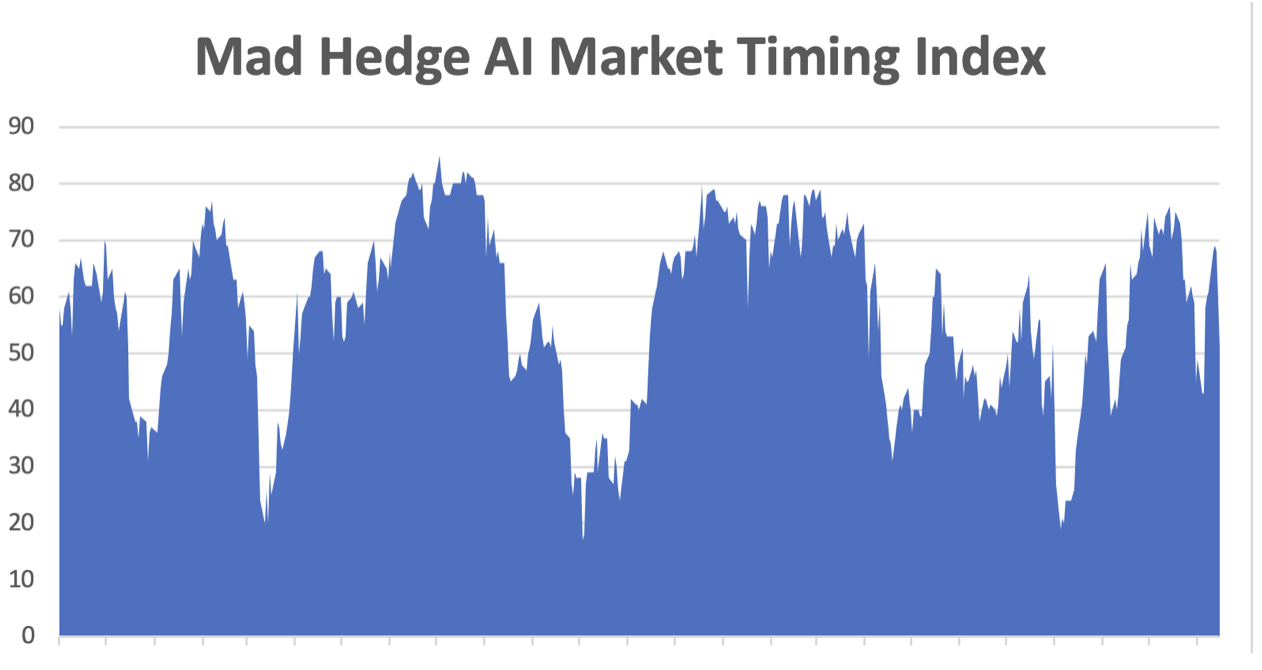

Q: What should we be looking for in the fear and greed index?

A: When we get to the high end, like in the 70s, start taking profits. When we get to the low end, like the 20s, start buying and adding LEAPS and more long-term leverage option plays.

Q: What are we looking for to go short?

A: Much higher highs and a bunch of other monetary and technical indicators flashing warning signals, which are too many to go into here. Suffice to say, we did make good money on the short side this year, a couple of times on Tesla (TSLA), including a pre-election short that we covered in Tesla, and we were short a whole bunch of technology stocks going into the July meltdown. So, you know, we do both the long side and the short side, but it's been a long play—11 months this year and a short play for a month.

Q: Is the euro going back up eventually, or does the dollar (UUP) rule?

A: Sorry, but as long as the US dollar has the highest interest rates in the developing world and the prospect of even higher rates in the future, it's going to be a dollar game for the next couple of years.

Q: Will a ceasefire in the Middle East affect the markets?

A: No. The U.S. interest in geopolitical data ends at the shores—all three of them. So if the war of the last couple of years doesn't change the market—and it's been an absolutely horrific war with enormous civilian casualties—why should the end of it affect markets?

Q: What stock market returns do you see for the next four years?

A: About half of what they were for the last four years, which will be about 90% by the time Biden leaves office. You're going to have much higher interest rates and much higher inflation, and while the new administration is very friendly for some industries, it is very hostile for others, and the net could be zero. So, enjoy the euphoria rally while it lasts.

Q: What about crypto?

A: Well, I did buy some crypto for myself at $6,000, and I'm now thinking of selling it at $96,000. Would I recommend it to a customer? Not on pain of death—not at this level. You missed the move. Wait for the next 95% decline, which is a certainty in the future. And, by the way, absolutely nobody in the industry can tell you when that is.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

November 21, 2024

Fiat Lux

Featured Trade:

(THURSDAY, JANUARY 16, 2025 SARASOTA FLORIDA STRATEGY LUNCHEON)

(TEN REASONS WHY I ONLY EXECUTE VERTICAL CALL DEBIT SPREADS)

(AAPL), ($VIX), (SPY)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Luncheon, which I will be conducting in Sarasota, Florida on Thursday, January 16, 2025. The cost of the luncheon will be $277.

An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I’ll be arriving early and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive Sarasota hotel. The precise location will be emailed with your purchase confirmation. Mad Hedge guests will be assigned their own dedicated table in a ballroom with 200 other participants.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for this luncheon, please click here.

Global Market Comments

November 20, 2024

Fiat Lux

Featured Trade:

(THE JOHN THOMAS BIOGRAPHY IS OUT)

(THE EIGHT WORST TRADES IN HISTORY)

Global Market Comments

November 19, 2024

Fiat Lux

Featured Trade:

(JANUARY 10 MIAMI FLORIDA STRATEGY LUNCHEON)

(THE MAD HEDGE DICTIONARY OF TRADING SLANG),

(TESTIMONIAL)

Global Market Comments

November 18, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or OUT WITH THE NEW, IN WITH THE OLD) Plus REPORT FROM THE QUEEN MARY II),

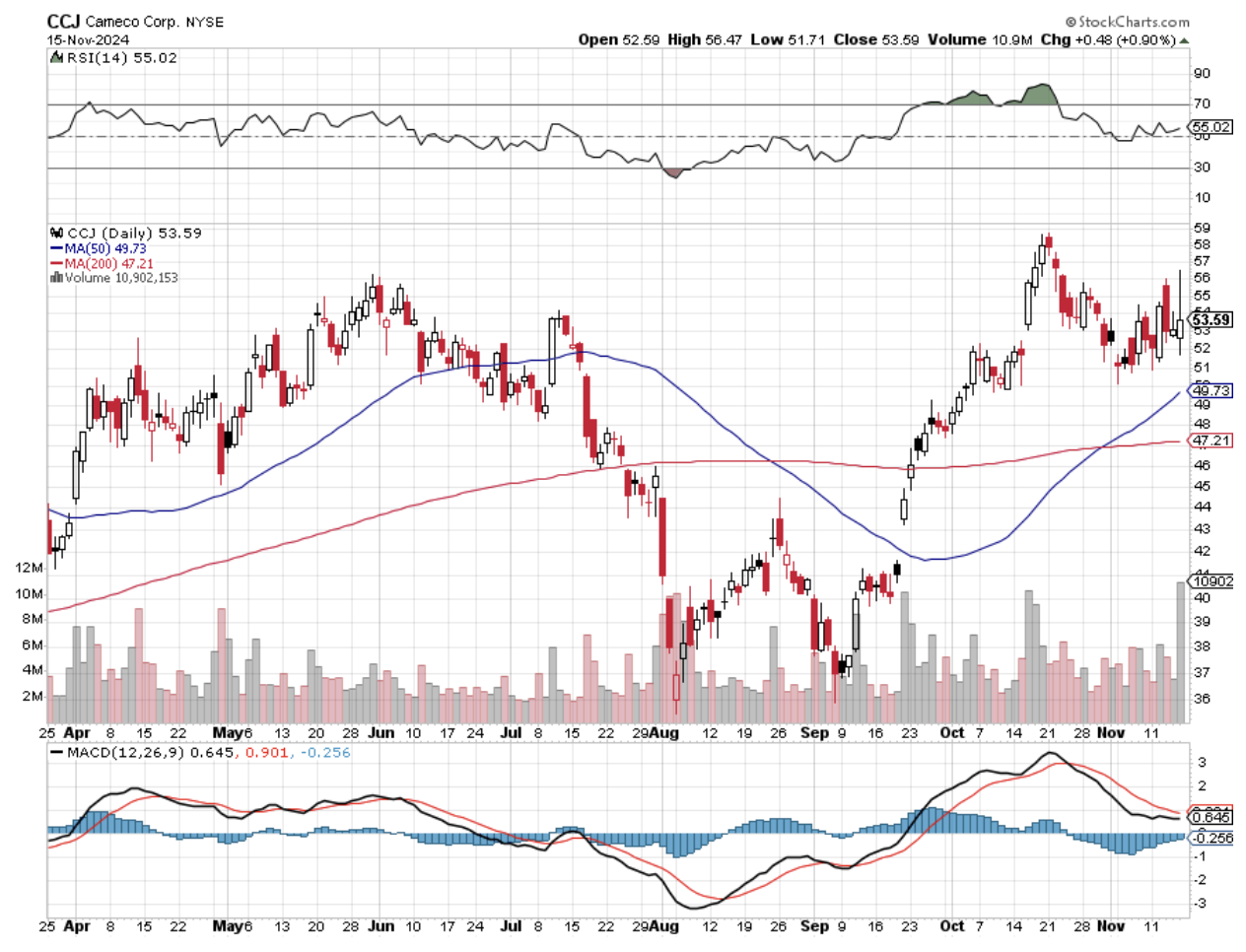

(TLT), (TSLA), (DHI), (LEN), (KBH), (LMT), (RTX), (GD), (GLD), (SLV), (GOLD), (WPM), (JPM), (NVDA), (BAC), (C), (CCJ), (MS), (SPY)

“Take things as they are and profit off the folly of the world.”

That is one of my favorite quotes from Anselm Rothschild, founder of the Rothschild banking dynasty, which ruled the financing of Europe for centuries. I lived next door to his great X 10 grandson in London for ten years, the late Jacob Rothschild, and boy, did I learn a few nuggets from him.

It's really just another way of saying that you have to trade the market you have, not the one you want. By the way, Anselm’s other famous quote? In 1815, the year the British defeated Napoleon at the Battle of Waterloo, he said, "I care not what puppet is placed upon the throne of England to rule the Empire on which the sun never sets. The man who controls the British money supply controls the British Empire, and I control the British money supply."

And that shall be my strategy in the coming years. The good news? There is a ton of folly out there and, therefore, tons of great new trades.

Let’s start with the market themes. Out with the new, in with the old. Falling interest rates plays are out. Rates will stay higher for longer. Artificial Intelligence will take an extended vacation. Saving the environment is history. Take a look at the woeful underperformance of NASDAQ. That will allow earnings to catch up with share prices, which are already at nosebleed levels.

Money managers will sell these areas, which in many cases have seen enormous appreciation, to finance the purchase of the new themes. These include deregulation, the end of antitrust, the Bitcoin ecosystem, and Tesla (TSLA).

It helps a lot that the outgoing themes are incredibly expensive, with price-earnings multiple of 30X-100X, while the new ones are dirt cheap, with multiples of 15X down to single digits.

Buy cheap, sell expensive….I like it!

If you think I’m just an aging old hippy from Berkeley spouting his iconoclastic, out-of-touch-with-reality views, then check with Mr. Market, who agrees with me on every point and is never wrong.

Notice the collapse of the bond market (TLT) since September. Fed funds futures have already backed out 100 basis points of easing, from 250 basis points to only 150, and we have already seen the first 75. If inflation makes a rapid comeback (prices started rising on November 6), we are likely to only see a couple more 25 basis point cuts from the Fed in this cycle, and that’s it.

The 30-year fixed rate mortgage has rocketed from 6.0% to 7.13%, sticking a dagger through the heart of the real estate market and homebuilders (DHI) (LEN), KBH).

Defense? Who needs weapons when we are withdrawing from the international community? We will just have to depend on our existing 50-year-old defense systems. And while you’re at it, end “cost plus” contracts, which have inflated defense spending since 1940.

This is what fried the shares of Lockheed Martin (LMT), builder of the Blackhawk helicopter, Raytheon (RTX), maker of Javelin antitank missiles, and General Dynamics (GD), manufacturer of the Abrams tank after the past month. What happens to these stocks when the Ukraine War ends?

I have received a lot of questions about whether it is time to go into pharmaceutical and biotech stocks. The answer is no, a thousand times no. The appointment of anti-vaxxer Robert F. Kennedy as the head of Health and Human Services puts the kibosh on that trade, who is likely to declare war on that department. That explains the wipeout of shares in that sector.

Precious metals? Forget it (GLD), (SLV), (GOLD), and (WPM). Witness their own recent hell they have entered. There is no doubt that the election ended the gold trade, which has fallen by 8.3% since November 5. That’s because investors pulled $600 million out of gold-backed ETFs just in the week ending November 8, according to the World Gold Council. It just had its worst week in three years. “Interest rates higher for longer” absolutely does not fit anywhere in the precious metals trade.

Another contributing factor has been the strength of Bitcoin, which raced to a new all-time high of $93,000 on the back of the Trump win. The industry had been a major contributor to the Trump campaign. What better way to fund Bitcoin purchases than to sell your gold, which in any case is up 40% in a year? Money has been pouring into Tesla shares for the same reason.

At some point, gold will fall to a level where Chinese saving alone supports the price. There is no way of knowing where that is, so I’ll wait for the market to tell me. Central bank buying will continue unabated, which has totaled 694 metric tonnes ($5.3 billion) so far in 2024.

I believe that gold will still hit $3,000 an ounce over the long term. But for now, the shine is clearly off those American Eagles. The last time gold took a rest, from 2011 to 2019, it was for eight years.

The bottom line is that there are plenty of new fish to fry out there and plenty of fire with which to cook them. Does anyone have any matches?

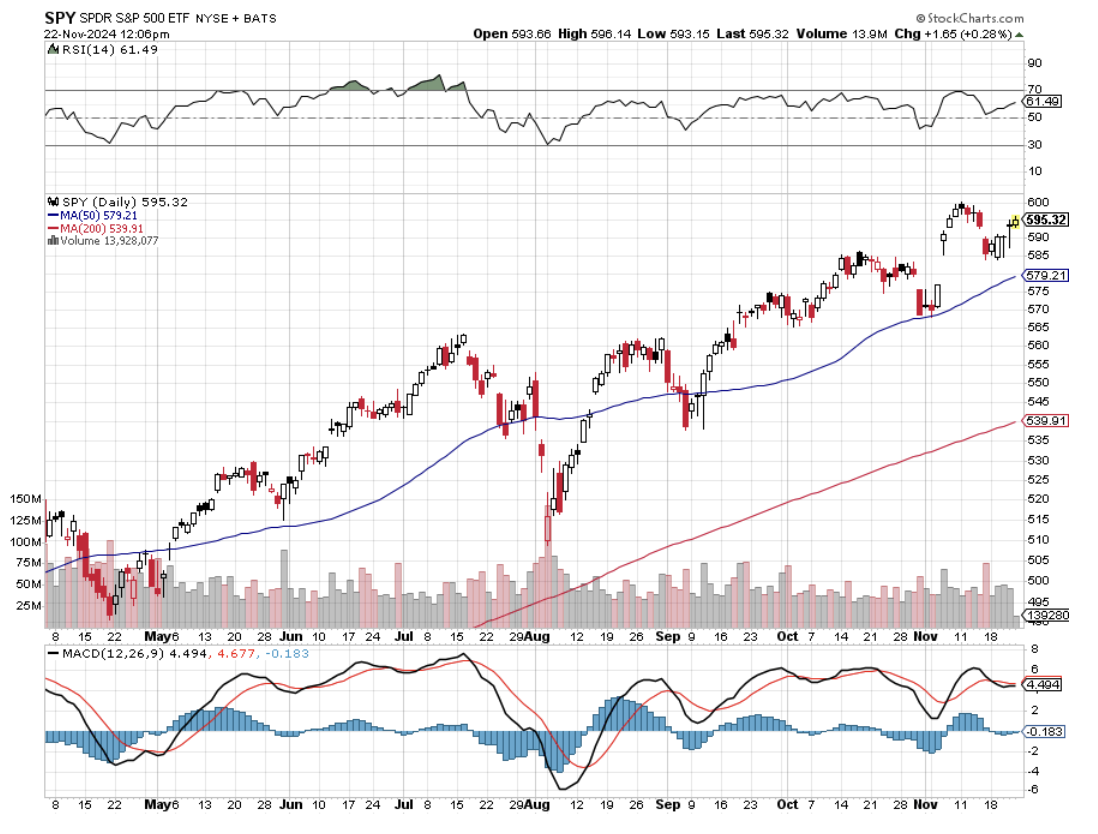

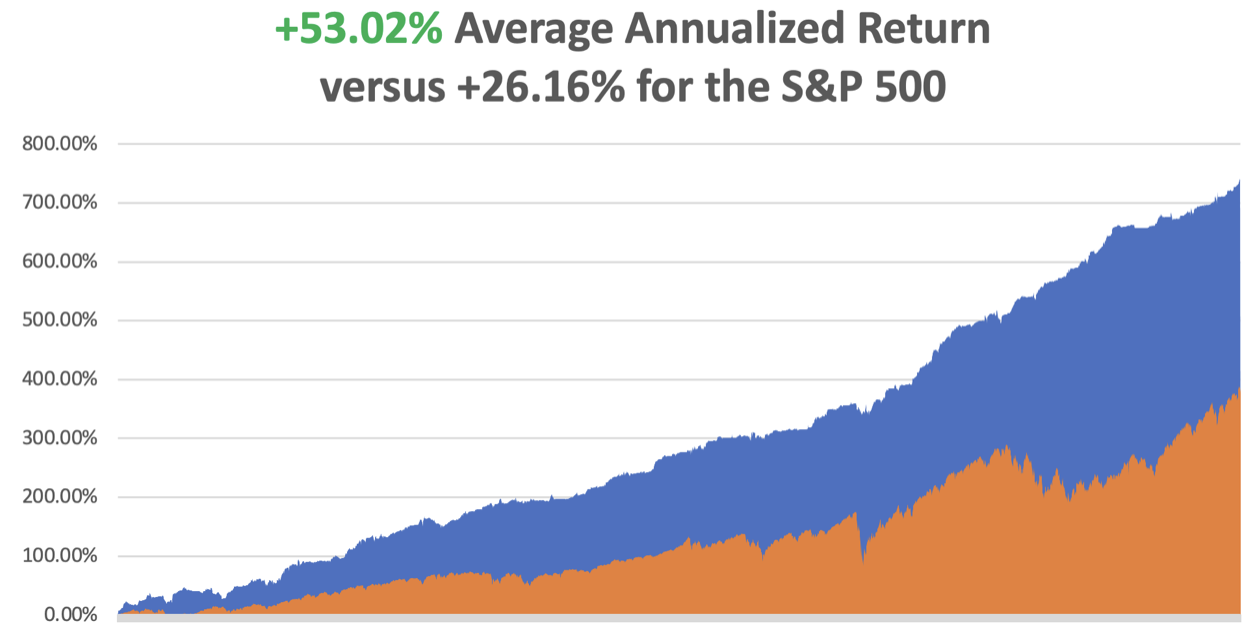

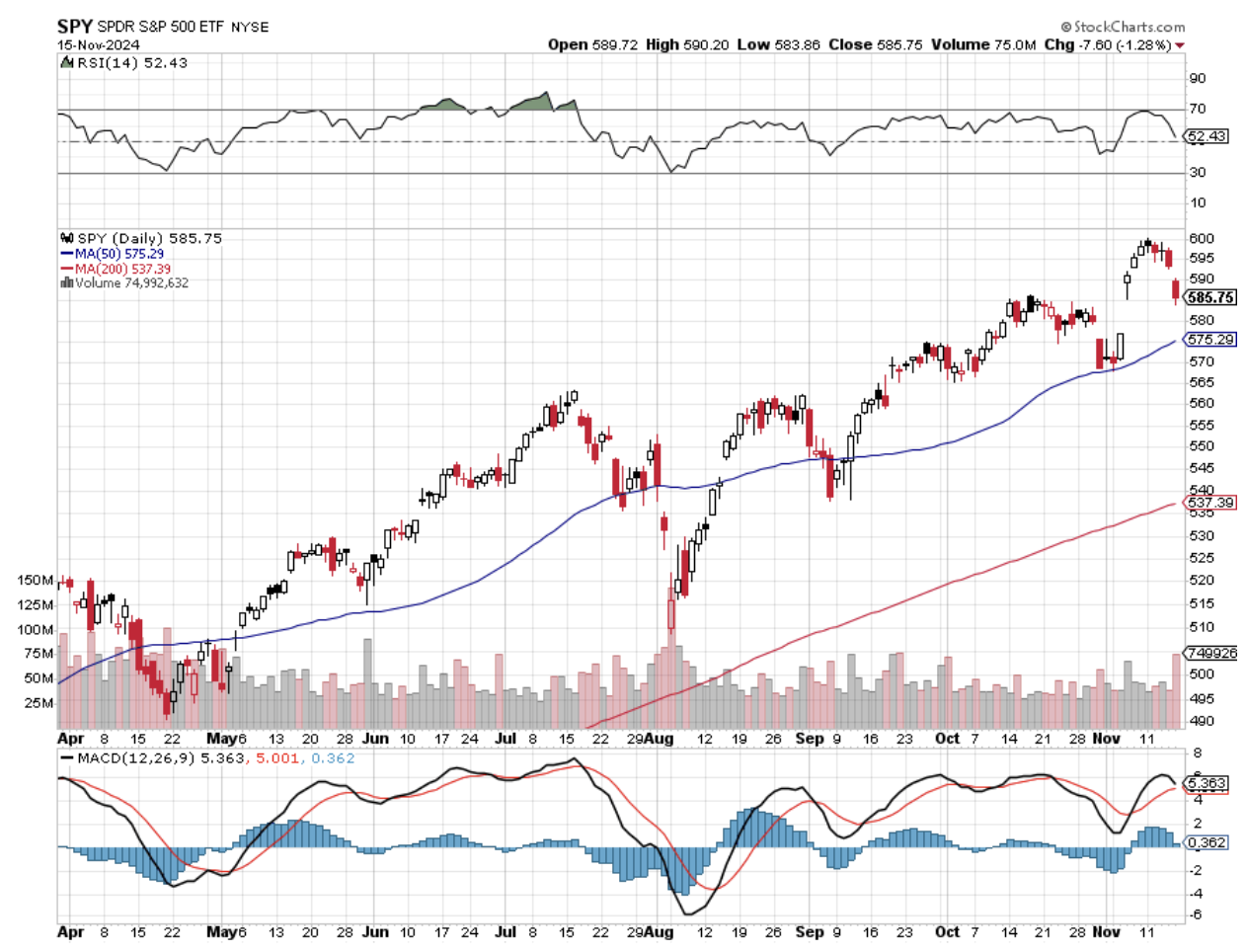

In November, we have gained a breathtaking +8.19%, amazing adding to our gains while the market dropped 2.3%. My 2024 year-to-date performance is at an amazing +61.33%. The S&P 500 (SPY) is up +25.79% so far in 2024. My trailing one-year return reached a nosebleed +62.15%. That brings my 16-year total return to +737.86%. My average annualized return has recovered to +53.02%.

I maintained a 100% long-invested portfolio, betting that the market doesn’t drop below pre-election levels. That includes (JPM), (NVDA), (BAC), (C), (CCJ), (MS), and a triple long in (TSLA). My November position in (JPM) expired at max profit. We should make 46 basis points a day until the December 20 option expiration in 24 trading days, thanks to time decay and falling volatility.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 73 of 93 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of +78.49%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at a headwind. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, November 18 at 8:30 AM EST, the NAHB Housing Market Index is out.

On Tuesday, November 19 at 8:30 AM, the US Building Permits take place. Nvidia (NVDA) announces earnings after the close.

On Wednesday, November 20 at 8:30 AM, the MBA Mortgages Rates are announced.

On Thursday, November 21 at 8:30 AM, Existing Home sales are printed. We also get Weekly Jobless Claims.

On Friday, November 22 at 8:30 AM, the S&P Global Flash PMI is announced. At 2:00 PM the Baker Hughes Rig Count is printed.

Location: 48 degrees, 02.12 minutes North, 043 degrees, 42.08 minutes West, or 1,421 nautical miles ENE of New York.

As for me, The Queen Mary 2 is currently plowing its way through a massive fog bank a thousand miles thick, sounding the foghorn every two minutes. Visibility is less than 100 yards, and the waves are a rough 12 feet high. The captain has closed the outside decks for fear of losing a passenger overboard. The weather has disrupted our satellite link, and our Internet is down. So here I write. Leave me alone with a laptop for an hour, and I can conquer the world.

One hour out of New York, and a passenger suffered a heart attack. So the captain turned the ship around and headed back to the harbor, where the New Jersey Search and Rescue sent out a launch to pick up the unfortunate man and his distraught spouse. Every passenger leaned over the port railing to watch.

That meant we could pass under the Verrazano Bridge three times, on each occasion deftly clearing the span by a mere ten feet. Talk about inauspicious beginnings. Visions of Leonardo di Caprio going down with the ship danced across my mind.

The ship is truly gigantic. You must allow 20 minutes to get anywhere, 5 minutes to walk there, and 15 minutes to get lost. When launched two decades ago, it was the largest cruise ship ever built at 148,900 tons, nearly double the size of the now decommissioned Queen Elizabeth II. It whisks up to 3,000 passengers and 1,325 crew across the seas in the utmost luxury at a steady 21.5 knots. You could water ski behind this leviathan of a vessel if only the crew permitted it.

As a 50-year guest of Cunard and the highest paying customer on the ship, I managed to bag the Sandringham Suite, possibly the most luxurious publicly available oceangoing accommodation ever created. The 2,200 square foot, two-floor, two-bedroom, three-bathroom, Q1 class apartment on decks nine and ten included a formal dining room, kitchen, his and her closets, a small gym, and 1,000 square feet of rear-facing teak deck.

All of this was a bargain for $56,000, or about the same as renting the presidential suite at the San Francisco Ritz for a week at $10,000 a night, except at the end, you wake up in England five pounds heavier. Not that I noticed, though. By the afternoon, the two complimentary bottles of Dom Perignon Champagne were already headed for the recycling bin.

The suite came staffed with two full-time butlers, Peter and Henry, who were an endless font of fascinating information about the ship. During one unfortunate cruise, eight senior citizens passed away. The onboard morgue held only six, so the extra two were stashed in the meat locker for the duration of the voyage. There was no reported change in the flavor of the Beef Wellington.

I asked if Cunard had ever performed burials at sea in these circumstances. They said they used to. But a few years back, an elderly billionaire, “Mr. Smith,” checked into a deluxe Q1 cabin with a hot young “Mrs. Smith” and then promptly expired. The grieving widow requested he be buried mid-Atlantic with the traditional yard of sail and a cannonball. When the ship docked at Southampton, a much older, real “Mrs. Smith” appeared to claim the body and sued the company when informed of his current disposition. So, no more burials at sea.

Yes, the ship did hit a whale once, which stuck to the bulbous bow. When it landed in Portugal, Cunard was fined for commercial fishing without a license. The unlucky cetacean’s skeleton is now in a Lisbon maritime museum. Apparently, this company gets sued a lot.

Of course, the memory of the sinking of the Titanic is ever present. There is a history display down on deck 2, and you can even have your photo taken in front of a backdrop of the grand staircase of the ill-fated ship. When we passed 10,000 feet over the wreck at 48 degrees, 38.50 minutes North, 50 degrees, 00.11 minutes West one day out of New York, the Queen Mary 2 let out three long blasts of its horn in memory of the lost. Cunard took over the Titanic’s White Star Line during the Great Depression and is, therefore, the inheritor of this legacy.

When I visited the computer center, I was stunned to learn that they were offering three-hour long classes on Apple products and programs every hour, all day long. They covered iMacs, iPads, iPhones, and all of the associated software and gizmos. I promptly signed up for five classes. Watch for my next webinar. It will be a real humdinger, with all the bells and whistles.

You would think that with 280 pounds of luggage, I could remember to bring a pair of black socks. It was not to be. So I headed out to the ballroom with my black tux and navy blue socks to tango, rhumba, and foxtrot with the best of them. The problem is that just as you twirl, the ship rolls, swiping the dance floor right out from under you. With several Octogenarian couples within range and my size, the consequences could have been fatal. Still, those oldsters really knew their steps. I really hope those pictures come out, especially the one of me on the dance floor, flat on my back.

Looking at the vast expanse of the sea outside my cabin window, I am reminded of the opening scenes of the 1950’s WWII documentary Victory at Sea. An endless, dark, tempestuous ocean churns and boils relentlessly. I am now even more awed by my early ancestors, who took three months to cross from Falmouth to Boston in a 50-foot-long wooden ship called the Pied Cow in 1630. They did this without navigation to speak of rotten food and a dreaded fear of sea monsters. What courage or religious ferocity must have driven them?

Four days of hearing foghorns is starting to get tiring. Captain Wells has been ducking many of his social responsibilities, feeling more secure in the bridge close to the radar. After a few days of intermittent access, the Internet is now gone for good, the satellite connection having given up the ghost. People are blaming everything from a lightning strike on the Virginia ground station to late-night watching of porn by the crew.

Instead of surfing the net, I am devoting more time to exercise in anticipation of my upcoming Swiss mountain climbing adventures. I have developed a careful routine where I fast walk three times around deck 7 in a brisk wind, take the elevator down to deck 1, walk up the stairs to deck 13, speed past the kennels, the practice golf range, two swimming pools, and a bar.

I can accomplish all of this three times in an hour and do it with 40 pounds of books stashed in my backpack. My butler, Peter, tells me there is always a certifiable nut case on every cruise, and I have been designated by the crew as “THE ONE”.

The 2,600 passengers are quite a mixed batch. We have 1,200 British, 750 Americans, 350 Germans, 80 Canadians, 4 dogs, three cats, and an assortment of other nationalities, and exactly one Japanese couple who didn’t speak a word of English.

I took pity on them and spent an evening translating and catching up on the world at large with them. He was a retired dance instructor, which explains why he and his wife owned the dance floor on most nights. They were grateful for the conversation, for during their entire 30-day cruise from New York to Southampton, then the Baltic Sea and the Norwegian fiords, then back to New York, they had no one to speak to. Still, that was better than last year, when they completed a 105-day round-the-world cruise with no one to talk to. Before they left, they gave me an exquisite, handmade, traditional Japanese purse as a gift.

Queen Mary II Passing Under the Verrazano Bridge

Your Intrepid Reporter

Breakfast on the High Seas

Check Out My New Digs

The Hard Life at Sea

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

"The government is now the biggest impediment to economic growth," said my old friend Steven Rattner of the Quadrangle Group.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.