Global Market Comments

December 26, 2013

Fiat Lux

Featured Trade:

(CHINA?S LONG AND WINDING ROAD), (FXI), (CYB),

(INDUSTIRES YOU WILL NEVER HEAR FROM ME ABOUT)

iShares China Large-Cap (FXI)

WisdomTree Chinese Yuan Strategy ETF (CYB)

Global Market Comments

December 24, 2014

Featured Trades:

(A CHRISTMAS STORY)

Global Market Comments

December 23, 2014

Fiat Lux

Featured Trade:

(INDIA IS CATCHING UP WITH CHINA),

(WHO SAYS HEDGE FUNDS AREN?T ADDING VALUE?)

(PIN), (FXI)

(PETER F. DRUCKER ON MANAGEMENT)

PowerShares India ETF (PIN)

iShares China Large-Cap (FXI)

According to my old friend, Rick Sopher, chairman of LCH Investments in London, the top ten hedge funds have earned $153 billion for their investors since inception.

Rick, who runs his business from an elegant flat on posh Eaton Square, compiled the list after a comprehensive survey of the still operating 7,000 hedge funds worldwide. It is dominated by marquee names like Bruce Kovner's Caxton and Louise Bacon's Moore Capital. Of the 100 largest funds, 95% have returned much of their investors' original capital, and are using the remaining profits to trade on.

Of course, the numbers show a huge survivor bias. They don't include the hundreds of billions of dollars lost by now shuttered 'wanabee' managers during the financial crash, largely with highly leveraged fixed income, spread oriented, 'low risk' strategies. Many of these are still in liquidation, peddling illiquid assets for pennies on the dollar through online auctions and elsewhere.

The numbers highlight the increasing barbell nature of the hedge fund industry. The biggest funds continue to attract the big bucks, and a steady wave of defections from Wall Street, are funding hundreds of new startups. But many mid-tier firms are getting nothing and are struggling to stay in business.

Global Market Comments

December 22, 2014

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE CHICAGO TUESDAY, DECEMBER 23 GLOBAL STRATEGY LUNCHEON)

(THE ONE BRIGHT SPOT IN REAL ESTATE),

(A SHORT HISTORY OF HEDGE FUNDS),

(THE POPULATION BOMB ECHOES), (POT), (MOS), (AGU),

(THANK GOODNESS I DON?T LIVE IN SWEDEN), (EWD)

Potash Corp. of Saskatchewan, Inc. (POT)

The Mosaic Company (MOS)

Agrium Inc. (AGU)

iShares MSCI Sweden (EWD)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Chicago on Tuesday, December 23. A three course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $219.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown Chicago venue on Monroe Street that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

I feel obliged to reveal one corner of this bubbling market that might actually make sense.

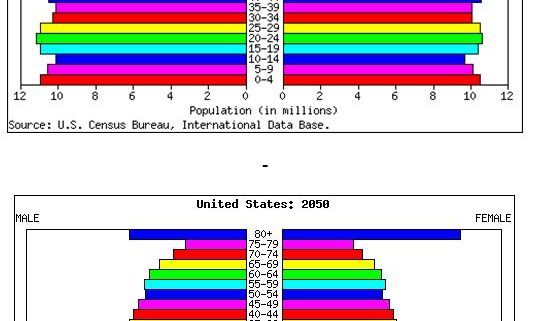

By 2050 the population of California will soar from 37 million to 50 million, and the US from 300 million to 400 million, according to data released by the US Census Bureau and the CIA fact Book (check out the population pyramid below).

That means enormous demand for the low end of the housing market, apartments in multi-family dwellings. Many of our new citizens will be cash short immigrants. They will be joined by generational demand for limited rental housing by 65 million Gen Xer's and 85 million Millennials enduring a lower standard of living than their parents and grandparents. These people aren't going to be living in cardboard boxes under freeway overpasses.

The trend towards apartments also fits neatly with the downsizing needs of 80 million retiring Baby Boomers. As they age, boomers are moving from an average home size of 2,500 sq. ft. down to 1,000 sq ft condos and eventually 100 sq. ft. rooms in assisted living facilities. The cumulative shrinkage in demand for housing amounts to about 4 billion sq. ft. a year, the equivalent of a city the size of San Francisco.

In the aftermath of the economic collapse, rents are now rising dramatically, and vacancies are shrinking. Fannie Mae and Freddie Mac financing is still abundantly available at the lowest interest rates on record. Institutions combing the landscape for low volatility cash flows and limited risk are starting to pour money in.

Pack your portfolios with agricultural plays like Potash (POT), Mosaic (MOS), and Agrium (AGU) if Dr. Paul Ehrlich is just partially right about the impending collapse in the world's food supply. You might even throw in long positions in wheat (WEAT), corn (CORN), soybeans (SOYB), and rice.

The never dull and often controversial Stanford biology professor told me he expects that global warming is leading to significant changes in world weather patterns that will cause droughts in some of the largest food producing areas, causing massive famines. Food prices will skyrocket, and billions could die.

At greatest risk are the big rice producing areas in South Asia, which depend on glacial run off from the Himalayas. If the glaciers melt, this crucial supply of fresh water will disappear. California faces a similar problem if the Sierra snowpack fails to show up in sufficient quantities, as it has for the past two years.

Rising sea levels displacing 500 million people in low-lying coastal areas is another big problem. One of the 80-year-old professor's early books The Population Bomb was required reading for me in college in 1970, and I used to drive up from Los Angeles to the San Francisco Bay area just to hear his lectures (followed by the obligatory side trip to the Haight-Ashbury).

Other big risks to the economy are the threat of a third world nuclear war caused by population pressures, and global plagues facilitated by a widespread growth of intercontinental transportation and globalization. And I won't get into the threat of a giant solar flare frying our electrical grid.

?Super consumption? in the US needs to be reined in where the population is growing the fastest. If the world adopts an American standard of living, we need four more Earths to supply the needed natural resources. We must to raise the price of all forms of carbon, preferably through taxes, but cap and trade will work too. Population control is the answer to all of these problems, which is best achieved by giving women an education, jobs, and rights, and has already worked well in Europe and Japan.

All sobering food for thought.

Buy Now While Supplies Last!

Buy Now While Supplies Last!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.