?When you look at the size of the US work force over the next 30 years, it is going to increase by 30%. That compares to Japan, where it is going to be shrinking, Europe, where it is contracting, and even China, where it turns down. The idea that the baby boomers are going to overwhelm this huge growth in the work force is a myth,? said Scott Minerd, Managing Partner of Guggenheim Partners.

Global Market Comments

November 4, 2014

Fiat Lux

Featured Trade:

(IS THERE A BITCOIN IN YOUR FUTURE?)

(TESTIMONIAL)

Global Market Comments

November 3, 2014

Fiat Lux

Featured Trade:

(JAPANESE YEN MELTS DOWN TO 12 YEAR LOW!),

(FXY), (YCS), (SPY), (TLT), (TBT), (DXJ),

(THERE ARE NO GURUS),

(WATCH OUT FOR THE MILLENNIAL VOTER)

(TESTIMONIAL)

CurrencyShares Japanese Yen ETF (FXY)

ProShares UltraShort Yen (YCS)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

WisdomTree Japan Hedged Equity ETF (DXJ)

Those who woke up early Friday morning may be forgiven for blinking at their screens quite a few times.

The Japanese yen (FXY), (YCS) was down by an incredible 3%, the Dow Average futures were trading at an all time high of $17,400, and the S&P 500 was just short of a new peak at $202.

The Japanese stock market blasted 5% to the upside, taking the Wisdom Tree Japan Hedged Equity ETF (DXJ) up a staggering 8%.

Was this a trick or treat?

It only took a few seconds for me to learn that this was all in reaction to bold moves announced by the Bank of Japan overnight. In one fell swoop, they boosted their target for monetary expansion this fiscal year from Y60 trillion to Y80 trillion, an instant gain of 33%, or $200 billion.

Prorate this number for the difference in out two nations? GDP?s, and that is like the Federal Reserve announcing a new $700 billion monetary stimulus program out of the blue. Quantitative easing is not dead. The baton has merely been passed from the US to Europe and Japan.

The bottom line for us? Asset prices everywhere go higher.

Of course, readers of the Mad Hedge Fund Trader knew all this was coming.

While taking profits yesterday on my Japan yen put spread, I cautioned holders of the ProShares Ultra Short Yen ETF (YCS) to hang on because the beleaguered Japanese currency was headed much lower.

Those who did so were richly rewarded with a one-day pop of $4.50 overnight to $79.50, an all time high.

Parsing through the BOJ statement, it?s clear that these spectacular, once a decade moves were justified.

When the Japanese government implemented a poorly conceived tax increase in April, the BOJ sat on its hands.

After sleeping through most of the year, the hand of Japanese central bank was finally forced by simultaneous weakness in Europe. It is now implementing the Fed QE policy lock, stock, and barrel, given the proven excellent results here in the US. They are only five years late!

An even bigger blockbuster was another announcement made by Japan?s government controlled Pension Investment Corp. that it was totally reshuffling its massive $1.2 trillion investment portfolio.

It is doubling its allocation to international equities from $150 billion to $300 billion. Given the dire conditions in Europe, you can count on most of that money going into the US stocks. That explains our gap up in the (SPX) this morning, and a similar move down in bonds (TLT), (TBT).

Here is their new Model Portfolio:

Domestic Bonds 35%

Domestic Stocks 25%

International Stocks 25%

International Bonds 15%

Total 100%

The net effect of all of this is to effect an epochal move out of bonds and into stocks, and also to increase international investments at the expense of domestic ones.

I believe this is the beginning of a prolonged world-wide investment trend.

The bottom line for us traders here is that the Japanese action opens up the possibility of an entire ?RISK ON? leg upward. This is occurring on top of one of the sharpest legs up in market history.

All of a sudden, my yearend target of $2,100 for the S&P 500 is firmly back on the table. If you have any outstanding short positions on your books, it is better to cover them at the earliest opportunity.

Tally Ho!

Global Market Comments

October 31, 2014

Fiat Lux

Featured Trade:

(NOVEMBER 5 GLOBAL STRATEGY WEBINAR),

(THE 2014 WORLD SERIES FROM YOUR BASEBALL CORRESPONDENT)

What a game! Burp.

The San Francisco Giants trounced the Kansas City Royals 3-2 in what had to be one of the most exciting games in World Series History. After winning four of seven games, the City by the Bay brings home the Commissioner?s Trophy for the third time in five years.

The Giants are starting to rival the incredible run enjoyed by the New York Yankees during the 1920?s. My grandparents went to every game 90 years ago, and enthralling me as a child with tales of Babe Ruth knocking the ball out of the park. Baseball runs in our blood in my family.

I attended game two in San Francisco, and spent the pregame completing my Christmas shopping for the year, feverishly buying commemorative baseballs, knit hats, and T-shirts at $40 a pop. China?s trade surplus must be soaring.

A Niagara Falls of beer was pouring out of the concession stands. The air was electric with enthusiasm. An entire flotilla of yachts and kayaks moored in McCovey cove, watching the game on iPhones, hoping for a home run to fly straight to them.

The F-16?s flew in formation 500 feet overhead right on cue, a GoPro camera broadcasting the cockpit view to a giant screen in the stadium.

Cool!

House Minority Leader, Nancy Pelosi, and California Lieutenant Governor, Gavin Newsome, sat just below me, where else, but in the left infield. In fact, a foul ball almost landed in the lap of the Pelosi.

Staring Giants pitcher, 25-year-old Madison Bumgarner, seemed to defy the laws of physics, using a slight, boyish frame to throw a sizzling 98 mile per hour fast ball. If he would only get a haircut! Are baseball players getting younger, or am I getting older?

I missed heavyweight, Juan ?The Panda? Sandoval, belt out a home run because I was stuck in the 30-minute line to get into the men?s room. The blue clad Royals cheering section went comatose, where else, but in the far upper right field bleachers.

Both sides threatened to score in every inning. We spent virtually the entire game standing on our feet screaming our lungs out.

Many thanks to the San Francisco Bay Area readers who emailed encouragement to me throughout the game. To the Kansas City readers who sent messages like ?Go Royals? when they scored, a pox on your houses, homesteads, teepees, or wherever you live in that God forsaken land.

When the Giants won their games, the fireworks exploded over the bay. The city ignited into celebration, with cars everywhere honking their horns and cable cars ringing bells.

Probably 100,000 poured out of packed bars into the streets for a huge nonstop party. Groping my way through the crowd, I almost got run over by the black GM Suburban?s of Nancy Pelosi?s Secret Service detail attempting a speedy exit.

I almost fell asleep on the last train home. If I had, I would have ended up at the end of the line at Pittsburgh/Bay Point, where I would have gotten mugged and lost all of my $40 T-shirts.

But I didn?t. I?m back to Earth today writing this letter with the mother of all hangovers. My clothes were so covered with spilled beer, cotton candy, and errant mustard and ketchup I undressed directly in the laundry room. Hopefully, the dry cleaner can figure out how to get the chewing gum off my prized Giants jacket.

To watch a two minute video of one of the most exciting games in history, please click here.

Global Market Comments

October 30, 2014

Fiat Lux

Featured Trade:

(FAREWELL TO QUANTITATIVE EASING),

(SPY), (TLT), (TBT), (FXE), (EUO), (FXY), (YCS),

(LNG), (BIDU), (TSLA),

(BAC), (MS), (GS), (AXP),

(AN EVENING WITH JAMES BAKER III),

(CONNECTING UP AMERICA)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

CurrencyShares Japanese Yen ETF (FXY)

ProShares UltraShort Yen (YCS)

Cheniere Energy, Inc. (LNG)

Baidu, Inc. (BIDU)

Tesla Motors, Inc. (TSLA)

Bank of America Corporation (BAC)

Morgan Stanley (MS)

The Goldman Sachs Group, Inc. (GS)

American Express Company (AXP)

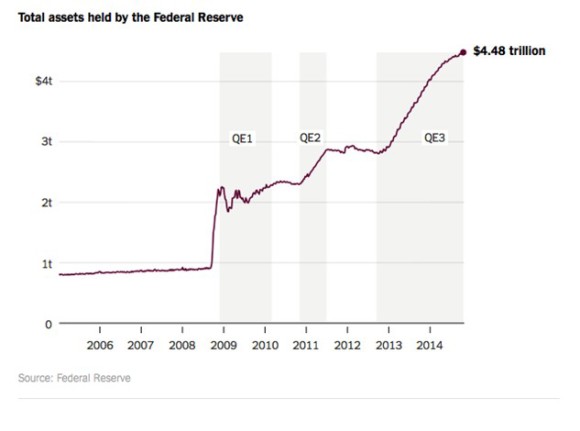

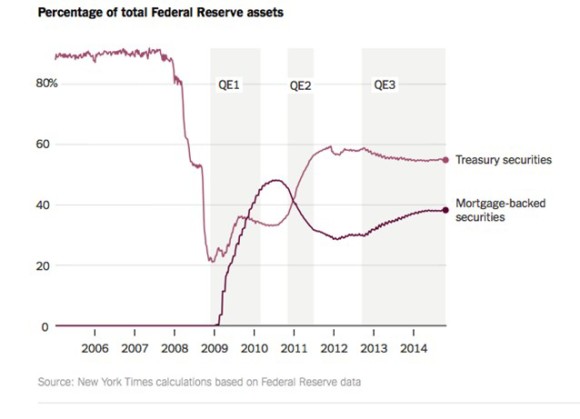

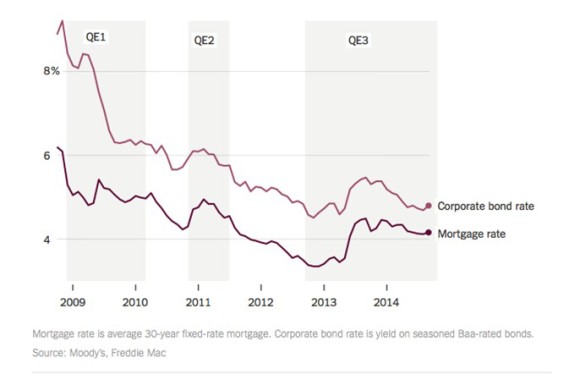

Finally, at long last, after infinite amounts of speculation and false starts, the Federal Reserve has decided to end quantitative easing.

After five years of soaking up both public and private debt in the marketplace, some $4.5 trillion worth, America?s central bank will quit picking up paper sometime next month. The printing presses are getting turned off and put into cold storage, job well done.

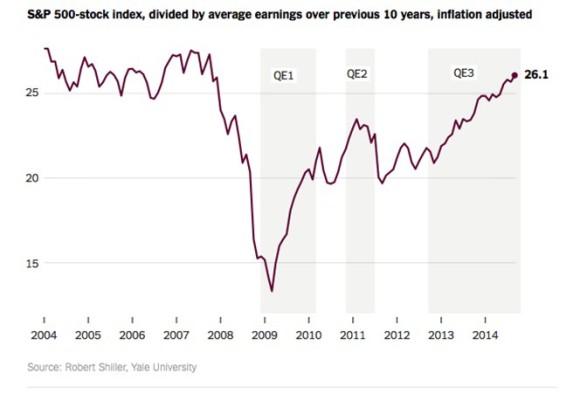

Boy, that was one hell of a monetary stimulus program, the likes of which has not been seen since the Great Depression. So much money flooded into the economy that homes values doubled on the bottom, stock indexes tripled, enriching quite a few traders along the way, including many followers of the Mad Hedge Fund Trader.

Who ended up making most of the money? Risk takers, equity owners, and the 1%. Everyone else was left in the dust, still waiting for the economic recovery to begin.

Since the controversial program was dreamed up and implemented by the former Fed governor, Ben Bernanke, five years ago, some $12 trillion was added to the value of equities alone. Some of my picks, like Cheniere Energy (LNG), Baidu (BIDU), ad Tesla (TSLA) soared by nearly 20 times.

Conservatives hated QE, fearing that such easy money would lead to hyperinflation and the collapse of the US dollar. The only problem is that the Consumer Price Index didn?t get the memo, with deflation now the country?s greatest economic threat. As I write this, the greenback is tickling new multiyear highs.

What QE did do was pull the US away from the brink of complete economic collapse. As far as the Fed is concerned, mission accomplished.

The other message that emanated from the Fed today is that it may raise interest rates sooner than expected. That trashed the bond market, taking Treasury bond yields to 2.35%, off an amazing 40 basis points from the low only two weeks ago.

There are some important points to take here for our trading strategy going forward.

First of all, the final top in bonds is looking more convincing by the day.

Second, the top in bonds, and slightly hawkish tone taken by the Fed today are extremely positive for the banks. I have already loaded up followers with Bank of America (BAC), which just pierced $17 on the upside and appears poised to claim new highs for the year.

I am inclined to add to this position on dips, and expand to my exposure to other names. On the menu are Morgan Stanley (MS), Golden Sachs (GS), JP Morgan (JPM), Wells Fargo (WFC), and American Express (AXP).

The dollar rocketed. Those who followed my recent Trade Alerts to aggressively sell short the Euro (FXE), (EUO) and the yen (FXY), (YCS) were sent laughing all the way to the bank.

I spoke to my colleague after the close today, ace Mad Day Trader, Jim Parker. We concluded that if the market doesn?t show any weakness Thursday morning, we could continue a straight line run up into the month end book closing on Friday, and then on to new all time highs.

I know it?s not gentlemanly to say ?I told you so,? but I told you so.

If you are bemoaning the loss of quantitative easing, don?t worry, it may not be gone for long.

When the economy goes into the tank in two or three years, it may well return from the dead in all its glory, especially if the inflation rate peaks in this cycle at an Appalachian 2.5% and then heads for negative numbers.

Will Quantitative Easing Return From the Dead?

Will Quantitative Easing Return From the Dead?

?We have 3,500 nuclear weapons left over from the cold war we don?t need, they take 20 seconds to re-aim, we?re not afraid to use them. And by the way, they?re already aimed at you.? That is the approach James Baker III thinks America should take with Iran, Ronald Reagan?s Chief of Staff and Secretary of the Treasury and George H.W. Bush?s Secretary of State.

At the same time we should be talking to the regime in Tehran, while doing everything we can to support the reformers, tighten sanctions, and enlist Europe?s help. Baker does not see a military solution in Iran, even though their potential to create instability in the region is enormous. This was one of dozens of amazing insights I gained chatting with the wily Texas lawyer during an evening in San Francisco.

Baker is happy to take on the ?America Bashers?, pointing out that the US still plays a dominant role in the UN, NATO, the IMF, and the World Bank. It accounts for 25% of global GDP, and its military is unmatched. The US spread globalization, and the spectacular growth of China and India is largely the result of open American trade policies, raising standards of living globally.

But the US can?t take its leadership role for granted. The biggest threats to American dominance are the runaway borrowing and entitlements. US debt to GDP will soar to over 100% in the near future, the highest level since WWII. This is unsustainable, is certain to bring a return of inflation, and unless dealt with, will lead to a long term American decline on the world stage.

Massive trade and capital flow imbalances also have to be addressed. The 84-year-old ex-Marine, who confesses to being the only Treasury Secretary in history who never took an economics class, believes that the advantageous rates that the government now borrows at are not set in stone.

Baker is the man who engineered an end to the cold war with a whimper, and not a bang. He thinks that ?even our power has its limits,? and that there is a risk of strategic overreach.? With the US politically evenly divided, Congress has degenerated from debating teams into execution squads, and consensus is impossible. The media are partly to blame, especially bloggers who propagate wild conspiracy theories, as confrontation sells better than accommodation.

Regarding the financial crisis, we need to end ?too big to fail? and embark on re-regulation, not strangulation. All in all, it was a fascinating few hours spent with a piece of living history who still maintains his excellent contacts in the diplomatic and intelligence communities.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.