It was with a mixture of nostalgia and awe that I attended the reunion luncheon celebrating the 72nd anniversary of America?s invasion of Guadalcanal. The event was hosted by my former division commander in Desert Storm, Major General Mike Myatt, at the Marines Memorial Association in San Francisco.

I was there to represent the family. My Uncle, Colonel Mitchell Paige, won the first Congressional Medal of Honor of WWII at Guadalcanal; single handedly wiping out 2,000 attacking Japanese in one night with his 30 caliber Brown machine gun (click here for ?Tribute to a True Veteran?).

My dad was there too, as a driver of a Steward light tank. My grandfather served in WWI, and historians tell me that I have a string of military heroes behind me that stretches all the way back to Valley Forge, where the first John Thomas served on George Washington?s staff.

I got plenty of dust under my fingernails myself, but lost a disc in my back from a plane crash, flying support missions for the First Marine Division in the Persian Gulf. Today I have three nephews serving in the Middle East in harm?s way, all in intelligence. So it is safe to say that my family has paid its dues in the defense of our country, and then some.

General Myatt delivered a lecture outlining the desperation and cruel arithmetic of the conflict. The Marines went in with virtually no intelligence and the few primitive maps they could scavenge from National Geographic Magazine against a Japanese army that until then had been undefeated. The US lost 7,000 men, 29 ships, and 600 aircraft. The Japanese lost 30,000 men, 37 ships, and many of their experienced pilots.

Japan never recovered from the blow, and played defense for the rest of the war. It was the single most important battle of the Pacific war. Afterwards, the Marines were sent to Melbourne, Australia for rest, wearing rags, often barefoot, but with weapons in perfect operating condition.

Whenever I give a strategy luncheon in that fair city, I never fail to thank my guests for the hospitality they once extended to my family. Today, a small case at the Melbourne Cricket Ground pays tribute to their sacrifice.

The youngest living Guadalcanal veteran today is 87, and eight of the elderly warriors made it to the reunion. Got to love that Marine health care plan! One 95 year old flew his own plane up from Los Angeles. Once a Marine, always a Marine.

I dined at a table with a van load of veterans from the California Veterans Hospital in Yountville, Napa Valley (click here if you want to, they need you).

One grizzled old sergeant told me that if a friend went missing at night, he was often found tied to a palm tree the next day, tortured to death.? Another time, a surrendering Japanese pulled a hand grenade out of his loincloth and threw it into a sympathetic, but gullible squad, with deadly results. Despite these atrocities, he respected the Japanese today as humble, respectful, and hard working. You don?t find these sentiments among the veterans of other nations at all.

Time has taken a toll on these aging vets more than the enemy ever could. Much of the conversation revolved around the daily aches and pains of living in your late eighties. Pulling out genuine anecdotes was difficult, often resulting in a canned memory dredged from a book or TV documentary produced decades after the event. Some may have been worried that if they did open the door to the past, they would dread what they found.

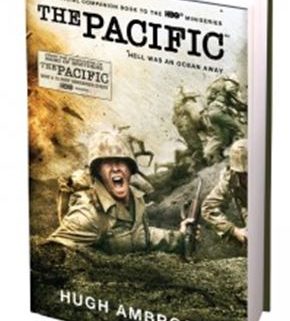

For a riveting account of the historic battle, please read ?The Pacific? by For a riveting account of the historic battle, please read ?The Pacific? by Hugh Ambrose.? You can purchase the book at Amazon by?clicking here. My uncle Mitch cooperated with Ambrose in the research for the book, which was the basis for the recently released and incredibly realistic HBO series of the same name.