I have to tell you that every year I do this, calling the market gets easier and easier. That’s because when you go from year 62 to 63 in the market, you actually learn quite a lot.

What gets more frustrating every year is convincing people to execute my trades because they are increasingly out of consensus, as opposed to conventional wisdom, tradition-shattering, or downright Mad.

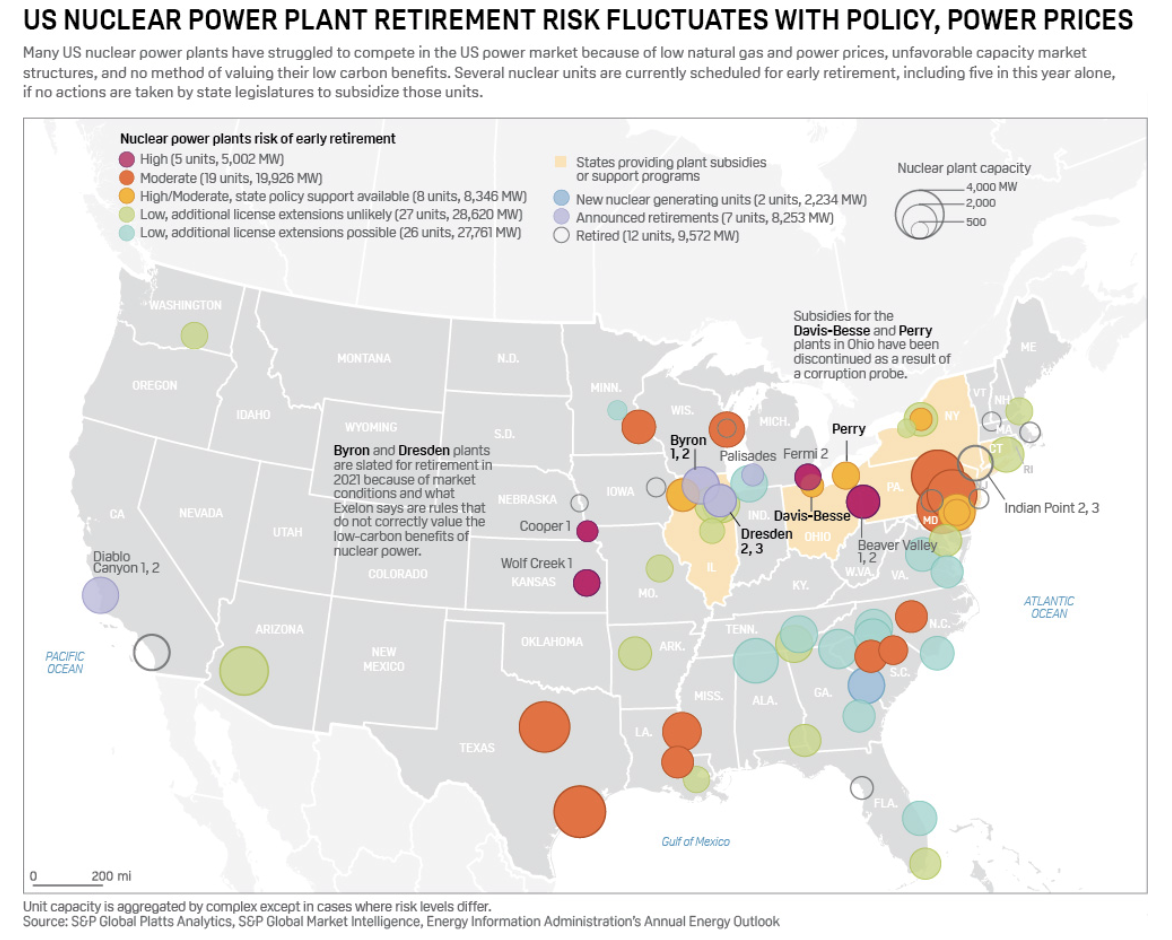

Nuclear stocks? Are you out of your mind? Haven’t you heard of Three Mile Island?

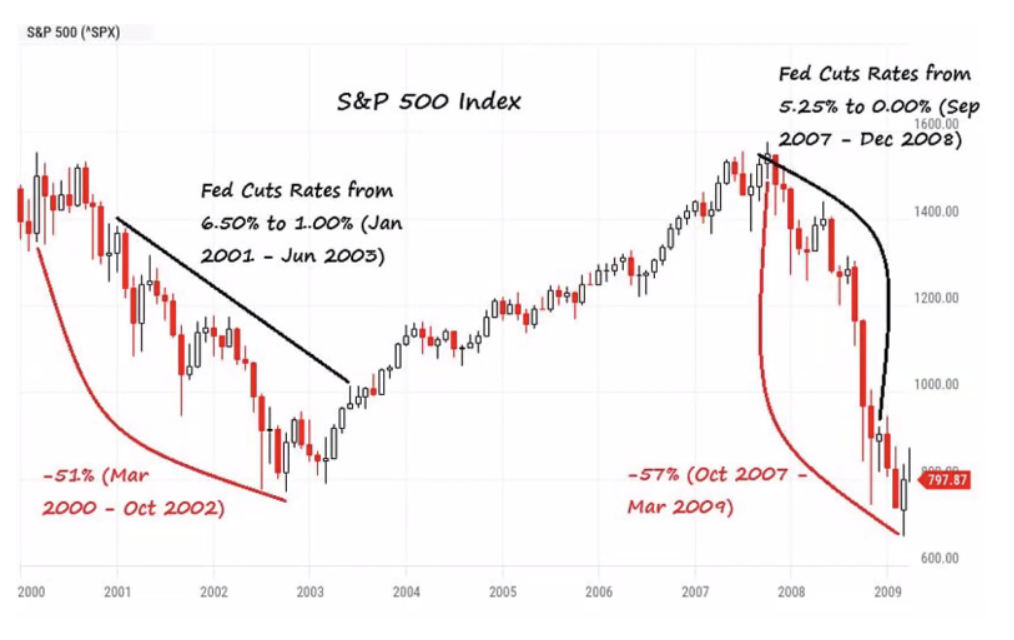

So, the Fed went with 50.

Initially, the stock reaction was “Oh my gosh, the free lunch is bigger than we thought!” By the close, this morphed to “Oh my gosh, the economy must be worse than we thought!” This opens the way to another possible 50 basis point rate cut in November, which happens to be the day after the presidential election. It only took 5 seconds for most investors to realize that they had way too much cash.

By acting so aggressively and out of character, Fed governor Jay Powell is admitting that he blundered, blew it, dropped the ball, and scored an own goal all at once by not lowering interest rates in July.

By doing his best impression of a deer frozen in the headlights in H1, all Powell got us were six more weeks of job losses, taking the headline Unemployment Rate up to 4.2%.

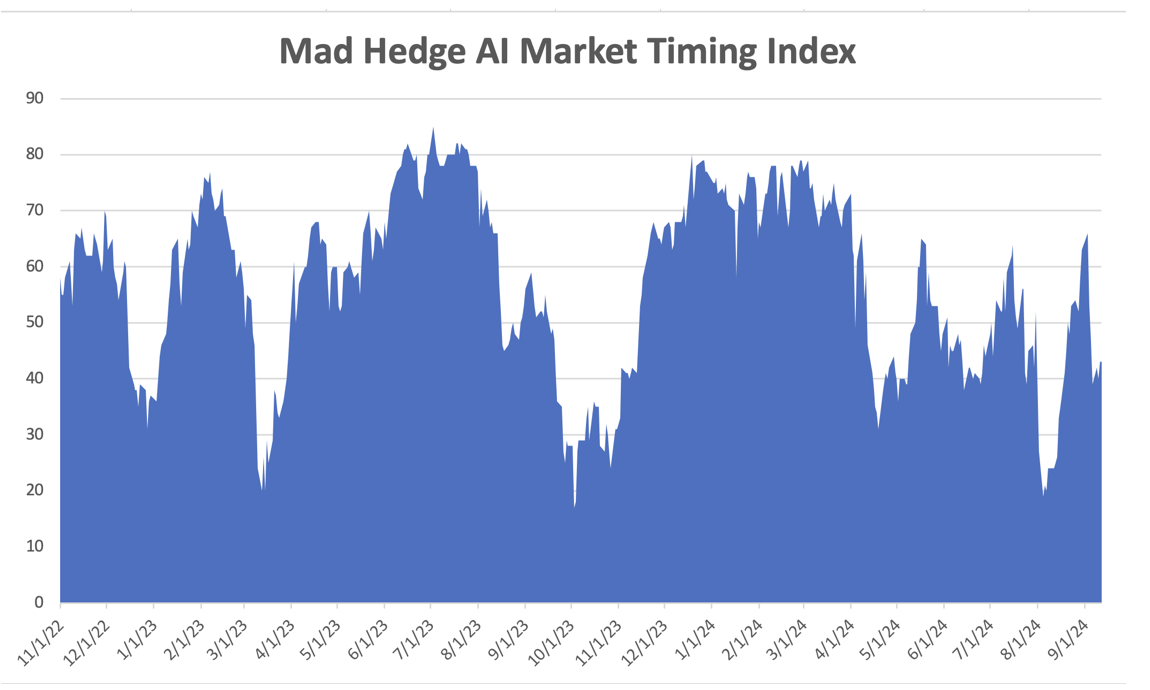

Don’t get too complacent though. Look at the chart below and you will see that when the Fed began an aggressive round of interest rate cuts in 2007, the market launched into a major crash of 57%.

Dow 42,000.

It may seem commonplace and ordinary for mere mortals to see this number. But for those of us who remember when it was only 600 back in 1982 (and predicted to immediately plunge to 300 by the late Joe Granville), we are now in the realm of science fiction.

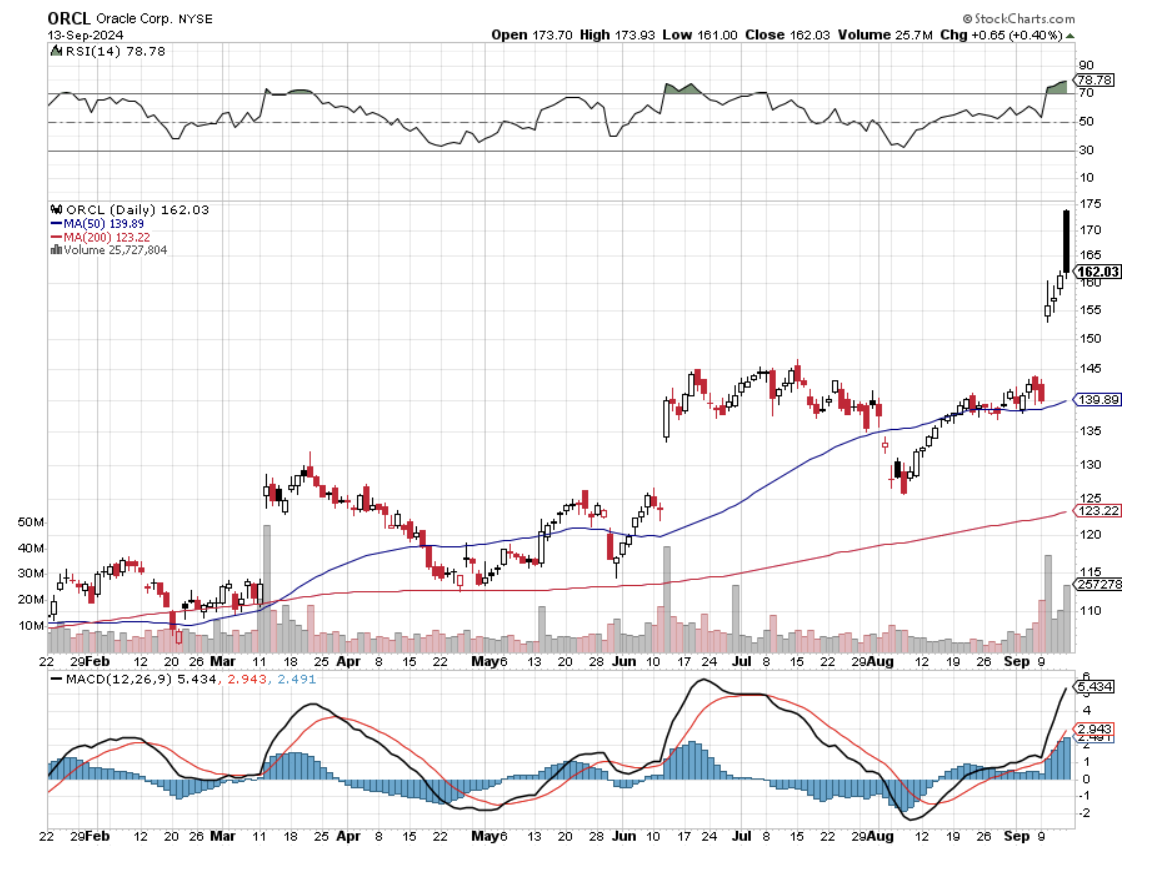

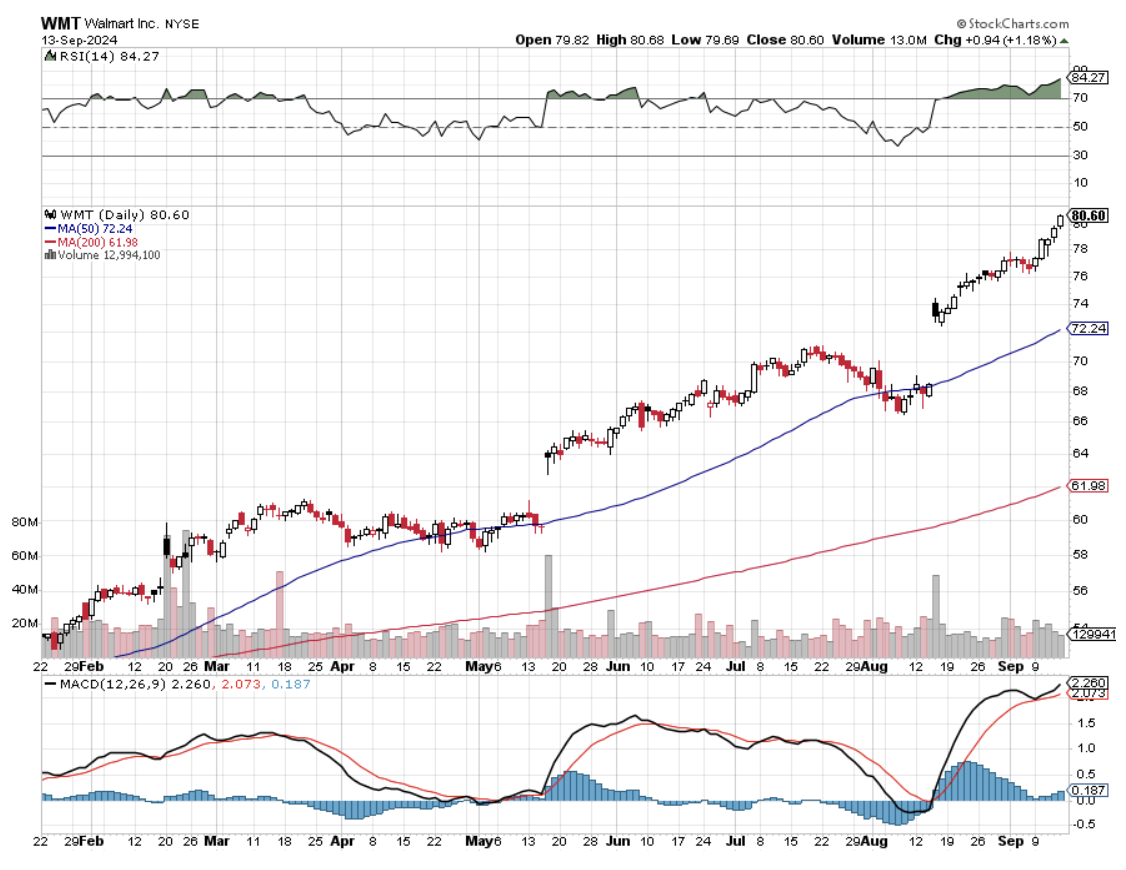

However, in Q3 this year, the character of the bull market suddenly changed, from a Dr. Jekyll to a Mr. Hyde. The Magnificent Seven has shrunk to the Pitiful Seven, with long boring sideways-range trades. In the meantime, growth and interest rate-sensitive value stocks that I have been pounding the table about for six months have begun trading like red-hot must-own biotech IPOs.

The choice is very simple. Do I buy a stock that has a single-digit price-earnings multiple that is flying like a bat out of hell, or do I choose an incredibly expensive tech stock with a PE multiple of 27X or worse that is stagnating?

I know what I’m going to do with my money, which reached new all-time highs almost every day this month. I’ll go with the former all day long.

Don’t get me wrong. The Mag Seven aren’t going to stay out of favor for very long. It’s like holding a basketball underwater that keeps inflating. Their earnings are still growing at an explosive rate. Personally, I think Nvidia (NVDA) will hit $160 a share by early 2025.

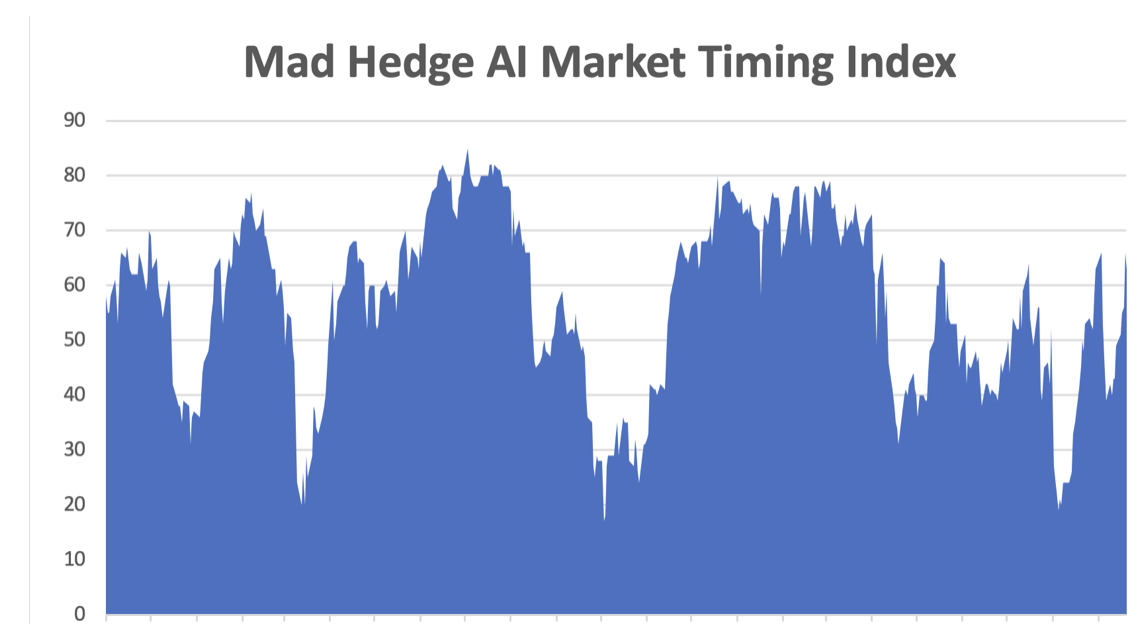

If there is one common factor in all financial markets today, it is the vast underestimation of the potential of AI and the impact on stock prices, which keeps surreptitiously sneaking into our lives every day.

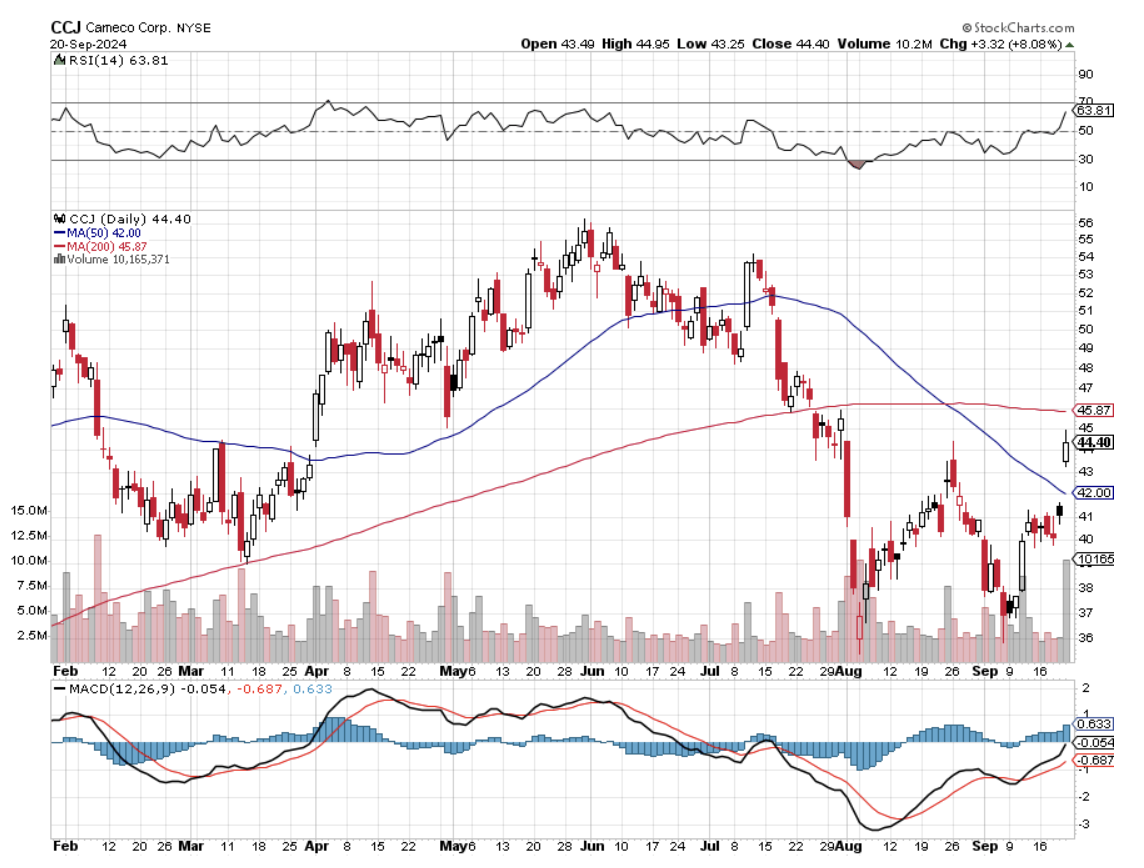

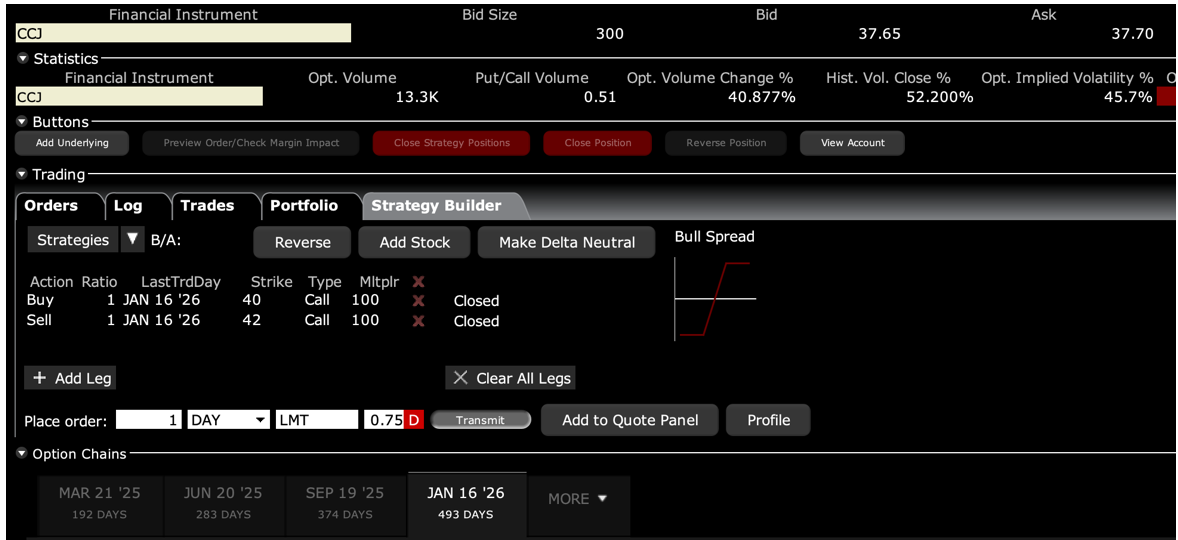

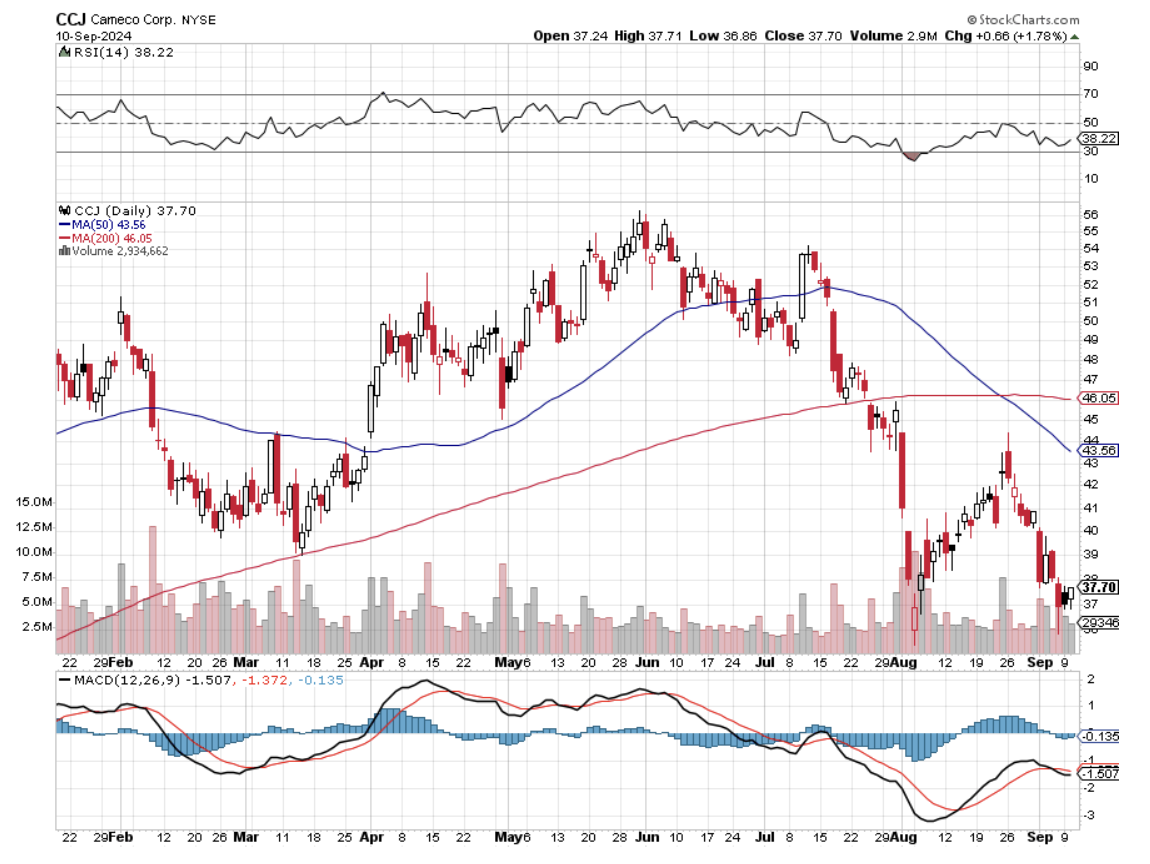

My Cameco (CCJ) trade alert came through in a week, immediately tacking on 10%. I have to tell you that reading my email, there is a lot of demand for positions that rise by 15% in a week. But that is better than the two-week wait for the Concierge clients who bought the 2026 $40-$42 LEAPS for only 75 cents. The consolation is that they will make a lot more money, potentially some 167% by expiration. The big money is always made with long-term trades.

I can honestly say that I put 54 years of work into this trade, dating back to when I started my work at the Atomic Energy Commission Nuclear Test Site in Nevada. While advanced nuclear power plant design and fuels (low enriched uranium oxide with an M5TM zirconium-based cladding) have been around for a long time, the industry had the kiss of death on it thanks to Three Mile Island (watch the movie China Syndrome), Chornobyl, and Fukushima.

It was going to take someone bold with deep pockets to restart this industry. Then out of the blue Microsoft (MSFT) announced the reopening of Three Mile Island, the site of the worst nuclear accident in US history in 1979.

Constellation Energy announced Friday that its Unit 1 reactor, which closed five years ago, is expected to be revived in 2028, dependent on Nuclear Regulatory Commission approval. Microsoft will purchase the carbon-free energy produced from it to power its data centers to support artificial intelligence.

Twelve U.S. nuclear power reactors have permanently closed since 2012, with the most recent being Indian Point 3 on April 30, 2021. Another seven U.S. reactor retirements have been announced through 2025, with a total generating capacity of 7,109 MW (equal to roughly 7% of U.S. nuclear capacity).

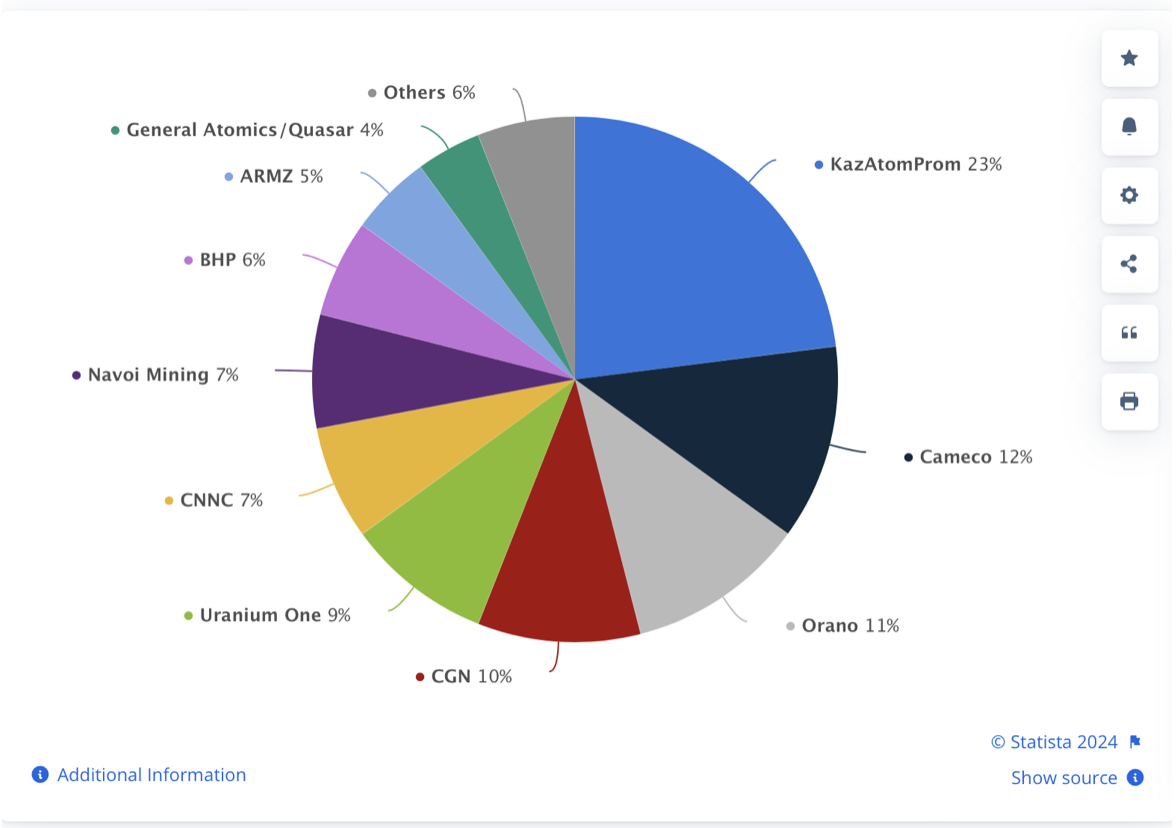

I have a feeling that all of these will get reopened, which cost about $4 billion each to build and can be bought now for pennies on the dollar. In the meantime, the world’s largest uranium supplier, Kazakhstan, is cutting supplies. Buy all nuclear plays in dips.

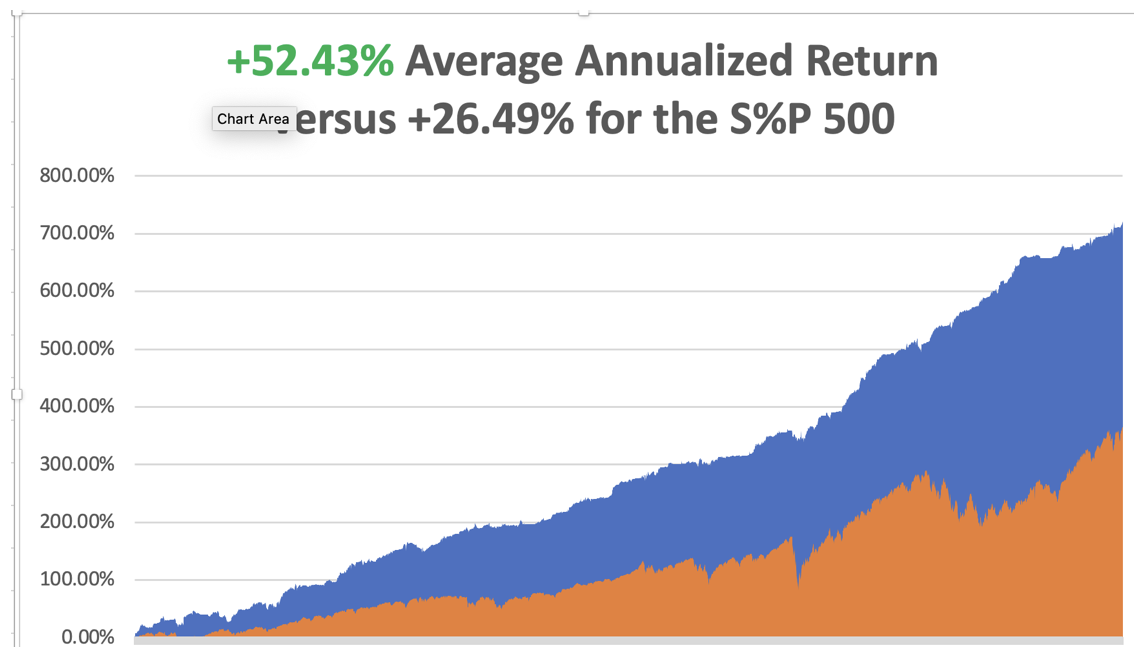

I have to tell you that this was one of those weeks that by making 6.74% it makes all the barbarically early mornings and exhausting late nights worth it. While all my friends are working on their golf swings or improving their bowling scores, I am scoring the Internet search for the next original investment theme. Every customer I have spoken to lately is having a great year.

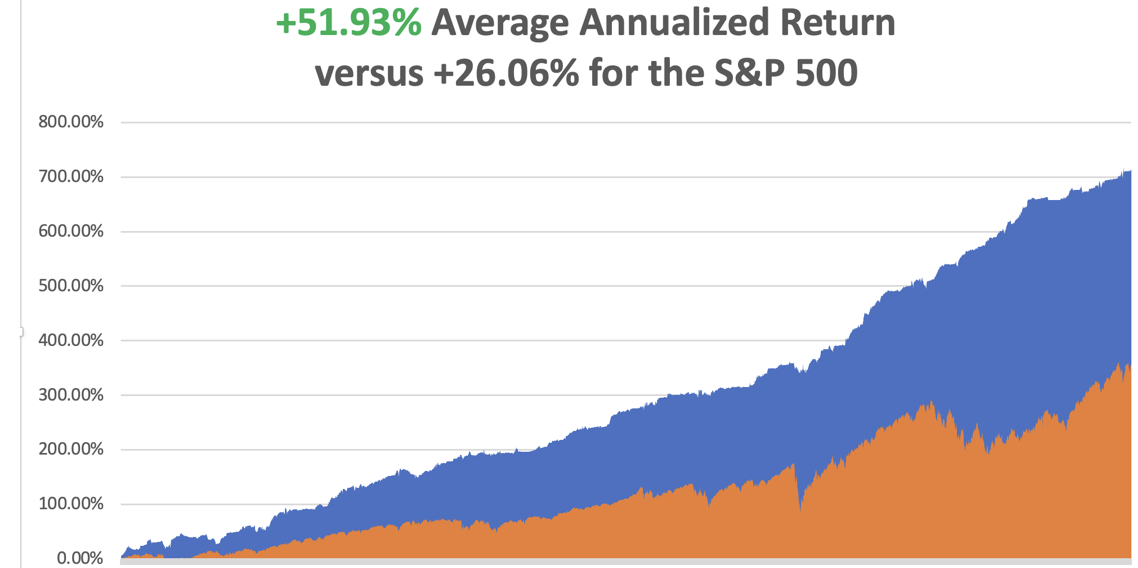

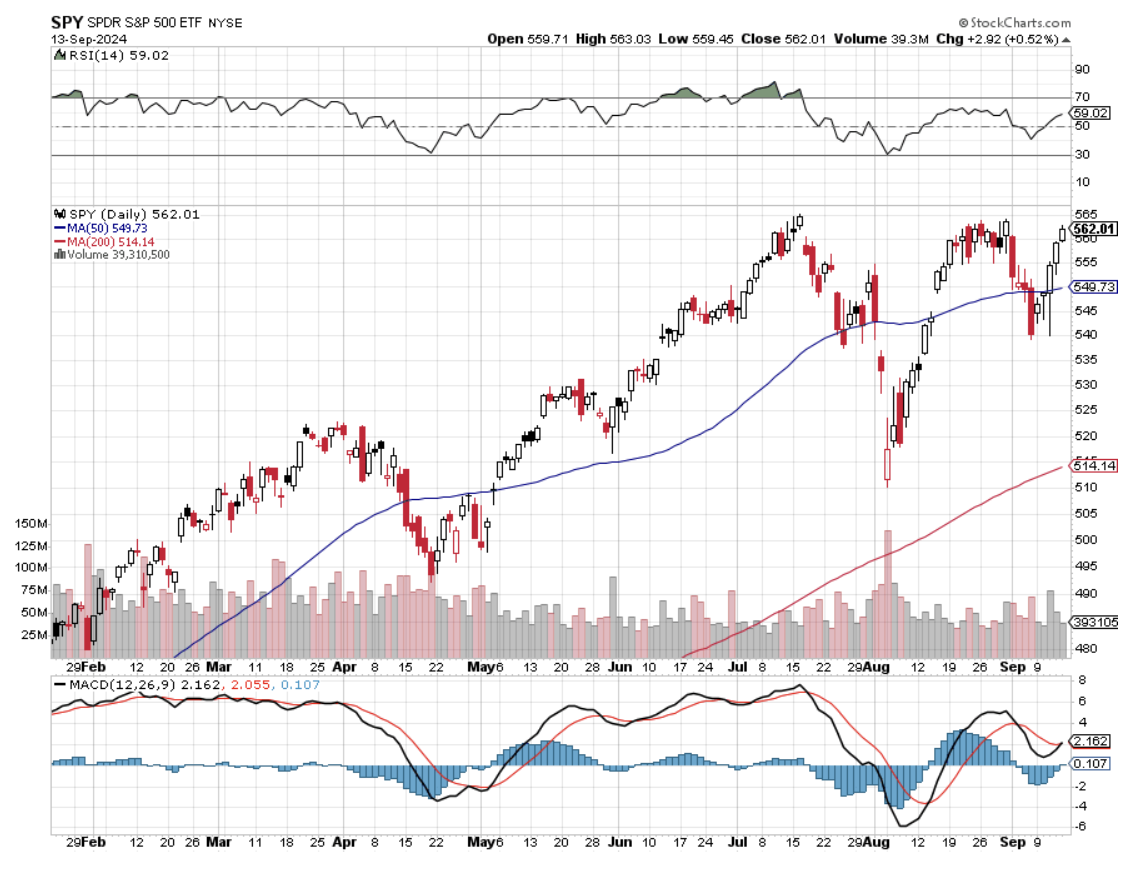

So far in September, we are up by a spectacular +9.67%. My 2024 year-to-date performance is at +44.36%. The S&P 500 (SPY) is up +19.08% so far in 2024. My trailing one-year return reached +63.00%. That brings my 16-year total return to +720.99%. My average annualized return has recovered to +52.43%.

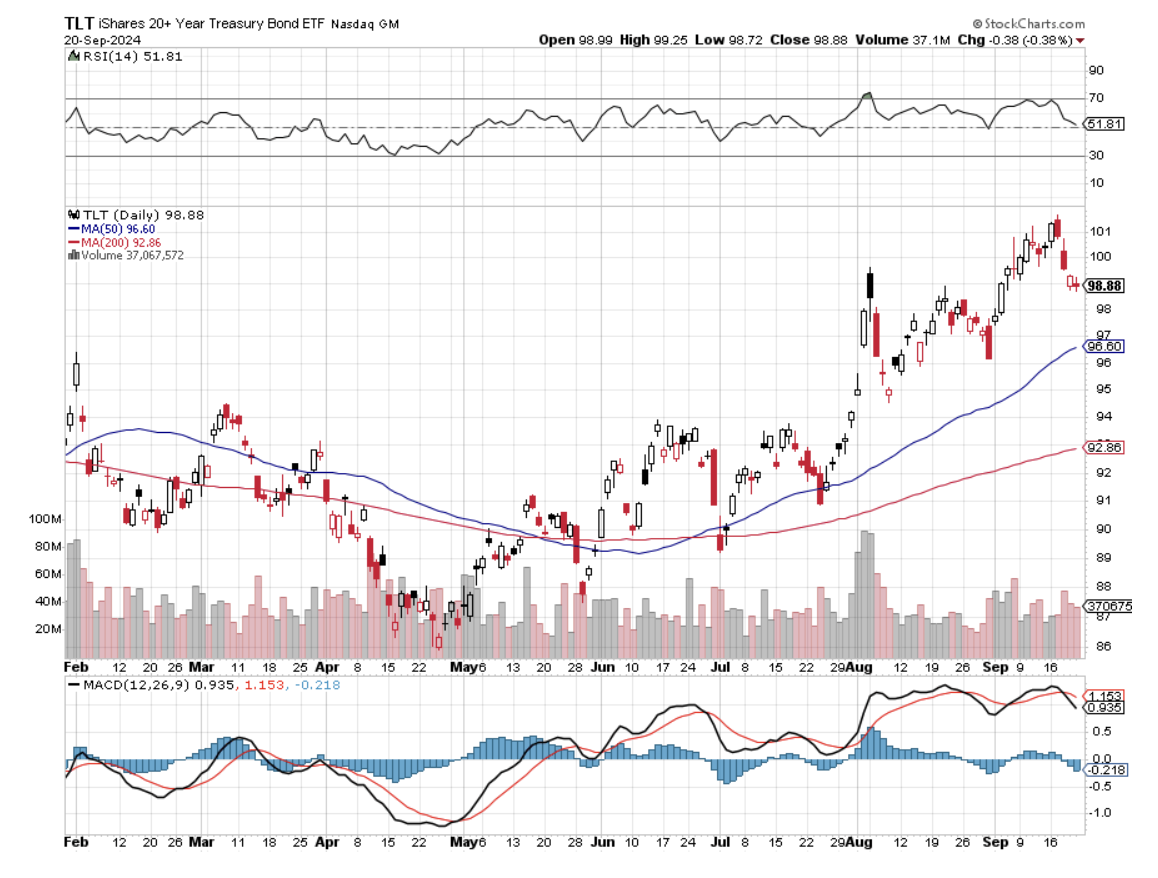

I front-ran the Fed move by adding positions in interest rate sensitives like (GLD), (NEM), and (TSLA). I added (CCJ) based on the arguments above. Once the Fed showed its hand, I added another interest rate sensitives with (DHI). I also added a short in (TLT).

My logic on (TLT) was very simple. I think it is safe to say that we won’t have any downside surprises in interest rates until the next Fed meeting on November 6. We don’t even get a Nonfarm Payroll Report until October 4.

In any case, the bond market has already fully priced in half of the 250 basis points worth of interest rate cuts now discounted by the June Fed futures markets. We have just witnessed a massive $20 rally off the (TLT) bottom. Upside surprises in prices from here should be nil.

If you couldn’t get into (TLT), you are not alone. As soon as the big hedge funds saw my trade alerts, they started hammering not only the options market but the underlying bond market as well with several large $100 million sales. That pushed the trade to near max profit almost immediately and made my trade alert impossible to execute.

At The Economist, they used to say that imitation is the sincerest form of flattery.

Some 63 of my 75 round trips, or 90%, were profitable in 2023. Some 57 of 75 trades have been profitable so far in 2024, and several of those losses were break-even. That is a success rate of +76%.

Try beating that anywhere.

FedEx Gets Crushed 10%, on disappointing earnings and guidance. Cost control is a big issue. Right now, investors are presented with the Dow Industrials at all-time highs and Transports barely positive for the year. Transports are up just 2.7% year to date, and a 13% drop in FedEx shares early Friday will likely drag it into the red for 2024. Buy (FDX) on dips, a great economic recovery play.

Existing Home Sales Drop 4.2%, in August to a seasonally adjusted annualized rate of 3.86 million units, according to the National Association of Realtors. There were 1.35 million units for sale at the end of August. That’s up 0.7% from July and up 22.7% year over year. median price of an existing home sold in August was $416,700, up 3.1% from August 2023, a new all-time high. Real estate should pick up once lower interest rates feed through.

Weekly Jobless Claims Hit 4 Month Low at 219,000. This flies in the face of yesterday’s 50 basis point rate cut by the Fed yesterday based on a weakening jobs market.

Alaska Airlines Takeover of Hawaiian Gets Approval, in a rare case of agreement from the government. The Feds have opposed the most concentration of industry. I think without the deal Hawaiian would have gone under. Expect prices to go and services to decline. Avoid the airlines.

Berkshire Hathaway Cash Approaches $300 Billion. Berkshire ended the second quarter with cash and equivalents (mostly Treasury bills) of $277 billion, up from $168 billion at year-end 2023, mostly due to heavy sales of Apple (AAPL). It highlights how much money is sitting on the sidelines waiting to come in on the next dip. It's also an indication that in the 75 years of Warren Buffet’s investing experience, stocks are expensive.

The Entire Energy Sector is About to Double, once the Chinese economy starts to recover. A recovering US economy powered by lower interest rates will also help. Everything from oil futures to master limited partnerships and stocks are on sale with the highest dividends in the market. It’s almost the only place Warren Buffet is buying.

Amazon Puts AI to Work, using it to plan new delivery routes which saves time and millions of gallons of gasoline. It’s a simple application with vast results. It all goes straight to the bottom line. AI is spreading throughout the economy far faster than most people realize. Buy (AMZN) on dips.

Foreign Direct Investment into China Collapses, down 31.5% in the first eight months of 2024 the Chinese Commerce Ministry said on Saturday. This could be a drag on the recovery of global commodity prices.

US Import Prices are in Free Fall, showing the biggest drop in eight months in August, driven by a broad decline in the costs of goods.

Ebbing price pressures give the Federal Reserve ample room to focus on the labor market which has slowed considerably from last year's robust job growth. Expectations of lower interest rates as well as slowing inflation results are making people feel better about the outlook for the economy.

Foreign Investors Pour $31 Billion into Emerging Markets in August. Fixed income funds ex-China accounted for $27.8 billion of inflows, with $1.4 billion funneled to Chinese debt, the data show. The net inflow to stocks stood at $1.7 billion despite a $1.5 billion outflow from Chinese equities. It’s all about falling US interest rates and a US dollar that is expected to be weak for years.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, September 23 at 8:30 AM EST, the S&P Global Flash PMI

is out

On Tuesday, September 24 at 6:00 AM, the S&P Case Shiller National Home Price Index is released.

On Wednesday, September 25 at 7:30 AM, New Home Sales are printed.

On Thursday, September 26 at 8:30 AM EST, the Weekly Jobless Claims are announced. We also get the final read on Q2 GDP.

On Friday, September 27 at 8:30 AM, we learn the Fed’s favorite inflation indicator, the Core PCE Price Index. At 2:00 PM EST, the 2:00 PM the Baker Hughes Rig Count is printed.

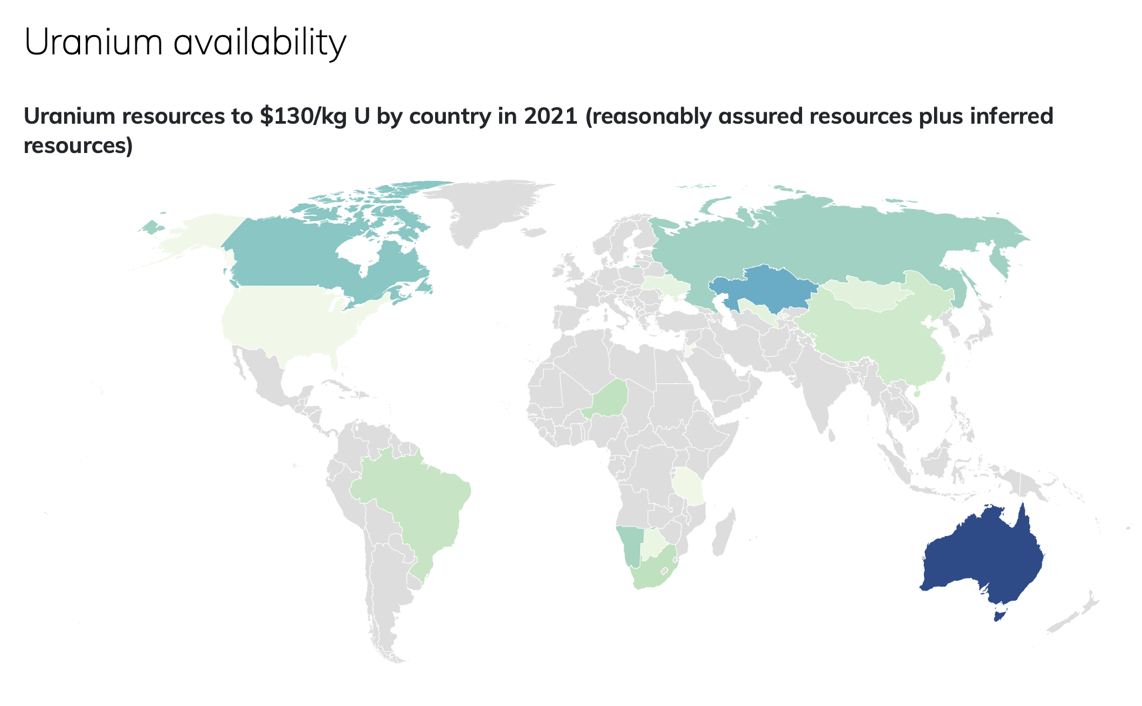

As for me, when the Cold War ended in 1992, the United States judiciously stepped in and bought the collapsing Soviet Union’s entire uranium and plutonium supply.

For good measure, my client George Soros provided a $50 million grant to hire every Soviet nuclear engineer. The fear then was that starving scientists would go to work for Libya, North Korea, or Pakistan, which all had active nuclear programs. They ended up here instead.

That provided the fuel to run all US nuclear power plants and warships for 20 years. That fuel has now run out and chances of a resupply from Russia are zero. The Department of Defense attempted to reopen our last plutonium factory in Amarillo, Texas, a legacy of the Johnson administration.

But the facilities were deemed too old and out of date, and it is cheaper to build a new factory from scratch anyway. What better place to do so than Los Alamos, which has the greatest concentration of nuclear expertise in the world?

Los Alamos is a funny sort of place. It sits at 7,320 feet on a mesa on the edge of an ancient volcano so if things go wrong, they won’t blow up the rest of the state. The homes are mid-century modern built when defense budgets were essentially unlimited. As a prime target in a nuclear war, there are said to be miles of secret underground tunnels hacked out of solid rock.

You need to bring a Geiger counter to garage sales because sometimes interesting items are work castaways. A friend almost bought a cool coffee table which turned out to be part of an old cyclotron. And for a town designing the instruments to bring on the possible end of the world, it seems to have an abnormal number of churches. They’re everywhere.

I have hundreds of stories from the old nuclear days passed down from those who worked for J. Robert Oppenheimer and General Leslie Groves, who ran the Manhattan Project in the early 1940s. They were young mathematicians, physicists, and engineers at the time, in their 20’s and 30’s, who later became my university professors. The A-bomb was the most important event of their lives.

Unfortunately, I couldn’t relay this precious unwritten history to anyone without a security clearance. So, it stayed buried with me for a half century, until now.

Some 1,200 engineers will be hired for the first phase of the new plutonium plant, which I got a chance to see. That will create challenges for a town of 13,000 where existing housing shortages already force interns and graduate students to live in tents. It gets cold at night and dropped to 13 degrees F when I was there.

I was allowed to visit the Trinity site at the White Sands Missile Test Range, the first visitor to do so in many years. This is where the first atomic bomb was exploded on July 16, 1945. The 20-kiloton explosion set off burglar alarms for 200 miles and was double to ten times the expected yield.

Enormous targets hundreds of yards away were thrown about like toys (they are still there). Half the scientists thought the bomb might ignite the atmosphere and destroy the world but they went ahead anyway because so much money had been spent, 3% of US GDP for four years. Of the original 100-foot tower, only a tiny stump of concrete is left (picture below).

With the other visitors, there was a carnival atmosphere as people worked so hard to get there. My Army escort never left me out of their sight. Some 78 years after the explosion, the background radiation was ten times normal, so I couldn’t stay more than an hour.

Needless to say, that makes uranium plays like Cameco (CCJ), NextGen Energy (NXE), Uranium Energy (UEC), and Energy Fuels (UUUU) great long-term plays, as prices will almost certainly rise and all of which look cheap. US government demand for uranium and yellow cake, its commercial byproduct, is going to be huge. Uranium is also being touted as a carbon-free energy source needed to replace oil.

At Ground Zero in 1945

What’s Left of a Trinity Target 200 Yards Out

Playing With My Geiger Counter

Atomic Bomb No.3 Which was Never Used in Tokyo

What’s Left from the Original Test

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader