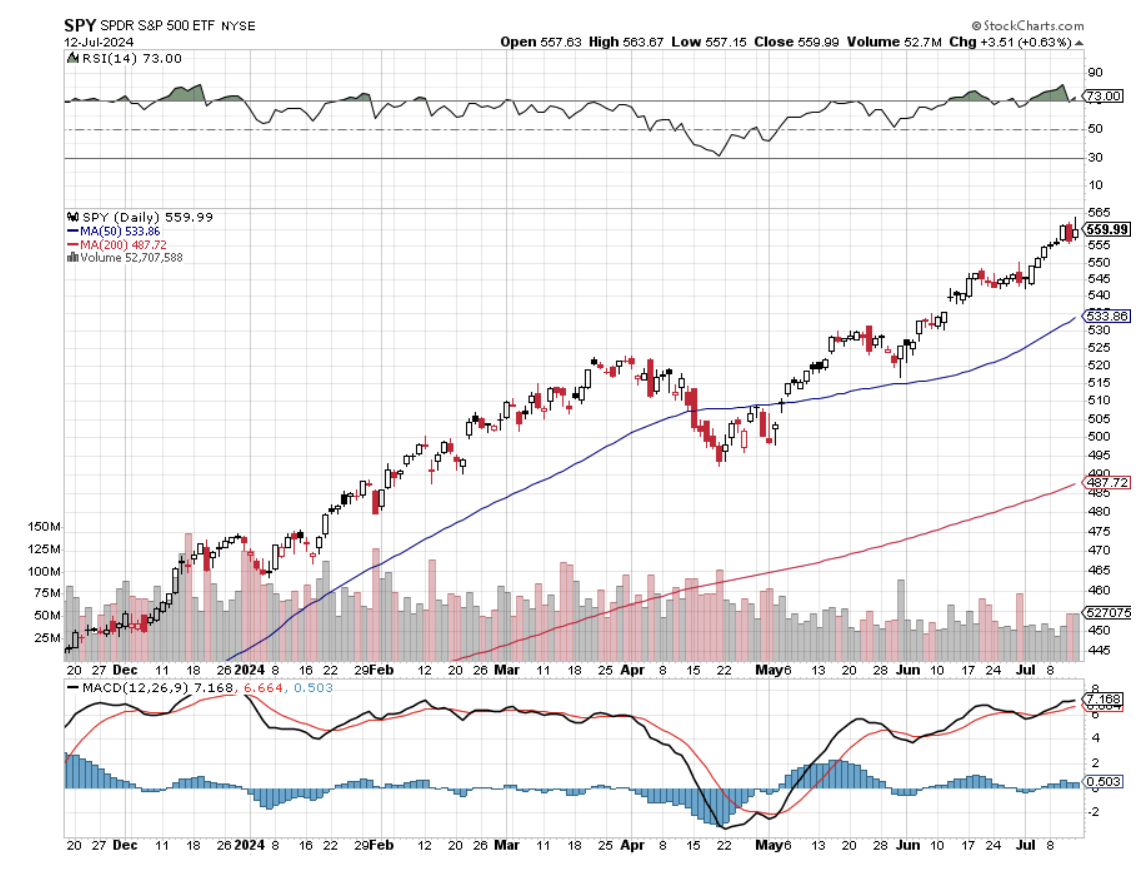

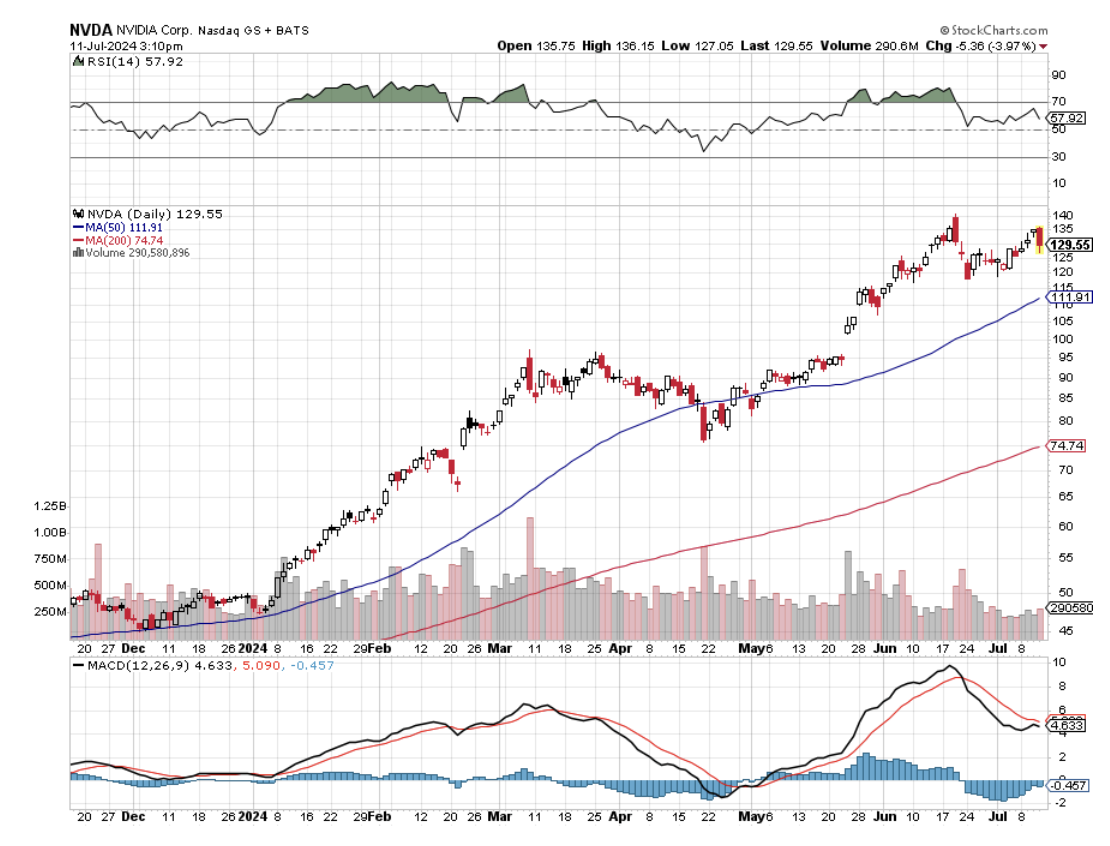

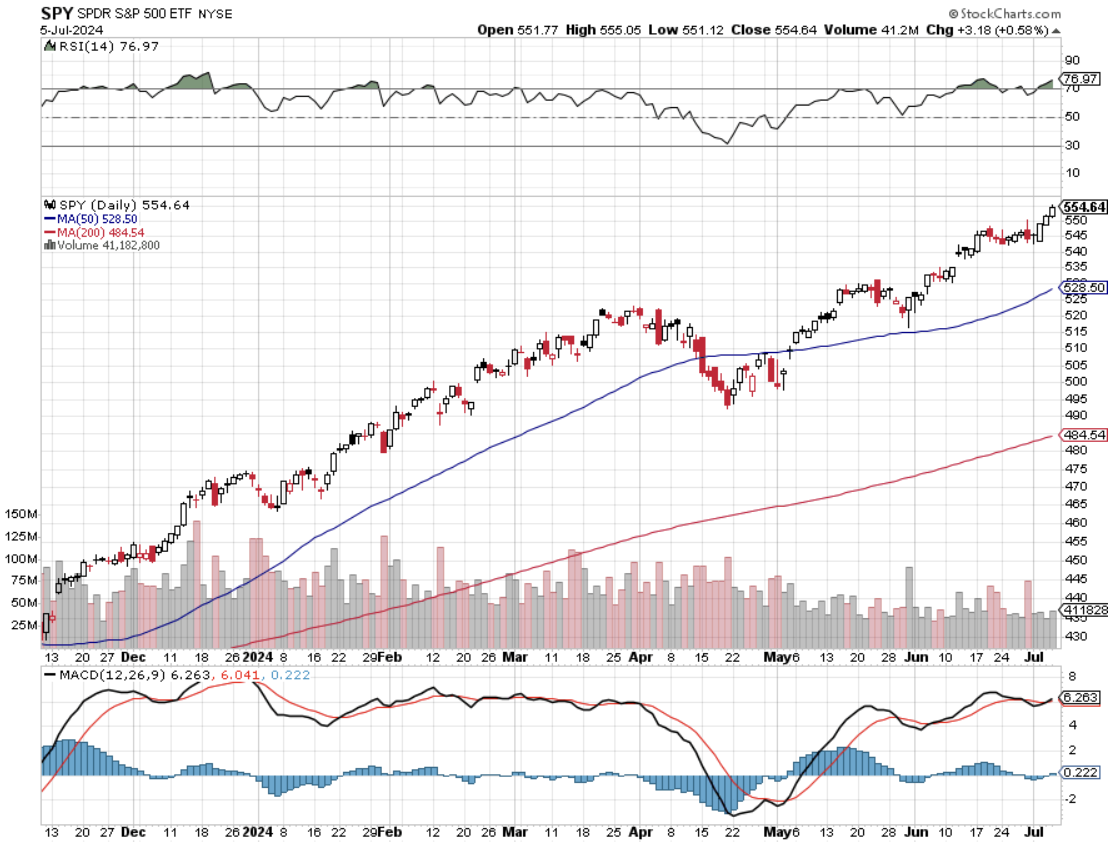

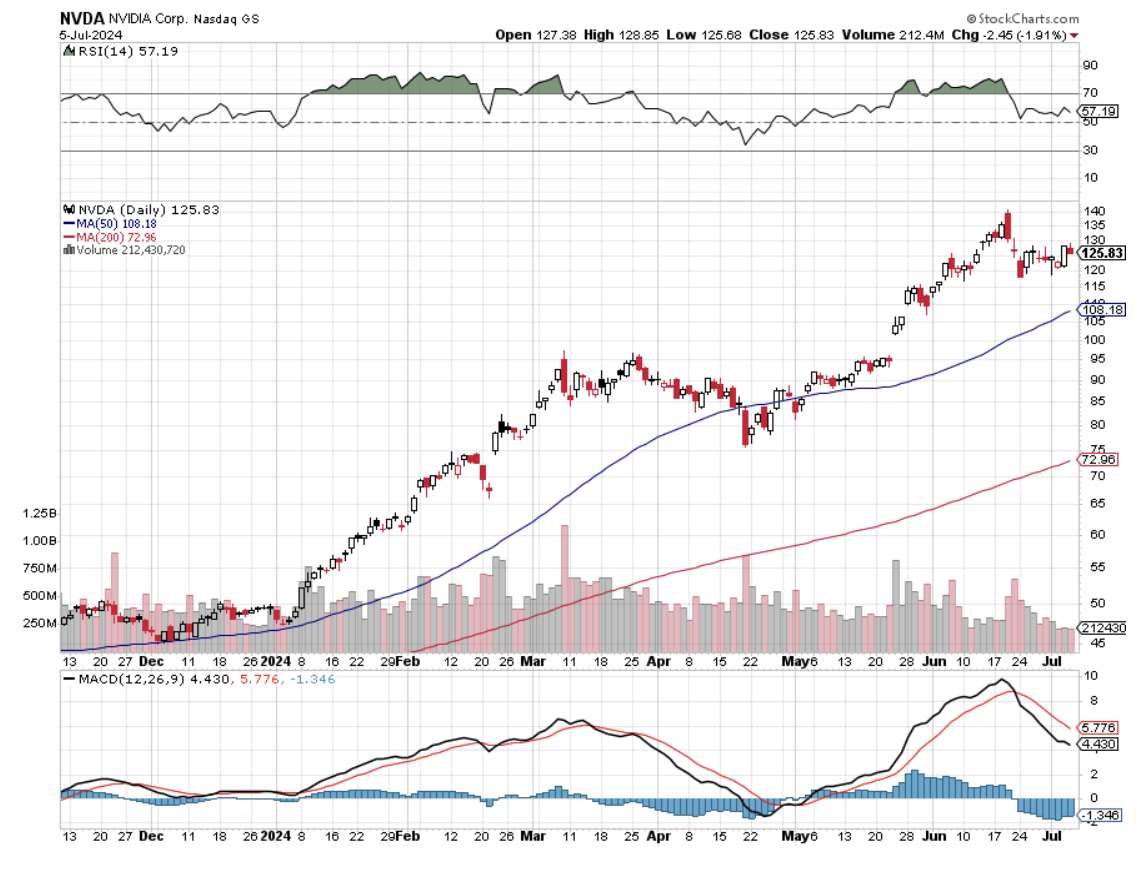

I believe there was a major sea change in the markets last week, which has taken the economy from inflation to deflation. All asset classes performed as they should, with some extreme moves. It is now time to focus on the 493 of the S&P 500 and let the Magnificent Seven take a long-needed rest.

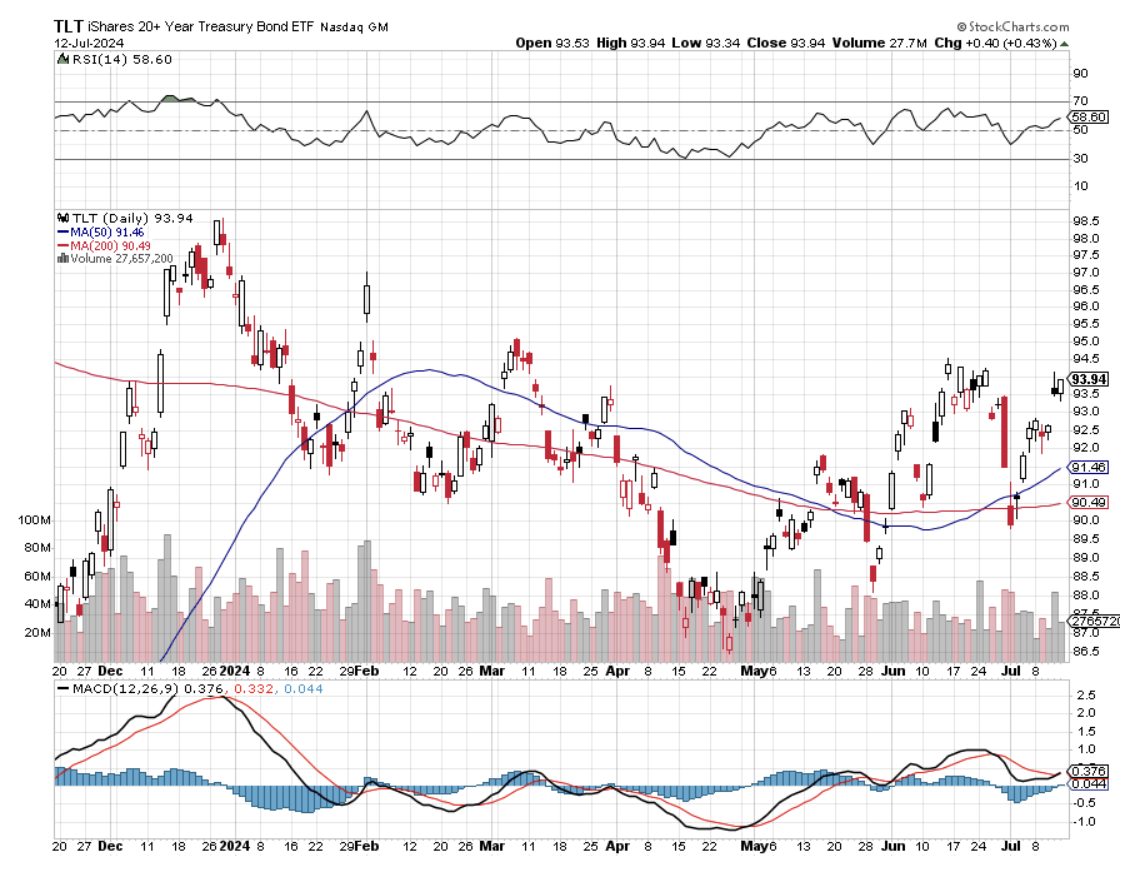

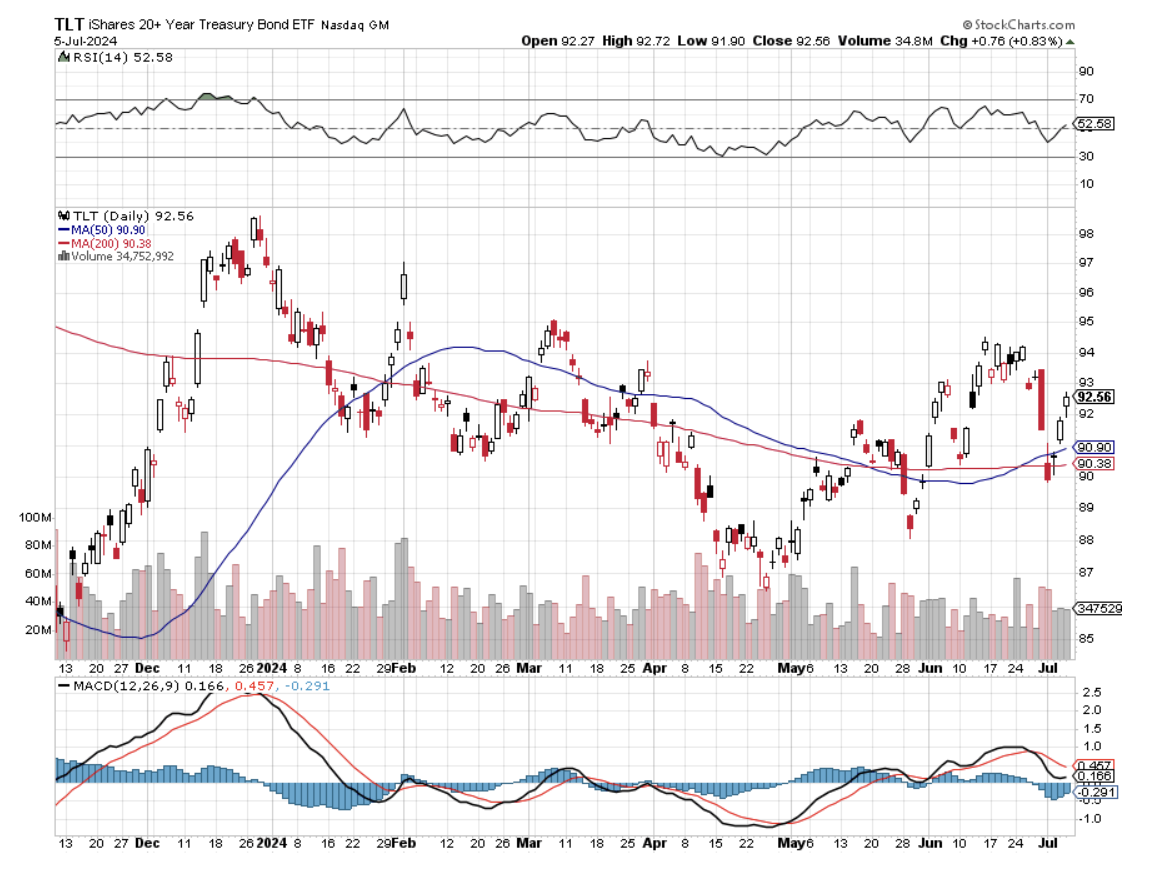

Not only does this pave the way for a Fed interest rate cut in September, but several more to follow. This opens the floodgates for the (TLT) to rise above $100 by yearend, and maybe even to $110. Remember the old high for bonds is $166. Higher beta fixed-income plays will rise much more.

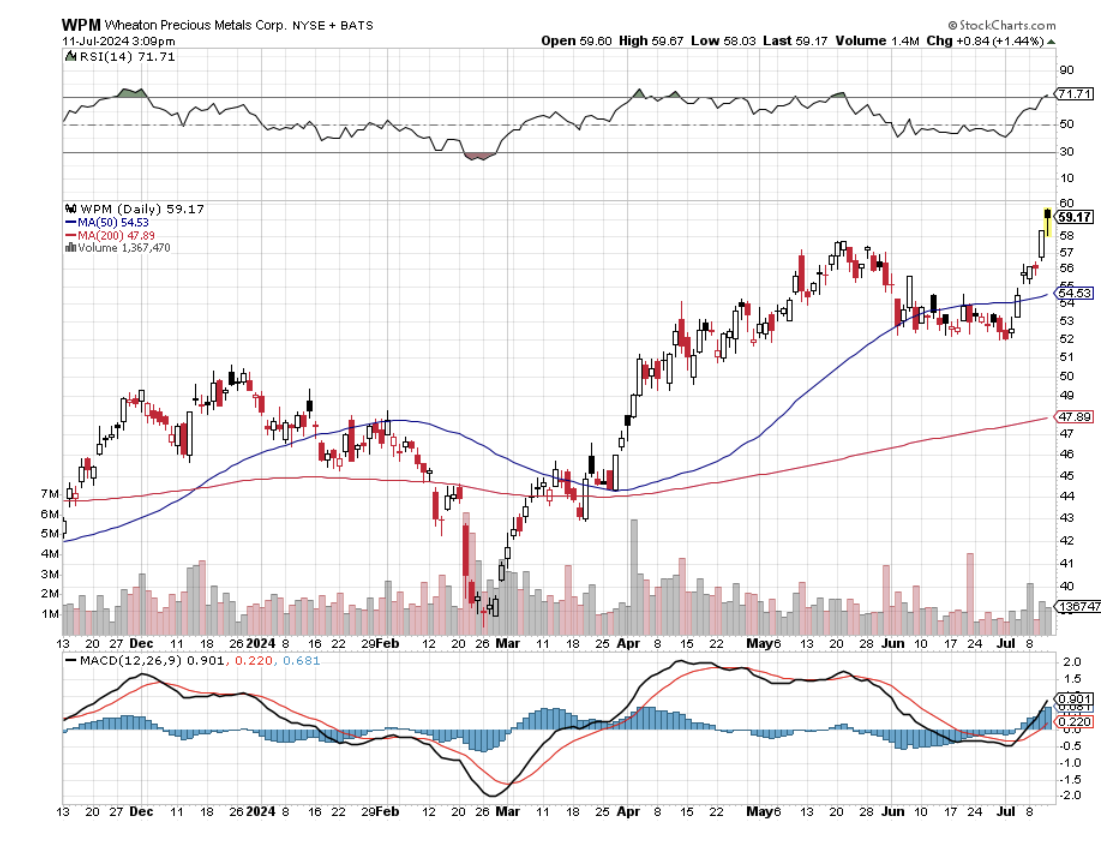

Stocks will keep rising but with different leadership from dozens of interest-sensitive sectors, including real estate, their suppliers, industrials, precious metals, financials, energy, and outright value plays long left in the doghouse. If you can’t grasp these new trends, your portfolio will be out to sea shortly. An S&P 500 of 6,000 looks like a pretty safe bet by yearend.

That brings to the fore investment in fixed-income securities. There are two ways to make money on a fixed income. Coupon interest rates are still at historically high levels. And as rates fall, fixed-income prices rise, opening the door to capital gains, which could reach 10%-20% in the coming year.

The fixed-income market at $100 trillion is double the size of the stock market. And there are many more bond listings than stock ones. So the number of possible investments is almost endless. I shall give you a brief overview of some of the more interesting subsectors.

US Government bonds – are the gold standard with a guaranteed return. But you pay for the extra security with lower rates; the current ten-year US Treasury bond yield is 4.20%, much lower than the present 90-day T-bill of 5.21%. The easiest way to buy these is through the (TLT). The 30-year government bond should be avoided as the extra 0.14% in yield doesn’t adequately compensate you for the extra 20 years of risk

Junk Bonds – Also known as “high yield” bonds have always been misnamed. The default rates never remotely approached the levels that justified their high yields, not even during the financial crisis, as my old friend former junk bond king Michael Milliken has amply proven. The (JNK) is currently yielding 6.59% and has the potential for larger capital gains than government bonds.

Master Limited Partnerships – These are partnerships granted generous tax benefits with the goal of producing oil. They issue annual Form K-1’s to include with your tax return. Dividends are deferred until the MLP’s investment reaches the end of its useful life, which can be decades. MLPs used to be a huge industry with dozens of listed companies.

When the price of oil went to negative numbers during the pandemic, most of them got wiped out. Because of this rocky past, there are a handful of large, well-capitalized MLPs with extremely high yields. One is Western Midstream Partners (WES) with a 9.20% yield. Energy Transfer Partners (ET) pay a 7.96% yield.

These yields will remain safe as long as oil prices are stable or rising, as I expect in a long-term global economic recovery. Take oil back to zero again in another pandemic and these returns will get turned on their head.

With the normalizing of interest rates, it's time to normalize investment strategies as well. That means bringing back the old 60/40 strategy where one half of the portfolio ensures the other, with a modern twist. You can put 60% of your assets in stocks, with half on technology and half on domestic cyclicals.

The other 40% should be allocated to some mix of the above fixed-income investments guaranteeing annual high returns. It is not a bad strategy for mature investors, especially if they would rather be on a golf course instead of spending all day in front of a screen picking bottoms and tops for stocks, like Millennials.

Here’s where to get a Safe 8.48% Yield, BB-rated bank loans, which will soar in value with even just one quarter-point rate cut. BB bank loans are very low risk, and they have a spread that’s about 290 basis points above the overnight Fed rate. How does one buy such an animal? The actual bank loans themselves are made by lending institutions to companies. These loans aren’t made accessible to individual investors who want to make a play for yield. Rather, large institutional investors snap them up and add them to their fixed-income portfolios. The top ticker symbols are (SLRN), (BRLN), (BKLN), and (FFRHX). Check them out.

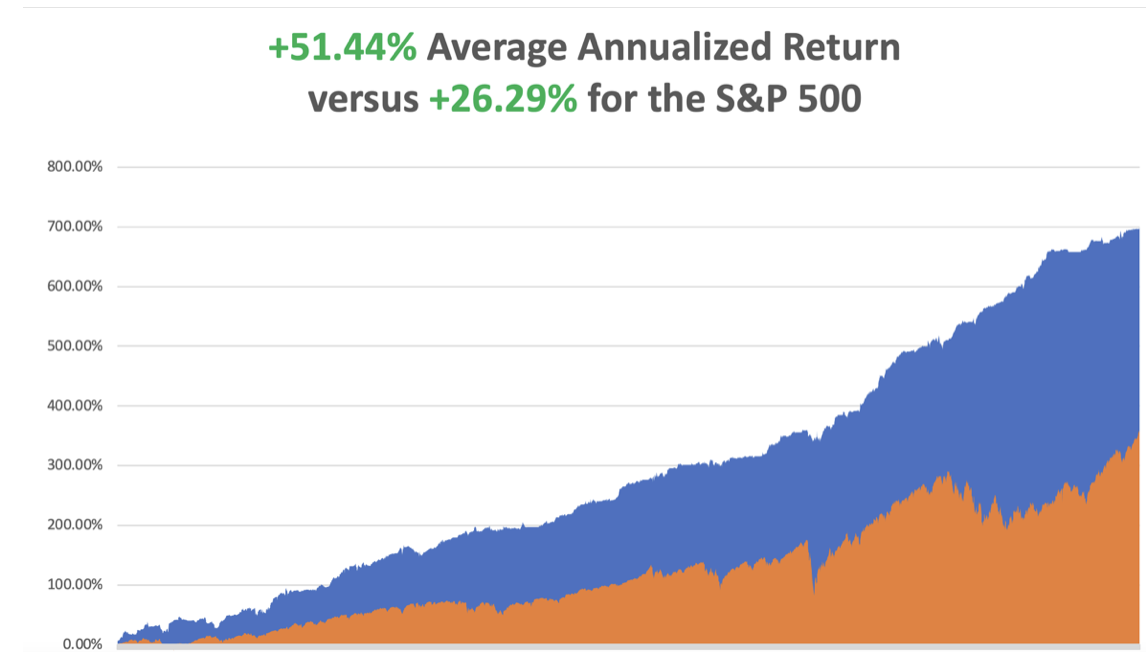

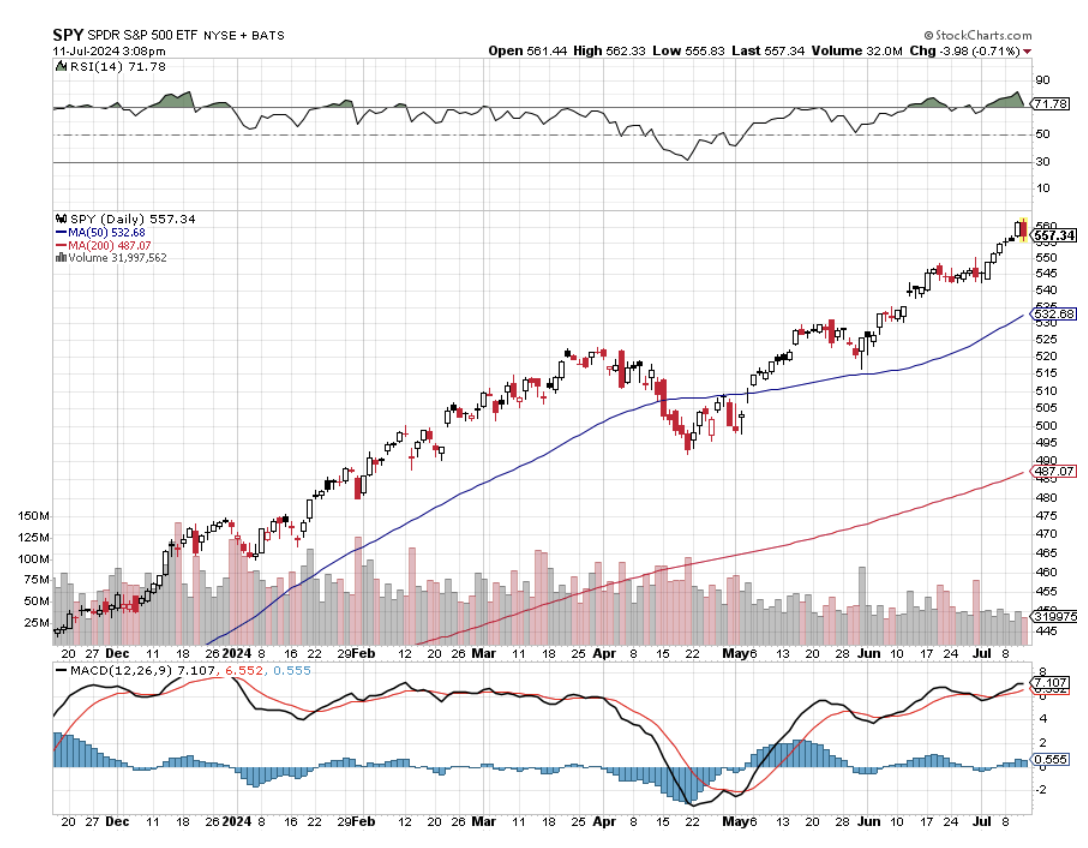

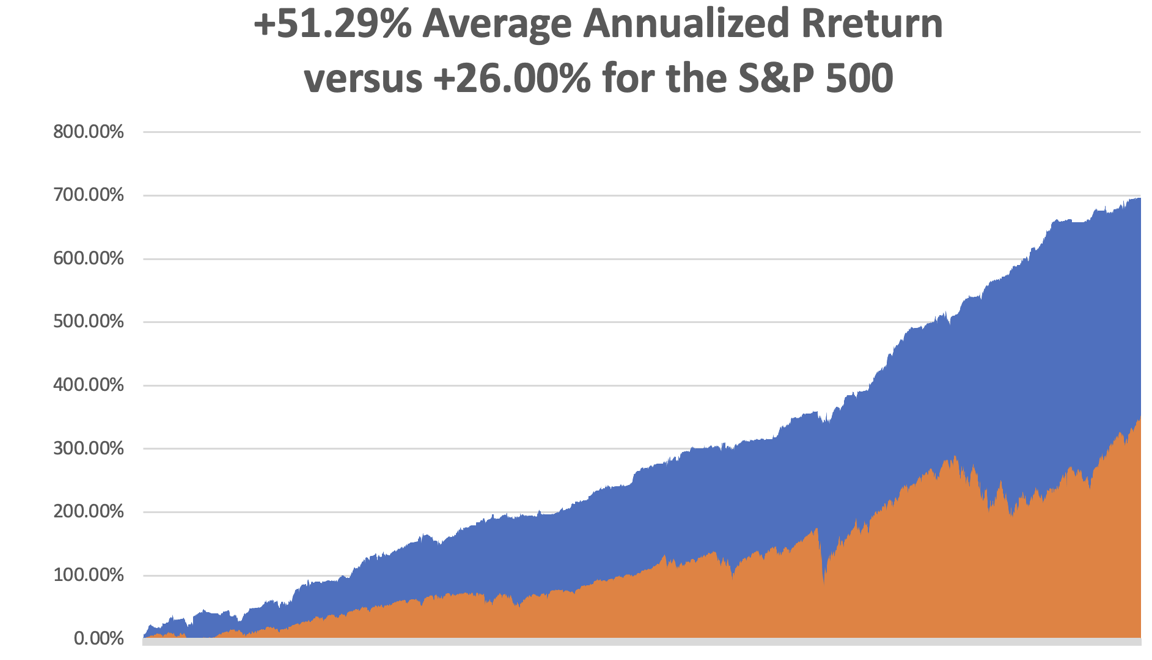

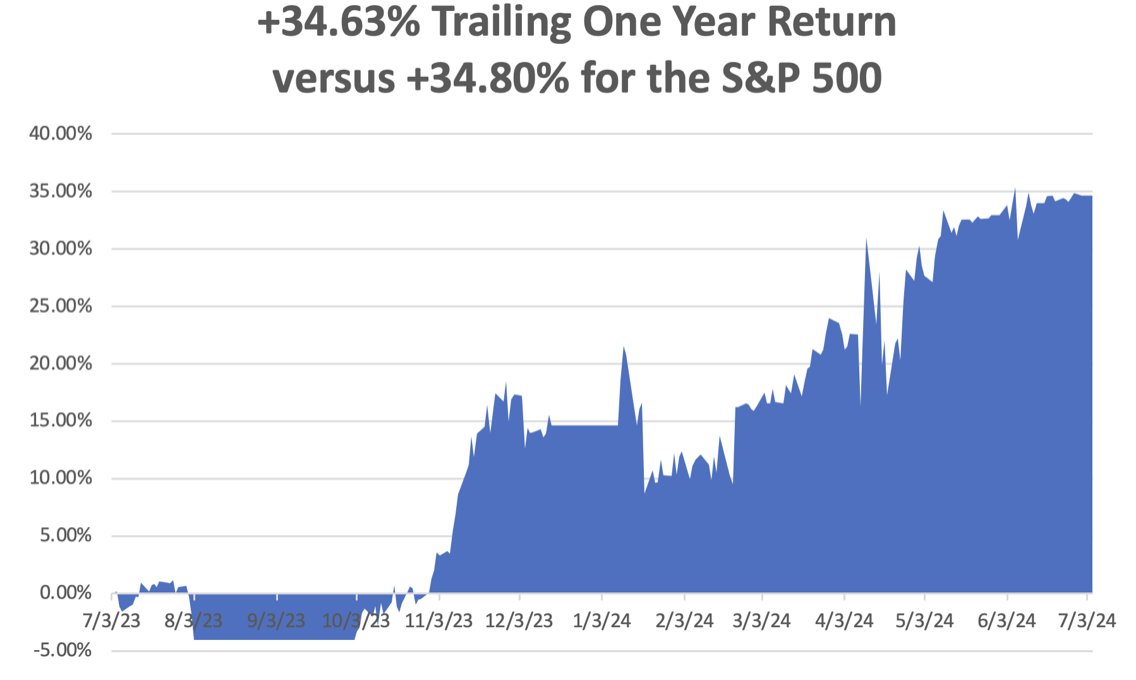

So far in July, we are up +2.17%. My 2024 year-to-date performance is at +22.19%. The S&P 500 (SPY) is up +17.40% so far in 2024. My trailing one-year return reached +37.07.

That brings my 16-year total return to +698.82%. My average annualized return has recovered to +51.44%.

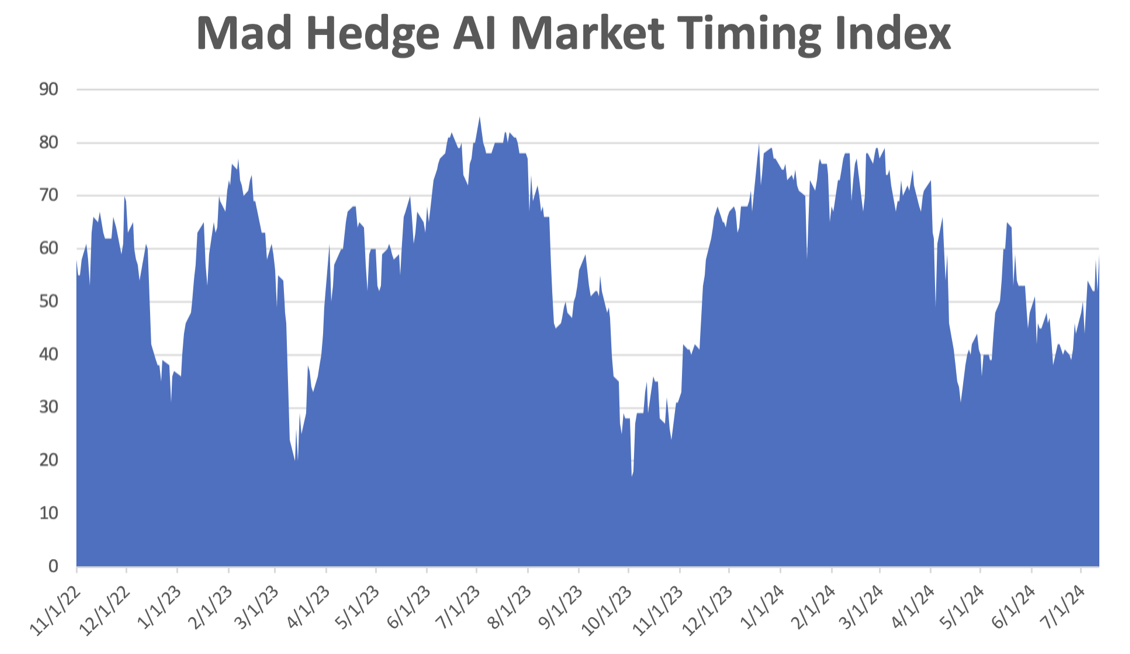

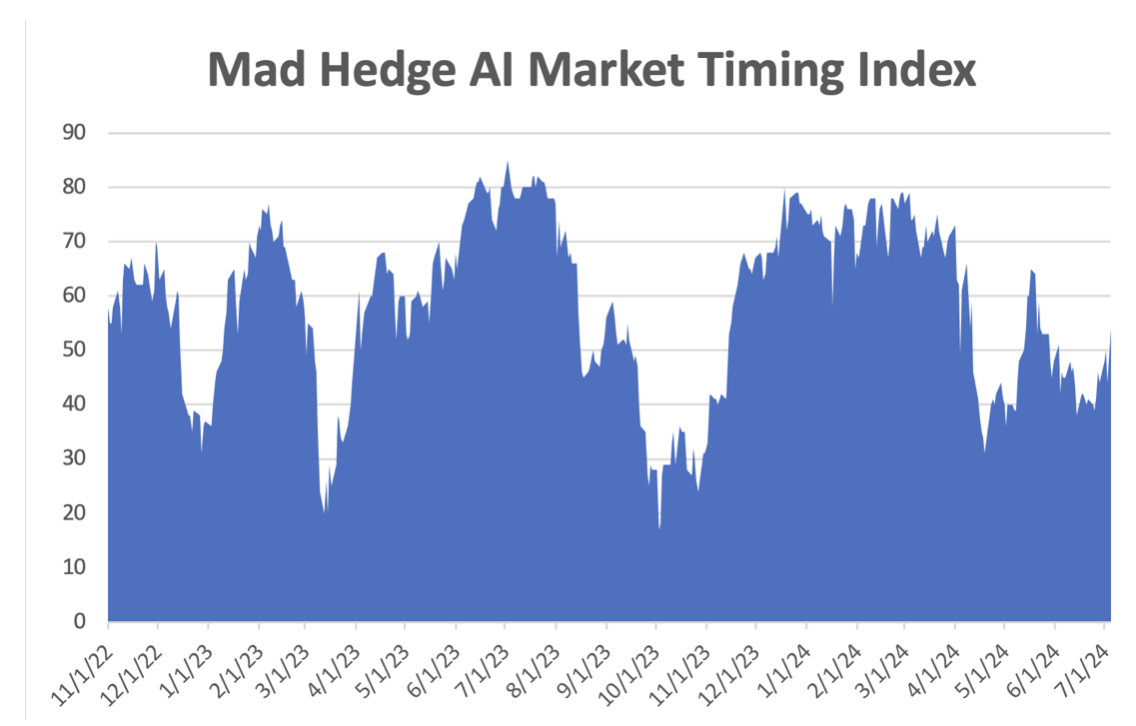

I used the blockbuster CPI Report last week to jump off my 100% cash position and piled on six new positions. Those included interest rate-sensitive longs in (CCI), (GLD), (DE), (BRK/B), and shorts in big tech leaders (TSLA) and (NVDA).

Some 63 of my 70 round trips were profitable in 2023. Some 35 of 44 trades have been profitable so far in 2024, and several of those losses were really break-even.

Nonfarm Payroll Report Comes in Weak for June at 206,000. The Headline Unemployment rate rose to a three-year high at 4.1%. All interest rate plays rocketed as a September interest rate comes back on the table. If the Fed doesn’t cut soon, we are going into recession. Buy (TLT) on dips.

Fed Governor Jay Powell Warns of Recession Risks if interest rate cuts don’t take place soon, spiking all markets. Powell is showing his cards for the next few Fed Meetings. Buy all interest rates plays like (TLT), (JNK), (NLY), and (CCI).

CPI comes in Negative. The writing is not only on the wall right now, it’s blasting us with great neon lights. That was the message this morning from the Consumer Price Index, which this morning delivered a gob-smacking 0.1% DECLINE in June. We are now in deflation and the YOY inflation rate is now down to only 3.0%. As a result, a Fed interest rate cut of 25 basis points is now a certainty in September and more will follow. All falling interest rate plays in the stock market are in play. Rising rate plays could be the trade for the rest of 2024.

PPI Rises 0.2%, with Wholesale Prices coming in as expected. The producer price index is now up 2.6% year over year. The inflation pictures goes back to mixed. Stocks rallied with big tech recovering about half of yesterday’s losses.

Consumer Sentiment at a Three-Year Low at 66.0%, down from 68.5 as the economic slide continues, according to the University of Michigan. It’s another pre-recession indicator.

Bank Earnings Beat and the stocks are rising in expectation of falling interest rates, with (JPM), (BAC), and (C) reporting. Wells Fargo (WFC) Bombed again. Buy banks on dips which have been on a tear all day.

Tesla Delays Robotaxi Day, past its original August 8 target to probably October, tanking the shares by 11%. The date propelled the massive 50% rally in the hares over the past month. Musk is always overly aggressive on his targets. Sell calls against existing (TSLA) stock positions.

Apple Expects 10% Rise in iPhone Shipments in 2024, after a bumpy 2023, counting on AI features to fuel demand for the iPhone 16. Apple is now the newly discovered AI stock. Buy (AAPL) on dips.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, July 15 at 9:30 AM EST, Feder Governor Jay Powell speaks. He has lately been leaning dovish.

On Tuesday, July 16 at 9:30 AM, Retail Sales are published.

On Wednesday, July 17 at 9:30 AM, Building Permits are out.

On Thursday, July 18 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, July 19 at 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, I usually get a request to fund some charity about once a day. I ignore them because they usually enrich the fundraisers more than the potential beneficiaries. But one request seemed to hit all my soft spots at once.

Would I be interested in financing the refit of the USS Potomac (AG-25), Franklin Delano Roosevelt’s presidential yacht?

I had just sold my oil and gas business for an outrageous profit and had some free time on my hands so I said, “Hell Yes,” but only if I get to drive. The trick was to raise the necessary $5 million without it costing me any money.

To say that the Potomac had fallen on hard times was an understatement.

When Roosevelt entered the White House in 1932, he inherited the presidential yacht of Herbert Hoover, the USS Sequoia. But the Sequoia was entirely made of wood, which Roosevelt had a lifelong fear of. When he was a young child, he nearly perished when a wooden ship caught fire and sank, he was passed to a lifeboat by a devoted nanny.

Roosevelt settled on the 165-foot USS Electra, launched from the Manitowoc Shipyard in Wisconsin, whose lines he greatly admired. The government had ordered 34 of these cutters to fight rum runners across the Great Lakes during Prohibition. Deliveries began just as the ban on alcohol ended.

Some $60,000 was poured into the ship to bring it up to presidential standards and it was made wheelchair accessible with an elevator, which FDR operated himself with ropes. The ship became the “floating White House,” and numerous political deals were hammered out on its decks. Some noted guests included King George VI of England, Queen Elizabeth, and Winston Churchill.

During WWII Roosevelt hosted his weekly “fireside chats” on the ship’s short-wave radio. The concern was that the Germans would attempt to block transmissions if the broadcast came from the White House.

After Roosevelt’s death, the Potomac was decommissioned and sold off by Harry Truman, who favored the much more substantial 243-foot USS Williamsburg. The Potomac became a Dept of Fisheries enforcement boat until 1960 and then was used as a ferry to Puerto Rico until 1962.

An attempt was made to sail it through the Panama Canal to the 1962 World’s Fair in Seattle, but it broke down on the way in Long Beach, CA. In 1964 Elvis Presley bought the Potomac so it could be auctioned off to raise money for St. Jude Children’s Research Hospital. It sold for $65,000. It then disappeared from maritime registration in 1970. At one point, there was an attempt to turn it into a floating disco.

In 1980, a US Coast Guard cutter spotted a suspicious radar return 20 miles off the coast of San Francisco. It turned out to be the Potomac loaded to the gunnels with bales of illicit marijuana from Mexico. The Coast Guard seized the ship and towed it to the Treasure Island naval base under the Bay Bridge. By now, the 50-year-old ship was leaking badly. The marijuana bales soaked up the seawater and the ship became so heavy it sank at its moorings.

Then a long rescue effort began. Not wanting to get blamed for the sinking of a presidential yacht on its watch, the Navy raised the Potomac at its own expense, about $10 million, putting its heavy lift crane to use. It was then sold to the City of Oakland, CA for a paltry $15,000.

The troubled ship was placed on a barge and floated upriver to Stockton, CA, which had a large but underutilized unionized maritime repair business. The government subsidies started raining down from the skies and a down to the rivets restoration began. Two rebuilt WWII tugboat engines replaced the old, exhausted ones. A nationwide search was launched to recover artifacts from FDR’s time on the ship. The Potomac returned to the seas in 1993.

I came on the scene in 2007 when the ship was due for a second refit. The foundation that now owned the ship needed $5 million. So, I did a deal with National Public Radio for free advertising in exchange for a few hundred dinner cruise tickets. NPR then held a contest to auction off tickets and kept the cash (what was the name of FDR’s dog? Fala!).

I also negotiated landing rights at the Pier One San Francisco Ferry Terminal, which involved negotiating with a half dozen unions, unheard of in San Francisco maritime circles. Every cruise sold out over two years, selling 2,500 tickets. To keep everyone well-lubricated, I became the largest Bay Area buyer of wine for those years. I still have a free T-shirt from every winery in Napa Valley.

It turned out to be the most successful fundraiser in the history of NPR and the Potomac. We easily got the $5 million and then some. The ship received a new coat of white paint, new rigging, modern navigation gear, and more period artifacts. I obtained my captain’s license and learned how to command a former Coast Guard cutter.

It was a win-win-win.

I was trained by a retired US Navy nuclear submarine commander, who was a real expert at navigating a now thin-hulled 73-year-old ship in San Francisco’s crowded bay waters. We were only licensed to cruise up to the Golden Gate Bridge and not beyond, as the ship was so old.

The inaugural cruise was the social event of the year in San Francisco with everyone wearing period Depression-era dress. It was attended by FDR’s grandson, James Roosevelt III, a Bay area attorney who was a dead ringer for his grandfather. I mercilessly grilled him for unpublished historical anecdotes. A handful of still-living Roosevelt cabinet members also came, as well as many WWII veterans.

As we approached the Golden Gate Bridge, some poor soul jumped off and the Coast Guard asked us to perform search and rescue until they could get a ship on station. Nobody was ever found. It certainly made for an eventful first cruise.

Of the original 34 cutters constructed, only four remain. The other three make up the Circle Line tour boats that sail around Manhattan several times a day.

Last summer, I boarded the Potomac for the first time in 14 years for a pleasant afternoon cruise with some guests from Australia. Some of the older crew recognized me and saluted. In the cabin, I noticed a brass urn oddly out of place. It contained the ashes of the sub-commander who had trained me all those years ago.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Captain Thomas at the Helm