The Big Comeback in Railroads

Want to know the best way to play the coming recovery in oil, commodities, precious metals, and emerging markets?

Buy the railroads. At least if you are early, you still have a functioning, cash flow positive business, unlike the rest of the above.

Since they peaked in early 2015, railroad stocks have been beaten like the proverbial red-headed stepchild, trading with the collapse in oil and coal tick for tick. Lead stock Union Pacific (UNP) has seen its share price crater by 36% since then before recently recovering half of that.

What follows a global synchronized slowdown, led by China and emerging markets? A global synchronized recovery, led by China and emerging markets.

I love railroads because they used to belch smoke and steam and have these incredibly loud, romantic, wailing whistles.

In fact, my first career goal in life (when I was 5) was to become a train engineer. By the time I was old enough to know better, American railroads almost no longer existed.

It turns out that the railroads today are a great proxy for the health of the entire global economy. They are, in effect, our canary in the coalmine.

If oil prices stay low enough for long enough, it will boost demand for everything else that Union Pacific ships, including houses, furniture, cars, and every other sweet spot for their franchise.

Union Pacific (UNP), in effect, has a great internal hedge for its many businesses. When one product line weakens, another strengthens. This has been going on since the 19th century.

The industry is carefully watching the construction of a second Panama Canal across Nicaragua (click here for ?Who the Grand Nicaragua Canal Has Worried?).

If completed by its Chinese promoters within the next decade, it could bring an incremental shift of traffic from the US West Coast to the Gulf Ports.

Even this is a mixed bag, as this will move some business away from strike-plagued ports that are currently causing so much trouble.

When I rode Amtrak?s California Zephyr from Chicago to San Francisco in 2014, I passed countless trains heading west hauling hoppers full of coal for shipment to China.

Last year? I took the same trip. The coal trains were gone. Instead I saw 100 car long tanker trains transporting crude oil from North Dakota south to the Gulf Coast. I thought, ?There?s got to be a trade here.? It turns out I was right.

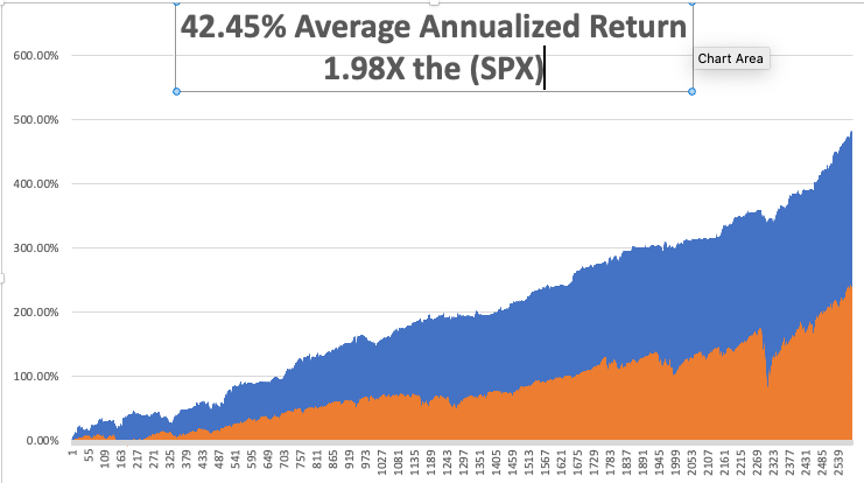

Take a look at the charts below, and you will see that the shares of virtually the entire railroad industry are breaking out to the upside.

In two short years, the big railroads have completely changed their spots, magically morphing from fading coal plays to emerging oil ones.

You?ve heard of ?fast fashion?? This is ?fast railroading?.

Today the big business is coming from the fracking boom, shipping oil from North Dakota?s Bakken field to destinations south. In fact, the first trainload of Texas tea arrived here in the San Francisco Bay area only a couple of years ago, displacing crude that formerly came from Alaska.

There are a wealth of interesting companies in the railroad sector now. You could almost pick any one.

These include Union Pacific (UNP), CSX Corp (CSX), Norfolk Southern (NSC), Kansas City Southern (KSU) and Canadian Pacific (CP).

Those of a certain age, such as myself, remember railroads as one of the great black holes of American industry. During the sixties, they were constantly on strike, always late, and delivered terrible service.

A friend of mine, taking a passenger train from New Mexico to Los Angeles, found his car abandoned on a siding for 24 hours where he froze and starved until he was discovered.

New airlines and the trucking industry were eating their lunch. They also hemorrhaged money like crazy.

The industry finally hit bottom in 1970, when the then dominant Penn Central Railroad went bankrupt, freight was spun off, and the government-owned Amtrak passenger service was created out of the ashes.

I know all of this because my late uncle was the treasurer of Penn Central.

Fast forward nearly half a century, and what you find is not your father?s railroad.

While no one was looking, they quietly became one of the best run and most efficient industries in America. Unions were tamed, costs slashed, and lines were reorganized and consolidated.

The government provided a major assist with sweeping deregulation. It became tremendously concentrated, with just four companies dominating the country, down from hundreds a century ago, giving you a great oligopoly play.

The quality of management improved dramatically.

Then the business started to catch a few lucky breaks from globalization. The China boom that started in the nineties created enormous demand for shipment inland of manufactured goods from West Coast Ports.

A huge trade also developed moving western coal back out to the Middle Kingdom, which now accounts for 70% of all traffic. The ?fracking? boom is having the same impact on the North/South oil by rail business.

All of this has ushered in a second ?golden age? for the railroad industry. This year, the industry is expected to pour $14 billion into new capital investment.

The US Department of Transportation expects gross revenues to rise by 50% to $27.5 billion by 2040. The net net of all of this is that freight rates are rising right when costs are falling, sending railroad profitability through the roof.

Union Pacific is investing a breathtaking $3.6 billion to build a gigantic transnational freight terminal in Santa Teresa, NM. It is also spending $500 million building a new bridge across the Mississippi River at Canton, Iowa.

Lines everywhere are getting double tracked or upgraded. Mountain tunnels are getting rebored to accommodate double stacked sea containers.

Indeed, the lines have become so efficient, that overnight couriers, like FedEx (FDX) and UPS (UPS), are diverting a growing share of their own traffic.

Their on time record is better than that of competing truckers, who face delays from traffic jams and crumbling roads, and are still hobbled by antiquated regulation.

I have some firsthand knowledge of this expansion. Every October 1st, I volunteer as a docent at the Truckee, California Historical Society on the anniversary of the fateful day in 1846 when the ill-fated Donner Party was snowed in.

There, I guide groups of tourists over the same pass my ancestors crossed during the 1849 gold rush. The scars on enormous ancient pines made by passing wagon wheels are still visible.

During 1866-1869, thousands of Chinese laborers blasted a tunnel through a mile of solid granite to complete the Transcontinental Railroad.

I can guide my guests through that tunnel today with flashlights because Union Pacific (UNP) moved the line to a new tunnel a mile south to improve the grade. The ceiling is still covered with soot from the old wood and coal-fired engines.

While the rebirth of this industry has been impressive, conditions look like they will get better still. Massive international investment in Mexico (low end manufacturing and another energy renaissance) and Canada (natural resources) promise to boost rail traffic with the US.

The rapidly accelerating ?onshoring? trend, whereby American companies relocate manufacturing facilities from overseas back home, creates new rail traffic as well. It turns out that factories that produce the biggest and heaviest products are coming home first, providing all great cargo for railroads.

And who knew?

Railroads are also a ?green? play. As Burlington Northern Railroad owner, Warren Buffett, never tires of pointing out, it requires only one gallon of diesel fuel to move a ton of freight 500 miles. That makes it four time

s more energy efficient than competing trucks.

In fact, many companies are now looking to railroads to reduce their overall carbon footprint. Warren doesn?t need any convincing himself. The $34 billion he invested in the Burlington Northern Railroad six years ago has probably doubled in value since then.

You have probably all figured out by now that I am a serious train nut, beyond the industry?s investment possibilities.

My past letters have chronicled adventures riding the Orient Express from London to Venice and Amtrak from New York to San Francisco.

I even once considered buying my own steam railroad, the fabled ?Skunk? train in Mendocino, California, until I figured out it was a bottomless money pit. Some 50 years of deferred maintenance is not a pretty sight.

It gets worse.

Union Pacific still maintains in running condition some of the largest steam engines every built, for historical and public relations purposes. One, the ?Old 844? once steamed its way over the High Sierras to San Francisco on a nostalgia tour.

The 120-ton behemoth was built during WWII to haul heavy loads of steel, ammunition, and armaments to California ports to fight the war against Japan. The 4-8-4-class engine could pull 26 passenger cars at 100 mph.

When the engine passed, I felt the blast of heat of the boiler singe my face. No wonder people love these things! To watch the video, click here and hit the ?PLAY? arrow in the lower left hand corner.

Please excuse the shaky picture. I shot this with one hand, while using my other hand to keep my over- excited kids from running onto the tracks to touch the laboring beast.

Railroads all look like ripe, ?buy on dips? low-hanging fruit to me.