November 1, 2010 - Is the Rare Earth ETF Calling a Market Top?

Featured Trades: (RARE EARTHS), (REMX), (MCP), (LYSCF), (AVARF)

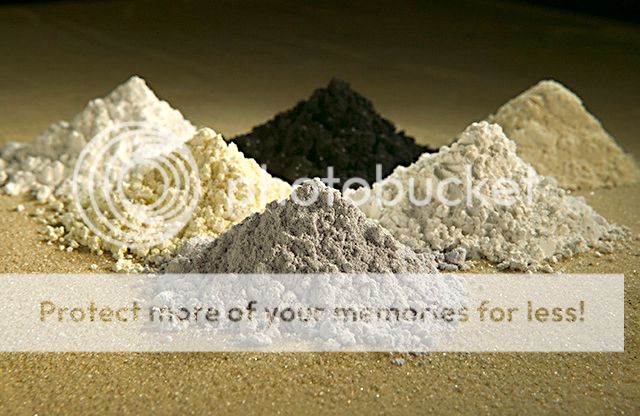

2) Is the Rare Earth ETF Calling a Market Top? It looks like the Van Eck mutual fund group reads the Diary of the Mad Hedge Fund Trader, because last week they launched the first ETF (REMX) dedicated to rare earth and strategic metals. The move comes on the heels of incredibly bullish developments in this space over the last six months. These include a ban by China, source of 97% of the world's rare earth supplies, to Japan, a temporary export ban to the US, and a 30% reduction in global export quotas next year.

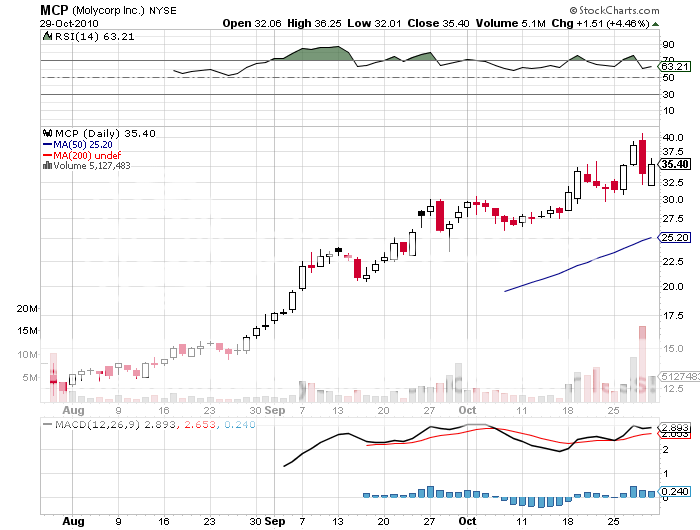

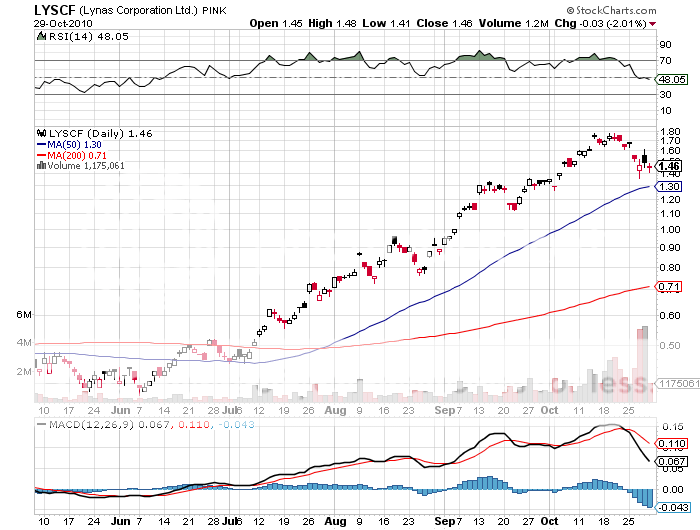

The new issue immediately gave a boost to the shares of the several names in this sector you have all come to know and love in the pages of this letter, including Molycorp. (MCP), Lynas Corp. (LYNCF), and Avalon Rare Metals (AVARF) (click here for 'Rare Earths Are About to Become a Lot More Rare'). That's becasue the launch of a new ETF in a thinly traded corner of the commodities markets is well known to suck in a ton of new money, as it did with Platinum (PPLT) and Palladium early this year (click here for the call).? MCP alone has moved up a stunning 240% since the end of August, partly on anticipation of the new ETF.

It even includes some outliers in the strategic metal area, like Titanium Metals Corp (TIE), which I mentioned earlier in the year (click here for 'Playing Catch Up With Titanium'). As if the issue needed any help, Secretary of State Hillary Clinton (see above) warned that the world needs to start developing alternative sources for rare earths. I have included the ETF's top ten holdings below.

I have been flooded with emails from readers this week asking if they should pile into the issue. Right here, I wouldn't touch with a ten foot pole. The deal comes on top of underlying equities that have rocketed by 400% and metals prices that have roared tenfold in six months. Great idea, but a little late.

When the CEO of Molycorp says his company's primary product is caught up in a bubble, you have to take notice. I think it's safe to say that if you are not in now, you have missed the move in this cycle. The train has left the station. Better to wait for the inevitable sell off that will come sometime next year, or find a completely different field which offers more immediate upside.

Lynas Corp Ltd (LYSCF.PK)

Iluka Resources Ltd (ILKAF.PK)

Titanium Metals Corp (TIE)

Thompson Creek Metals Co Inc (TC)

OSAKA Titanium Technologies Co

RTI International Metals Inc (RTI)

Toho Titanium Co Ltd

China Molybdenum Co Ltd

Kenmare Resources PLC

Molycorp Inc (MCP)