November 1, 2010 - Pricking the Bubble in the Yen

Featured Trades: (JAPANESE YEN), (FXY), (YCS)

3) Pricking the Bubble in the Yen. Analysts have been puzzled by the relentless appreciation of the Japanese yen, which went out at ?80.40 on Friday, and seems poised to break out to the ?70 handle and an all time high. Having written the authoritative tome on the Japanese banking system 30 years ago (it's in the Library of Congress), I can shed more than a little light on why.

Unknown to most in the trading community, foreign banks have engaged in a massive recapitalization of their Japanese subsidiaries since over the last six months. Since May, excess foreign bank reserves held in yen have soared from $246 billion to $562 billion, an increase of a staggering $316 billion, creating immense upward pressure. Some $136 billion of this poured into the yen in September alone. By comparison, there are only $7.3 billion worth of net longs held in futures markets by speculators.

Ask Japanese senior bankers why this is happening, and you get lame excuses, like anticipation of stiffer capital requirements from the Bank of Japan to head off any future financial crisis. The truth is that banks are using their balance sheets to speculate in the currency markets and boost profits. Adding fuel to the fire has been efforts by the People's Bank of China to diversify out of the dollar as a reserve asset by pouring new cash flows into the yen. This is showing up in a huge jump in overnight bill purchases by foreign investors.

In days of old, countries used to destroy their neighbors by sending in invading armies of screaming warriors swinging great long swords. Today, you simply buy their currency; drive it to ridiculous heights, making its industry hopelessly uncompetitive in the global market place, thus collapsing its economy. This is what China is doing to Japan today.

This explains why the central bank's intervention efforts to slow the yen's appreciation have been an abject failure. In September, total BOJ sales of yen amounted to only $61 billion, and has been spread among a range of lower tier assets, like 'BBB' rated corporate bonds, exchange traded funds (ETF's), and REIT's. The Japanese government is slumming with its own version of QEII. But the amounts so far are miniscule compared to the inflows. They might as well be pissing in the ocean.

There are two ways this kabuki play will go end. The obvious one is for the BOJ to boost its intervention to the $1 trillion that worked the last time it was in this pickle eight years ago. I sense that a Pearl Harbor type surprise attack of this sort is setting up. Suck the shorts in with a series of small, ineffective interventions that invite laughter and derision, and then all of a sudden, its tora, tora, tora and bombs away. The shorts get taken to the cleaners.

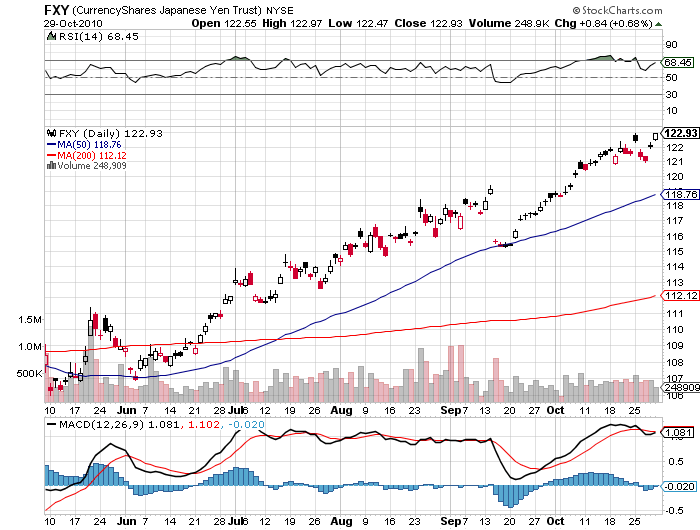

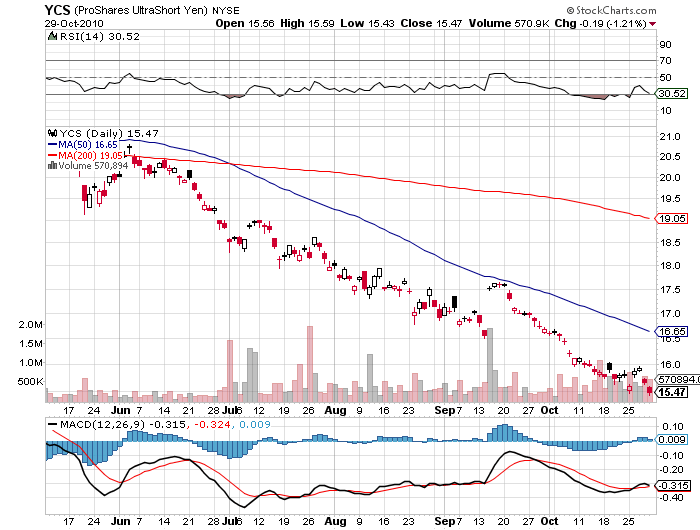

The second approach will be more subtle. Banks are currently earning 10 basis points on their excess reserves. Turn this number negative, as Germany and Switzerland did, and the banks will bail on their excess reserves in a heartbeat. It's not a matter of if, but when they do this. Then the 15 year double top chartists have been waiting for will be in place, and one of the great shorts of the decade, and the (FXY) and the (YCS) will be in play. This all may happen very fast, so keep you finger poised over that mouse.

Is the Bank of Japan Planning a Surprise Attack on the Yen Shorts?

Why the Bank of Bank of Japan's Intervention Efforts Aren't Working