November 10, 2009

November 10, 2009

SPECIAL PAUL TUDOR JONES ISSUE

Featured Trades: (GOLD), (EEM), (TAIWAN), (EWT), (TBT)

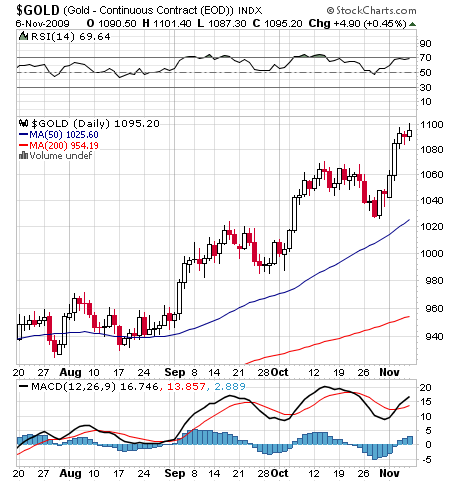

2) Paul nicely summed up the fundamental argument in favor of gold.? The yellow metal is accumulated, and not consumed, and is the ultimate store of value. Gold does particularly well during times of excessive monetization, inflation, and instability of the banking system, as we are seeing now. Central banks, which have been consistent sellers for the last 20 years, are about to flip to net buyers. If non G7 central banks, like China, want to increase their gold holdings from the current 20% of reserves to the 35% weighting now owned by the G7, it will require 1.3 billion ounces of new purchases, or 20% of the total world supply. Certainly they are getting fed up with their ever depreciating dollar holdings. Witness last week?s Bank of India purchase of 200 metric tonnes. ETF?s now own $50 billion worth of the barbaric relic, about 3% of the world total, making them the sixth largest holder in the world, and retail demand for these gold proxies is expected to explode in coming years. Private investors, mutual funds, and pension funds are all underweight gold. This is all happening in the face of declining production from traditional gold suppliers like South Africa. It all adds up to a whole lot of new gold buyers and a shrinking body of sellers. Paul didn?t give any specific price targets other than ?up.? Long time readers of this letter know I have been banging the table about gold all year. Time to salt away more American eagles for those college funds and grandkids.

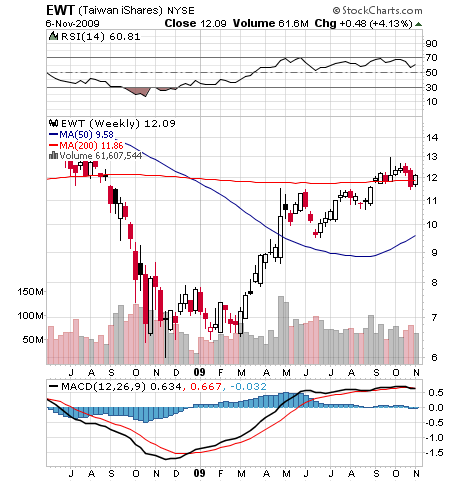

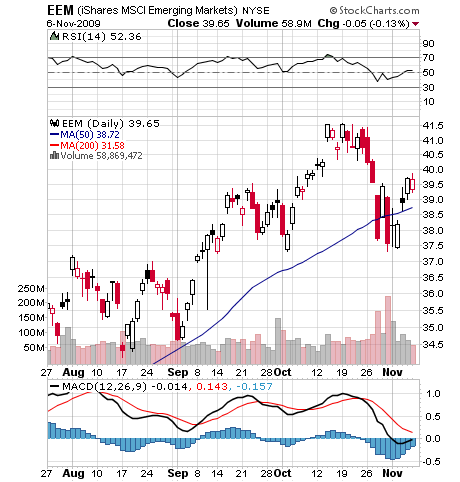

3) The handful of Chinese army officers I huddled with in the underground bunker all stared intently at their watches. Three, two, one, then KABOOM! At exactly 12:00 noon, the blast of distant artillery sent a five inch shell screaming over our heads and exploded into the hill above us, shaking the ground under our feet and causing dust to drift down from the concrete ceiling above us. It was 1976, and The People?s Republic of China just let lose its daily symbolic protest against its errant rebellious province, known locally as the Republic of China, and to you and I, as Taiwan. Fast forward 33 years later and the Middle Kingdom is sending salvos of money raining down on that prosperous island. China Mobile (CHL), the world?s largest cell phone company, has bought 12% of Far Eastone Telecommunications (4904.Taiwan). Although a small deal, it represented the first ever direct investment from China into Taiwan. The move could trigger a takeover binge by big Chinese companies of their offshore cousins. It was only a few years ago Taiwanese businessmen suffered long prison terms for just visiting, let alone investing in China, which they have done in a major but surreptitious way for 30 years. Readers of this letter are well aware of my aggressive recommendations to buy emerging markets China and Taiwan since the beginning of the year (click here for my April recommendation). Now you have another reason to buy both. Closer ties between China and Taiwan auger well for the stock markets of the two high growth countries. The iShares MSCI Taiwan fund ETF (EWT) at one point were up an impressive 92% from the March lows, so if you see a substantial dip it might be a good idea to double up. I guess Beijing figured out that if you can?t beat them, buy them. The proxy takeover bid is mightier than the sword.

?I have never been a gold bug. It?s just an asset, like everything else in life, that has its time and place. And now is that time,? said legendary hedge fund manager Paul Tudor Jones.