November 12, 2010 - Has the Euro Turned?

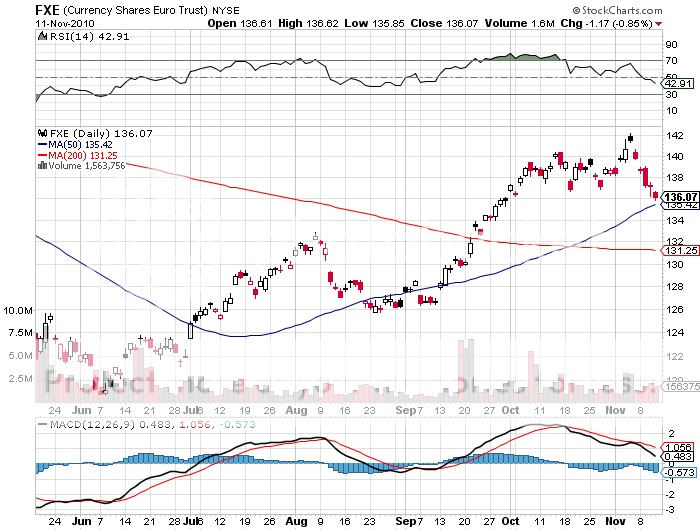

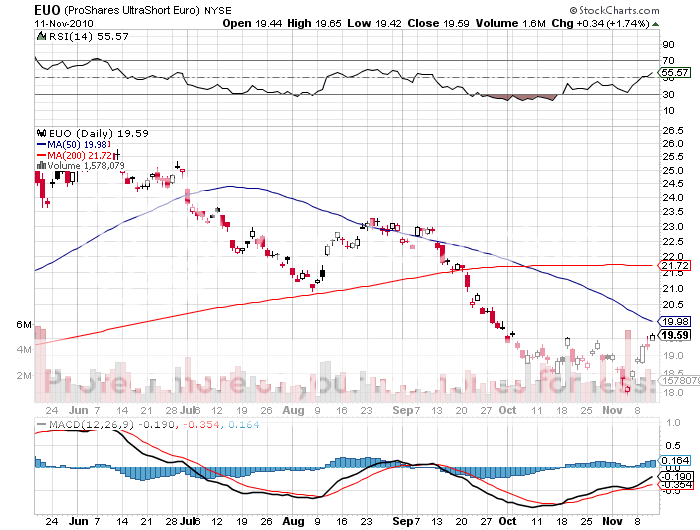

Featured Trades: (HAS THE EURO TURNED?), (FXE), (EUO)

ProShares Ultra Short Euro ETF

Currency Shares Euro Trust

3) Has The Euro Turned? The call that a turn in the dollar was imminent by Brown Brothers Harriman's Mark Chandler is looking more prescient by the day (click here for the call). September and October was all about pricing in Ben Bernanke's quantitative easing, and that is looking pretty much done. The next play in this kabuki drama will see 'uncertainty' emigrate from the US to Europe, sending the dollar off to the races and the Euro in for rehab. Lindsay Lohan, eat your heart out.

A reemergence of the 'PIIGS' disease, concerns about the deteriorating quality of the lesser sovereign credits in Europe, is now unfolding as the triggering event. US interest rates rising at the long end are adding fuel to the fire, shifting interest rate differentials overwhelmingly in Uncle Buck's favor. It also helps that 95% of traders are bearish on the dollar, the surest indicator you'll ever see that it is about to go the other way. While America's trade deficit remains massive, that shortfall is being overwhelmed by enormous amounts of foreign capital pouring into our stock and bond markets, on which Ben has painted a giant bullseye.

It all adds up to the $1.4250 print we saw on the Euro last week marking the high. Rallies from here in the European currency are to be sold. Players new to the space can achieve this through buying the (EUO) ETF, a leveraged 200% short bet against the Euro. Looking at the charts and the momentum, we could see a plunge below $1.33 by year end.

The Euro is Moving into Rehab With Lindsay Lohan

So They Do Love Me After All?