November 12, 2010 - The Cisco Shock

Featured Trades: (CISCO), (CSCO)

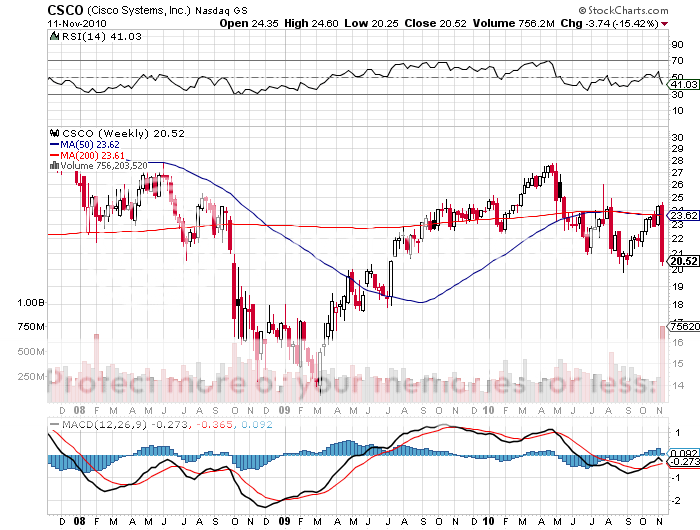

4) The Cisco Shock. When a great company announces a surprise, temporary setback that sends the stock plunging, I am drawn like a starving great white shark to fresh blood in the water. All it took was a matching of earnings expectations for this great technology firm to crater 13% in minutes, triggering stop losses, the gnashing of teeth, and the rending of great swatches of hair. This is not a commentary on Cisco itself, but of the fragile, over extended nature of the markets at this lofty altitude.

Of course, the big surprise came from a sudden drop off in sales to state and local governments, who are big users of video conferencing products. Somehow, it escaped notice in the recent midterm election that spending cuts always lead to falling sales and swinging great job losses. This is what it really looks like up close and ugly. I have been warning readers about this all year, but it seems I have few readers in Washington, and those that do mostly use the hard copies to line the bottoms of their bird cages. The other disappointment came from the cable industry, which is cutting back capital investment while its lunch is being relentlessly eaten by the Internet.

At $20.52 a share, Cisco offers a PE multiple of 10 times, versus a market average of 15, the prospect of a dividend next year, and at 12%-17%, one of the most consistent long term growth outlooks of anyone. Did I mention that they get a majority of their sales from overseas, where growth rates are posting white hot double digit rates? Buy this baby on dips to catch a Q1, 2011 rebound. Despite the sorry state of the US economy, demand from the Internet for Cisco's high end routers from data centers continues to grow at blistering rates.

Got Any Cisco For Sale?