November 15, 2010 - Tremors in the Market

Featured Trades: (TREMORS IN THE MARKET)

1) Tremors in the Market. Yes! There is risk in the market! That was the hard lesson learned by latecomers to Ben Bernanke's quantitative easing party who, having watched the prices of all assets climb relentlessly for the last 2? months, jumped in at the end and got burned. Perhaps they didn't want to be the last one in the locker room at the country club to profess their admiration for everything hard this year.

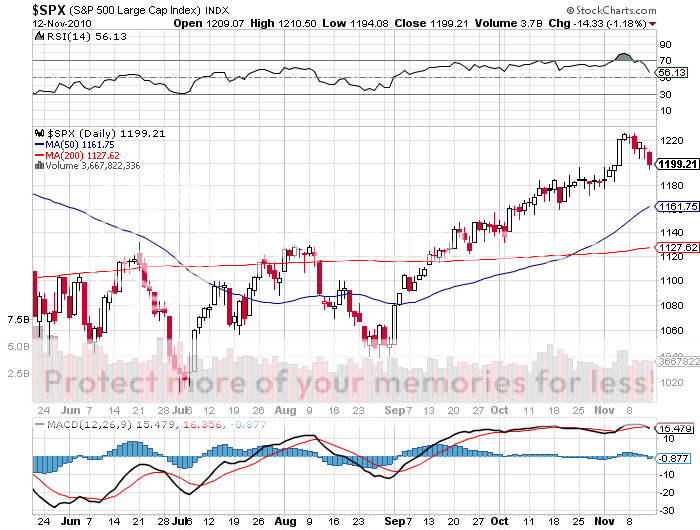

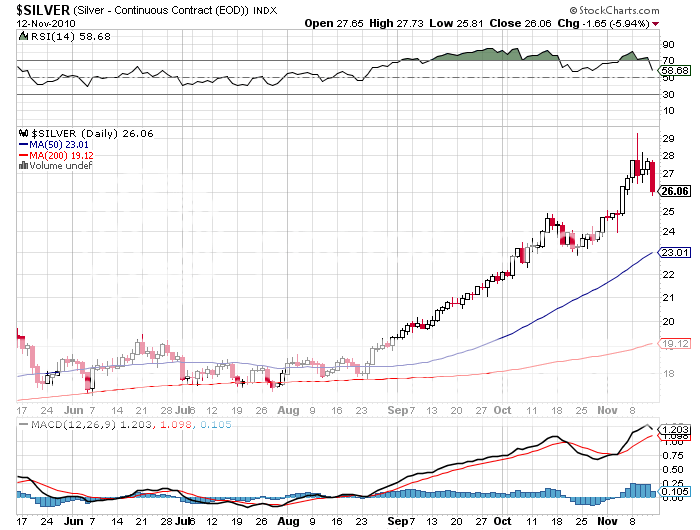

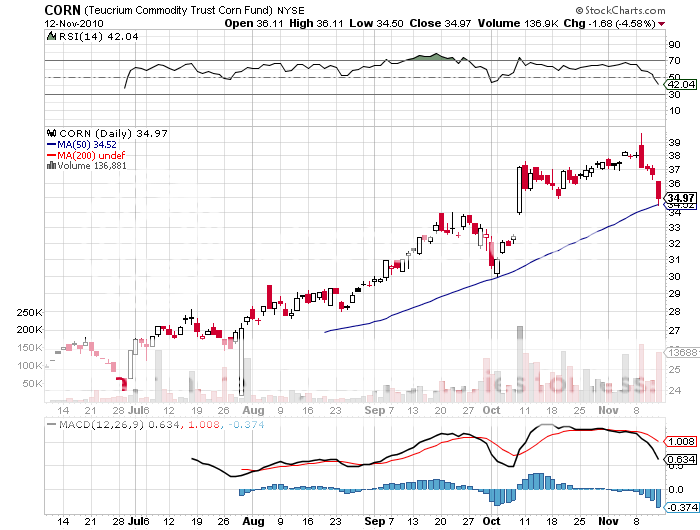

Let's start with a forensic examination of the wreckage. There were gut wrenching plunges in everything that had raced up the most, including precious metals, copper, sugar, coal, the commodity currencies, and technology stocks. The markets with weaker fundamentals that hadn't moved much, like the broader US stock indexes, managed only a whimper instead of a bang.

There were more possible triggers than found in an Agatha Christie murder mystery. My favorite is the weakness of the Euro, which I have been predicting is the new canary in the coal mine for global risk taking (click here for the piece). Another smoking gun is the hike in Chinese interest rates, which calls into question their economic miracle that is enriching everyone. Also suspicious is a computer glitch at the Federal Reserve that scared traders into thinking that the central bank's first bond purchases for QE2 had been a complete failure.

Suffice it to say that the trading short term books had piled risk higher than Mount Everest, and also had a hair trigger to bail at the first sign of trouble. Could it be as simple as buy the rumor and sell the news?

You can use days like Friday as a great crystal ball for the future. This is what the shadowy spirits are communing to us. That it is a binary '?RISK ON', '?RISK OFF WORLD'. When things go bad, there is no place to hide but cash. The CFTC raised silver margin requirements, and corn and sugar get trashed? Even flight to safety, Treasury bonds were unloaded in size. Everything went up the most went down the most, regardless of fundamentals. And that we are dealing with a substantially higher level of risk than only a couple of months ago.

Living in California, one gets used to monthly earthquakes that rattle the dishes, rock the water in the swimming pool, and scare small children, but little more, so we ignore them. However, we all know that 'The Big One' that will flatten the city is coming someday. I think the current pull back is only a minor tremor. But the 'Big One' for the markets is coming, and could unfold as early as the next quarter. Please tighten up your stops and your risk control accordingly.

What is the Market Trying to Tell Us?

Not the 'Big One'