November 17 Biweekly Strategy Webinar Q&A

Below please find subscribers’ Q&A for the November 17 Mad Hedge Fund Trader Global Strategy Webinar broadcast from the safety of Silicon Valley.

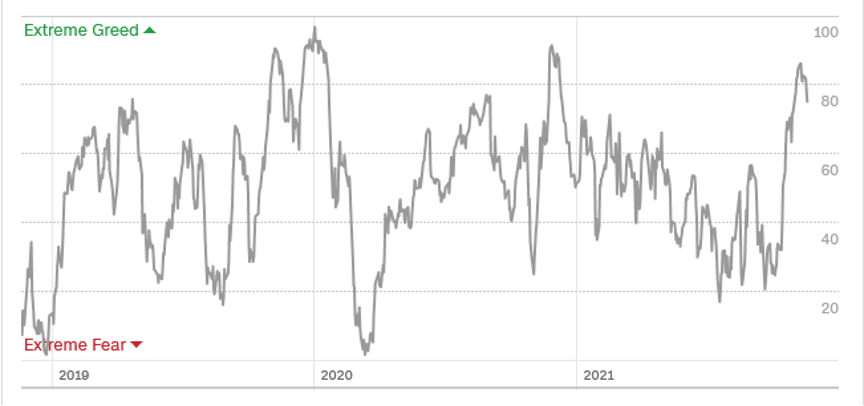

Q: Even though your trading indicator is over 80, do you think that investors should be 100% long stocks using the barbell names?

A: Yes, in a hyper-liquidity type market like we have now, we can spend months in sell territory before the indexes finally rollover. That happened last year and it’s happening now. So, we can chop in this sort of 50-85 range probably well into next year before we get any sell signals. Selling apparently is something you just do anymore; if things go down, you just buy more. It’s basically the Bitcoin strategy these days.

Q: What do you think about Rivian's (RIVN) future?

A: Well, with Amazon behind them, it was guaranteed to be a success. However, we mere mortals won't be able to buy any cars until 2024, and they have yet to prove themselves on mass production. Moreover, the stock is ridiculously expensive—even more than Tesla was in its most expensive days. And it’s not offering any great value, just momentum so I don’t want to chase it right here. I knew it was going to blow up to the upside when the IPO hit because the EV sector is just so hot and EVs are taking over the global economy. I will watch from a distance unless we get a sudden 40% drawdown which used to happen with Tesla all the time in the early days.

Q: Are you worried about another COVID wave?

A: No, because any new virus that appears on the scene is now attacking a population that is 80-90% immune. Most people got immunity through shots, and the last 10% got immunity by getting the disease. So, it’s a much more difficult population for a new virus to infect, which means no more stock market problems resulting from the pandemic.

Q: Is investing in retail or Walmart (WMT) the best way to protect myself from inflation?

A: It’s actually quite a good way because Walmart has unlimited ability to raise prices, which goes straight through to the share price and increases profit margins. Their core blue-collar customers are now getting the biggest wage hikes in their lives, so disposable income is rocketing. And really, overall, the best way to protect yourself from inflation is to own your own home, which 62% of you do, and to own stocks, which 100% of the people in this webinar do. So, you are inflation-protected up the wazoo coming to Mad Hedge Fund Trader. Not to mention we buy inflation plays like banks here.

Q: Why are financials great, like Bank of America (BAC)?

A: Because the more their assets increase in value, the greater the management fees they get to collect. So, it’s a perfect double hockey stick increase in profits.

*Interest rates are rising

*Rising interest rates increase bank profit margins

*A recovering economy means default rates are collapsing

*Thanks to Dodd-Frank, banks are overcapitalized

*Banks shares are cheap relative to other stocks

*The bank sector has underperformed for a decade

*With rates rising value stocks like banks make the perfect rotation play out of technology stocks.

*Cryptocurrencies will create opportunities for the best-run banks.

Q: Do you think the market is in a state of irrational exuberance?

A: Yes. Warning: irrational exuberance could last for 5 years. That’s what happened when Alan Greenspan, the Fed governor in 1996, coined that phrase and tech stocks went straight up all the way up until 2000. We made fortunes off of it because what happens with irrational exuberance is that it becomes more irrational, and we’re seeing that today with a lot of these overdone stock prices.

Q: Should I hold cash or bonds if you had to choose one?

A: Cash. Bonds have a terrible risk/reward right now. You’re getting like a 1% coupon in the face of inflation that's at 6.2%. It’s like the worst mismatch in history. In fact, we made $8 points on our bond shorts just in the last week. So just keep selling those rallies, never own any bonds at all—I don’t care what your financial advisor tells you, these are worthless pieces of paper that are about to become certificates of confiscation like they did back in the 80s when we had high inflation.

Q: What’s your yearend target for Nvidia (NVDA)?

A: Up. It’s one of the best companies in the world. It’s the next trillion dollar company, but as for the exact day and time of when it hits these upside targets, I have no idea. We’ve been recommending Nvidia since it was $50, and it’s now approaching $400. So that’s another mad hedge 20 bagger setting up.

Q: What about CRISPR Therapeutics (CRSP)?

A: The call spread is looking like a complete write-off; we missed the chance to sell it at $170, it’s now at $88. So, I’m just going to write that one-off. Next time a biotech of mine has a giant one-day spike, I am selling. What you might do though with Crisper is convert your call spread to straight outright calls; that increases your delta on the position from 10% to 40% so that way you only need to get a $20 move up in the stock price and you’ll get a break-even point on your long position. So, convert the spreads to longs—that’s a good way of getting out of failed spreads. You do not need a downside hedge anymore, and you’ll find those deep out of the money calls for pennies on the dollar. That is the smart thing to do, however, you have to put money into the position if you’re going to do that.

Q: Would you buy a LEAP in Tesla (TSLA) at this time?

A: No, it’s starting a multi-month topping out process, then it goes to sleep for 5 months. After it’s been asleep for 5 months then I go back and look at LEAPS. Remember, we had a 45% drawdown last year. I bet we get that again next year.

Q: Will inflation subside?

A: Probably in a year or so. A lot depends on how quickly we can break up the log jam at the ports, and how this infrastructure spending plays out. But if we do end the pandemic, a lot of people who were afraid of working because of the virus (that’s 5 or 10 million people) will come back and that will end at least wage inflation.

Q: When is the next Mad Hedge Fund Trader Summit?

A: December 7, 8, and 9; and we have 27 speakers lined up for you. We’ll start emailing probably next week about that.

Q: Are gold (GLD) and silver (SLV) getting close to a buy?

A: Maybe, unless Bitcoin comes and steals their thunder again. It has been the worst-performing asset this year. The only gold I have now is in my teeth.

Q: Morgan Stanley (MS) is tanking today, should I dump the call spread?

A: I’m going to see if we hold here and can close above our maximum strike price of $98 on Friday. But all of the financials are weak today, it’s nothing specific to Morgan Stanley. Let’s see if we get another bounce back to expiration.

Q: Where can I view all the current positions?

A: We have all of our positions in the trade alert service in your account file, and you should find a spreadsheet with all the current positions marked to market every day.

Q: What is the barbell strategy?

A: Half your money is in big tech and the other half is in financials and other domestic recovery plays. That way you always have something that’s going up.

Q: Is Elon Musk selling everything to avoid taxes from Nancy Pelosi?

A: Actually, he’s selling everything to avoid taxes from California governor Gavin Newsom—it’s the California taxes that he has to pay the bill on, and that’s why he has moved to Texas. As far as I know, you have to pay taxes no matter who is president.

Q: Will the price of oil hit $100?

A: I doubt it. How high can it go before it returns to zero?

Q: Is it time to buy a Caterpillar (CAT) LEAP?

A: We’re getting very close because guess what? We just got another $1.2 billion to spend on infrastructure. Not a single job happens here without a Caterpillar tractor or a tractor from Komatsu for John Deere (DE).

Q: Will small caps do well in 2022?

A: Yes, this is the point in the economic cycle where small caps start to outperform big caps. So, I'd be buying the iShares Russell 2000 ETF (IWM) on dips. That's because smaller, more leveraged companies do better in healthy economies than large ones.

Q: Is it too late to buy coal?

A: Yes, it’s up 10 times. The next big move for coal is going to be down.

Q: Peloton (PTON) is down 300%; should I buy here?

A: Turns out it’s just a clothes rack, after all, it isn't a software company. I didn’t like the Peloton story from the start—of course, I go outside and hike on real mountains rather than on machines, so I’m biased—but it has “busted story” written all over it, so don’t touch Peloton.

Q: Will spiking gasoline prices cause US local governments to finally invest in Subways and Trams like European cities, or is this something that will never happen?

A: This will never happen, except in green states like New York and California. A lot of the big transit systems were built when labor was 10 cents a day by poor Irish and Italian immigrants—those could never be built again, these massive 100-mile subway systems through solid rock. So if you want to ride decent public transportation, go to Europe. Unfortunately, that’s the path the United States never took, and to change that now would be incredibly expensive and time-consuming. They’re talking about building a second BART tunnel under the bay bridge; that’s a $20 billion, 20-year job, these are huge projects. And for the last five years, we’ve had no infrastructure spending at all, just lots of talk.

Q: Would Tesla (TSLA) remains stable if something happened to Elon Musk?

A: Probably not; that would be a nice opportunity for another 45% correction. But if that happened, it would also be a great opportunity for another Tesla LEAPS. My long-term target for the stock is $10,000. Elon actually spends almost no time with Tesla now, it’s basically on autopilot. All his time is going into SpaceX now, which he has a lot more fun with, and which is actually still a private company, so he isn’t restricted with comments about space like he is with comments about Tesla. When you're the richest man in the world you pretty much get to do anything you want as long as you're not subject to regulation by the SEC.

Q: How realistic is it that holiday gatherings will trigger a huge wave of COVID in the United States forcing another lockdown and the Fed to delay a rise in interest rates?

A: I would say there’s a 0% chance of that happening. As I explained earlier, with 90% immunity in much of the country, viruses have a much harder time attacking the population with a new variant. The pandemic is in the process of leaving the stock market, and all I can say is good riddance.

Q: What about the Biden meeting with President Xi and Chinese stocks (FXI)?

A: It’s actually a very positive development; this could be the beginning of the end of the cold war with China and China’s war on capitalism. If that’s true, Chinese stocks are the bargain of the century. However, we’ve had several false green lights already this year, and with stuff like Microsoft (MSFT) rocketing the way it is, I’d rather go for the low-risk high-return trades over the high-risk, high return trades.

Q: What’s your opinion of Zillow (Z)?

A: I actually kind of like it long term, despite their recent disaster and exit from the home-flipping business.

Q: Do you like copper (CPER) for the long term?

A: Yes, because every electric car needs 200 lbs. of copper, and if you’re going from a million units a year to 25 million units a year, that’s a heck of a lot of copper—like three times the total world production right now.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

An Old Fashioned Peloton (a Mountain)