November 2, 2010 - The Treasury Bond Dilemma

Featured Trades: (THE TREASURY BOND DILEMMA), (TBT), (IEF)

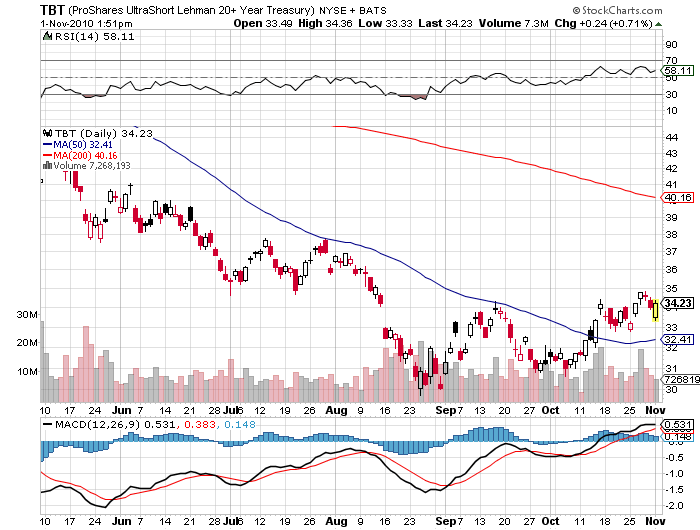

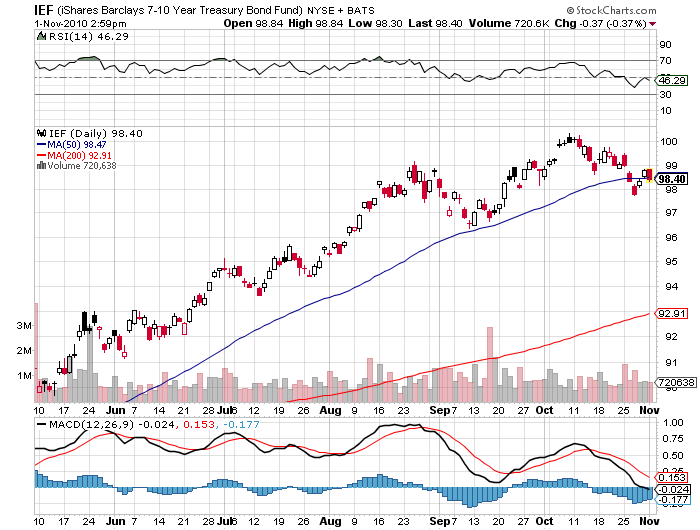

2) The Treasury Bond Dilemma. There is a very interesting divergence going on in the Treasury bond market which readers should be aware of. The leveraged short ETF for long dated paper, the (TBT), looks like it bottomed in the end of August, indicating that the collapse I have been predicting has already been started, just five days before my seminal post on the topic (click here for 'The Great Bond Market Crash of 2010'). The ETF for seven to ten year paper (IEF), motored on to a new high six weeks later, and has been grinding sideways since, the ten year since levitating at an amazing 2.60% yield.

This is happening because many bond traders believe that Ben Bernanke is going to focus his QEII on durations less than ten years, and will leave long dated paper, like the 30 year, out in the cold. Which is another way of saying that without temporary, artificial government support, all bond markets would be in free fall by now. This gives us all a wonderful insight into how bonds will behave, once QEII is finished, is thought to be halfway done, or gets canceled (click here for 'Ha, Ha, I fooled you' in 'Contemplations on Risk'). I think what these two charts are telling you is that if the great bull market in the (TBT) hasn't started yet, it is not far off.