November 2, 2010 - There is Less Than Meets the Eye in Q3 GDP

Featured Trades: (Q3 GDP)

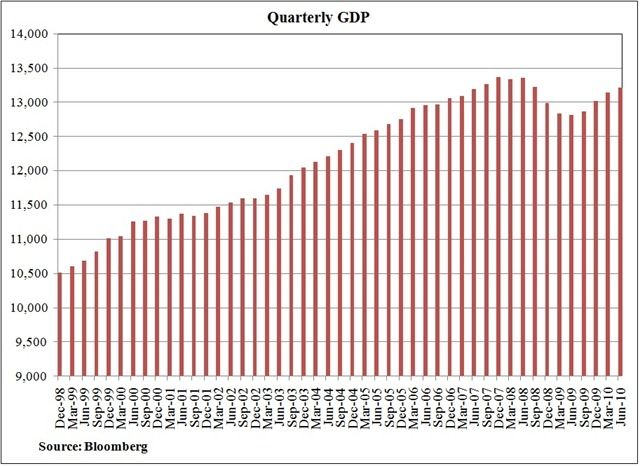

3) There is Less Than Meets the Eye in Q3 GDP. There was much celebration that the US economy managed a 2.0% growth rate in Q3, sending double dippers to the dust bin of history, where they rightfully belong. Of course, you already knew this was going to happen last January, because this is exactly the number I predicted then in my 2010 Asset Allocation Review' (please click here for the call) . I made this prediction because I thought that American companies doing business with the white hot emerging markets would generate just enough growth to offset the huge drag created by moribund industries, like housing, real estate and every shrinking state and local government portions of the economy. This is precisely what unfolded.

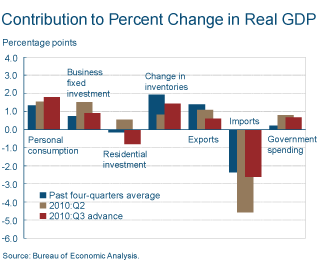

A closer examination of the breakdown show that even this modest, lackluster figure may be overstating the true level of business activity. By the time you strip out the 2.2% GDP deflator and the inventory build of 1.4%, real GDP growth was actually negative. The GDP deflator is no doubt being overstated by the huge expansion of the Fed balance sheet. Much of the inventory build was a one time only affair which has since ceased and can't be counted to repeat in the future.

What all this says about the US stock markets is that further rises are going to be driven mostly by a QEII that will lift all boats, especially the yachts. They will be supported less by actually profit making activities of US companies. That is sort of a long winded way of saying that we are in the middle of a mini stock bubble. Party away, but stay close to the exit at all times.