November 24, 2010 - The San Francisco Hard Asset Conference

Featured Trades: (SAN FRANCISCO HARD ASSET CONFERENCE),

(GOLD), (SILVER), (PLATINUM), (PALLADIUM),

(GLD), (SLV), (PPLT), (PALL)

1) The San Francisco Hard Asset Conference. Attending the San Francisco Hard Asset Investment Conference this week, I learned that the people who inhabit this world are different from you and I. They camp in remote, mosquito infested swamps, risking hepatitis or dysentery, or 100 degree below zero temperature in the frozen wastelands of the north. The mines in which they toil present dangerous and claustrophobic working conditions in unbearably hot deserts and stifling jungles. They do this in the world's most corrupt countries where they will happily expropriate your holdings and throw you in fetid, stinking jails if the required 'consulting fees' go unpaid.

They do all of this so when you shake their hardened, calloused hands with red dirt under their fingernails and you look into their darkly tanned faces they can tell you with the fervence of a religious zealot that the value of their metal, ore, mines, exploration rights, or stock price are about to take off like a rocket. Perhaps it was appropriate that gold hit a new all time high this month, which explained why so many of the visitors seemed to be floating by on a cushion of air. Everyone seemed to be wearing better tailored, suits, cleaner shirts, and sharper haircuts than last year.? These were the hard core faithful who suffered a 20-year bear market in hard assets, and even hung on during the dark days when gold plumbed the depths to $260/ounce in 1999, and were now witnessing the second coming.

The conference was one of the most satisfying I attended this year. I spent half the time, going from table to table, thanking them for delivering the stellar performance I promised would arrive, companies like Avalon Rare Metals. I spent the other half signing programs for enthralled visitors who spotted my conspicuous Mad Hedge Fund Trader nametag.

The gold and silver coin dealers were there in force with their usual patter and free lotteries. There were a number of new Canadian mining companies raising money for an IPO or a secondary on the back of their latest findings in the field. The uranium and yellow cake producers were waxing eloquent about the nuclear power boom in China and the coming renaissance in the US (click here for my piece).

The poster child for the conference had to be the rare earths miners whose stocks have clocked meteoric 400% returns in the past six months. What I heard from the other attendees was fascinating. At least 30 others told me they sold all their real estate in 2004-2005 and poured the proceeds into hard assets, which have since doubled, tripled, or quadrupled.? I received no end of tips about better than expected assay result from exploratory core drillings in British Columbia, Chile, and Gambia. I steered clear of the booths staffed by hotties who clearly had more firsthand knowledge of silicon, than gold, silver, copper, or uranium.

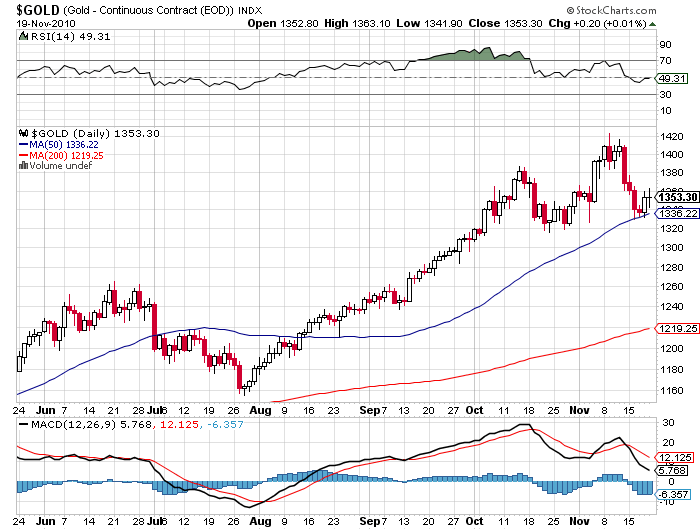

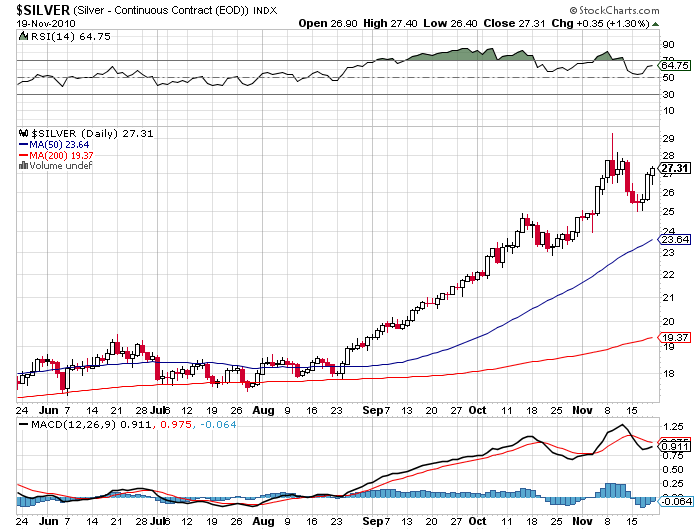

While the long term fundamental case for gold, silver, and other hard assets is overwhelmingly positive, there is no doubt that it is overheated for the short term, and the recent $90 sell off over the last 10 days has shown. Still it is absolutely something to keep on your radar.

All in all, it gave a great overview on many key commodities and precious metals that are in long term bull markets. There are few sure things in life, but one for me is that I will be attending the next Hard Asset Investment Conference in New York during May 9-10, 2011 (click here for the link), which is free for all comers.

-

-

-

What a Chart is Supposed to Look Like