November 28 Biweekly Strategy Webinar Q&A

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader November 28 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader.

Q: Is it time to get out of semiconductor stocks?

A: The time to get out is before it drops 60%, not afterwards. So, if you have semiconductor stocks, I would look for the next major rally to get out. I think we will get one of those rallies into December/January. We went negative on this sector in June, took all our profits, and didn’t go back in until last week.

Q: Is it time to buy semiconductor stocks?

A: No, that is the group you want to buy at the absolute bottom of the next recession which might be next year sometime. They lead on the downside, and they will lead on the upside as soon as they sniff a recovery in the economy.

Q: I held on to my position in Square (SQ). Should I sell now for a small profit?

A: Yes, in recessions, big companies prosper much more than small companies like Square; that’s why it had such a tremendous selloff; down 55% in six weeks. A small technology stock is not what you want to own in a recession. Big companies slow down, small ones die. At least that’s how conservative investors see it.

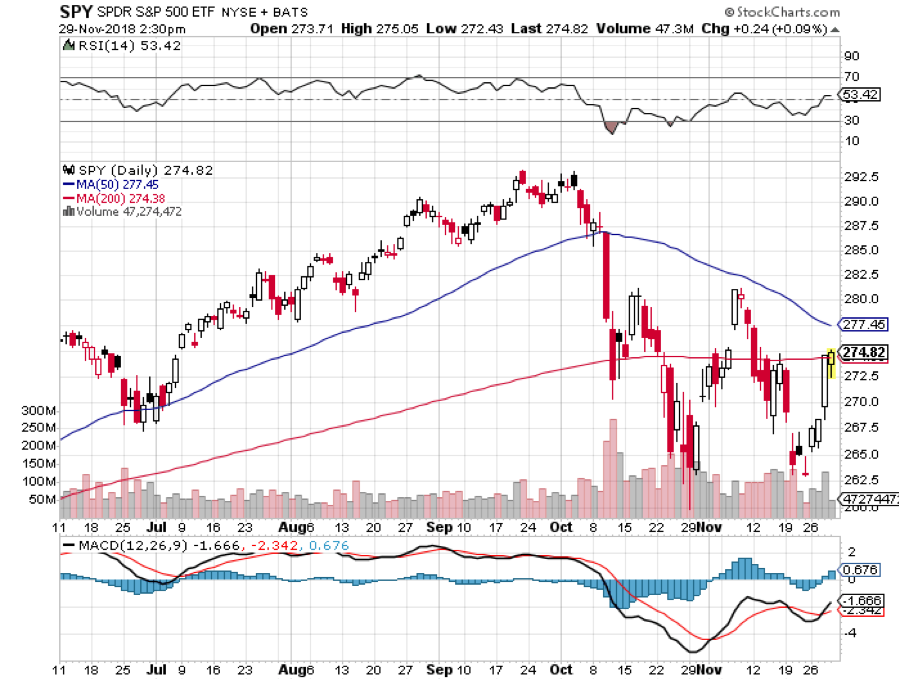

Q: What do you make of Fed comments this morning that asset prices are high?

A: I agree with them. They were certainly overpriced with a P/E multiple of 20 that we saw in September; they’re moderately priced now with a P/E multiple of 14.9. I think real estate markets are the overpriced assets that the Fed is talking about though, far more than the stock market, and markets like San Francisco, Seattle, and Vancouver are still way too high.

Q: What are your comments on Apple (AAPL)?

A: There’s an interesting thing going on here; you’ve just had a massive move out of hardware stocks like Apple, which basically makes phones and computers, into software stocks like Microsoft (MSFT), which is growing their cloud business like crazy. You may see this as a long-term industry trend, out of hardware stocks into software stocks. It’s all about the cloud now. The future is in software and that is where Apple is going to with services like the cloud, iTunes, streaming, and advertising, although they are doing it slowly.

Q: Will Trump be able to persuade Fed Chair Powell to stop hiking interest rates?

A: He will not, Powell is one of the few principled people in the government. He’s going to stick to his discipline, only look at the data, and that is going to require him to keep raising interest rates. One of the big black swans for 2019 may be that Trump fires Powell and gets a friendly rent-a-Fed chair in there who lowers interest rates on command. If Trump can hold on for nine months though, even Powell will see the economy’s in trouble and will have to respond accordingly by capping or even lowering interest rates.

Q: Why are you not stopping out of Roku (ROKU)?

A: We haven't yet approached our upper strike price on the December $30-$35 vertical bull call spread. That’s usually where I bail out; I like to give stocks plenty of room to do the right thing. Stocks have to breathe and I pick strike prices to compensate for that. Otherwise, you’d be stopping out of every trade immediately.

Q: Should we close the iPath S&P 500 VIX Short Term Futures ETN (VXX) trade or leave it open?

A: I’m looking for a bit more of a rally in stocks and a drop in the Volatility Index (VIX); then we’ll try to grab whatever additional couple of pennies we can get out of that.

Q: What do you think of Brazil (EWZ)?

A: Avoid emerging markets (EEM) as long as the U.S. is raising interest rates and the dollar is strong. Rising dollar means rising debt for emerging markets and less ability to service that debt, all bad for business.

Q: Morgan Stanley (MS) says “buy emerging markets”; are they nuts?

A: For the short term yes, for the multi-year long term they are a screaming buy. They are at historical lows in terms of valuation and already have a recession priced into them. But jumping in too soon could be painful.

Q: What are your expectations for the yield curve?

A: I expect all levels of the fixed income market to drop in price and rise in yield with the sharpest move in overnight rates. This eventually leads to a very steep inverted yield curve which causes recessions and bear markets.

Q: Thoughts on Master Limited Partnerships?

A: They could be relatively safe now that oil is at $50. There have been big selloffs recently. The yield on these are high and there is going to be big infrastructure building for energy going forward. I would say don’t put all your eggs in one basket and diversify your risk. In the Great Recession, many of these went bankrupt. I would look at the Alerian MLP (AMLP), which has fallen 15% in six weeks.

Q: Should I be rotating out of the Tech (XLK) stocks on rallies into more defensive stocks like Staples (SPLS)?

A: That’s half right. You should be rotating out of Tech stocks and rotating into cash which yields up to 2-3% these days. Nothing does well in a real bear market except cash. Defensive stocks still go down, just at a slower rate.

Q: Is General Electric (GE) good for the long term?

A: Yes, if anyone can turn around GE it’s the current management. That said, it could be a long-term slog—that’s why I had a long-term leap in this thing before it collapsed. It could turn around and still go up but these are throwaway, chapter eleven level type prices that we’re getting now. And now they are going to have to do a turnaround going into a recession.

Q: Do you see GE as good for a long-term trade?

A: Long term and trade don’t belong in the same sentence; but I’d say for a long-term investment at these levels, probably yes. It certainly is a bargain from $30 down to $7.40 in a year.

Q: Is this webinar archived?

A: A: Yes, they are always posted on the website within two hours of recording. Just go to www.madhedgefundtrader.com/, login and then hover your cursor over “MY ACCOUNT” click on “GLOBAL TRADING DISPATCH,” “Mad Hedge Technology Letter” or “Newsletter” depending on your membership then click on the Webinars button. The last ten years of webinars should show up, with the most recent one at the top.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader