November 3, 2009

Global Market Comments

November 3, 2009

SPECIAL ?END OF JAPAN? ISSUE

Featured Trades: (NIKKEI), (YEN), (JGB),

(ATLANTIS JAPAN GROWTH FUND), (LSE-AJG)

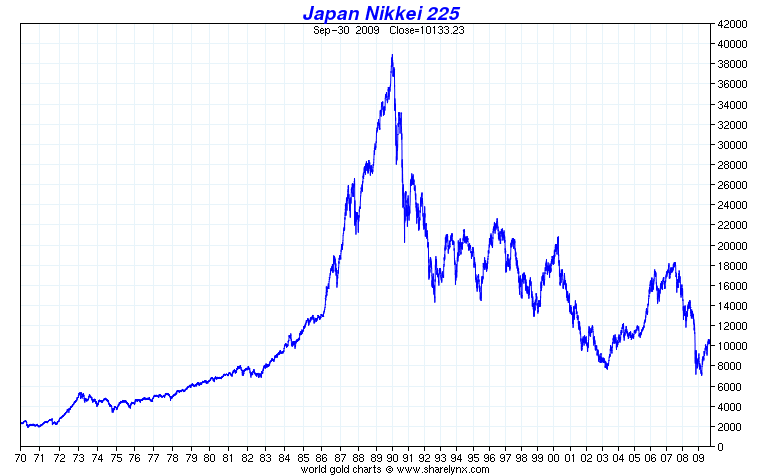

1)? Having spent a decade living in Japan sharing shoe box sized apartments, living on fish heads, rice, and instant ramen, I am something of an authority on that enchanting country. I spent the seventies toiling away learning Japanese, shuffling hundreds of flash cards whenever I rode the train or subways. My friends said I was crazy when I learned obscure, seemingly useless terms like hitokabu rieki (earnings per share) and genka shokyaku (depreciation). I even made the ultimate sacrifice to improve my fluency, taking a Japanese girlfriend, who later became a wife and mother. As with most bilingual families, discussions at the family dinner table were a mash up of Japanese and English, leaving visitors in the dark, as they only caught half the conversation.? Alas, my wife passed away too soon, and when my kids grew they complained how rotten my accent was, unaware that I had first learned it from the only free language school around, the bar girls and yakuza who attached themselves to stray foreigners. During the eighties, Japanese suddenly became the world?s most valuable language, as the stock market soared from ?6,000 to ?39,000, and PE multiples ballooned from 10 to 100, landing me a job at Morgan Stanley. A friend who delivered sandwiches for a living was even able to land a job at a special bracket firm because he had a reasonable fluency in this impossible to learn, 5,000 year old language. But languages rise and fall, as do civilizations, and I?m afraid that my language skills are getting downgraded to the relevance of Vulgar Latin. That?s what happened to our army of Vietnamese speakers, who could only land jobs in welfare offices after we pulled out our troops there, and Farsi speakers who ended up running Seven Elevens after the fall of the Shah. Japan is making new history in the demographic world, as they aren?t making Japanese anymore. There are now three workers supporting each retiree, and that is expected to drop to an impossible 2:1 over the next decade. That means no more money for expansive infrastructure projects, social services, and even debt service. More research on this last point to follow.

2) As much as I want to find a trade in Japan and therefore have an excuse to go there again, my searches have recently come up empty. With America maintaining its lead in innovation and the creation of new business models, and China taking over the world?s low end manufacturing, it is hard to see a future for Japan. Can a country of 127 million live only off of the high end manufacturing of luxury cars, video games, and electronics? The country is increasingly looking like a ?has been? emerging market. During my career, I watched GDP growth rates fall from a white hot 10% in the sixties, to 4% in the seventies and eighties, to 1% in the nineties and the early 21st century. Are we flat lining at 0% in the teens? That leaves fertile ground only for stock pickers who are willing to do the local spade work to find one hit wonders like Toyota and Fast Retail. That is a job best left to country specialists, like my old friend, 40 year veteran Ed Merner, who runs the Atlantis Japan Growth Fund (LSE-AJG) traded in London, which has shot up a sizzling 80% in six months.

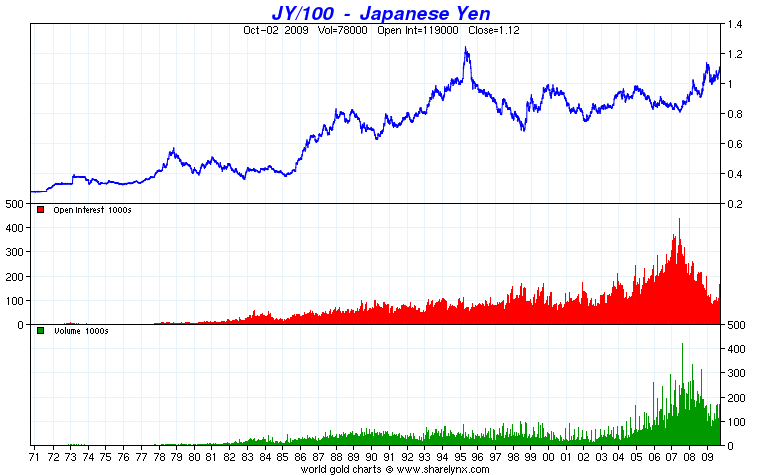

3) The collapse of the Japanese government bond market has long been the holy grail of the international hedge fund community. Unfortunately, it has remained just that for nearly 20 years, much talked about, unattainable, and some would say imaginary. During the early eighties, I took the entire pension fund of the Foreign Correspondents? Club of Japan out of US dollar bonds and put it into JGB?s, then yielding 10%, earning the eternal gratitude of the staff there. Even today, I am showered with free drinks and lunches when I visit Tokyo. After the 1990 stock market crash, JGB?s rocketed on a flight to safety bid, the ten year eventually reaching an unimaginable yield of only 0.46%. During this decade, we have largely traded in a 1.20% to 1.90% range. Every wave of government stimulus spending brought hopes of an imminent collapse in bond prices. But the country?s gun shy institutional investors weren?t buying it, and the end result was soaring national debt, a still stagnant economy, and 1,000 bridges to nowhere, some of them truly gigantic. Hedge fund guru, Julian Robertson, annually wrote a nine figure check to the JGB market anticipating a rate spike which never appeared. However, the day of reckoning for the JGB market may at last be coming. The savings rate has dropped from 20% during my time there, to a spendthrift 3%, because real falling standards of living leave a lot less money for the piggy bank. The national debt has rocketed to 200% of GDP, and 100% when you net out government agencies buying their own securities. Japan has the world?s worst demographic outlook. Now that the country is entering its third lost decade, unfunded pension fund liabilities are exploding. I?m not saying this is going to happen tomorrow. But when the break does come, you can expect the big hedge funds to dog pile in. And if JGB?s do go down the crapper, can the yen be far behind?

?It?s better to speak than to shoot,? said Thorbjorn Jagland, chairman of the Oslo based Nobel committee, in explaining why Obama was awarded the Peace Prize.