November 4, 2009

November 4, 2009

(UNP), (CSX), (KCSR), (OBAMA), (HEDGE FUNDS)

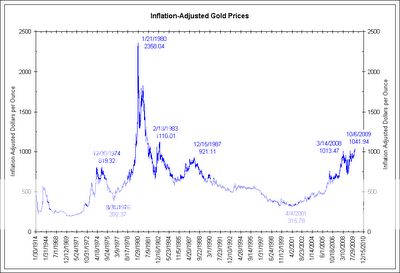

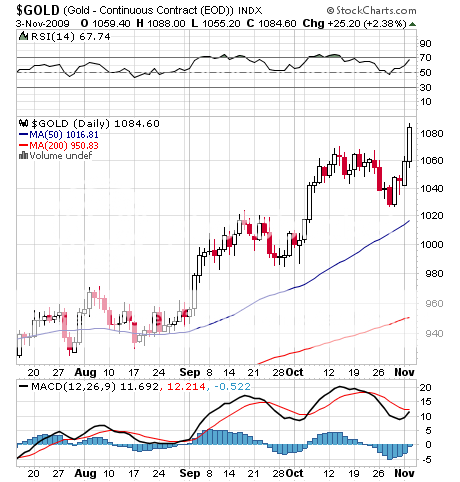

1) News broke this morning that, out of the blue, the Reserve Bank of India bought 200 metric tonnes of gold from the IMF for a handy $6.8 billion. The news set the gold market on fire, boosting the December futures $40 to an all time high of $1,088. It is the largest transaction in the barbaric relic since the Alaric's Visigoths sacked Rome in 410 AD. It has been public knowledge for some time that the IMF was looking to unload 403 tonnes of the yellow metal in order to fund lending to poor countries. Many traders say this threatening overhang is why gold failed to definitively break out to the upside this year, despite six attempts. The expectation was that China would take this hoard as part of a broader diversification away from the dollar. Bringing India into the fray, which had no prior history of stockpiling gold, is a whole new plate of basmati rice. Not only does this raise the prospect of a bidding war with China for more gold reserves, other cash rich emerging market central banks are likely to join the mosh pit as well, no doubt panicked by the ominously rising whirr of printing presses in the developed countries. My short term goal for gold was $1,200, but I now have to raise that to the $1,300 favored by some chartists in view of the new dynamics. If you want to see my long term target, take a look at the chart below, which has gold zeroing in on its inflation adjusted all time high of $2,358. For those who prefer holding the barbaric relic of the physical kind, visit the tightest spreads in town on American Eagles and bullion by clicking here at http://www.millenniummetals.net/ . And while you?re there, sign up for their free research product on precious metals.

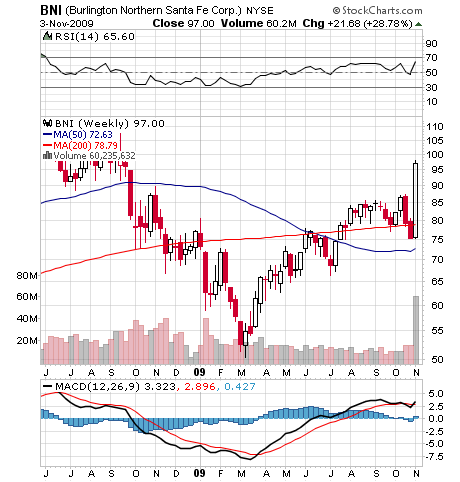

2) You've got to hand it to Warren Buffett, who never does anything half heartedly. The stunning news that his Berkshire Hathaway (BRK/A) is paying $44 billion for the 73.4% of Burlington Northern Sante Fe (BNI) he doesn't already own, a 30% premium, had punch drunk traders picking themselves off of the floor. The other rails rocketed, like Union Pacific (UNP), CSX (CSX), and Kansas City Southern (KCSR). The deal is the Oracle of Omaha's largest in his career, and took the BNI board all of 15 minutes to approve. For me this deal speaks volumes about the long term trends in the US economy as seen by its greatest investor. It screams Commodities! Commodities! Commodities! Rails can only prosper moving bulk freight from the heartland to ports on the three coasts, which foreigners are buying in ever larger quantities at ever higher prices. It also says the coal industry isn't going anywhere soon, as it accounts for 70% of all rail traffic, so you can kiss Cap & Trade goodbye. Buffet let loose of some fascinating statistics about the enormous productivity increases the industry has accomplished. In the last 25 years, it cut employment from 500,000 to 175,000, while increasing freight by 60% and reducing track by 40%, and now accounts for 40% of the total goods moved in the country. Railroads are the greenest transportation out there, a ton of freight requiring only a gallon of fuel to move 470 miles. When I was growing up, my big goal in life was to become a train engineer. Maybe it's time for me to revisit that aspiration. And I promise not to text while driving!

3) I know what keeps Obama awake at night. Let's say we spend our $2 trillion in stimulus and get a couple of quarters of weak growth. Then once the effects of the stimulus wear off, we slip back into a deep recession, setting up a classic 'W.' Unemployment never does stop climbing. This happened to Roosevelt in the thirties. So congress passes another $2 trillion reflationary budget. Everybody gets wonderful new mass transit upgrades, alternative energy infrastructure, and bridges to nowhere. But with $4 trillion in spending packed into two years, inflation really takes off. The bond market collapses, the dollar tanks big time, gold goes ballistic to $5,000, and silver explodes to $50. Ben Bernanke has no choice but to engineer an interest rate spike, taking the Fed funds rate up to a Volkeresque 18%. Housing, having never recovered, drops by half again. This all happens in the 2012 election year. Obama is burned in effigy, a Mormon is elected president, and the Republicans, reinvigorated by new leadership, retake both houses of congress. We invade Iran. Crude hits $500. This is not exactly a low probability scenario. Remember Jimmy Carter? This is why junk bond yields are still stubbornly high at 12.5%, and credit default swaps live at lofty levels. Are the equity markets pricing in this possibility? No chance. The risk of Armageddon is still out there. Personally, I give it a one in three chance. Pass the Xanax.

4) The hedge fund industry is still emerging from the ashes of 2008, but will inevitably grab a larger share of the investing public's assets. Low interest rates and hero status made it way too easy for inexperienced, untested, and sometimes unscrupulous managers to raise new funds that charged management fees as high as 3%, with a 50% performance bonus. Behind every 'liar loan' was a bond manager happy to soak it up through securitized Fannie Mae (FNM), Freddie Mac (FRE), or bank debt, shorting Treasuries against them, and then leveraging the 40 basis point spread 50 times to generate a highly marketable 20% annual gross return. Never mind the risks. It was easy money, as long as there were lots of liars- which mortgage brokers herded in by droves, and as long as spreads narrowed-which they did for most of the 21st century. By the beginning of 2008, assets under management soared to $2 trillion. The melt down that followed wiped out large numbers of funds, and raised gates for the survivors, making investors wonder if they would ever get their money back. Total assets plunged to $1 trillion in the blink of an eye through a combination of redemptions and market losses. The new era that is emerging will be populated with humbled and chastened managers offering more disclosure, lower fees, no gates, and thanks to Madoff, oodles of third party oversight. Their portfolios will have less leverage, be invested in more liquid securities, and bring in lower returns. But the new generation will also offer investors battle tested strategies that survived the 100 year flood. Bridgewater, with $37 billion in assets, is now the largest hedge fund, followed by JP Morgan with $36 billion, Pauls

on & Co. at $27 billion, DE Shaw showing $26 billion, and Soros still at a hefty $24 billion. Long track records and a Gucci cachet will assure that these will prosper. Fees will settle down to the 1%/20% range. For the rest of us this means more capital bunching up in the most successful trades, as we have already seen this year in financials, China, oil, copper, and the multitude of short dollar plays. It is also going to be much harder to get new fund launches off the ground.

'I just basically believe that this country will prosper, and have more people moving more goods in 10, 20, and 30 years from now, and the rails should benefit,' said Warren Buffet, explaining why he is taking over Burlington Northern. What guts! Only Buffet would, at the age of 79, make a 30 year bet. Most men his age don't even buy green bananas.