November 4, 2010 - What the Election Means for the Markets

SPECIAL ELECTION ISSUE

Featured Trades: (WHAT THE ELECTION MEANS FOR THE MARKETS),

(SPY), (TBT), (YCS)

S&P 500 SPDR ETF

ProShares Ultra Short Lehman 20+ Year Treasury ETF

ProShares Ultra Short Yen ETF

3) What the Election Means for the Markets. Who really won this election? I did! It is setting up trends in the global financial markets that will be easy to identify and cash in on. If you want to jump on my bandwagon and get a peak at some market timing, then keep reading this letter.

While voters may be enthralled with empty promises, platitudes, spin, and sound bites, markets clearly aren't. Like a huge, dumb animal, they respect only the remorseless mathematics of supply and demand. QEII is still the principal driver, the first $600 million of which we got today. This promises to lift all boats, especially the yachts, to year end, and possible through Q1, 2011 (click here for 'Contemplations on Risk'). When it ends, the full impact of this election will bite. This will be the outcome:

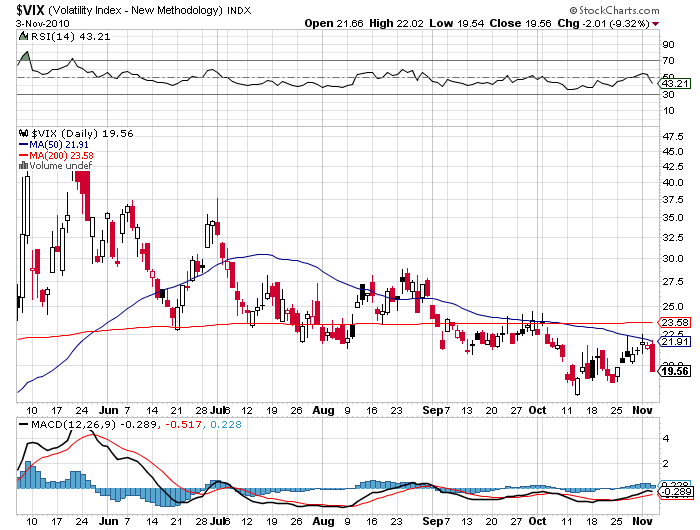

1) There will be a major sell off next year, not just in stocks, but in all asset classes. The election results increase the certainty and the severity of this event. Volatility (VIX) will rise across the board.

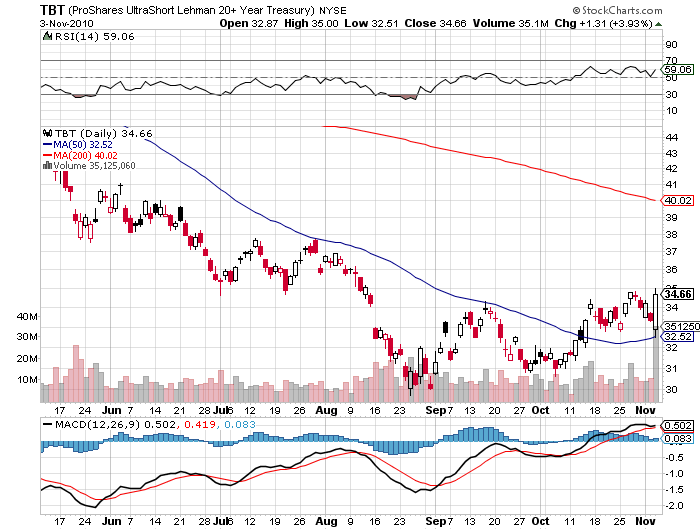

2) The deficit will rise faster. The debt markets' breaking point will be reached sooner. This means we will get a collapse in bond prices, no matter how much liquidity floods the system. Whether this happens with the national debt at $15 trillion, $18 trillion, or $20 trillion is anyone's guess. We are headed towards all of those numbers trapped in a runaway Toyota with the accelerator stuck on the floor.

With the administration and congress gridlocked, the Federal Reserve is the sole functioning branch of government, and creating inflation is virtually the only thing they know how to do well. This nicely sets up my (TBT) trade, one of my core shorts for the coming decade.

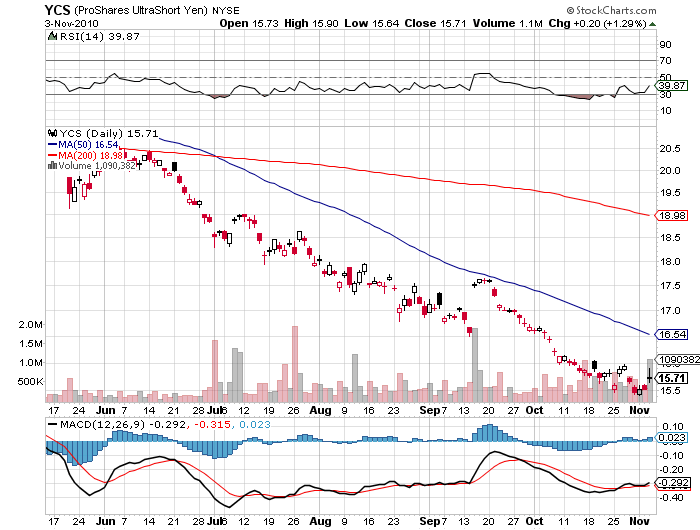

3) A flight to safety will trigger an extended period of dollar strength. This is bad for stocks, commodities, emerging markets. Flip the 'RISK OFF' button. This sets up the crash in the yen, my other core short of the decade, and bodes well for the (YCS).

4) Since many conservatives believe that global warming is a leftist hoax, you can expect more favorable policies and tax treatment for oil, natural gas, and coal. Expect dependence on foreign energy sources to rise and crude prices to rocket. The congressman who apologized to BP for it harsh treatment is now the chairman of the House energy committee. The Bush administration took oil from $20/barrel to $150. Expect something similar going forward. The giant target on our backs in the Middle East stays there. Buy your electric car now.

Sorry, guys, but read it and weep. As with a World Series umpire, I call them as I see them. This is the letter where hard data and facts trump uninformed opinion every day of the week. There are thousands of letters out there whose primary goal is to make you feel better. This isn't one of them.