November 5, 2010 - I'm Singing "Waltzing Mathilda" Again

Featured Trades: (AUSTRALIA), (FXA), (FXE), (EWA)

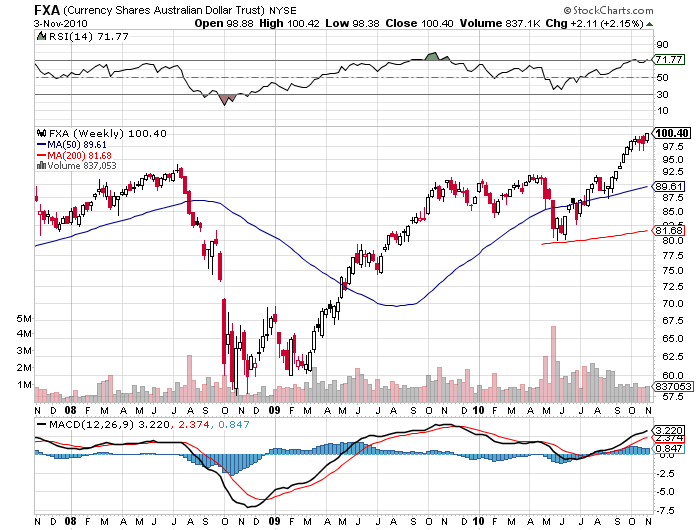

Currency Shares Australian Dollar Trust ETF

PowerShares Indio Portfolio ETF

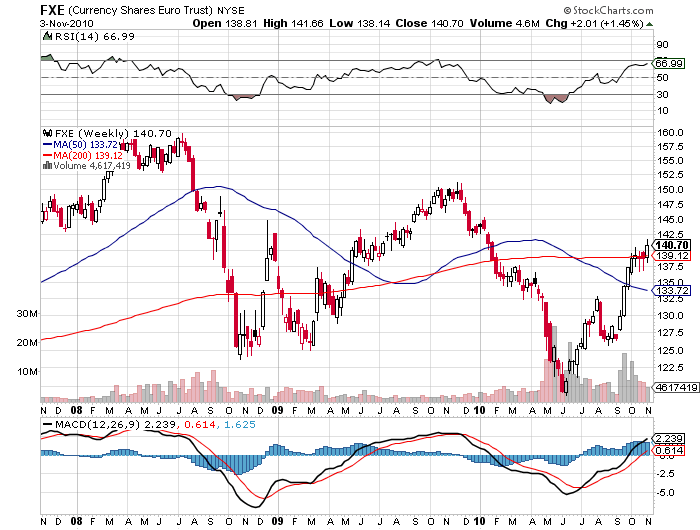

Currency Shares Euro Dollar Trust ETF

3) I'm Singing 'Waltzing Mathilda' Again. Many readers made a killing last February when I recommended they buy Australian dollars and short the euro against it (click here for the call). A lot of the hottest hedge fund money then poured into The Land Down Under, while the Euro has crashed. The outright Aussie/US Dollar (FXA) jumped from $AUS.85 to $AUS1.01, while the cross soared from AUS$.63 to AUS$1.41.

Last week, the Reserve Bank of Australia surprised observers and raised overnight interest rates to 4.5%. Ben Bernanke's QEII is triggering simultaneous quantitative tightening in the best managed, but inflation prone commodity producing or emerging countries of the world, like the Land Down Under, India, and of course China. All this does is widen the yield spread between their currencies and the dollar, making them even more attractive to speculators. You might as well be waving a red flag at a bull

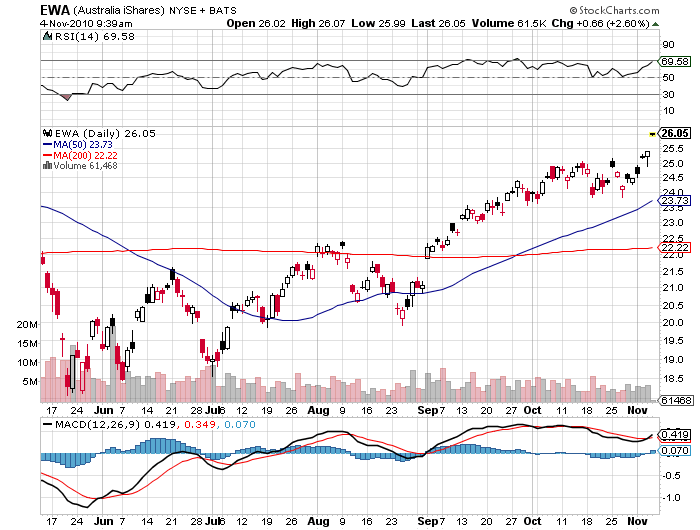

I still think Australia is blessed, with that perfect combination of huge resource and energy exports, a strong economy, rising interest rates, a small population to support, and great looking women. Australian stocks (EWA), which have gained a mind blowing 45% since July, should be at the top of your list too.

Another Reason to Invest in Australia