Now the Fat Lady is REALLY Singing for the Bond Market

The most significant market development so far in 2020 has not been the epic stock market crash and rebound, the nonstop rally in tech stocks (NASDQ), the rebound of gold (GLD), or negative oil prices, although that is quite a list.

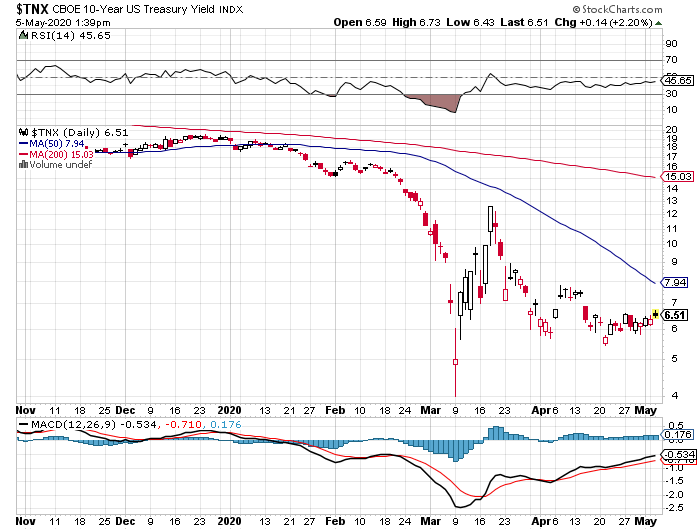

It has been the recent peaking of the bond market (TLT), which a few weeks ago was probing all-time highs.

I love it when my short, medium, and long-term calls play out according to script. I absolutely hate it when they happen so fast that I and my readers are unable to get in at decent prices.

That is what has happened with my short call for the (TLT), which has been performing a near-perfect swan dive since April. The move has been enough to boost me back into positive numbers for 2020.

The yield on the ten-year Treasury bond has soared from 3.25% in 2018 to an intraday low of 0.31% in March.

Lucky borrowers who demanded rate locks in real estate financings at the end of January are now thanking their lucky stars. We may be saying goodbye to the 3% handle on 5/1 ARMS for the rest of our lives.

The technical damage has been near-fatal. The writing is on the wall. A 1.00% yield for the ten-year is now easily on the menu for 2020, if not 2.00% or 3.0%.

This is crucially important for financial markets, as interest rates are the well spring from which all other market trends arise.

Wiser thinkers are peeved that the promised bleeding of federal tax revenues is causing the annual budget deficit to balloon from a low of a $450 billion annual rate in 2016 to $1.2 trillion last year and over $5 trillion in 2020.

Add in the bond purchases from the Fed’s new promise of $8 trillion in quantitative easing and you get true government borrowing of $13 trillion for 2020. It will all end in tears for bond and US dollar holders.

And don’t forget the president, who recently threatened to default on US Treasury bonds, just as the Treasury was trying to float $3 trillion in new issues. It is a short seller’s dream come true.

As rates rise, so does the debt service costs of the world’s largest borrower, the US government. The burden will soar in a hockey stick-like manner, currently at 4% of the total budget.

What is of far greater concern is what the tax bill does to the National Debt, taking it from $24 trillion to $32 trillion over the next year, a staggering rise of 50%. Even Tojo and Hitler couldn’t get the US to buy that much. If we get the higher figure, then we are looking not at another recession, but at yet another 1930-style depression.

Better teach your kids to drive for UBER early, as they are the ones who are going to have to pay off this gargantuan debt. That is if (UBER) is still around.

So what the heck are you supposed to do now? Keep selling those bond rallies, even the little ones. It will be the closest thing to a rich uncle you will ever have, if you don’t already have one.

Make your year now because the longer you put it off, the harder it will be to get.