Obama?s Unintended Oil Consequences

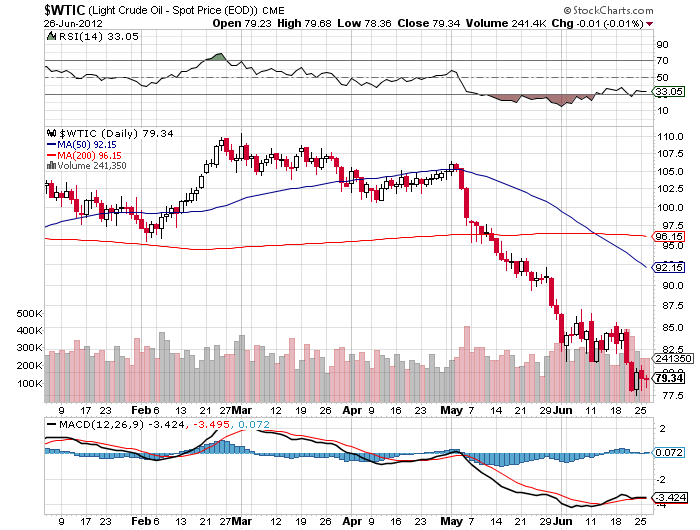

Back in March, oil broke the $110/barrel level and gasoline was rapidly approaching the $5/gallon level, threatening to derail Obama?s reelection campaign. The administration enlisted Europe to join it in a boycott of Iranian oil in an effort to get the Islamic republic to retreat from is program to develop a nuclear weapon. Iranian president, Mahmoud Ahmadinejad, responded by threatening to close the Straits of Hormuz, thus blocking exports to the west. It all had the makings of a first class crises that could have taken oil up to $125 or higher.

There was no way that the president was going to let Texas Tea to pee on his parade, so he took quick action to cut the knees out from under it. He threatened to release supplies from the Strategic Petroleum Reserve in Louisiana, which was chocked full. He browbeat the CFTC into substantially raising margin requirements for oil and other commodities with his attack on ?speculators?.

He then convinced Saudi Arabia to ramp up its production to the max, over 12 million barrels a day, to head off any ill-timed price spikes. The Saudis, believing it was time to discipline recalcitrant minor producing OPEC members, like Iran, with the threat of lower prices, happily complied.

Crude gave back $5 in the bat of an eyelash, and then launched a $33 downslide that had oil trading at the $77 handle on Monday. What Obama didn?t expect was an assist in his strategy to cripple oil prices from a flock of ?black swans?.

The next chapter in the European sovereign debt debacle pushed the continent into a more severe recession, cooling energy demand there. Libya has been bringing production on line faster than expected. Every downtick in China?s anticipated GDP growth rate shaves a few more dollars off oil. A shortage of pipeline capacity is causing oil to pile up at the massive storage facilities Cushing, Oklahoma, slowing export deliveries. It all adds up to a rare perfect storm for oil. To Obama?s delight, gasoline may be selling for the high $2 range in much of the country by the November election.

As I regularly harangue readers and attendees at my strategy luncheons, imminent America energy independence is the least understood but most important factor that will impact financial markets in the years ahead. Over the last two years, domestic production has soared from 8.5 million barrels a day to 10.5 million, thanks to the miracle of fracking technology, which I helped pioneer a decade ago. That?s more that we buy from Saudi Arabia annually.

North Dakota has just replaced Alaska as the second largest oil producing state. The boom there has been so rapid that massive RV camps of itinerate roustabouts now litter the Northern plains. In the meantime, imports have plummeted from 13 million barrels a day to only 9 million.

But I think the current crash in oil will be a temporary one. For a start, the Seaway pipeline reverses next week, breaking the Cushing bottleneck, enabling North Dakota oil to reach the Gulf ports. The current $78 oil price is already below the cost of the most important sources of supply, such as Canadian oil sands and deep offshore wells.

I think that financial markets will enjoy a ?RISK ON? rally starting from this summer as they start to discount the conclusion of the presidential election, the next European LTRO quantitative easing, and possibly a QE3 from the Federal Reserve. This could all pave the way for a rebound in oil to $90 or more.

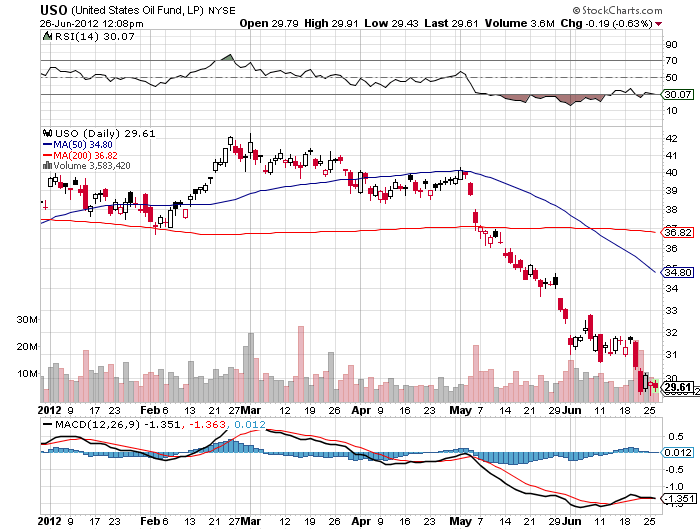

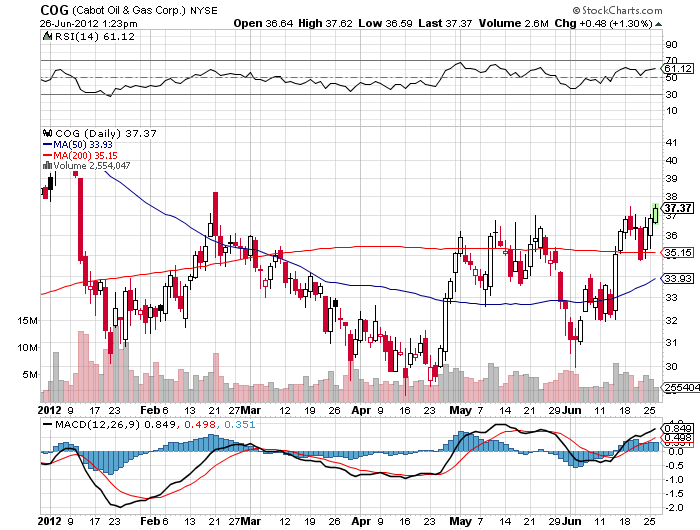

So there is an attractive trade setting up here. You can buy the oil major ETF (DIG). Interesting single stock plays at these levels include ExxonMobile (XOM), Occidental Petroleum (OXY), and Cabot Oil & Gas (COG). You can also buy call spreads in the oil ETF (USO). A more cautious strategy might be to sell short out of the money puts on the (USO). Sure, the tracking error on this horrible ETF is huge, thanks to the contango, but at least you can take in the time premium.

My long term view on oil is that we spike one more time to $150-$200. Having spent 45 years studying the industry closely and knowing principals like Armand Hammer and Boone Pickens, I can tell you the one simple rule of thumb to observe with this industry. Doing anything costs extraordinary amounts of money and takes a really long time. The calloused men who run the oil majors don?t hesitate to spending tens of billions of dollars to finance projects in the most inhospitable parts of the world with 40 year payouts. No matter what we do today, it will be impossible to head off another severe oil shortage.

After that, we will fall to $10 as oil is removed from the global economy and is only used as a petrochemical feedstock for plastics, pharmaceuticals, asphalt, and jet fuel. This will happen because of the rise of cheap natural gas, alternative energy sources, more efficient building designs, a better power grid, the advent of low end nuclear power plants, and cars that get 100 miles per gallon or use no gasoline at all.

Of course the CEO?s of the oil majors laugh when I tell them this. I?m sure that the hay industry similarly laughed in 1900 if you told them about the coming demise of the horse as a mode of transportation. But it may take 40 year for us to get there. I hope I live to see it.

Time for a Punt?