October 11, 2010 - Run Over by the Grain Train

Featured Trades: (THE GRAIN TRAIN), (CORN), (WHEAT), (SOYBEANS), (MOS), (AGU)

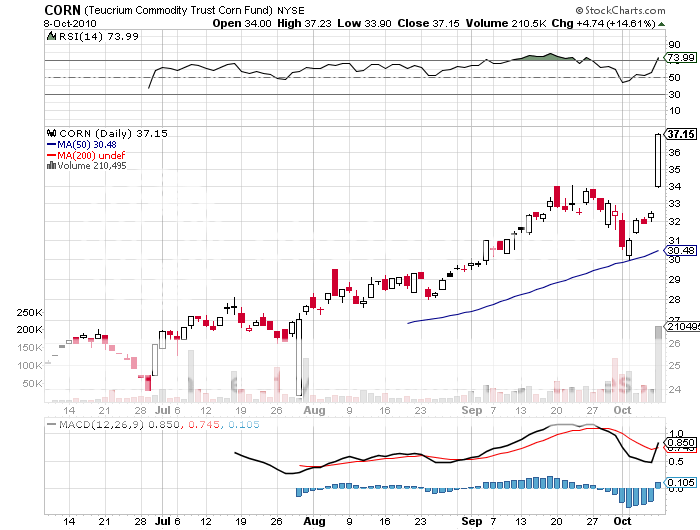

Teucrium Commodity Trust Corn Fund ETF

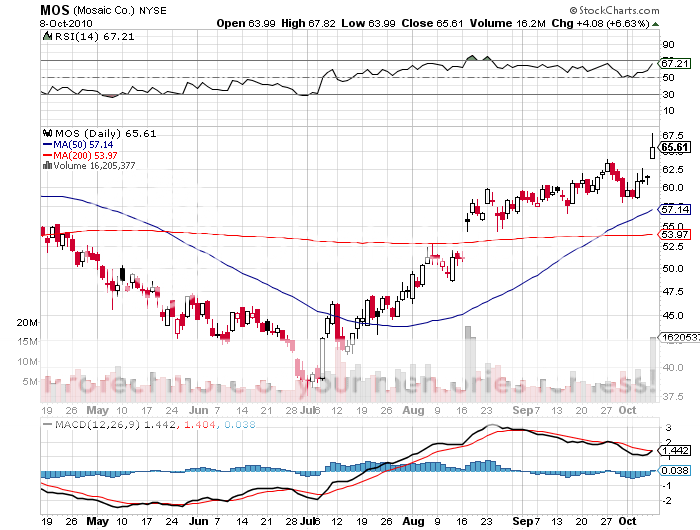

2)? Run Over by the Grain Train. The US Department of Agriculture released a shocking report on Friday that triggered rare limit up moves in all three major grains simultaneously, corn, (CORN), wheat, and soybeans, and sent the prices of shares of anything with an agriculture flavor through the roof. Futures contracts for corn were up 30 cents to $5.28/bushel, wheat by 60 cents to $7.19, and soybeans 70 cents to $11.35. My long term picks, Mosaic (MOS) soared by 13%, while Agrium (AGU) popped 8%. After the corn futures locked up with an enormous imbalance of buyers, traders rushed into the ETF (CORN) taking it up a gob smacking 16% in hours.

The free-for-all was triggered by government forecasts that the corn crop would come in 4% smaller than expected, while the soybean crop was shy by 2%, and that stockpiles had shrunk to only a few weeks, a 20 year low. The shortfall was caused by the baking heat we saw last summer. While supplies are adequate to meet US demand, foreign importers facing possible famines panicked. Local traders went into the report short, convinced that the meteoric price rises seen this year were overdone. With a second limit up move possible on Monday, a number of smaller firms are now facing ruin.

I put out a piece a few weeks ago advising readers to rotate out of corn into hard winter wheat as a risk control measure (click here for 'Wheat Melt Up Warning'). Corn had been up almost every day for two weeks, while wheat had spent several months consolidating a serious move up in June/July on the back of out of control Russian fires (click here for the tip from my old KGB friend in 'The Grains are On Fire'). I don't call limit up moves very often, but it does happen occasionally. When you have the long term secular trend right, the accidents tend to happen in your favor.

This is exactly the sort of move I have been anticipating since I put out my watershed call to buy the sector in June (click here for 'Going Back into the Ags'). When push comes to shove in the global economy, the commodites you have to have are the grains. If you don't believe me, trying eating gold, silver, iron ore, coal, or copper. It all fits in with my view that we are entering a major secular bull market in food, as the world is making people faster than the food to feed them, at the rate of 175,000 a day! The Scottish reverend Thomas Malthus must be smiling from his grave.

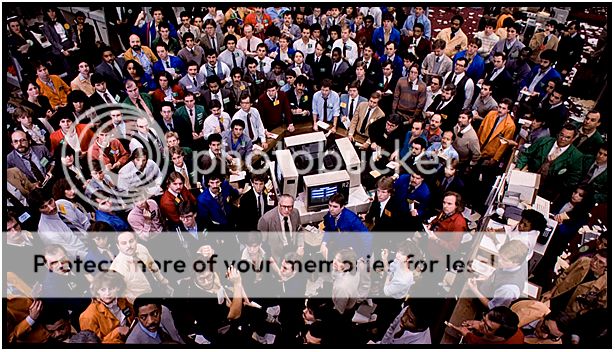

The Grain Pits Have Been a Wee Bit Busy Lately

Good Thing 'Mad' Told Us to Stay Long Food

Should Have Covered that Corn Short on Thursday