October 13, 2009

October 13, 2009GLOBAL RISK ALERT!

Featured Trades: (GOLD), (SILVER), (CANADIAN DOLLARS), (AUSTRALIAN DOLLARS), (NEW ZEALAND DOLLARS), (BRAZIL), (RUSSIA), (INDIA), (CHINA), (TAIWAN), (SOUTH KOREA), (VIETNAM), (JNK), (TBT)

1) When everything is working, and my portfolio is firing on all 12 cylinders, I pinch myself and ask ?Is this real? What can go wrong?? I?m reminded of the slave whose task it was to remind conquering Roman generals ?All glory is fleeting.? Virtually all of my recommended core longs in gold, silver, Canadian, New Zealand, and Australian dollars, Brazil, Russia, India, South Korea, Taiwan, Vietnam, and?? junk bonds are at or near highs for the year. I called the bottom in Natural Gas within 40 cents, and mercifully baled on my one short in US government bonds, the TBT. What we are seeing is a global surge in liquidity as cash emerges from the bomb shelter, squints at the day light, and then rushes to buy the first thing it can find. Everything is going up, regardless of fundamentals. It is the proverbial tide that is lifting all boats. You can make a lot of money in these conditions, but there is no way of knowing if this will last for one week, or another year. But they can go on much longer than you think. In the last two liquidity driven markets I traded, Japan in the eighties and NASDAQ in the nineties, fundamental analysts railed against the tide for years, claiming that stocks were overvalued, each call getting their office moved ever closer to the elevator and men?s bathroom. When someone finally did throw the switch on these markets, it got dark amazingly fast. Tokyo went out at an all time high on the last day of 1989, and then dropped a staggering 45% in January. NASDAQ plunged just as fast from its 2000 top. The one thing we can all be certain about is that the survivors have vastly improved their risk control after our recent crash. Make hay while the sun shines, but keep your finger hovering over that mouse. The level of risk is definitely high than it was in March. When the next real downturn starts, it could resemble a flash fire in a movie theater.

2)?? I have to admit that I was stunned when the announcement hit the tape that Obama won the Nobel Peace Prize. I was sure he would get it, but not until he left office in 2012 or 2016. Even Obama admitted he didn?t deserve it. I happen to know the Swedish royal family quite well, as they invested in my hedge fund during the nineties. When I visited their money managers in Stockholm, I stayed at the Grand Hotel, where the Nobel winners are put up during the December ceremonies. On the wall of my suite hung original letters from fellow Californian and Nobel Prize winner in literature John Steinbeck. It turns out that more than 20% of?? the 829 Nobel Prizes have been awarded to Californians, thanks to the state?s massive investment in the sciences, 21 to UC Berkeley professors alone, including this year?s prize for economics. During the 100 year anniversary of the prize in 2004, all living Nobel winners in the state were invited to lunch with the Crown Princess Victoria, the Duchess of V??sterg??tland. I sat next to Milton Friedman and debated monetarism with the cantankerous University of Chicago economist for an hour. Swedes feel that since their country is small and relatively insignificant on the world stage, the Nobel Prizes are one of the few ways they can influence international events. By giving Obama an early prize, they are giving him a vote of confidence and attempting to give him some credibility in his dealings. Many countries certainly have every reason to be wary of his outstretched hand, given our recent history. The best news for Obama? The $1.5 million prize is denominated in Swedish kroner, which has been appreciating against the dollar. And no, I don?t have a Nobel Prize myself, at least until they start handing them out to hedge fund managers.

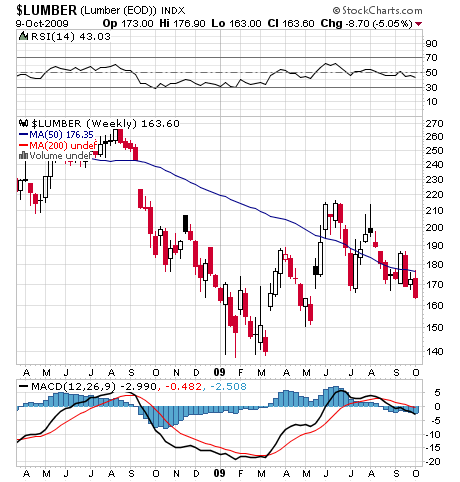

3) There?s nothing like getting up in the morning, sharpening your ax, taking off your shirt, and splitting a quarter cord of wood to get the blood flowing. I managed get the same invigorating effect by catching part of a nice 50% move in lumber futures earlier in the year, based on an expected recovery of exports to China (click here for my earlier call ). A wave of buyers followed me, heralding a recovery in the housing market, which I didn?t believe in for two seconds. Since June, the performance of the knotty, aromatic commodity has been definitely pekid. Listen hard and the trees are trying to tell us something. How are we supposed to have a recovery in the housing market with falling lumber prices? Are they building houses now without wood? Have I missed some great technological development in the home construction industry where termite proof houses are now all the rage? I think it?s much more likely that the Chinese topped up their inventories and the recovery in real estate is wishful thinking. Please take a look at the chart and tell me where I?ve gone wrong. If the trees are right, then real estate stocks, REIT?s, homebuilders, and even the banks are about to get slammed again. Is that smoke I smell?

?Sic transit gloria mundi?

For over a thousand years Roman conquerors returning from the wars enjoyed the honor of triumph, a tumultuous parade. In the procession came trumpeters, musicians and strange animals from conquered territories, together with carts laden with treasure and captured armaments. The conquerors rode in a triumphal chariot, the dazed prisoners walking in chains before him. Sometimes his children, robed in white, stood with him in the chariot or rode the trace horses. A slave stood behind the conqueror holding a golden crown and whispering in his ear a warning: that all glory is fleeting.

? Gen. George C. Patton