October 13, 2010 - The Frenzy to Buy Corn

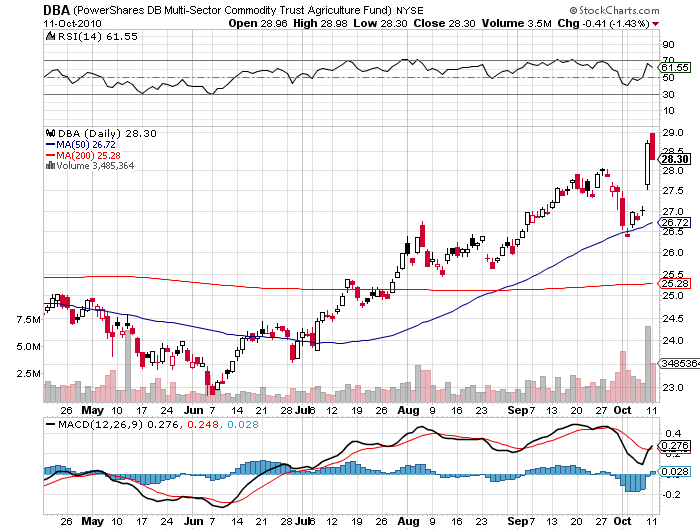

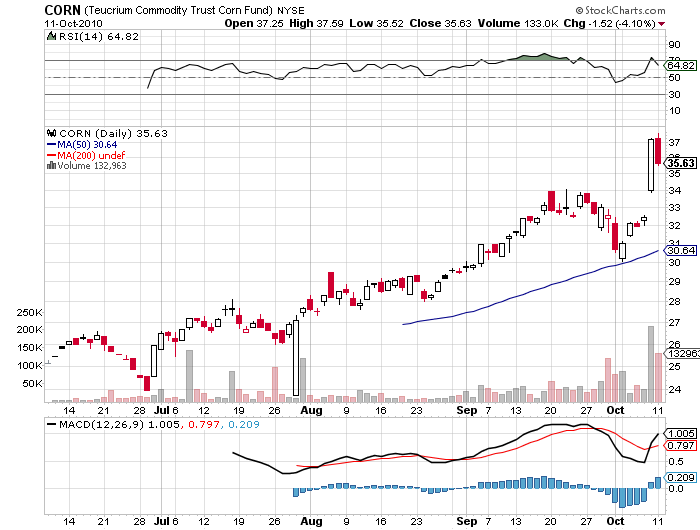

Featured Trades: (CORN), (DBA)

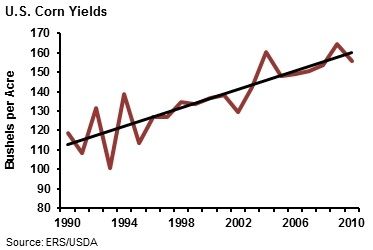

2) The Frenzy to Buy Corn. I have managed to catch a few limit up moves in my career, but never two consecutive back to back moves. That is what we got yesterday when panic buying swamped traders in the wake of Friday's USDA report showing that corn yields plunged from 162.5 bushels per acre to 155.9 bushels. I can only recall two earlier episodes of such price action in the commodities markets, the Russian 'Great Grain Robbery' in the seventies, and when mad cow disease hit the cattle market in the nineties. Maybe market historians with better memories than mine can cite further examples.

Indiana took the biggest hit, with yields down a stunning 14%, followed by Iowa (-10%), and Nebraska (-95). The USDA now figures that this year's total corn crop will fall to 902 million bushels, well below the crucial 1 billion figure needed for suppliers to meet their contractual obligations. It is now every man for himself.

Suffice it to say, if you didn't follow my advice and get into corn earlier, it is way too late to get involved here (click here for 'Going Back Into the Ags'). I think corn has broken out to the upside, and the door is now open for substantially higher prices. But to buy on top of two limit up moves would be shear lunacy. Better to wait for a major pull back before you develop a new appetite for corn.