October 13, 2010 - Goldman Sachs Bursts Out of the Penalty Box

Featured Trades: (GS)

3) Goldman Sachs Bursts Out of the Penalty Box. Let's say that quantitative easing ensues, the global financial system is flooded with money, and the price of everything rises in unison. What is the one company that would benefit most from this scenario, whose hand on the pulse beat of the market is so fine that it senses the movement of money anywhere, anytime, and is perfectly positioned to extract the maximum amount for its own bottom line?

You just described Goldman Sachs (GS) to a T, the Vampire Squid that is able to suck the life out of the markets, regardless of the borders they must cross, their denominations, or the orientations of the asset classes involved. GS has been in the shareholders penalty box long enough after paying a record $550 million settlement for indiscretions during the real estate bubble, which amounted to little more than a pat on the hand (click here for 'Way to Go, Goldman').

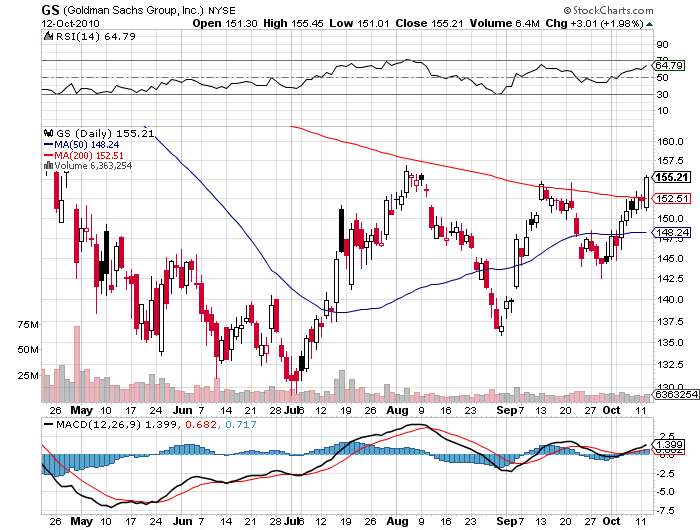

Yesterday a large block of GS stock changed hands, which often presages major price moves. Take a look at the chart below, and if you took the name off it, you would be convinced that it was about to break out to the upside. And let's face it, a Republican win would be great for Goldman, as it would leash the regulatory dogs that have been hounding it so severely for the past two years.