October 20, 2009

October 20, 2009

(MS), (BYRON WIEN), (JULIUS CAESAR),

1) The black GM Suburban barreled into the parking structure at San Francisco?s posh St. Francis Hotel, its emergency lights flashing, and quickly disgorged a team of secret service agents. Behind them the armored Cadillac limo screeched to a halt, and out lept Barrack Obama, the President of the United States. He came to speak to a select group of wealthy, A-list, party faithful who had paid $15,200 each for the privilege of? having their picture taken with our famous president. Although the tension was so thick you could cut it with a knife, Obama firmly shook my hand with the controlled cool he is famous for, and produced the obligatory grin for the camera, as if on autopilot. The scene outside in Union Square was a mad house, with every fringe group but the Lemurians well represented, and the police struggling to prevent a shouting match between antiwar demonstrators and the anti-abortion activists exploding into violence. An Obama win in the California was never in doubt, with 85% of some districts going for the Democratic candidate. Yet,?? the Golden State was a mandatory stop for Obama as it generated the cash flow needed to fund wins in a half dozen battleground states. The support paid off, as dozens of desperately needed infrastructure projects started raining down upon us the second after the budget was passed, and no less than a half dozen UC Berkeley notables filed into the administration, with more waiting in the wings. I always thought that Obama was a man from the future, but he is 150 years from the future, and would bring upon us more rapid change than many even in his own party are able to digest. He is not an African American, but an African and an American, and bears no taint of slavery in his DNA. He is taking huge risks with the future of the country now, and may drive us all to ruin if his lofty plans don?t work out. But what choice does he have? The backdrop for the 2012 was either going to be the Great Depression II or a fragile recovery fueled by massive borrowing. Seems like a no brainer to me. I?ll just go out and short more dollars, laughing all the way to the bank. Call me a cynic, but as they used to say at Morgan Stanley, who is guilty of losing the $100 bill, the guy who dropped it, or the one who picked it up? You can find the photo on my Facebook page.

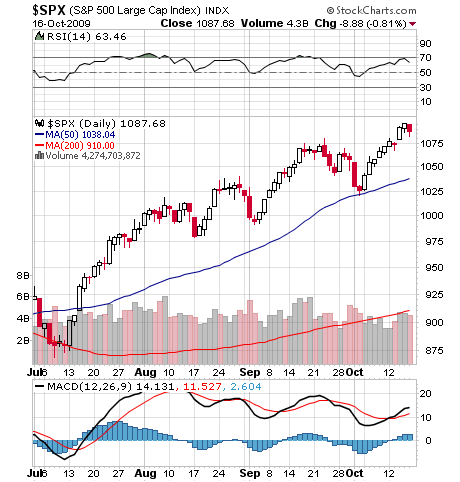

2) It warmed the heart to see my old Morgan Stanley (MS) colleague, Byron Wien, on TV. After my incendiary and iconoclastic interview with Bill Fleckenstein yesterday (click here to read), I thought I?d get the view from the other side of the street. Byron was our strategy guru at MS, then went on to mega hedge fund Pequot, and then parachuted comfortably into a co-chairman?s role at the all seeing, all knowing Blackstone. At 76, he looks pretty old and crotchety, but then he looked old and crotchety when I first met him 30 years ago. Byron gained his fame by annually publishing a top ten list of market surprises that traders believe are unlikely, but have a high probability of happening, which the clients used to absolutely eat up. His list for 2009 is looking pretty good. Back in January when the world was ending, Byron predicted that by year end, gold would blast through to a new high of $1,200, oil would rebound to $80, the S&P 500 would reach 1,200, Chinese growth would come in at 7%, ten year Treasuries would sell off to a 4% yield, housing would bottom, and Obama would become a hawk on Afghanistan. He could be batting ten for ten by year end. He argues that Christmas sales will come in better than expected, and the top line surge will enable the S&P 500 to climb the last leg to his target. We are close enough to his other targets to call it a win for him. When his next top ten list comes out in January, pay close attention.

3) One of the great pleasures of running an online business like this is that not a day passes without being totally amazed by the Internet. You may recall that last week I wrote a piece translating the arcane Latin found on a US dollar bill (click here for the story). What do I find in my in-box the next morning but a dozen new subscriptions from Romans! Who knew Romans were surfing the net? I mean the modern kind from Rome and other parts of Italy. It turns out that an Italian language investment website is screening the net for Italian language pieces, and to your dumb, garden variety search engine, Latin is close enough. If you want to give your Italian a real work out and see that I?m not making this up, click here . I haven?t been to Italy since I totaled a plane there taking off from Palermo, Sicily, which it turns out has one of the worst wind shear airports in Europe (it was a rental). So to my new Italian subscribers, I say, quoting Julius Caesar, vini, vidi, vici!

QUOTE OF THE DAY

?In the next two to three years, more money will be lost in long term Treasury bonds than was lost in the last two years in the stock market,? said Allan Lance of the Lance Letter.