October 20 Biweekly Strategy Webinar Q&A

Below please find subscribers’ Q&A for the October 20 Mad Hedge Fund Trader Global Strategy Webinar broadcast from the safety of Silicon Valley.

Q: Why are stocks so high? Won’t inflation hurt companies?

A: Inflation hurts bonds (TLT), not companies, which is why we are short the bond market and have been short for most of this year. Inflation actually helps companies because it allows them to raise prices at a faster rate. The ability to raise prices is the best that it’s been in 45 years, and that is enabling them to either maintain or increase profit margins.

Q: Where is all this liquidity coming from to drive the stocks high after the Fed ends Quantitative easing?

A: In the last 20 years, the liquidity of the US has gone from 6% of GDP to 47% of GDP. That is an enormous increase, and most of that money has gone into stocks and real estate, which is why both have been on a tear for the last 11 years. And I expect that to continue; the Fed isn’t even hinting at taking liquidity out of the system until well into 2023. On top of that, you have corporate profit exploding from $2 trillion last year to $10 trillion this year, adding another $8 trillion to the system, and outpacing any Fed taper by a five to one margin. Corporations alone are using these profits to buy back more than $1 trillion of their own stock this year.

Q: I’m hearing so much about the supply chain problems these days. Is that just a short-term fixable problem or a long-term structural one?

A: Absolutely it’s short-term. This actually isn’t a pandemic-related problem but a private capital investment one. It’s being caused by the record growth of the US economy which is sucking in more imports than it has ever seen before. We’ve actually exceeded pre-pandemic levels of imports a while ago. Import infrastructure isn’t big enough to handle it. If it was there wouldn’t be enough truckers to handle it. We had a shortage of 50,000 truckers before the pandemic, now we’re short 100,000. Some of these guys are making up to $100,000 a year, not bad for a high school level education. Expect it to get worse before it gets better, but it will get better eventually. That is why Amazon is having trouble, because supply chain problems may bring a weak Christmas, which is the most profitable time of year for them. If we get any big selloff at Amazon for this reason, you want to buy that bottom because it’ll double again in 3 years.

Q: Walt Disney (DIS) has pretty much sideways the whole year around $70, is this going down or should I buy?

A: I would look to buy but I would buy an in-the-money LEAPS, like a $150-$170 one year out. Disney’s been hit with a lot of slowdowns lately, slowdowns with park reopening, movie releases, new streaming customers. But these are all temporary slowdowns and will pick up again next year. Disney is the classic reopening play, so you will get another bite at the apple with a second reopening. Maybe “bite of the mouse” is a better metaphor.

Q: Global growth is down because of China (FXI) with their PMI under 50; do you think they will drag down the entire global economy in 2022?

A: No, if we recover, their largest customer, they will recover too. Remember their pandemic cases are only a tiny fraction of what ours were, some 4,000 or so, and their economy is still export-driven. You can't have major port congestion in Los Angeles and a weak economy in China, those are just two ends of one chain. I would look for a recovery in China next year. As for the stocks, I don’t know because that’s an entirely political issue; Baidu (BIDU), (JD), and Alibaba (BABA) are still getting beaten like a redheaded stepchild. We don’t know when that’s going to end; it’s an unknown. So, stand aside on Chinese plays, especially when the stuff at home is so much better with all these financials and tech stocks to invest in.

Q: What do you think about meme stocks?

A: I think you should avoid them like the plague. When there are so many good quality stocks with long term uptrends, why bother dumpster diving? You’re better off buying a lottery ticket.

Q: Which US bank should I invest in?

A: If you want the gold standard, you buy JP Morgan (JPM) which just announced blowout earnings. If you want a broker, go for Morgan Stanley (MS), which also just announced blowout earnings last week. And I want you to make my monthly pension payment secure, as it comes from Morgan Stanley. Keep those checks coming!

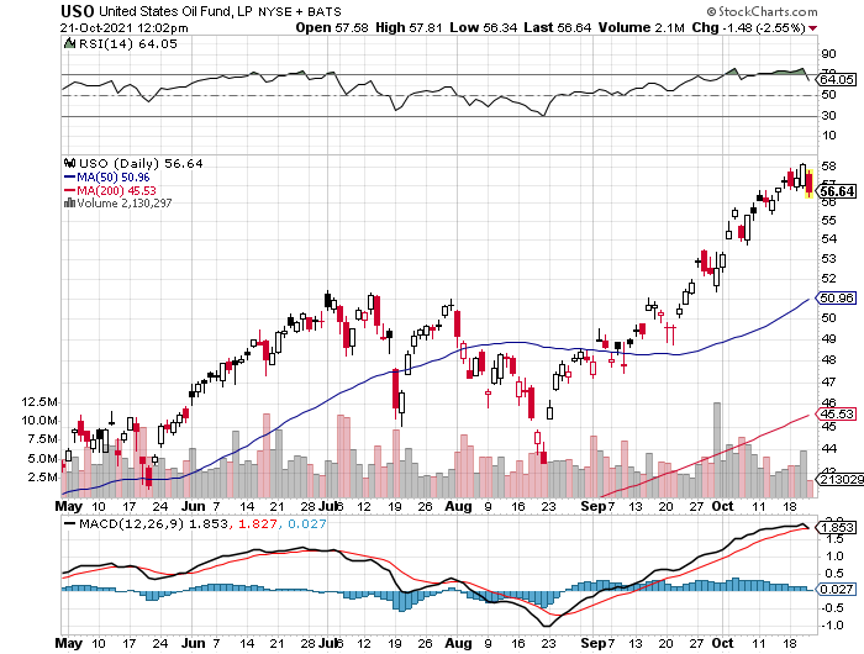

Q: Are we headed to $150 oil (USO)?

A: No, what we’re seeing here is a short-term spike in prices due to supply chain problems, OPEC discipline, a booming economy, and Russia trying to squeeze Europe on energy supplies. I don’t see it continuing much per year as the stocks could be popping out, so avoid oil and energy plays. The solar plays, like (TAN), (FSLR), and (SPWR) on the other hand, all look like they have miles to go.

Q: You said in your Webinar that you can still get a 50% Return on the United States Treasury Bond Fund (TLT) LEAPS. Can you give me the specifics?

A: If you went a year out on Tuesday when I recorded this webinar, you could buy the (TLT) October 2022 $150-$150 vertical bear put spread for $3.40 for a maximum profit on expiration at $5.00 of $47%. That’s where you buy the $155 put and sell short the $150 put against it. Since then, bonds have fallen by $3.00, and it is now trading at $3.60 giving you a 39% return. Try to establish this position on the next (TLT) rally.

Q: What is your yearend target for Bitcoin?

A: Now that we have broken the old high at $66,000, we should be able to make it to $100,000 by January. The SEC approving that new ProShares Bitcoin Strategy ETF (BITO) ETF unlocks trillions of dollars which can now go into Bitcoin, those regulated by the Investment Company Act of 1940. Crypto is now the fastest-growing segment of the financial markets. It’s inflation that driving this, and the Fed is throwing fuel on the fire by taking no action in the face of a red hot 5.4% Consumer Price Index. Even if the Fed does taper, the action will be more than offset by the massive $8 trillion increase in corporate profits. Companies are not only buying their own stocks, they are also using these profits to buy Bitcoin. I see this as a Bitcoin node myself. Be sure to dollar cost average your position by putting in a little bit of money every day because Bitcoin is wildly volatile, up 140% since August 1. By the way, it’s not too late to subscribe to the Mad Hedge Bitcoin Letter, which we are taking down from the store on Monday for a major upgrade by clicking here. We are raising prices after that.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on the paid service you are currently in (GLOBAL TRADING DISPATCH, TECH LETTER, or BITCOIN LETTER), then select WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good luck and stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader