October 21, 2024

(COMPANY EARNINGS WILL BE CENTRE STAGE THIS WEEK)

October 21, 2024

Hello everyone

WEEK AHEAD CALENDAR

Monday, Oct. 21

9:00 a.m. US Fed Speeches

10:00 a.m. Leading Indicators (September)

Tuesday, Oct 22

10:00 am Euro Area ECB Speech

10:00 a.m. Philadelphia Reserve Bank President Harker speaks in Ten Independence Mall, Philadelphia

Earnings: Verizon, General Motors, General Electric, Moody’s, Sherwin Williams, Baker Hughes, Seagate, Lockheed Martin.

Wednesday, Oct 23

9:45 am Canada Rate Decision

Previous: 4.25%

Forecast: 3.75%

10:00 a.m. Existing Home Sales (September)

10:00 a.m. Fed Beige Book

Earnings: Vertiv, Boeing, AT&T, Coca-Cola, Boston Scientific, Hilton, Tesla, Lam Research, IBM, Newmont, T-Mobile, Whirlpool

Thursday, Oct 24

4:00 am Euro Area Manuf. PMI

Previous: 45

Forecast: 45.1

8:00 a.m. Building Permits final (September)

8:30 a.m. Chicago Fed National Activity Index (September)

8:30 a.m. Continuing Jobless Claims (10/12)

8:30 a.m. Initial Claims (10/19)

9:45 a.m. PMI Composite preliminary (October)

9:45 a.m. S&P PMI Manufacturing preliminary (October)

9:45 a.m. S&P PMI Services preliminary (October)

10:00 a.m. New Home Sales (September)

11:00 a.m. Kansas City Fed Manufacturing Index (October)

Earnings: American Airlines, UPS, Southwest, Harley Davidson, Honeywell, Western Digital, Amazon.

Friday, Oct 25

8:30 am US Durable Goods

Previous: 0.0%

Forecast: -0.9%

Earnings: Colgate Palmolive

This week, the market is all about earnings. The results of these earnings will indicate whether stocks can keep roaring along and support the broadening we are witnessing in the market. Valuations are stretched – the S&P500 is trading at a 40% premium to its long-term P/E ratio, while tech stocks are trading at upwards of 60%. Earnings growth expectations are lower for this season, so the market could reward stocks that beat expectations. On the flip side, a big earnings miss could disappoint and sway investor sentiment.

Whatever the market deals out, retail sales are still expected to be quite strong this holiday season, and they are expected to be influenced by hurricanes and the Election.

MARKET UPDATE

S&P500

Uptrend is intact. Through an Elliott Wave lens, the market is still rallying within a broad wave 5 advance.

Next Target = ~ 5, 930

Support = ~ 5,800/5,750

GOLD

Uptrend intact. No signs of exhaustion yet.

Next target = ~ $2,750/$2,770

Support = ~ $2,700/$2,680

BITCOIN

Rally in progress. In the next week or two, we are looking to break out of the large flag pattern Bitcoin has formed over the last few months.

We reached $68,000 last week, and now we should see the bullish move continue to reach higher targets.

Next Target = ~ $73,400/$81,500

Support Range lies between $67,000 to $64,500

WHERE TO ADD WEIGHT

On October 10, I recommended a list of stocks to either add weight to if you held them or to start scaling into if you didn’t own them.

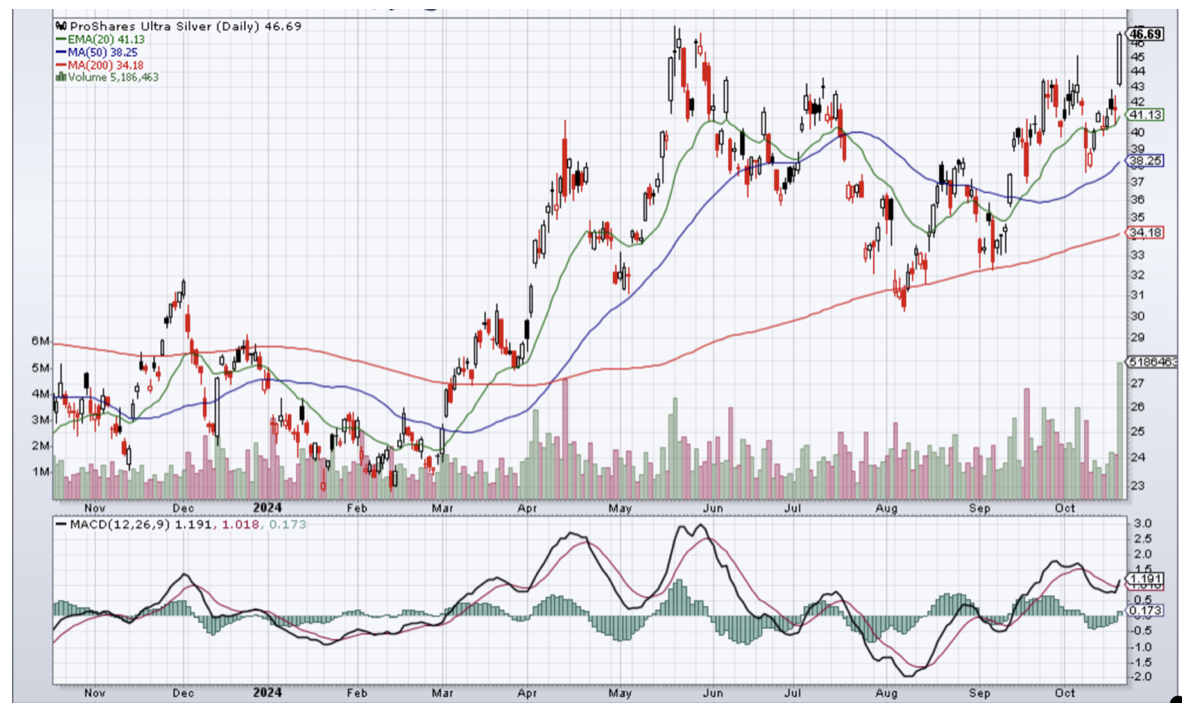

Today, I’m recommending you, once again, add weight to (SLV) and start scaling into (AGQ) Pro Shares Ultra Silver. Both stocks are now breaking out of a 6-month range pattern that could be interrupted as an inverse head and shoulders, and that sets up the potential for a bullish move, which would be a continuation of the overall bullish theme in the precious metals markets.

Pro Shares Ultra Silver (AGQ)

iShares Silver Trust (SLV)

AUSTRALIAN CORNER

Charles and Camilla are Down Under for a brief tour. (It may be the final time Charles visits Australia).

QI CORNER

SOMETHING TO THINK ABOUT

TRIVIA CORNER

Answers

1/ Which country has the longest coastline?

Canada. Its coastline measures 243,042 km (151,019 miles). This includes the mainland coast and the coasts of offshore islands. Canada’s coastline borders the Atlantic, Pacific, and Arctic Oceans.

2/ Who was the first U.S. billionaire?

Henry Ford. He has often been referred to as “American’s second billionaire” by those who believed Rockefeller to be the first. Henry Ford reached 10-figure zone by about 1925. His net worth was estimated to be around $1.2 billion by the mid-1920s. Today, that fortune would be worth around $200 billion.

3/ Which first lady was the first to appear on U.S. currency?

Martha Washington, the wife of the first U.S. President. She was the first woman to be featured on U.S. paper currency with a solo portrait.

Cheers

Jacquie